HOUSTON, Dec. 8 /PRNewswire-FirstCall/ -- Mitcham Industries, Inc.

(NASDAQ:MIND) (the "Company") today announced financial results for

its fiscal 2009 third quarter ended October 31, 2008. Highlights

include: -- Core leasing revenues increased 19 percent to $10.0

million for the third quarter of fiscal 2009 from $8.4 million for

the third quarter of fiscal 2008. -- Net income for the third

quarter increased to $2.7 million, or $0.27 per diluted share, from

$2.4 million, or $0.24 per diluted share, in the third quarter of

fiscal 2008. -- The Company announced today that Seamap was awarded

orders totaling approximately $11 million by The Polarcus Group of

Companies (Polarcus), a new entrant in the marine seismic market,

to equip all six of its new state-of-the-art vessels with the

GunLink 4000 fully distributed digital gun controller systems and

BuoyLink RGPS tail buoy positioning systems. -- The Company has

modified its fiscal 2009 guidance to take into account the

continuing turmoil and uncertainty in the financial markets with

the resulting slowdown of the economy and the decline in commodity

prices. Bill Mitcham, the Company's President and CEO, stated, "We

are pleased with our core seismic equipment leasing revenues, which

rose 19 percent over last year's third quarter. However, sales from

Seamap did not meet our expectations in the third quarter. This is

attributable primarily to a GunLink 4000 system that we had

expected to ship in October. Due to delays from a specific

supplier, we did not complete shipping the system until November.

