Iconix Brand Group, Inc. - Value

June 22 2011 - 8:00PM

Zacks

Iconix Brand Group, Inc. (ICON) saw record revenue in the

first quarter as its collection of brands saw strong growth,

including internationally. Even with shares near a 10-year high,

this Zacks #1 Rank (strong buy) still has attractive valuations,

with a forward P/E of 14.3.

Iconix Brand Group was formerly Candie's but

changed its name to acknowledge the wealth of consumer brands the

company now owns and licenses to major retailers and

manufacturers.

Those include, of course, Candie's, but also

Badgley Mischka, Joe Boxer, Rampage, Mudd, London Fog, Mossimo,

Danskin, Roca Wear, Cannon, Royal Velvet, Fieldcrest, Charisma,

Starter and Waverly.

The company also owns an interest in the Artful

Dodger, Marc Ecko, Zoo York, Material Girl and Peanuts.

Acquired More of the Ed Hardy Brand

On Apr 27, Iconix Brand announced it acquired the

worldwide master license for the Ed Hardy brand for $55 million

plus $7 million earn-out from Nervous Tattoo.

Nervous Tattoo will continue as a licensee for Ed

Hardy T-shirts, hats and hoodies. This acquisition increased its

total ownership stake in the Ed Hardy brand to 85%.

The company had previously had a small investment

in the brand through a joint venture with Don Ed Hardy, the artist

who is known as the "godfather of the modern tattoo."

Iconix Brand estimated that the Ed Hardy brand will

generate total annual royalty revenue between $15 and $16

million.

Iconix Brand Has a Record First Quarter

On Apr 27, Iconix Brand reported its first quarter

results and beat the Zacks Consensus Estimate by 9.8%. It was the

5th consecutive earnings beat.

Earnings per share were a record 45 cents compared

to the consensus of 41 cents. It made just 36 cents in the year ago

quarter.

Revenue soared 29% to a record $92.4 million from

$71.7 million in the first quarter of 2010.

All of its brands showed strength but it was

especially strong in the direct-to-retail brands, which continued

to gain shelf space. International sales also expanded as its

partners opened up hundreds of stores in China.

Raised 2011 Guidance

Given the beat and the Ed Hardy acquisition, which

will definitely impact revenue, the company raised both its revenue

and EPS guidance for 2011.

Revenue is now expected between $355 - $365

million, up from the prior guidance of $340 to $350 million.

Earnings per share jumped to the range of $1.50 to

$1.55 from $1.40 to $1.45.

Analysts are even more bullish, as the Zacks

Consensus has risen to $1.66 from $1.54 in the last 2 months.

That is earnings growth of 15%.

Shares Near 10-Year High

The record quarter was icing on the cake for

shareholders, who have been celebrating a stock trading around 10

year highs for the past several months.

But even with the shares at such elevated levels,

earnings have been keeping the pace which results in a stock that

still has attractive valuations.

In addition to a P/E under 15, which is what I use

to determine a "value" stock, Iconix Brand has a price-to-book

ratio of only 1.5. A P/B ratio under 3.0 is what I use to determine

value.

Additionally, the company has a solid return on

equity (ROE) of 10.2%.

There is growth in consumer brands, especially

overseas, as consumers are opening their wallets now that the

global economy is recovering. With double digit earnings growth

expected in 2011, and cheap value metrics, Iconix Brand is an

attractive value stock.

Tracey Ryniec is the Value Stock Strategist for

Zacks.com. She is also the Editor of the Turnaround Trader and

Insider Trader services. You can follow her at

twitter.com/traceyryniec.

ICONIX BRAND GP (ICON): Free Stock Analysis Report

Zacks Investment Research

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Jul 2024 to Aug 2024

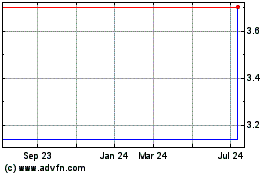

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Aug 2023 to Aug 2024