SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2008

MAGAL SECURITY SYSTEMS LTD.

(Name of Registrant)

P.O. Box 70, Industrial Zone, Yahud 56100 Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

If "Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- __________

This Report on Form 6-K is incorporated by reference into the Registrant's Form

F-3 Registration Statements File Nos. 333-9050 and 333-123265 and Form S-8

Registration Statement File No. 333-06246.

Magal Security Systems Ltd.

6-K Items

1. Press Release re Magal Reports Second Quarter 2008 Revenues of $25

Million Representing a 78% Year-Over-Year Increase dated July 30,

2008.

ITEM 1

Press Release Source: Magal Security Systems Ltd

Magal Reports Second Quarter 2008 Revenues of $25 Million Representing a

78% Year-Over-Year Increase

Wednesday July 30, 6:30 am ET

Net Income on a Non-GAAP Basis for the Second Quarter Increases 108%

Year-Over-Year to $0.9 Million

YAHUD, Israel, July 30 /PRNewswire-FirstCall/ -- Magal Security Systems Ltd.

(Nasdaq GM: MAGS; TASE: MAGS) today announced its consolidated financial results

for the three and six month periods ended June 30, 2008.

Second Quarter 2008 Results

Revenues for the second quarter of 2008 increased 77.6% reaching US$25.0

million, compared to US$14.1 million in the second quarter of 2007. Effective

September 1, 2007, Magal's financial statements consolidate the results of a

European integration company acquired in August 2007. Following the sale in

December 2007 of Magal's U.S. based video monitoring business operated by Smart

Interactive Systems Inc., the results of this business were reclassified as

discontinued operations.

Gross profit for the second quarter of 2008 increased by 47.6%, reaching US$9.5

million (38.0% of revenues) compared with $6.4 million (45.7% of revenues) in

the second quarter of 2007. Gross margin for the quarter was adversely affected

by the ongoing weakening of the US dollar against the Israeli Shekel as well as

the shift in revenue mix towards larger scale integration projects.

Operating expenses on a GAAP basis in the second quarter of 2008 were US$8.7

million or 34.7% of sales, compared to US$5.6 million or 39.6% of revenues on a

non-GAAP and GAAP basis in the second quarter 2007. Operating expenses on a

non-GAAP basis, for the second quarter of 2008, totalled US$7.6 million or 30.2%

of revenues.

The operating expenses for the quarter, on a GAAP basis, included a US$1.1

million amortization of intangible assets relating to a recently acquired

European subsidiary. Operating expenses for the quarter were also adversely

affected by the devaluation of the US dollar against the Israeli Shekel and the

Canadian Dollar, increasing operating expenses by approximately US$0.7 million

for the quarter compared with the second quarter of 2007.

Operating income on a GAAP basis for the second quarter of 2008 decreased 4.4%

reaching US$0.8 million (3.3% of revenues) compared to US$0.9 million (6.1% of

revenues) in the second quarter of 2007 on a GAAP and non-GAAP basis. Operating

income on a non-GAAP basis for the second quarter of 2008 increased 125.4%

reaching US$1.9 million (7.7% of revenues).

Net income on a GAAP basis for the second quarter of 2008 reached US$0.1 million

compared with net income of $0.3 million in the second quarter 2007. Diluted

earnings per share on a GAAP basis in the second quarter of 2008 was $0.01

compared to $0.03 in the second quarter of 2007.

Net income on a non-GAAP basis, totalled US$0.9 million, compared with non-GAAP

net income of US$0.4 million in the second quarter of 2007. Diluted non-GAAP

earnings per share for the second quarter totalled US$0.09 compared to non-GAAP

diluted earnings per share of US$0.04 in the same quarter of last year.

"We are particularly encouraged by our strong revenue growth over last year and

our improved non-GAAP operating profitability this quarter," commented Izhar

Dekel, CEO of Magal. "This year is shaping up as an exceptionally strong year in

terms of revenue growth, which increases our confidence in realizing our target

of doubling revenues within the next four to five years. We are also encouraged

by our operating margin improvement which represents the initial fruits of our

efforts to focus on increasing profitability. At the same time, we are

successfully executing on our strategy of becoming a more project focused

company, winning a number of high profile projects."

Continued Mr. Dekel, "Over the past year, we have won a number of orders for

municipal security systems based on our Fortis system, which is becoming a

growth engine and strong revenue generator for Magal. While the majority of our

project wins have to date been for municipalities in Israel and there still

remains significant potential within Israel, we see far greater prospects for

this system outside of Israel. We have already won some international orders

based on our local success and we are competing in a number of other

international tenders at magnitudes greater than what we have seen so far."

