UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2015

Golden Entertainment, Inc.

___________________________________________

(Exact name of registrant as specified in its charter)

|

Minnesota |

|

000-24993 |

|

41-1913991 |

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

|

| |

|

|

|

|

| 6595 S Jones Blvd., Las Vegas, Nevada |

|

|

|

89118 |

| |

|

|

|

|

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (702) 893-7777

Not Applicable

______________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 |

Entry into a Material Definitive Agreement |

On December 9, 2015, Lakes Jamul Development, LLC, a subsidiary of Golden Entertainment, Inc. (the “Company”), entered into a Note Sale and Purchase Agreement with, and completed the sale of its subordinated promissory note from, the Jamul Indian Village (the “Note”) to San Diego Gaming Ventures, LLC, a subsidiary of Penn National Gaming, Inc. (the “Buyer”), for $24.0 million in cash. A copy of the Note Sale and Purchase Agreement is attached as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

The Company also issued a press release announcing the sale of the Note and the Company’s intent to distribute the net proceeds from the sale of the Note to certain of the Company’s shareholders in the future. A copy of the press release is furnished herewith as Exhibit 99.1.

| Item 9.01 |

Financial Statements and Exhibits. |

|

10.1 |

|

Note Sale and Purchase Agreement, dated as of December 9, 2015, between Lakes Jamul Development, LLC and San Diego Gaming Ventures, LLC |

|

99.1 |

|

Press Release dated December 10, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

GOLDEN ENTERTAINMENT, INC. |

|

|

|

(Registrant) |

|

|

|

|

|

|

|

Date: December 11, 2015 |

/s/ Matthew W. Flandermeyer |

|

|

|

Name: |

Matthew W. Flandermeyer |

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

EXHIBIT INDEX

|

Exhibit Number |

|

Description |

| |

|

|

| 10.1 |

|

Note Sale and Purchase Agreement, dated as of December 9, 2015, between Lakes Jamul Development, LLC and San Diego Gaming Ventures, LLC |

| |

|

|

| 99.1 |

|

Press Release dated December 10, 2015 |

|

|

Exhibit 10.1 |

| |

Execution Copy |

NOTE SALE AND PURCHASE AGREEMENT

THIS NOTE SALE AND PURCHASE AGREEMENT (this “Agreement”) is entered into effective as of the 9th day of December, 2015, by and between LAKES JAMUL DEVELOPMENT, LLC, a Minnesota limited liability company (“Seller”), and San Diego Gaming Ventures, LLC, a Delaware limited liability company (“Buyer”).

RECITALS

A. Borrower (as defined below), Seller and Penn National Gaming, Inc., a Pennsylvania corporation (“Senior Lender”) entered into a Subordination and Intercreditor Agreement dated as of August 29, 2012 (as amended by that certain Amendment No. 1 to Subordination and Intercreditor Agreement dated as of April 24, 2014, the “Intercreditor Agreement”), by which payment of indebtedness (and liens securing such indebtedness) of the Jamul Indian Village (f.k.a., Jamul Indian Village of California), a federally recognized Indian tribe (“Borrower”), to Seller (the “Loans”) have been subordinated to the payment of indebtedness (and liens securing such indebtedness) of Borrower to Senior Lender, as more fully described in the Intercreditor Agreement.

B. Pursuant to the Intercreditor Agreement, Borrower and Seller entered into a Modification Agreement dated as of April 24, 2014 (the “Modification Agreement”), pursuant to which the parties provided for the modification of the terms of the Loans to be consistent in certain respects with the provisions of the Intercreditor Agreement, the issuance of a new promissory note to replace the existing promissory notes evidencing the Loans, and the continued effectiveness of the Amended Operative Documents (as defined therein).

C. In connection with the execution and delivery of the Modification Agreement, Borrower executed and delivered to Seller that certain Consolidated Restated Promissory Note of the Borrower dated as of April 24, 2014, to be effective as of August 29, 2012 (the “Note”), to evidence the Loans.