"As a result of the additions in lease pool equipment made last

year and earlier this year, our lease pool depreciation expense

rose approximately 47 percent from the third quarter last year,

which partially explains the lower gross profit margin in the third

quarter of this year compared to a year ago. These lease pool

additions, which also include newly deployed vertical seismic

profiling and ultra light submersible equipment, have helped us

diversify and strengthen our world-wide market presence. "We are

very pleased with the Polarcus award, which is to be delivered in

fiscal 2010. Seamap is providing Polarcus with its GunLink 4000

fully distributed digital gun controller systems and BuoyLink RGPS

tail buoy positioning systems. With this award, Seamap's backlog of

firm orders amounts to a near record high of approximately $17

million. With its solid backlog, Seamap appears to be well

positioned going into fiscal 2010. "Demand within our core leasing

business has been strong overall, but we are seeing some weakness

in certain markets such as Russia and projects involving higher

cost, non-conventional sources of oil and gas. Historically, we

have often provided financing to our customers for purchases of

lease pool equipment or new seismic equipment. In the current

economic environment, we are, and will be, much more reluctant to

sell equipment under such arrangements. "We certainly realize that,

along with the rest of the industry, we are likely to be affected

by the slowdown in economic activity. However, we believe we have

adequate liquidity and credit availability to meet the challenges

ahead. With the broad range of equipment in our lease pool, our

geographic diversity and our focus on customer service, we believe

we are well positioned both operationally and financially to deal

with the uncertainties that are facing us and the rest of the

energy industry." THIRD QUARTER FISCAL 2009 RESULTS Total revenues

for the third quarter of fiscal 2009 were $14.5 million compared to

$17.2 million for the third quarter of fiscal 2008, roughly a 16

percent decline. Core revenues from equipment leasing, excluding

equipment sales, rose 19 percent to $10.0 million from $8.4 million

in the same period a year ago. This increase in leasing revenues

was driven by continued solid demand for seismic equipment in both

domestic and international markets and expansion of the Company's

lease pool. Year-to-date, approximately $20 million of new

equipment has been added to the Company's lease pool. This follows

$26 million in new equipment added during fiscal 2008. Sales of new

seismic, hydrographic and oceanographic equipment were $1.8 million

compared to $2.0 million in the comparable period a year ago. Sales

of lease pool equipment were $0.3 million compared to $1.7 million

in the third quarter of fiscal 2008. Seamap equipment sales in the

third quarter declined 53 percent to $2.4 million from $5.1 million

in the comparable period a year ago primarily due to the delayed

shipment of a GunLink 4000 system and lower than expected

purchasing activity by marine customers. Total gross profit in the

third quarter was $7.3 million compared to $9.3 million in the

third quarter of fiscal 2008, a 22 percent decline. Gross profit

margin was 50 percent in this year's third quarter compared to 54

percent a year ago. General and administrative costs for the third

quarter were $4.3 million, or 30 percent of total revenues, versus

$5.0 million, or 29 percent of total revenues, in the third quarter

a year ago. Operating income for the third quarter of fiscal 2009

was $2.7 million compared to $3.8 million in the comparable period

a year ago. Net income for the third quarter was $2.7 million, or

$0.27 per diluted share, compared to $2.4 million, or $0.24 per

diluted share, in the third quarter of fiscal 2008. The benefit for

income taxes for the third quarter of fiscal 2009 includes a tax

benefit of $0.9 million resulting from the elimination of uncertain

tax positions upon the expiration of the period in which certain

prior periods could be examined by taxing authorities. EBITDA

(earnings before interest, taxes, depreciation and amortization)

for the third quarter was $6.8 million, or 47 percent of total

revenues, compared to $6.8 million, or 39 percent of total

revenues, in the same period last year. EBITDA, which is not a

measure determined in accordance with generally accepted accounting

principles ("GAAP"), is defined and reconciled to reported net

income in Note A under the accompanying financial tables. YEAR TO

DATE FISCAL 2009 RESULTS Total revenues for the first nine months

of fiscal 2009 declined approximately 9 percent to $50.6 million

from $55.6 million in the first nine months of fiscal 2008;