Use of Non-GAAP Financial Information

In addition to disclosing financial results calculated in accordance with United

States generally accepted accounting principles (GAAP), this release of

operating results also contains non-GAAP financial measures, which the Company

believes are the principal indicators of the operating and financial performance

of its business. The non-GAAP financial measures exclude the effects of

stock-based compensation charges recorded in accordance with SFAS 123R as well

as amortization of customer related intangible assets and a loss associated with

a discontinued operation. Management believes the non-GAAP financial measures

provided are useful to investors' understanding and assessment of the Company's

on-going core operations and prospects for the future, as the charges eliminated

are not part of the day-to-day business or reflective of the core operational

activities of the Company. Management uses these non-GAAP financial measures as

a basis for strategic decisions, forecasting future results and evaluating the

Company's current performance. However, such measures should not be considered

in isolation or as substitutes for results prepared in accordance with GAAP.

Reconciliation of the non-GAAP measures to the most comparable GAAP measures are

provided in the schedules attached to this release.

Results Conference Call

The Company will be hosting its quarterly conference call later today at 9:00am

ET. On the call, management will review and discuss the second quarter 2008

results. They will then be available to answer questions.

To participate, please call one of the following teleconferencing numbers.

Please begin placing your calls 5 minutes before the conference call commences.

If you are unable to connect using the toll-free numbers, please try the

international dial-in number.

US Dial-in Number: +1-866-345-5855

Israel Dial-in Number: 03-918-0688

International Dial-in Number: +972-3-918-0688

at: 9:00 am Eastern Time; 6:00 am Pacific

Daylight Time; 4:00 pm Israel Time

A replay of the call will be available for three months from the day after the

call. The webcast and the replay will both be accessible from Magal's website

at: http://www.magal-ssl.com.

About Magal Security Systems, Ltd.

Magal Security Systems Ltd. (Magal) is engaged in the development, manufacturing

and marketing of computerized security systems, which automatically detect,

locate and identify the nature of unauthorized intrusions. The Company's

products are currently used in more than 70 countries worldwide to protect

national borders, airports, correctional facilities, nuclear power stations and

other sensitive facilities from terrorism, theft and other threats.

Magal trades under the symbol MAGS in the U.S. on the Nasdaq Global Market and

in Israel on the Tel-Aviv Stock Exchange (TASE).

This press release contains forward-looking statements, which are subject to

risks and uncertainties. Such statements are based on assumptions and

expectations which may not be realized and are inherently subject to risks and

uncertainties, many of which cannot be predicted with accuracy and some of which

might not even be anticipated. Future events and actual results, financial and

otherwise, may differ from the results discussed in the forward-looking

statements. A number of these risks and other factors that might cause

differences, some of which could be material, along with additional discussion

of forward-looking statements, are set forth in the Company's Annual Report on

Form 20-F filed with the Securities and Exchange Commission.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(All numbers except EPS expressed in

thousands of US$)

Six Months Ended Three months Ended

June 30, June 30,

2008 2007 % change 2008 2007 % change

Revenues 51,311 28,204 81.9 25,021 14,091 77.6

Cost of 32,122 15,382 108.8 15,514 7,650 102.8

revenues

Gross profit 19,189 12,822 49.7 9,507 6,441 47.6

Operating

expenses:

Research and 3,154 2,602 21.2 1,529 1,148 33.0

development,

net

Selling and 8,927 5,737 55.6 4,691 3,028 54.9

marketing

General and 4,562 2,723 67.5 2,467 1,407 75.3

administrative

Special Post 438

employment

benefit

Total 17,081 11,062 54.4 8,687 5,583 55.6

operating

expenses

Operating 2,108 1,760 19.8 820 858 (4.4)

income

Financial 1,399 444 215.1 415 140 196.4

expense, net

Income from 709 1,316 (46.1) 405 718 (43.6)

continuing

operations

before income

taxes

Income tax 571 428 279 280

Net Income 138 888 (84.5) 126 438 (71.2)

from

continuing

operations

Loss on 309 248 61 96

discontinued

operations,

net

Net income (171) 640 65 342 (81.0)

(loss)

|

Basic and 0.01 0.08 0.01 0.04

diluted net

earnings per

share from

continuing

operations

Basic and (0.03) (0.02) (0.005) (0.01)

diluted loss

per share from

discontinued

operations,

net

Basic and (0.02) 0.06 0.005 0.03

diluted net

earnings

|

(loss) per share

FINANCIAL RATIOS

Six Months Ended Three months Ended

June 30, June 30,

2008 2007 2008 2007

Gross margin 37.4 45.5 38.0 45.7

Research and 6.1 9.2 6.1 8.1

development,

net as a % of

revenues

Selling and 17.4 20.3 18.7 21.5

marketing as a

% of revenues

General and 8.9 9.7 9.9 10

administrative

as a % of

revenues

Special post 0.9 - - -

employment

benefit

Operating 4.1 6.2 3.3 6.1

margin

Net income (0.3) 2.3 0.3 2.4

margin (after

discontinued

operation)

|

MAGAL SECURITY SYSTEMS LTD.

