SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR

15D-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MARCH 2008

MAGAL SECURITY SYSTEMS LTD.

(Name of Registrant)

P.O. Box 70, Industrial Zone, Yahud 56100 Israel

(Address of Principal Executive Office)

INDICATE BY CHECK MARK WHETHER THE REGISTRANT FILES OR WILL FILE ANNUAL

REPORTS UNDER COVER OF FORM 20-F OR FORM 40-F.

FORM 20-F [X] FORM 40-F [_]

INDICATE BY CHECK MARK IF THE REGISTRANT IS SUBMITTING THE FORM 6-K IN

PAPER AS PERMITTED BY REGULATION S-T RULE 101(B)(1): [_]

INDICATE BY CHECK MARK IF THE REGISTRANT IS SUBMITTING THE FORM 6-K IN

PAPER AS PERMITTED BY REGULATION S-T RULE 101(B)(7): [_]

INDICATE BY CHECK MARK WHETHER BY FURNISHING THE INFORMATION CONTAINED IN

THIS FORM, THE REGISTRANT IS ALSO THEREBY FURNISHING THE INFORMATION TO THE

COMMISSION PURSUANT TO RULE 12G3-2(B) UNDER THE SECURITIES EXCHANGE ACT OF 1934.

YES [_] NO [X]

IF "YES" IS MARKED, INDICATE BELOW THE FILE NUMBER ASSIGNED TO THE

REGISTRANT IN CONNECTION WITH RULE 12G3-2(B): 82- ____________

THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE INTO THE REGISTRANT'S FORM

F-3 REGISTRATION STATEMENTS FILE NOS. 333-9050 AND 333-123265 AND FORM S-8

REGISTRATION STATEMENT FILE NO. 333-06246.

MAGAL SECURITY SYSTEMS LTD.

6-K Items

1. Press Release re Magal Security Systems Ltd. Announces Fourth Quarter and

Full Year 2007 Financial Results dated March 6, 2008.

ITEM 1

PRESS RELEASE Source: Magal Security Systems Ltd

MAGAL SECURITY SYSTEMS LTD. ANNOUNCES FOURTH QUARTER AND FULL YEAR 2007

FINANCIAL RESULTS

Thursday March 6, 7:06 am ET

RECORD ANNUAL REVENUES, UP 14% OVER 2006

YAHUD, Israel, March 6 /PRNewswire-FirstCall/ - Magal Security Systems Ltd.

(Nasdaq: MAGS - NEWS; TASE: MAGS) today announced its consolidated financial

results for the three and twelve month periods ended December 31, 2007.

Effective September 1, 2007, Magal's financial statements include the

consolidation of its recently acquired European integration subsidiary.

Furthermore, following the sale of Magal's U.S. based video monitoring business

operated by Smart Interactive Systems Inc., the results of this business, for

the fourth quarter and the years ended December 31, 2006 and 2007, were

reclassified as discontinued operations.

Fourth Quarter Results

Revenues for the fourth quarter of 2007 increased 7.0 percent over the fourth

quarter 2006, reaching US$23.2 million.

Gross profit for the fourth quarter of 2007 increased 4.1 percent over the

fourth quarter of 2006, reaching US$8.3 million, or 35.9 percent of revenues.

Gross margin for the quarter was negatively affected by a strategic and

prestigious project performed for the Israeli government. The majority of this

project was completed by the end of 2007.

Operating income in the fourth quarter of 2007, reached US$826,000 compared with

US$877,000 for the fourth quarter of 2006.

Net income from continuing operations in the fourth quarter of 2007 increased

157 percent over the fourth quarter of 2006, reaching US$857,000.

Net income in the fourth quarter of 2007, reached US$2.9 million, compared with

a net loss of US$231,000 in the fourth quarter of 2006.

Net income for the quarter includes the discontinued operations of Magal's U.S.

based video monitoring business operated by Smart Interactive Systems Inc.,

which business was sold in the fourth quarter 2007 to iVerify US, Inc. for $8.5

million. The sale follows Magal's strategy to focus on its core business of

perimeter security projects and products.

Diluted earnings per share from continuing operations for the fourth quarter of

2007 was US$0.08, compared with US$0.03 in the same period last year. Diluted

net earnings per share for the fourth quarter of 2007 was US$0.28, compared with

diluted loss per share of US$0.02 in the same period last year.

Full Year Results

Revenues for the year ended December 31, 2007 increased 13.8 percent compared

with 2006, reaching US$72.4 million.

Gross profit for the year ended December 31, 2007 increased 9.5 percent,

reaching US$28.9 million, or 39.9 percent of revenues, compared with US$26.4

million for 2006, or 41.5 percent of revenue.