however, core revenues from equipment leasing, excluding equipment

sales, increased 21 percent to $29.9 million from $24.7 million in

the same period a year ago. Sales of new seismic, hydrographic and

oceanographic equipment for the first nine months of fiscal 2009

were $7.0 million versus $6.9 million a year ago. Sales of lease

pool equipment were $2.7 million compared to $3.2 million a year

ago. Seamap equipment sales for the first nine months of fiscal

2009 were $11.0 million compared to $20.8 million in the first nine

months of fiscal 2008. Operating income for the first nine months

of fiscal 2009 was $11.3 million compared to $12.2 million in the

same period of fiscal 2008. Net income was $8.6 million, or $0.84

per diluted share, compared to $8.1 million, or $0.79 per diluted

share, in the same period a year ago. Net income for the first nine

months of fiscal 2009 also included the tax benefit from the

elimination of uncertain tax positions. EBITDA (earnings before

interest, taxes, depreciation and amortization) for the first nine

months of fiscal 2009 increased 14 percent to $23.6 million, or 47

percent of total revenues, from $20.7 million, or 37 percent of

total revenues, in the first nine months of fiscal 2008. OUTLOOK

Robert Capps, Executive Vice President and Chief Financial Officer,

stated, "Regarding our outlook for the balance of fiscal 2009,

while our core leasing business has continued its strong growth in

recent periods, there is much uncertainty as to the timing and

scope of several pending projects. Our earlier expectations for

Seamap revenues to be stronger in the second half of the year are

not expected to be realized in the current environment. We also

expect little, if any, revenue from the sale of lease pool or new

seismic equipment for the balance of fiscal 2009. Therefore, given

our current pipeline of business and the uncertainties surrounding

our year-end fiscal 2009 outlook, we are reducing our prior

guidance for fiscal 2009. We expect revenues for the fiscal year

ending January 31, 2009 to now range between $67 million and $70

million, operating income to range between $13.3 million and $15.5

million, and earnings per share to range between $0.96 and $1.10

per diluted share." CONFERENCE CALL The Company has scheduled a

conference call for Tuesday, December 9, 2008 at 9:00 a.m. Eastern

time to discuss fiscal 2009 third quarter results. To access the

call, please dial (303) 262-2205 and ask for the Mitcham Industries

call at least 10 minutes prior to the start time. Investors may

also listen to the conference live on the Mitcham Industries

corporate website, http://www.mitchamindustries.com/, by logging on

that site and clicking "Investors." A telephonic replay of the

conference call will be available through December 18, 2008 and may

be accessed by calling (303) 590-3000, and using the passcode

11122639#. A web cast archive will also be available at

http://www.mitchamindustries.com/ shortly after the call and will

be accessible for approximately 90 days. For more information,

please contact Donna Washburn at DRG&E at (713) 529-6600 or

email . Mitcham Industries, Inc., a geophysical equipment supplier,

offers for lease or sale, new and "experienced" seismic equipment

to the oil and gas industry, seismic contractors, environmental

agencies, government agencies and universities. Headquartered in

Texas, with sales and services offices in Calgary, Canada;

Brisbane, Australia; Singapore; Ufa, Bashkortostan, Russia; and the

United Kingdom and with associates throughout Europe, South America

and Asia, Mitcham conducts operations on a global scale and is the

largest independent exploration equipment lessor in the industry.

This press release includes forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934 and

Section 27A of the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical facts

included herein, including statements regarding the Company's

future financial position and results of operations, planned

capital expenditures, the Company's business strategy and other

plans for future expansion, the future mix of revenues and

business, future demand for the Company's services and general

conditions in the energy industry in general and seismic service

industry, are forward-looking statements. Actual results may differ

materially from such forward-looking statements. Important factors

that could cause or contribute to such differences include the

inherent volatility of oil and gas prices and the related

volatility of demand for the Company's services; loss of

significant customers; significant defaults by customers on amounts

due to the Company; international economic and political

instability; dependence upon additional lease contracts; the risk

of technological obsolescence of the Company's lease pool;

vulnerability of seismic activity and demand to weather conditions

and seasonality of operating results; dependence upon few

suppliers; and other factors that are disclosed in the Company's

2008 Annual Report on Form 10-K and its other Securities and

Exchange Commission filings and available from the Company without

charge. All information in this release is as of the date of this

release and the Company undertakes no duty to update or revise any

forward-looking statement whether as a result of new information,

future events or otherwise. - Tables to follow - MITCHAM

INDUSTRIES, INC. CONSOLIDATED BALANCE SHEETS (In thousands, except

per share data) October 31, 2008 January 31, 2008 (unaudited)

ASSETS Current assets: Cash and cash equivalents $5,802 $13,884

Restricted cash 990 - Accounts receivable, net 14,613 12,816

Current portion of contracts receivable 1,356 2,964 Inventories,

net 5,710 6,352 Deferred tax asset 936 1,230 Prepaid expenses and

other current assets 2,356 1,491 Total current assets 31,763 38,737

Seismic equipment lease pool and property and equipment, net 56,356

53,179 Intangible assets, net 2,970 3,692 Goodwill 4,320 4,358 Net

deferred tax asset 2,072 1,505 Long-term portion of contracts

receivable and other assets 5,272 2,430 Total assets $102,753

$103,901 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities:

Accounts payable $7,492 $16,729 Current maturities - long-term debt

- 1,500 Income taxes payable 1,470 1,967 Deferred revenue 799 872

Accrued expenses and other current liabilities 3,480 3,674 Total

current liabilities 13,241 24,742 Long-term debt 8,400 -

Non-current income taxes payable 3,274 3,391 Total liabilities

24,915 28,133 Shareholders' equity: Preferred stock, $1.00 par

value; 1,000 shares authorized; none issued and outstanding - -

Common stock $0.01 par value; 20,000 shares authorized; 10,725 and

10,708 shares issued at October 31, 2008 and January 31, 2008,

respectively 107 107 Additional paid-in capital 73,906 71,929

Treasury stock, at cost (922 and 921 shares at October 31, 2008 and

January 31, 2008, respectively) (4,826) (4,805) Retained earnings

9,306 662 Accumulated other comprehensive (loss) income (655) 7,875

Total shareholders' equity 77,838 75,768 Total liabilities and

shareholders' equity $102,753 $103,901 MITCHAM INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share

data) (unaudited) For the Three Months Ended For the Nine Months

Ended October 31, October 31, 2008 2007 2008 2007 Revenues:

