UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 8)*

Under the Securities Exchange Act of 1934

MAGAL SECURITY SYSTEMS LTD.

(Name of Issuer)

Ordinary Shares, par value NIS1.00 per share

(Title of Class of Securities)

M6786D 10 4

(CUSIP Number)

Steven J. Glusband

Carter Ledyard & Milburn LLP

2 Wall Street, New York, New York 10005

(212) 732-3200

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

December 22, 2008

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report

the acquisition which is the subject of this Schedule 13D, and is filing this

schedule because of ss.ss. 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box [ ].

Note: Schedules filed in paper format will include a signed original and five

copies of the schedule, including all exhibits. See ss. 240.13d-7 for other

parties to whom copies are to be sent.

*The remainder of this cover page will be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

The information required on the remainder of this cover page will not be deemed

to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but will be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. M6786D 10 4

1 NAME OF REPORTING PERSON: Mira Mag Inc.

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY): Not Applicable

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP: (a) [ ]

(b) [X]

3 SEC USE ONLY

4 SOURCE OF FUNDS: WC

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e): [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION: Liberia

NUMBER OF 7 SOLE VOTING POWER: 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER: 1,485,852*

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER: 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER: 1,485,852*

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 1,485,852

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11): 14.29%

14 TYPE OF REPORTING PERSON: CO

----------------------

* Mr. Kirsh, The Eurona Foundation, Ki Corporation Limited and Mira Mag Inc. are

the beneficial owners of 1,485,852 ordinary shares of the Issuer. Mira Mag Inc.

directly holds 1,485,852 ordinary shares of the Issuer. The Eurona Foundation is

Lichtenstein trust controlled by Nathan Kirsh, who is also the trustee of such

entity. The Eurona Foundation holds 100% of Ki Corporation Limited. Ki

Corporation Limited holds 100% of the shares of Mira Mag Inc. Accordingly, Mr.

Kirsh may be deemed to have the sole voting and dispositive power as to the

1,485,852 ordinary shares of the Issuer held by Mira Mag Inc.

2

|

CUSIP No. M6786D 10 4

1 NAME OF REPORTING PERSON: Ki Corporation Ltd.

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY): Not Applicable

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP: (a) [ ]

(b) [X]

3 SEC USE ONLY

4 SOURCE OF FUNDS: WC

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e): [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION Liberia

NUMBER OF 7 SOLE VOTING POWER: 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER: 2,169,893*

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER: 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER: 2,169,893*

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 2,169,893

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11): 20.87%

14 TYPE OF REPORTING PERSON: CO

----------------------

* Mr. Kirsh, The Eurona Foundation and Ki Corporation Limited and Mira Mag Inc.

are the beneficial owners of 1,485,852 ordinary shares of the Issuer. Mira Mag

Inc. directly holds 1,485,852 ordinary shares of the Issuer. The Eurona

Foundation is Lichtenstein trust controlled by Nathan Kirsh, who is also the

trustee of such entity. The Eurona Foundation holds 100% of Ki Corporation

Limited. Ki Corporation Limited holds 100% of the shares of Mira Mag Inc. In

addition, Ki Corporation directly holds 684,041 ordinary shares of the Issuer.

Accordingly, Mr. Kirsh may be deemed to have the sole voting and dispositive

power as to the 2,169,893 ordinary shares of the Issuer held by Ki Corporation

and Mira Mag Inc.