Operating income for the year ended December 31, 2007, including a one-time

charge of $904,000, totalled US$2.8 million, compared with US$3.8 million for

2006. The one-time charge relates to contractual post employment benefits for

the Company's founder and former chairman who retired at the end of the fourth

quarter of 2007.

Financial expenses for the full year of 2007 totalled US$2.3 million and

includes approximately US$1.5 million of foreign exchange losses resulting from

the devaluation of the US dollar against both the new Israeli Shekel and the

Canadian dollar.

Net income from continuing operations for 2007 totalled US$196,000 compared with

$2 million in 2006. Net income for the year totalled US$1.9 million, compared to

US$0.8 million for full year 2006.

Diluted earnings per share from continuing operations for the year ended

December 31, 2007 was US$0.02, compared with diluted earnings per share of

US$0.20 in the year 2006.

Diluted net earnings per share for the year ended December 31, 2007 was US$0.18,

compared with diluted earnings per share of US$0.08 in the year 2006.

Commenting on the results, Mr. Izhar Dekel, CEO of Magal, said, "2007 was very

much a year of meeting strategic milestones. This included targeting larger

scale integration projects, expanding our global presence and acquiring

complementary businesses. During the year we acquired a European integrator,

offering us access to new markets, while expanding our capabilities to target

larger projects."

Mr. Dekel added, "We are pleased that we had another year of revenue growth in

2007. During the fourth quarter we continued to focus our efforts and resources

to maximize our synergies and the integration of the capabilities of our recent

and accretive European acquisition. Furthermore, we continued to focus on our

core competencies, and, as such, sold our US-based video monitoring systems'

business. Looking ahead, and based on the significant new orders that we

received in recent months, we believe that Magal will generate increased

revenues and improved results in 2008."

The Company will be hosting its quarterly conference call at 10:00am EST today.

Management will review and discuss the fourth quarter 2007 results. They will

then be available to answer questions.

To participate, you may call one of the teleconferencing numbers that follows.

Please place your calls 5-10 minutes before the conference call commences. If

you are unable to connect using one of the toll-free numbers, please try the

international dial-in number.

US Dial-in Number: 1-888-668-9141

Canada Dial-in Number: 1-800-917-9141

ISRAEL Dial-in Number: 03-918-0609

INTERNATIONAL Dial-in Number: +972-3-918-0609

At: 10:00am Eastern Time; 7:00am Pacific Time; 5:00pm Israel Time

About Magal Security Systems, Ltd.:

Magal Security Systems Ltd. is engaged in the development, manufacturing and

marketing of computerized security systems, which automatically detect, locate

and identify the nature of unauthorized intrusions. The Company's products are

currently used in more than 70 countries worldwide to protect national borders,

airports, correctional facilities, nuclear power stations and other sensitive

facilities from terrorism, theft and other threats. Magal trades under the

symbol MAGS on the Nasdaq since 1993 and on the Tel-Aviv Stock Exchange (TASE)

since July 2001.

This press release contains forward-looking statements, which are subject to

risks and uncertainties. Such statements are based on assumptions and

expectations which may not be realized and are inherently subject to risks and

uncertainties, many of which cannot be predicted with accuracy and some of which

might not even be anticipated. Future events and actual results, financial and

otherwise, may differ from the results discussed in the forward-looking

statements. A number of these risks and other factors that might cause

differences, some of which could be material, along with additional discussion

of forward-looking statements, are set forth in the Company's Annual Report on

Form 20-F filed with the Securities and Exchange Commission.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(All numbers except EPS expressed in thousands of US$)

Year Ended December 31, Quarter Ended December 31,

% %

2007 2006 (* change 2007 2006 (* change

-------- -------- -------- -------- -------- --------

Revenues 72,375 63,600 13.8 23,155 21,635 7.0

Cost of revenues 43,510 37,236 16.8 14,837 13,648 8.7

Gross profit 28,865 26,364 9.5 8,318 7,987 4.1

Operating expenses:

Research and development, net 5,764 5,378 7.2 1,879 1,576 19.2

Selling and marketing 13,029 11,603 12.3 3,498 3,861 (9.4)

General and administrative 6,399 5,547 15.4 2,171 1,673 29.8

Special post employment benefit 904 - (56) -

Total operating Expenses 26,096 22,528 15.8 7,492 7,110 5.4

Operating income 2,769 3,836 (27.8) 826 877 (5.8)

Financial expenses, net 2,259 864 161.5 832 216 285.2

Income (loss) from continuing

operations before income taxes 510 2,972 (82.8) (6) 661

Income tax (tax benefit) 314 943 (66.7) (863) 327

Net Income from continuing operations 196 2,029 (90.3) 857 334 156.6

Net Income (loss) from discontinued operations 1,686 (1,219) 2,022 (565)

Net income (loss) 1,882 810 132.3 2,879 (231)