Equipment leasing $10,043 $8,402 $29,916 $24,732 Lease pool

equipment sales 333 1,661 2,738 3,153 Seamap equipment sales 2,385

5,144 10,952 20,807 Other equipment sales 1,787 1,998 6,971 6,926

Total revenues 14,548 17,205 50,577 55,618 Cost of sales: Direct

costs - equipment leasing 810 475 1,595 1,296 Direct costs - lease

pool depreciation 3,781 2,567 11,094 7,413 Cost of equipment sales

2,697 4,887 11,886 20,956 Total cost of sales 7,288 7,929 24,575

29,665 Gross profit 7,260 9,276 26,002 25,953 Operating expenses:

General and administrative 4,317 5,045 13,622 12,685 Depreciation

and amortization 287 389 1,046 1,110 Total operating expenses 4,604

5,434 14,668 13,795 Operating income 2,656 3,842 11,334 12,158

Other income Interest, net 36 178 409 319 Other, net 29 (6) 37 (3)

Total other income 65 172 446 316 Income before income taxes 2,721

4,014 11,780 12,474 Benefit (provision) for income taxes 20 (1,583)

(3,136) (4,382) Net income $2,741 $2,431 $8,644 $8,092 Net income

per common share: Basic $0.28 $0.25 $0.89 $0.84 Diluted $0.27 $0.24

$0.84 $0.79 Shares used in computing net income per common share:

Basic 9,776 9,733 9,764 9,682 Diluted 10,188 10,333 10,303 10,257

MITCHAM INDUSTRIES, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In

thousands) (unaudited) For the Nine Months Ended October 31, 2008

2007 Cash flows from operating activities: Net income $8,644 $8,092

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 12,258 8,523

Stock-based compensation 1,691 1,628 Provision for doubtful

accounts 518 165 Provision for inventory obsolescence 230 316 Gross

profit from sale of lease pool equipment (1,363) (2,193) Excess tax

benefit from exercise of non-qualified stock options (96) (1,219)

Deferred tax (benefit) provision (190) 1,981 Non-current income

taxes payable (598) - Changes in: Accounts receivable (3,970)

(1,429) Contracts receivable (88) 1,535 Inventories (601) 1,317

Prepaid expenses and other current assets (1,051) 850 Income taxes

payable (390) 1,252 Accounts payable, accrued expenses, other

current liabilities and deferred revenue (4,885) (430) Net cash

provided by operating activities 10,109 20,388 Cash flows from

investing activities: Purchases of seismic equipment held for lease

(24,620) (19,199) Purchases of property and equipment (488) (434)

Additional payments related to subsidiary acquisition - (1,000)

Sale of used lease pool equipment 2,738 3,153 Net cash used in

investing activities (22,370) (17,480) Cash flows from financing

activities: Net proceeds from line of credit 8,400 4,500 Payments

on borrowings (1,500) (6,000) Purchase of short-term investments

(1,413) - Proceeds from issuance of common stock upon exercise of

warrants and stock options, net of stock surrendered to pay taxes

184 341 Excess tax benefit from exercise of non-qualified stock

options 96 1,219 Net cash provided by financing activities 5,767 60

Effect of changes in foreign exchange rates on cash and cash

equivalents (1,588) 755 Net (decrease) increase in cash and cash

equivalents (8,082) 3,723 Cash and cash equivalents, beginning of

period 13,884 12,582 Cash and cash equivalents, end of period

$5,802 $16,305 Note A MITCHAM INDUSTRIES, INC. Reconciliation of

Net Income to EBITDA and Adjusted EBITDA (In thousands) (Unaudited)

