- Licensing revenue $18.4 million versus $4.3 million in prior year

quarter NEW YORK, July 27 /PRNewswire-FirstCall/ -- Iconix Brand

Group, Inc. (NASDAQ:ICON) ("Iconix" or the "Company"), today

announced financial results for the second quarter of 2006.

Licensing revenue increased to approximately $18.4 million as

compared to $4.3 million in the second quarter of the prior year.

The increase in licensing revenue was driven primarily by the

continued roll out and success of the Candie's brand at Kohl's

Department Stores, contributions from the Company's 2005

acquisitions of the Joe Boxer and Rampage brands, and a

greater-than-expected contribution from the Company's recent

acquisition of the Mudd brand in April 2006. The Company reported

fully diluted earnings per share of $0.19 versus $0.08 in the

second quarter of the prior year, which included a non-cash income

tax benefit of $0.01 and $0.06, respectively. Net income for the

quarter was approximately $8.3 million versus $2.5 million in the

prior year quarter. EBITDA was approximately $11.4 million versus

$1.6 million in the prior year quarter and free cash flow was

approximately $9.4 million versus $1.2 million in the prior year

quarter. Six months ended June 30: For the six months ended June

30, 2006 licensing revenue was approximately $31.7 million compared

to $8.6 million in the prior year six month period. Net income was

approximately $15.7 million versus $3.3 million in the prior year

six month period. Fully diluted earnings per share were $0.37

compared to $0.11 in the prior year six month period. EBITDA for

the six months ended June 30, 2006 was approximately $19.8 million

compared to $3.4 million in the prior year six month period and

free cash flow was approximately $15.9 million compared to $2.6

million in the prior year six month period. Other Developments: The

Company has announced that due to delays associated with the

completion of the proxy statement/prospectus relating to the

Mossimo transaction, the merger is now expected to close in

September. The delay in closing Mossimo, which was originally

planned for July, combined with the treatment that approximately $2

million of the Company's deferred tax asset has been recognized as

equity, and not through the income statement, will impact 2006 net

income. However, the Company is currently experiencing stronger

than anticipated organic growth in several of its divisions and is

also evaluating several acquisition opportunities, one of which it

anticipates closing this year, and either or both of which could

offset the impact of the delayed Mossimo closing and tax treatment.

Neil Cole, Chairman and CEO of Iconix commented "Our year-over-year

results demonstrate the growth potential of our business model and

our ability to generate substantial profits and cash flow. Our

strategy is on track with our existing portfolio of brands growing

nicely, our acquisition pipeline deeper and more diverse than ever

before and we hope to be announcing new international agreements

later this year. With our acquisition of Mossimo Inc. later this

year, the Company will have purchased four brands in a little over

twelve months and will have an annualized base of royalty revenue

of approximately $100 million. Looking ahead to 2007, I am

confident that we can continue this pace of growth and further

build and diversify our portfolio of brands and royalty revenue."

2006 Guidance: Based upon the timing of the Mossimo closing, the

treatment to recognize approximately $2 million of the tax benefit

as equity rather than through the income statement, and also taking

into consideration additional organic growth and acquisition

opportunities this year, the Company is expanding its current 2006

full year guidance from its previously stated range of $0.75 -

$0.80 per fully diluted share to a broader range of $0.70 - $0.80

per fully diluted share. 2007: While the Company has yet to issue

detailed guidance for 2007, it is currently comfortable with the

First Call consensus estimate of $0.87 fully- taxed and fully

diluted EPS for 2007. Iconix Brand Group Inc. (NASDAQ:ICON) owns,

licenses and markets a growing portfolio of consumer brands

including CANDIE'S (R), BONGO (R), BADGLEY MISCHKA (R), JOE BOXER

(R) RAMPAGE (R) and MUDD (R). The Company licenses it brands to a

network of leading retailers and manufacturers that touch every

major segment of retail distribution from the luxury market to the

mass market. Iconix, through its in-house advertising agency,

advertises and markets its brands to continually drive greater

consumer awareness and loyalty. For non-GAAP measures, see

accompanying reconciliation schedules. Safe Harbor Statement under

the Private Securities Litigation Reform Act of 1995. The

statements that are not historical facts contained in this press

release are forward looking statements that involve a number of

known and unknown risks, uncertainties and other factors, all of

which are difficult or impossible to predict and many of which are

beyond the control of the Company, which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward looking

statements. Such factors include, but are not limited to,

uncertainty regarding the results of the Company's acquisition of

additional licenses, continued market acceptance of current

products and the ability to successfully develop and market new

products particularly in light of rapidly changing fashion trends,

the impact of supply and manufacturing constraints or difficulties

relating to the Company's licensees' dependence on foreign

manufacturers and suppliers, uncertainties relating to customer

plans and commitments, the ability of licensees to successfully

market and sell branded products, competition, uncertainties

relating to economic conditions in the markets in which the Company

operates, the ability to hire and retain key personnel, the ability

to obtain capital if required, the risks of litigation and

regulatory proceedings, the risks of uncertainty of trademark

protection, the uncertainty of marketing and licensing acquired

trademarks and other risks detailed in the Company's SEC filings.