3

|

CUSIP No. M6786D 10 4

1 NAME OF REPORTING PERSON: The Eurona Foundation

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY): Not Applicable

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP: (a) [ ]

(b) [X]

3 SEC USE ONLY

4 SOURCE OF FUNDS: WC

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e): [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION: Liechtenstein

NUMBER OF 7 SOLE VOTING POWER: 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER: 2,169,893*

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER: 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER: 2,169,893*

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON: 2,169,893

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11): 20.87%

14 TYPE OF REPORTING PERSON: OO

----------------------

* Mr. Kirsh, The Eurona Foundation, Ki Corporation Limited and Mira Mag Inc. are

the beneficial owners of 1,485,852 ordinary shares of the Issuer. Mira Mag Inc.

directly holds 1,485,852 ordinary shares of the Issuer. The Eurona Foundation is

Lichtenstein trust controlled by Nathan Kirsh, who is also the trustee of such

entity. The Eurona Foundation holds 100% of Ki Corporation Limited. Ki

Corporation Limited holds 100% of the shares of Mira Mag Inc. In addition, Ki

Corporation directly holds 684,041 ordinary shares of the Issuer. Accordingly,

Mr. Kirsh may be deemed to have the sole voting and dispositive power as to the

2,169,893 ordinary shares of the Issuer held by Ki Corporation and Mira Mag Inc.

4

|

CUSIP No. M6786D 10 4

1 NAME OF REPORTING PERSON: Mr. Nathan Kirsh

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY): Not Applicable

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP: (a) [ ]

(b) [X]

3 SEC USE ONLY

4 SOURCE OF FUNDS: PF, WC

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e): [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION: Swaziland

NUMBER OF 7 SOLE VOTING POWER: 346,375

SHARES

BENEFICIALLY 8 SHARED VOTING POWER: 2,169,893*

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER: 346,375

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER: 2,169,893*

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 2,516,268

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11): 24.20%

14 TYPE OF REPORTING PERSON: IN

----------------------

* Mr. Kirsh, The Eurona Foundation, Ki Corporation Limited and Mira Mag Inc. are

the beneficial owners of 1,485,852 ordinary shares of the Issuer. Mira Mag Inc.

directly holds 1,485,852 ordinary shares of the Issuer. The Eurona Foundation is

Lichtenstein trust controlled by Nathan Kirsh, who is also the trustee of such

entity. The Eurona Foundation holds 100% of Ki Corporation Limited. Ki

Corporation Limited holds 100% of the shares of Mira Mag Inc. In addition, Ki

Corporation directly holds 684,071 ordinary shares of the Issuer. Accordingly,

Mr. Kirsh may be deemed to have the sole voting and dispositive power as to the

2,169,893 ordinary shares of the Issuer held by Ki Corporation and Mira Mag Inc.

5

|

Item 1. Security and Issuer.

This Amendment No. 8 to the Statement on Schedule 13D dated July 24,

2003, and previously amended on April 25, 2008, is being filled to report the

purchase by Ki Corporation Limited ("Ki Corporation") of an aggregate of 325,106

ordinary shares, NIS 1.0 par value, of Magal Security Systems, Ltd., an Israeli

corporation, (the "Issuer"), whose principal executive offices are located at 17

Altalef Street, Yahud Industrial Zone, 56100, Israel.

Item 2. Identity and Background

ITEM 2 OF THIS STATEMENT IS HEREBY AMENDED AND RESTATED TO READ IN ITS

ENTIRETY AS FOLLOWS:

This statement is being filed by Mr. Nathan Kirsh, The Eurona

Foundation (the "Foundation"), Ki Corporation and Mira Mag Inc., ("Mira Mag").

Mr. Nathan Kirsh is an independent investor. Mr. Kirsh has served as a

director of the Issuer since 1984, as a trustee of the Foundation since its

incorporation and as a director of Mira Mag since its incorporation in 1984. Mr.

Kirsh's business address is c/o Kirsh Holdings Ltd. Development House, Swazi

Plaza, Mbabane, Swaziland.

The Foundation is a trust organized in Liechtenstein. The Eurona

Foundation is an entity controlled by Nathan Kirsh, the trustees of which are

Prinz Michael von Liechtenstein and Nathan Kirsh. The principal business office

of the Foundation is Altenbach 8, P. O. Box 339, FL 9490 Vaduz, Liechtenstein.

