Iconix Brand Group, Inc. Announces Pricing for Convertible Senior Subordinated Notes

June 15 2007 - 8:30AM

PR Newswire (US)

NEW YORK, June 15 /PRNewswire-FirstCall/ -- Iconix Brand Group,

Inc. (NASDAQ:ICON) today announced the pricing of its offering of

$250 million aggregate principal amount of Convertible Senior

Subordinated Notes due 2012 (the "Notes") in an offering pursuant

to Rule 144A under the Securities Act of 1933, as amended (the

"Securities Act"), through the initial purchasers of the Notes.

Iconix also granted the initial purchasers of the Notes an option

to purchase up to an additional $37.5 million aggregate principal

amount of Notes solely to cover over-allotments, if any. The

issuance of the Notes is expected to close on June 20, 2007. If

certain conditions are met, the Notes will be convertible into cash

up to the principal amount of the Notes and, with respect to any

excess conversion value, into cash, shares of Iconix common stock

or a combination of cash and common stock, at Iconix' option. The

Notes will pay interest semiannually at a rate of 1.875% per annum.

The Notes will be convertible at an initial conversion rate of

36.2845 shares of common stock per $1,000 principal amount of

Notes, which is equal to an initial conversion price of

approximately $27.56 per share. This represents a 30% conversion

premium based on the last reported sale price of $21.20 per share

on the NASDAQ Global Select Market on June 14, 2007. Iconix

estimates that the net proceeds from the offering of Notes will be

approximately $243.4 million after deducting the initial

purchasers' discount and estimated offering expenses (approximately

$280.0 million if the initial purchasers exercise in full the

over-allotment option). Iconix intends to use a portion of the net

offering proceeds to fund convertible note hedge transactions to be

entered into with affiliates of the initial purchasers, which

transactions are intended to offset Iconix' exposure to potential

dilution upon conversion of the Notes. Iconix will also enter into

separate warrant transactions with affiliates of the initial

purchasers that, together with the convertible note hedge

transactions, will have the effect of increasing the effective

conversion price to Iconix to approximately $42.40, which

represents a 100% conversion premium. Iconix plans to use the

remaining net proceeds from the note offering to invest in or

acquire new brands through mergers, stock or asset purchases and/or

other strategic relationships, although it has no present

commitments or agreements with respect to any such investment or

acquisition, and for general corporate purposes. In connection with

the convertible note hedge and warrant transactions, the hedge

counterparties have advised Iconix that they or their affiliates

intend to enter into various derivative transactions with respect

to the common stock of Iconix, and may purchase our common stock,

concurrently with or shortly following pricing of the Notes. These

activities could have the effect of increasing or preventing a

decline in the price of the common stock of Iconix concurrently or

following the pricing of the Notes. In addition, the hedge

counterparties or their affiliates may from time to time, following

the pricing of the Notes, enter into or unwind various derivative

transactions with respect to the common stock of Iconix and/or

purchase or sell common stock of Iconix in secondary market

transactions. These activities could have the effect of decreasing

the price of the common stock of Iconix and could affect the price

of the Notes. The convertible note hedge transactions are intended

to reduce potential dilution to Iconix' common stock upon potential

future conversion of the Notes. This notice does not constitute an

offer to sell or the solicitation of an offer to buy securities.

Any offers of the securities will be made only by means of an

offering memorandum. Iconix' issuance of the Notes and the shares

of Iconix common stock issuable upon conversion of the Notes have

not been, and will not be, registered under the Securities Act or

the securities laws of any other jurisdiction. Such securities may

not be offered or sold in the United States absent registration or

an applicable exemption from registration requirements. Certain

statements and information included in this release constitute

"forward-looking statements" within the meaning of the Federal

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Iconix to be materially different

from any future results, performance or achievements expressed or

implied in such forward-looking statements. Important factors that

could cause actual results to differ materially from the results

expressed or implied in such forward looking statements include the

risk that the notes offering is not timely consummated or is not

consummated at all. Additional discussion of factors that could

cause actual results to differ materially from management's

projections, estimates and expectations is contained in Iconix'

Annual Report on Form 10-K for the fiscal year ended December 31,

2006 and the other documents Iconix files with the SEC from time to

time. Iconix undertakes no duty to update its forward-looking

statements. Contact: Warren Clamen Chief Financial Officer Iconix

Brand Group, Inc. 212-730-0030 DATASOURCE: Iconix Brand Group, Inc.

CONTACT: Warren Clamen, Chief Financial Officer of Iconix Brand

Group, Inc., +1-212-730-0030 Web site: http://iconixbrand.com/

Copyright

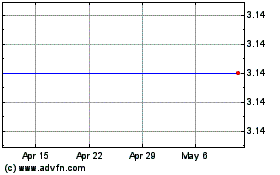

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Jun 2024 to Jul 2024

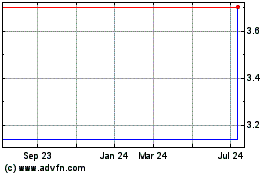

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Jul 2023 to Jul 2024