For the Three Months Ended For the Nine Months Ended October 31,

October 31, 2008 2007 2008 2007 Reconciliation of Net Income to

EBITDA and Adjusted EBITDA Net income $2,741 $2,431 $8,644 $8,092

Interest income, net (36) (178) (409) (319) Depreciation and

amortization 4,105 2,956 12,258 8,523 Provision (benefit) for

income taxes (20) 1,583 3,136 4,382 EBITDA (1) 6,790 6,792 23,629

20,678 Stock-based compensation 528 643 1,691 1,628 Adjusted EBITDA

(1) $7,318 $7,435 $25,320 $22,306 (1) EBITDA is defined as earnings

(loss) before (a) interest income, net of interest expense, (b)

provision for (or benefit from) income taxes and (c) depreciation

and amortization. Adjusted EBITDA excludes stock-based

compensation. We consider EBITDA and Adjusted EBITDA to be

important indicators for the performance of our business, but not

measures of performance calculated in accordance with accounting

principles generally accepted in the United States of America

("GAAP"). We have included these non-GAAP financial measures

because they provide management with important information for

assessing our performance and as indicators of our ability to make

capital expenditures and finance working capital requirements.

EBITDA and Adjusted EBITDA are not measures of financial

performance under GAAP and should not be considered in isolation or

as alternatives to cash flow from operating activities or as

alternatives to net income as indicators of operating performance

or any other measures of performance derived in accordance with

GAAP. Other companies in our industry may calculate EBITDA or

Adjusted EBITDA differently than we do, and EBITDA and Adjusted

EBITDA may not be comparable with similarly titled measures

reported by other companies. MITCHAM INDUSTRIES, INC. Segment

Operating Results (In thousands) (Unaudited) For the Three Months

Ended For the Nine Months Ended October 31, October 31, 2008 2007

2008 2007 Revenues: Equipment Leasing $12,163 $12,061 $39,625

$34,811 Seamap 2,601 5,313 11,208 21,431 Inter-segment sales (216)

(169) (256) (624) Total revenues 14,548 17,205 50,577 55,618 Cost

of sales: Equipment Leasing 6,118 4,655 19,089 14,914 Seamap 1,325

3,215 5,766 15,314 Inter-segment costs (155) 59 (280) (563) Total

cost of sales 7,288 7,929 24,575 29,665 Gross profit: Equipment

Leasing 6,045 7,406 20,536 19,897 Seamap 1,276 2,098 5,442 6,117

Inter-segment amounts (61) (228) 24 (61) Total gross profit 7,260

9,276 26,002 25,953 Contacts: Billy F. Mitcham, Jr., President

& CEO Mitcham Industries, Inc. 936-291-2277 Jack Lascar / Karen

Roan Dennard Rupp Gray & Easterly (DRG&E) 713-529-6600

DATASOURCE: Mitcham Industries, Inc. CONTACT: Billy F. Mitcham,

Jr., President & CEO of Mitcham Industries, Inc.,

+1-936-291-2277; or Jack Lascar or Karen Roan of Dennard Rupp Gray

& Easterly (DRG&E), +1-713-529-6600, for Mitcham

Industries, Inc. Web site: http://www.mitchamindustries.com/

Copyright

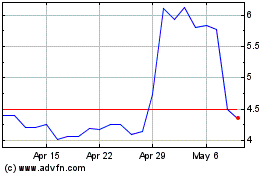

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From May 2024 to Jun 2024

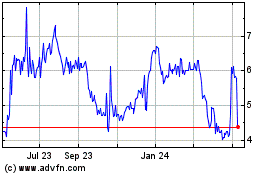

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From Jun 2023 to Jun 2024