Ki Corporation is a holding company, incorporated under the law of the

state of Liberia. 100% of the shares of Ki Corporation are held by the

Foundation. The business address of Ki Corporation is c/o 4th Floor, Liqhaga

House, Nkoseluhlaza Street. Ki Corporation's directors are Messrs. Nathan Kirsh,

Philip William Kirsh and Paul Jonathan Friedlander and Mrs. Myra Anne Salkinder.

Mira Mag is a holding company, incorporated under the law of the state

of Liberia. 100% of the shares of Mira Mag are held by Ki Corporation. The

business address of Mira Mag is c/o International Trust Company of Liberia, 80

Broad Street, City of Monrovia, County of Montserrado, Republic of Liberia. Mira

Mag's directors are Messrs. Nathan Kirsh, Stanley Fleishman and Jacob Even Ezra.

During the last five years, neither Mr. Kirsh, the Foundation, Ki

Corporation or Mira Mag, nor any of the trustees of the Foundation or the

directors and executive officers of Ki Corporation and Mira Mag, listed on

Schedule 1 hereto, has been (1) convicted in a criminal proceeding (excluding

traffic violations or similar misdemeanors) or (2) was a party to a civil

proceeding of a judicial or administrative body of competent jurisdiction and as

a result of such proceeding was or is subject to a judgment, decree or final

order enjoining future violations of, or

6

prohibiting or mandating activities subject to, U.S. federal or state securities

laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

ITEM 3 OF THIS STATEMENT IS HEREBY AMENDED TO ADD THE FOLLOWING:

From April 24, 2008 through December 22, 2008, Ki Corporation purchased

an aggregate of 325,016 ordinary shares of the Issuer in a series of

transactions. The aggregate purchase price for such 325,016 ordinary shares was

approximately $1,808,192 all of which amount was paid by Ki Corporation from its

working capital.

Item 4. Purpose of Transaction

ITEM 4 OF THIS STATEMENT IS HEREBY AMENDED TO ADD THE FOLLOWING:

(c) The 325,016 ordinary shares purchased by Ki Corporation during the

period from April 24, 2008 through December 22, 2008 were purchased for

portfolio investment purposes. Mr. Nathan Kirsh, the Foundation, Ki Corporation

and Mira Mag currently do not have any plan or proposal, which relates to or

would result in:

(a) the acquisition by any person of additional securities of the

Issuer, or the disposition of securities of the Issuer;

(b) an extraordinary corporate transaction, such as a merger,

reorganization, or liquidation, involving the Issuer or any of its

subsidiaries;

(c) a sale or transfer of a material amount of the assets of the Issuer

or any of its subsidiaries;

(d) any change in the present board of directors or management of the

Issuer, including any plan or proposal to change the number or term of

directors or to fill any existing vacancies on the board;

(e) any material change in the present capitalization or dividend

policy of the Issuer;

(f) any other material change in the Issuer's business or corporate

structure;

(g) changes in the Issuer's charter or by-laws or other actions which

may impede the acquisition of control of the Issuer by any person;

(h) a class of securities of the Issuer being delisted from a national

securities exchange or ceasing to be authorized to be quoted in an

inter-dealer quotation system of a registered national securities

association;

7

(i) a class of equity securities of the Issuer becoming eligible for

termination of registration pursuant to Section 12(g)(4) of the

Securities Exchange Act of 1934; or

(j) any action similar to any of those enumerated above.

Item 5. Interest in Securities of the Issuer

ITEM 5 OF THIS STATEMENT IS HEREBY AMENDED AND RESTATED TO READ IN ITS

ENTIRETY AS FOLLOWS:

(a) Mr. Kirsh is the holder of 346,375 ordinary shares of the Issuer,

or approximately 3.33 % of the 10,396,548 ordinary shares of the Issuer's issued

and outstanding shares as of December 22, 2008.