Basic net earnings per share from

continuing operations $ 0.02 $ 0.20 $ 0.08 $ 0.03

Basic net earnings (loss) per share

from discontinued operations $ 0.16 $ (0.12) $ 0.20 $ (0.05)

Basic net earnings (loss) per share $ 0.18 $ 0.08 $ 0.28 $ (0.02)

Weighted average number of shares

outstanding used in computing

basic net earnings per share (in thousands) 10,395 10,384 10,397 10,392

Diluted net earnings per share from

continuing operations $ 0.02 $ 0.20 $ 0.08 $ 0.03

Diluted net loss per share from

discontinued operations $ 0.16 $ (0.12) $ 0.20 $ (0.05)

Diluted net earnings (loss) per share $ 0.18 $ 0.08 $ 0.28 $ (0.02)

Weighted average number of shares

outstanding used in computing diluted net

earnings per share (in thousands) 10,431 10,442 10,398 10,427

|

(* Reclassified

FINANCIAL RATIOS

Year ended Quarter ended

December 31 December 31

2007 2006 (* 2007 2006 (*

---- ------- ---- -------

Gross margin 39.9% 41.5% 35.9% 36.9%

Research and development, net as a % of revenues 8.0% 8.5% 8.1% 7.3%

Selling and Marketing as a % of revenues 18.0% 18.2% 15.1% 17.8%

General and administrative as a % of revenues 8.8% 8.7% 9.4% 7.7%

Operating income margin 3.8% 6.0% 3.6% 4.1%

Net income margin (before discontinued operation) 0.3% 3.2% 3.7% 1.5%

Net income (loss) margin (after discontinued operation) 2.6% 1.3% 12.4% (1.1)%

Total bank debt to total Capitalization * 0.36 ** 0.43 * 0.36 ** 0.43

Current ratio * 1.75 ** 2.15 * 1.75 ** 2.15

|

* As of December 31, 2007

** As of December 31, 2006

(* Reclassified

MAGAL SECURITY SYSTEMS LTD.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(All numbers expressed in thousands of US$)

December 31, December 31,

2007 2006 (*

------------ ------------

CURRENT ASSETS:

Cash and cash equivalents $ 9,814 $ 4,908

Marketable securities 9,464 3,067

Short term bank deposits 11,220 14,186

Trade receivables 26,623 27,754

Unbilled accounts receivable 4,003 5,389

Other accounts receivable and prepaid expenses 6,976 3,821

Deferred income taxes 1,847 1,604

Inventories 23,816 13,971

Total current assets 93,763 74,700

Long term investments and receivables:

Long-term trade receivables 2,019 40

Long-term loans 808 622

Long-term bank deposits 1,846 4,800

Escrow deposit 4,442 -

Severance pay fund 2,765 2,401

Total long-term investments and receivables 11,880 7,863

PROPERTY AND EQUIPMENT, NET 8,429 7,707

OTHER ASSETS, NET 13,755 6,002

ASSETS ATTRIBUTED TO DISCONTINUED OPERATION 244 7,409

Total assets $128,071 $103,681

CURRENT LIABILITIES:

Short-term bank credit $ 16,434 $ 17,026

Current maturities of long-term bank debt 4,303 795

Trade payables 7,344 5,954

Deferred income taxes 687 -

Other accounts payable, accrued expenses and

customer advances 24,791 11,041

Total current liabilities 53,559 34,816

LONG-TERM LIABILITIES:

Long-term bank debt 3,095 7,399

Long-term accounts payable - 178

Deferred income taxes 1,218 -

Accrued severance pay 3,873 2,524

Total long-term liabilities 8,186 10,101

LIABILITIES ATTRIBUTED TO DISCONTINUED OPERATION 849 614

SHAREHOLDERS' EQUITY 65,477 58,150

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $128,071 $103,681

|

(* Reclassified

Contacts:

Company

Magal Security Systems, Ltd

Lian Goldstein, CFO

Tel: +972-3-5391444

Fax: +972-3-5366245

E-mail: magalssl@trendline.co.il

Investor Relations

GK Investor Relations

Ehud Helft/Kenny Green

Tel: +1-646-201-9246

E-mail: info@gkir.com

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

MAGAL SECURITY SYSTEMS LTD.

(Registrant)

By: /s/ Izhar Dekel

-------------------

Izhar Dekel

Chief Executive Officer

Date: March 6, 2008

|

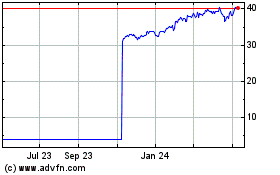

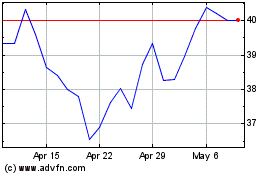

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From May 2024 to Jun 2024

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From Jun 2023 to Jun 2024