0001741830FALSE00017418302024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2024

Kronos Bio, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39592 | 82-1895605 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1300 So. El Camino Real, Suite 400

San Mateo, California 94402

(Address of principal executive offices including zip code)

Registrant’s telephone number, including area code: (650) 781-5200

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | KRON | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, Kronos Bio, Inc. issued a press release providing a corporate update and announcing its financial results for the quarter ended March 31, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this report.

The information in this report and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| |

| |

| | |

| 104 | | The cover page of this report has been formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | KRONOS BIO, INC. |

| | | | |

Dated: May 9, 2024 | | By: | | /s/ Norbert Bischofberger |

| | | | Norbert Bischofberger, Ph.D. |

| | | | President and Chief Executive Officer |

| | | | |

| | | | |

| | | | |

Kronos Bio Reports First-Quarter 2024 Financial Results

— $152.0 million cash runway into the second half of 2026 —

— A study update on KB-0742-1001 will be presented at the upcoming American Society of Clinical Oncology (ASCO); expansion cohorts at new dose schedule remain on track to open in Q3 2024 —

— KB-9558 remains on track with IND-enabling studies expected to complete in 2024 with first-in-human study anticipated to commence in the first half of 2025 —

SAN MATEO, Calif., and CAMBRIDGE, Mass., May 9, 2024 – Kronos Bio, Inc. (Nasdaq: KRON), a company dedicated to developing small molecule therapeutics that address cancers and other diseases driven by deregulated transcription, today reported recent business progress and financial results for the first-quarter of 2024.

“We have continued to make good progress towards our goals. We are looking forward to sharing a clinical update on the KB-0742 data to date at ASCO in June,” said Nobert Bischofberger, Ph.D., president and chief executive officer of Kronos Bio, Inc. “We expect to complete the IND-enabling studies for KB-9558 by the end of 2024 and expect to dose our first patients in the first half of 2025. Our collaboration with Genentech and our internal discovery programs continue to advance and we look forward to sharing our progress later this year.”

Recent Company News

•At the American Association for Cancer Research (AACR) Annual Meeting in April 2024, the Company presented three posters, including the first public presentation of data from its p300 program. The posters include:

◦p300 catalytic inhibition selectively targets IRF4 oncogenic activity in multiple myeloma (link to poster)

◦A dose escalation and cohort expansion study of the CDK9 inhibitor KB-0742 in relapsed, refractory and transcriptionally addicted solid tumors (link to poster)

◦KB-0742, an oral highly selective CDK9 inhibitor, demonstrates preclinical activity in transcription factor fusion driven adenoid cystic carcinoma patient-derived models (link to poster)

•The Company announced that they will be presenting updated study data from KB-0742-1001, the ongoing Phase 1/2 trial of KB-0742 at the upcoming American Society of Clinical Oncology (ASCO):

Title: Study update of the oral CDK9 inhibitor KB-0742 in relapsed or refractory transcriptionally addicted advanced solid tumors

Presenter: Brian A. Van Tine, M.D., Ph.D., Washington University in St. Louis

Abstract ID#: 3102

Poster Session: Developmental Therapeutics—Molecularly Targeted Agents and Tumor Biology

Location: Hall A, McCormick Place, Chicago, Illinois

Poster Board #: 247

Date and Time: Saturday, June 1, 2024, from 9:00 a.m. to 12:00 p.m. CDT

First Quarter 2024 Financial Highlights

•Cash, Cash Equivalents and Investments: With its ongoing and currently planned clinical programs and $152.0 million in cash, cash equivalents and investments as of March 31, 2024, the Company anticipates sufficient resources to fund its planned operations into the second half of 2026.

•R&D Expenses: Research and development expenses were $14.2 million for the first quarter of 2024, which includes non-cash stock-based compensation expense of $1.2 million.

•G&A Expenses: General and administrative expenses were $7.5 million for the first quarter of 2024, which includes non-cash stock-based compensation expense of $2.2 million.

•Impairment of Long-lived Assets and Restructuring: The Company incurred impairment of long-lived assets expense of $6.6 million for the first quarter of 2024. The Company also incurred restructuring expense of $6.2 million for the first quarter of 2024, which includes non-cash stock-based compensation of $4.4 million.

•Net Loss: Net loss for the first quarter of 2024 was $30.0 million, or $0.50 per share, including non-cash stock-based compensation expense of $7.7 million.

About Kronos Bio, Inc.

Kronos Bio, Inc (Nasdaq: KRON) is a clinical-stage company dedicated to developing small molecule therapeutics that address deregulated transcription, a hallmark of cancer and other diseases. Our proprietary discovery engine decodes complex transcription factor (TF) regulatory networks to identify druggable cofactors. We screen for and optimize small molecules that target these cofactors in a tumor-specific context. These efforts have yielded a preclinical pipeline along with two internally developed drug candidates. KB-0742 targets CDK9 to address MYC deregulation in solid tumors and KB-9558 targets p300 to address IRF4 dependence in multiple myeloma.