Mr. Kirsh, the Foundation and Ki Corporation are the beneficial holders

of 1,030,416 ordinary shares of the Issuer, or approximately 9.91 % of the

10,396,548 ordinary shares of the Issuer's issued and outstanding shares as of

December 22, 2008.

Mr. Kirsh, the Foundation, Ki Corporation and Mira Mag are the

beneficial holders of 2,516,268 ordinary shares of the Issuer, or approximately

24.20 % of the 10,396,548 ordinary shares of the Issuer's issued and outstanding

shares as of December 22, 2008.

(b) Mr. Kirsh has sole power to vote or direct the vote and the sole

power to dispose or direct the disposition of the 346,375 ordinary shares

currently held by him.

Mr. Kirsh, the Foundation and Ki Corporation have shared power to vote

or direct the vote and the shared power to dispose or direct the disposition of

the 1,030,416 ordinary shares currently beneficially owned by Mr. Kirsh, the

Foundation and Ki Corporation.

Mr. Kirsh, the Foundation, Ki Corporation and Mira Mag have shared

power to vote or direct the vote and the shared power to dispose or direct the

disposition of the 2,516,268 ordinary shares currently beneficially owned by Mr.

Kirsh, the Foundation, Ki Corporation and Mira Mag.

(c) The following table sets forth all the transactions in the

ordinary shares of the Issuer effected by Ki Corporation in the last 60 days.

All such transactions were open market purchases effected on the Tel Aviv Stock

Exchange and on the NASDAQ National Market.

Date of Purchase by Number of

Ki Corporation Ordinary Shares Price Per Share*

-------------- --------------- ----------------

Nov 17, 2008 2,189 $5.00

Nov 20, 2008 1,974 $5.00

Nov 21, 2008 6,599 $5.00

Nov 24, 2008 7,100 $5.00

Dec 1, 2008 5,200 $5.00

|

8

Dec 15, 2008 5,598 $5.00

Dec 22, 2008 4,402 $5.00

-------------------

|

* Does not include broker's commissions.

Except for such transactions, Mr. Kirsh, the Foundation, Ki Corporation

and Mira Mag have not effected any transactions in the ordinary shares since

April 23 2008.

(d) No person other than Mr. Kirsh, the Foundation, Ki Corporation and

Mira Mag, has the right to receive or the power to direct the receipt of

dividends from, or the proceeds from the sale of, the shares reported above in

this Item 5.

(e) Not applicable.

9

SIGNATURES

After reasonable inquiry and to the best of our knowledge and belief,

the undersigned hereby certify that the information set forth in this Statement

is true, complete and correct.

Date: January 15, 2009

/s/ Nathan Kirsh

----------------

Mr. Nathan Kirsh

|

The Eurona Foundation

/s/ Nathan Kirsh

----------------

By: Nathan Kirsh

Title: Trustee

|

Ki Corporation Ltd.

/s/ Nathan Kirsh

----------------

By: Nathan Kirsh

Title: Director

|

Mira Mag Inc.

/s/ Nathan Kirsh

-----------------

By: Nathan Kirsh

Title: Director

|

10

Schedule 1

List of Trustees of The Eurona Foundation

Name

Prinz Michael von Liechtenstein

Nathan Kirsh

List of Directors and Executive Officers of Ki Corporation Limited

Name

Nathan Kirsh

Philip William Kirsh

Paul Jonathan Friedlander

Myra Anne Salkinder

List of Directors and Executive Officers of Mira Mag Inc.

Name

Nathan Kirsh

Stanley Fleishman

Jacob Even Ezra

11

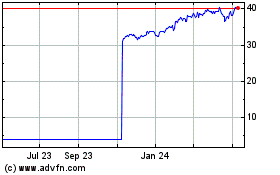

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From May 2024 to Jun 2024

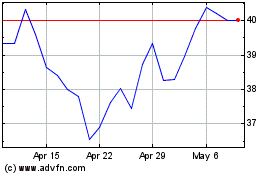

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From Jun 2023 to Jun 2024