Reconciliation of GAAP to Non-GAAP Measures

(All numbers expressed in thousands of US$)

Six Months Ended Three months

June 30, Ended June 30,

2008 2007 2008 2007

GAAP operating income 2,108 1,760 820 858

Amortization of customer 2,101 - 1,056 -

related intangible assets

Special post employment 438 - -

benefit

Amortization of deferred 114 - 57 -

stock based compensation

Non-GAAP operating income 4,761 1,760 1,933 858

GAAP operating income as a 4.1% 6.2% 3.3% 6.1%

percentage of revenues

Non-GAAP operating income as 9.3% 6.2% 7.7% 6.1%

a percentage of revenues

Six Months Three months

Ended June 30, Ended June 30,

2008 2007 2008 2007

GAAP net income (loss) (171) 640 65 342

Amortization of customer 2,101 1,056

related intangible assets

Special post employment 438

benefit

Loss on discontinued 309 248 61 96

operation, net

Amortization of deferred 114 57

stock based compensation

Income taxes with respect to (768) (332)

the above items

Non-GAAP net income 2,023 888 907 438

GAAP net income (loss) as a (0.3) 2.3 0.3 2.4

percentage of revenues

Non GAAP net income as a 3.9 3.1 3.6 3.1

percentage of revenues

GAAP basic and diluted net (0.02) 0.06 0.005 0.03

earnings (loss) per share

Non-GAAP basic and diluted 0.19 0.08 0.09 0.04

net earnings per share

|

MAGAL SECURITY SYSTEMS LTD.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(All numbers expressed in thousands of US$)

June 30, December 31,

2008 2007

CURRENT ASSETS:

Cash and cash equivalents 12,220 9,205

Marketable securities 9,732 9,464

Short term bank deposits 4,496 11,220

Trade receivables 24,282 26,775

Unbilled accounts receivable 5,204 4,053

Other accounts receivable and prepaid 6,935 5,753

expenses

Deferred income taxes 2,479 1,936

Inventories 16,884 23,785

Total current assets 82,232 92,191

Long term investments and receivables:

Long-term trade receivables 2,076 2,019

Long-term loans 919 808

Long-term bank deposits 1,834 1,846

Escrow deposit 992 4,442

Severance pay fund 2,853 2,765

Total long-term investments and 8,674 11,880

receivables

PROPERTY AND EQUIPMENT, NET 8,987 8,429

DEFERRED INCOME TAXES 2,220 763

OTHER INTANGIBLE ASSETS, NET 5,277 7,040

GOODWILL 12,847 5,610

ASSETS ATTRIBUTED TO DISCONTINUED 60 244

OPERATION

Total assets 120,297 126,157

CURRENT LIABILITIES:

Short-term bank credit 15,183 16,434

Current maturities of long-term bank 4,303 4,303

debt

Trade payables 4,192 7,344

Other accounts payable, accrued 16,966 22,584

expenses and customer advances

Total current liabilities 40,644 50,665

LONG-TERM LIABILITIES:

Long-term bank debt 2,695 3,095

Deferred income taxes 4,029 2,097

Accrued severance pay 4,135 3,873

Total long-term liabilities 10,859 9,065

LIABILITIES ATTRIBUTED TO DISCONTINUED 246 849

OPERATION

SHAREHOLDERS' EQUITY 68,548 65,578

TOTAL LIABILITIES AND SHAREHOLDERS' 120,297 126,157

EQUITY

Total bank debt to total 0.32 0.36

capitalization

Current ratio 2.02 1.82

|

Contacts:

Company Investor Relations

Magal Security Systems, Ltd GK Investor Relations

Lian Goldstein, CFO Ehud Helft/Kenny Green

Tel: +972-3-5391444 Tel: +1-646-201-9246

Fax: +972-3-5366245 E-mail: info@gkir.com

E-mail: lian@magal-ssl.com

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

MAGAL SECURITY SYSTEMS LTD.

(Registrant)

By: /s/ Izhar Dekel

---------------

Izhar Dekel

Chief Executive Officer

Date: July 30, 2008

|

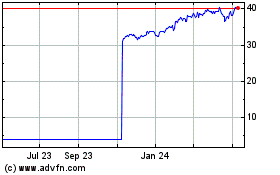

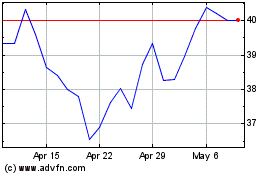

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From May 2024 to Jun 2024

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From Jun 2023 to Jun 2024