Statement of Changes in Beneficial Ownership (4)

March 02 2021 - 2:23PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Stenger Thomas |

2. Issuer Name and Ticker or Trading Symbol

HOPE BANCORP INC

[

HOPE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

EVP, Chief Risk Officer |

|

(Last)

(First)

(Middle)

3200 WILSHIRE BLVD STE 1400 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/28/2021 |

|

(Street)

LOS ANGELES, CA 90010

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 2/28/2021 | | M | | 1140 | A | $13.16 | 2706 | D | |

| Common Stock | 2/28/2021 | | F | | 395 | D | $13.16 | 2311 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Time-based Restricted Stock Units | (1) | | | | | | | (1) | (1) | Common Stock | 8000 | | 8000 | D | |

| Performance-based Restricted Stock Units | (2) | | | | | | | (2) | (2) | Common Stock | 4000 | | 4000 | D | |

| Performance-based Restricted Stock Units | (3) | | | | | | | (3) | (3) | Common Stock | 4000 | | 4000 | D | |

| Time-based Restricted Stock Units | (4) | | | | | | | (4) | (4) | Common Stock | 4233 | | 4233 | D | |

| Time-based Restricted Stock Units | (5) | | | | | | | (5) | (5) | Common Stock | 2466 | | 2466 | D | |

| Performance-based Restricted Stock Units | (6) | | | | | | | (6) | (6) | Common Stock | 1849 (6) | | 1849 (6) | D | |

| Performance-based Restricted Stock Units | (7) | | | | | | | (7) | (7) | Common Stock | 1849 (7) | | 1849 (7) | D | |

| Time-based Restricted Stock Units | (8) | 2/28/2021 | | M | | | 1140 | (8) | (8) | Common Stock | 3420 | $13.16 | 3420 | D | |

| Explanation of Responses: |

| (1) | Total 8,000 Restricted Stock Units ("RSU") were granted on April 22, 2020 pursuant to the Hope Bancorp, Inc. 2017 Long-Term Incentive Plan ("2017 LTIP") and the Hope Bancorp, Inc. 2020 Incentive Compensation Plan ("2020 ICP"). Each RSU represents a contingent right to receive one share of Hope common stock. Installments of 2,666 will vest on April 22, 2021, and 2667 shares each will vest annually on April 22, 2022, and 2023. |

| (2) | 4,000 performance-based restricted stock units ("PRSU") were granted on April 22, 2020 pursuant to the 2017 LTIP and 2020 ICP and subject to a 3-year cliff vesting. Vesting of these PRSU shares depends upon Hope's achievement of a specified relative ranking of the total stockholder return in relation to the KRX Index over an 11-quarter period from April 1, 2020 through December 31, 2022. Each PRSU represents a contingent right to receive one share of Hope common stock at Target performance. The "Target" number of shares is reported. Possible payout ranges from 0% of Target if the Threshold goal is not met, 50% to 99% on a prorated basis if the Threshold is met but the Target goal is not met, 100% to 149% on a prorated basis if the Target goal is met but the Stretch goal is not met, and 150% if the Stretch goal is met or exceeded. |

| (3) | 4,000 PRSU were granted on April 22, 2020 pursuant to the 2017 LTIP and 2020 ICP and subject to a 3-year cliff vesting. Vesting of these PRSU shares depends upon Hope's achievement of a specified relative return on average assets in relation to the KRX Index over an 11-quarter period from April 1, 2020 through December 31, 2022. Each PRSU represents a contingent right to receive one share of Hope common stock at Target performance. The "Target" number of shares is reported. Possible payout ranges from 0% of Target if the Threshold goal is not met, 50% to 99% on a prorated basis if the Threshold is met but the Target goal is not met, 100% to 149% on a prorated basis if the Target goal is met but the Stretch goal is not met, and 150% if the Stretch goal is met or exceeded. |

| (4) | Total 4,233 RSU were granted on March 6, 2020 pursuant to the Hope Bancorp, Inc. 2019 Incentive Compensation Plan ("2019 ICP"). Each RSU represents a contingent right to receive one share of Hope common stock. Installments of 2,115 and 2,116 shares each will vest annually on March 6, 2021 and 2022 respectively. |

| (5) | Total 3,698 RSU were granted on May 23, 2019 pursuant to the 2017 LTIP and 2019 ICP. Each RSU represents a contingent right to receive one share of Hope common stock. Installments of 1,232 shares each will vest annually on May 23, 2020, 2021, and 2022. |

| (6) | 1,849 PRSU were granted on May 23, 2019 pursuant to the 2017 LTIP and 2019 ICP and subject to a 3-year cliff vesting. Vesting of these PRSU shares depends upon Hope's achievement of a specified relative return on average assets in relation to the KRX Index during the 11-quarter period from April 1, 2019 through December 31, 2021. Each PRSU represents a contingent right to receive one share of Hope common stock at Target performance. The "Target" number of shares is reported. Possible payout ranges from 0% of Target if the Threshold goal is not met, 50% to 99% on a prorated basis if the Threshold is met but the Target goal is not met, 100% to 149% on a prorated basis if the Target goal is met but the Stretch goal is not met, and 150% if the Stretch goal is met or exceeded. |

| (7) | 1,849 PRSU were granted on May 23, 2019 pursuant to the 2017 LTIP and 2019 ICP and subject to a 3-year cliff vesting. Vesting of these PRSU shares depends upon Hope's achievement of a specified relative ranking of the total stockholder return in relation to the KRX Index over an 11-quarter period from April 1, 2019 through December 31, 2021. Each PRSU represents a contingent right to receive one share of Hope common stock at Target performance. The "Target" number of shares is reported. Possible payout ranges from 0% of Target if the Threshold goal is not met, 50% to 99% on a prorated basis if the Threshold is met but the Target goal is not met, 100% to 149% on a prorated basis if the Target goal is met but the Stretch goal is not met, and 150% if the Stretch goal is met or exceeded. |

| (8) | Total 5,700 RSU were granted on February 28, 2019 pursuant to the BBCN Bancorp, Inc. 2016 Incentive Compensation Plan ("2016 ICP"). Each RSU represents a contingent right to receive one share of Hope common stock. Installments of 1,140 shares each will vest annually over five years beginning February 28, 2020. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Stenger Thomas

3200 WILSHIRE BLVD STE 1400

LOS ANGELES, CA 90010 |

|

| EVP, Chief Risk Officer |

|

Signatures

|

| /s/Claire Hur as attorney-in-fact for Thomas Stenger | | 3/2/2021 |

| **Signature of Reporting Person | Date |

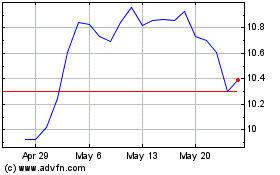

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Jun 2024 to Jul 2024

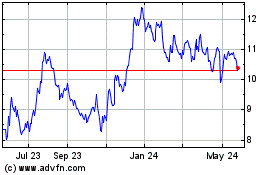

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Jul 2023 to Jul 2024