Kronos Bio is based in San Mateo, Calif., and has a research facility in Cambridge, Mass. For more information, visit https://www.kronosbio.com/ or follow the Company on LinkedIn.

Forward-Looking Statements

Statements in this press release that are not statements of historical fact are forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The press release, in some cases, uses terms such as “anticipate,” “believe,” “could,” “expect,” “plan,” “will,” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements include statements regarding Kronos Bio’s intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, the next clinical update on KB-0742; our expected completion of IND-enabling studies and the timing thereof for KB-9558; our expected clinical trial for KB-9558 and the timeline for dosing the first patients; future pipeline development activities or outcomes; the potential of Kronos Bio’s product candidates; Kronos Bio’s expected cash runway; and other statements that are not historical fact. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, including, without limitation: risks associated with changes to the assumptions underlying estimated expenses and savings; changes in the macroeconomic environment or competitive landscape that impact Kronos Bio’s business; risks associated with completing necessary preclinical studies and receiving regulatory clearance for, and enrolling, clinical trials; whether Kronos Bio will be able to progress its clinical trials on the timelines anticipated, including due to risks inherent in the clinical development of novel therapeutics; risks related to Kronos Bio’s limited experience as a company in conducting clinical trials; the risk that results of preclinical studies and early clinical trials (including

preliminary results) are not necessarily predictive of future results; and risks associated with the sufficiency of Kronos Bio’s cash resources and need for additional capital. These and other risks are described in greater detail in Kronos Bio’s filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 21, 2024, and in its Quarterly Report on Form 10-Q for the quarter ended March 21, 2024, being filed with the SEC today. Any forward-looking statements that are made in this press release speak only as of the date of this press release and are based on management’s assumptions and estimates as of such date. Except as required by law, Kronos Bio assumes no obligation to update the forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release.

Kronos Bio, Inc.

Condensed Statements of Operations and Comprehensive Loss

(in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| | 2024 | | 2023 | | | | |

| Revenue | | $ | 2,520 | | | $ | 1,221 | | | | | |

| Operating expenses: | | | | | | | | |

| Research and development | | $ | 14,222 | | | $ | 19,658 | | | | | |

| General and administrative | | 7,506 | | | 10,056 | | | | | |

| Impairment of long-lived assets and restructuring | | 12,786 | | | — | | | | | |

| Total operating expenses | | 34,514 | | | 29,714 | | | | | |

| Loss from operations | | (31,994) | | | (28,493) | | | | | |

| Other income (expense), net: | | | | | | | | |

| | | | | | | | |

| Interest and other expense, net | | 2,036 | | | 2255 | | | | |

| Total other income (expense), net | | 2,036 | | | 2,255 | | | | | |

| Net loss | | $ | (29,958) | | | $ | (26,238) | | | | | |

| Other comprehensive loss: | | | | | | | | |

| Net unrealized loss on available-for-sale securities | | (68) | | | 432 | | | | | |

| Net comprehensive loss | | $ | (30,026) | | | $ | (25,806) | | | | | |

| Net loss per share, basic and diluted | | $ | (0.50) | | | $ | (0.46) | | | | | |

| Weighted average shares of common stock, basic and diluted | | 59,521 | | | 57,147 | | | | | |

| | | | | | | | |

Kronos Bio, Inc.

Selected Balance Sheet Data

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| Cash, cash equivalents and investments | | $ | 151,984 | | | $ | 174,986 | |

| Total assets | | 182,979 | | | 213,279 | |

| Total liabilities | | 46,011 | | | 54,201 | |

| Total stockholders’ equity | | 136,968 | | | 159,078 | |

Investor & Media Contact:

Margaux Bennett

Vice President, Corporate Development and Investor Relations, Kronos Bio

650-781-5026

mbennett@kronosbio.com

v3.24.1.u1

Cover Page

|

May 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 09, 2024

|

| Entity Registrant Name |

Kronos Bio, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39592

|

| Entity Tax Identification Number |

82-1895605

|

| Entity Address, Address Line One |

1300 So. El Camino Real

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Mateo

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94402

|

| City Area Code |

650

|

| Local Phone Number |

781-5200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

KRON

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001741830

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

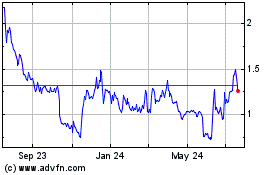

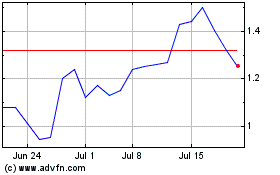

Kronos Bio (NASDAQ:KRON)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kronos Bio (NASDAQ:KRON)

Historical Stock Chart

From Jul 2023 to Jul 2024