The words "believe", "anticipate," "expect", "confident",

"project", provide "guidance" and similar expressions identify

forward-looking statements. Readers are cautioned not to place

undue reliance on these forward looking statements, which speak

only as of the date the statement was made. Contact: Warren Clamen

Chief Financial Officer Iconix Brand Group 212.730.0030 Joseph

Teklits Integrated Corporate Relations 203.682.8200 Iconix Brand

Group, Inc. and Subsidiaries Condensed Consolidated Income

Statements - (Unaudited) (in thousands, except earnings per share

data) Three Months Ended Six Months Ended June 30, June 30,

-------------------- ------------------- 2006 2005 2006 2005

Licensing and commission revenue $ 18,409 $ 4,287 $ 31,678 $ 8,587

Selling, general and administrative expenses 6,817 2,734 11,501

5,308 Special charges 712 328 1,268 707 --------------------

------------------- Operating income 10,880 1,225 18,909 2,572

Interest expense - net 2,882 504 4,826 1,054 --------------------

------------------- Income before income taxes 7,998 721 14,083

1,518 Income taxes (benefits) (347) (1,790) (1,619) (1,780)

-------------------- ------------------- Net income $8,345 $2,511 $

15,702 $3,298 ==================== =================== Earnings per

share: Basic $0.22 $0.09 $0.42 $0.12 ====================

=================== Diluted $0.19 $0.08 $0.37 $0.11

==================== =================== Weighted average number of

common shares outstanding: Basic 38,680 28,602 37,208 28,516

==================== =================== Diluted 44,712 30,247

42,872 30,115 ==================== =================== Selected

Balance Sheet Data: June 30, 2006 December 31, 2005 (in thousands)

(audited) Total Assets $335,141 $217,244 Total Liabilities $162,518

$116,348 Stockholders' Equity $172,623 $100,896 The following table

details unaudited reconciliations from non-GAAP amounts to U.S.

GAAP and effects of these items: (in thousands) Three Months Ended

Six Months Ended ------------------- ------------------- June 30,

June 30, June 30, June 30, 2006 2005 2006 2005 ------- -------

------- ------- EBITDA (1) $11,447 $1,616 $19,826 $3,393 =======

======= ======= ======= Reconciliation of EBITDA: Operating income

10,880 1,225 18,909 2,572 Add: Depreciation and amortization 567

391 917 821 ------- ------- ------- ------- EBITDA $11,447 $1,616

$19,826 $3,393 ======= ======= ======= ======= (1) EBITDA, a

non-GAAP financial measure, represents income from operations

before income taxes, interest, depreciation and amortization

expenses. The Company believes EBITDA provides additional

information for determining its ability to meet future debt service

requirements, investing and capital expenditures. Free Cash Flow

(2) $9,353 $1,236 $15,920 $2,568 ======= ======= ======= =======

Reconciliation of Free Cash Flow: Net income $8,345 $2,511 $15,702

$3,298 Add: Depreciation, amortization and changes in the reserve

for accounts receivable 1,355 515 1,837 1,050 Less: Non-cash income

tax benefit (347) (1,790) (1,619) (1,780) ------- ------- -------

------- Free Cash Flow $9,353 $1,236 $15,920 $2,568 ======= =======

======= ======= (2) Free Cash Flow, a non-GAAP financial measure,

represents net income before depreciation, amortization, changes in

the reserve for accounts receivable and excludes non-cash income

tax benefit. The Company believes Free Cash Flow is useful for

evaluating its financial condition because it is representative of

cash flow from operations that is available for repaying debt,

investing and capital expenditures. DATASOURCE: Iconix Brand Group,

Inc. CONTACT: Warren Clamen, Chief Financial Officer of Iconix

Brand Group, +1-212-730-0030; or Joseph Teklits of Integrated

Corporate Relations, +1-203-682-8200 Web site:

http://iconixbrand.com/

Copyright

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Jun 2024 to Jul 2024

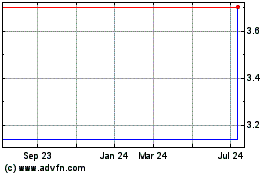

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Jul 2023 to Jul 2024