D. The payment and performance of the Note are secured by certain of the Amended Operative Documents, including the Collateral Documents, and are otherwise subject to the Amended Operative Documents (each as defined in the Modification Agreement).

E. Buyer desires to purchase and Seller desires to sell all of the indebtedness evidenced by the Note, as secured by the Collateral Documents and as otherwise subject to the Amended Operative Documents and the Intercreditor Agreement, such purchase and sale to be effective as of the Effective Date.

AGREEMENT

IN CONSIDERATION of the foregoing premises and the mutual covenants contained in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Purchase and Sale.

a. Subject to the terms and conditions of this Agreement, Seller shall sell, assign, and transfer to Buyer, and Buyer shall purchase and accept from Seller, the Purchased Assets (as defined below).

b. Effective upon receipt by Seller of $24,000,000 in immediately available funds (such amount being referred to herein as the “Purchase Price”) on or before December 31, 2015 (the date of Seller’s receipt of Buyer’s payment of the Purchase Price being herein referred to as the “Effective Date”), Seller will sell, assign and transfer to Buyer, without recourse (except with respect to the representations and warranties of Seller set forth in Section 3 below), and Buyer will purchase and accept from Seller, all of Seller’s right, title, and interests arising out of or related (i) to the Loans, the Note, and the other Amended Operative Documents, (ii) to any benefits under the Loans, the Note or the other Amended Operative Documents arising out of or related to the gaming project currently under construction in Jamul, California (the “Project”), but, for avoidance of doubt, excluding (A) any net operating losses that have been incurred or have otherwise arisen in connection with the Project, (B) any real estate currently owned by Seller or any of its affiliates, and (C) any contractual rights with respect to such real estate (collectively, the “Excluded Assets”), (iii) to the right to enforce the Loans, the Note, and the other Amended Operative Documents, and (iv) to the security interests in the collateral subject to the Collateral Documents (the “Collateral”) (clauses (i) through (iv) above, collectively, the “Purchased Assets”), in each case as of the Effective Date and subject to the terms of the Intercreditor Agreement. Without limiting the generality of the foregoing, Buyer agrees that, with respect to the Loans. the Note and the other Amended Operative Documents, it will be deemed to be bound (and will be so bound), as of and from and after the Effective Date, by the Intercreditor Agreement as the Subordinate Lender (as defined therein) thereunder.

c. Buyer may extend the date on which the occurrence of the Effective Date is required to occur by this Agreement on a month-by-month basis, from January 1, 2016 until no later than June 30, 2016 (the “Outside Date”); provided that the Purchase Price shall increase to the amount set forth in the chart below, based on the actual date on which the Purchase Price is paid by Buyer and received by Seller and the Effective Date accordingly occurs:

|

Effective Date |

Purchase Price |

|

January 1, 2016-January 31, 2016 |

$25,000,000 |

|

February 1, 2016-February 29, 2016 |

$25,500,000 |

|

March 1, 2016-March 31, 2016 |

$26,000,000 |

|

April 1, 2016-April 30, 2016 |

$26,500,000 |

|

May 1, 2016-May 31, 2016 |

$27,000,000 |

|

June 1, 2016-June 30, 2016 |

$27,500,000 |

In any event, Buyer’s payment of the Purchase Price shall be due and payable no later than the earlier to occur of (i) within 10 business days after the date on which funding of Refinancing Indebtedness (as defined in the Intercreditor Agreement) or other financing for the construction of or refinancing of existing indebtedness relating to the Project exceeds $400,000,000 in the aggregate, or (ii) the Outside Date.

d. Notwithstanding anything to the contrary in the Note, the other Amended Operative Documents, or the Intercreditor Agreement, Seller shall not assign, participate, delegate or transfer any of its rights or obligations under the Note, the other Amended Operative Documents, or the Intercreditor Agreement prior to the Outside Date.

e. BUYER ACKNOWLEDGES, WARRANTS, AND REPRESENTS THAT, EXCEPT WITH RESPECT TO THE REPRESENTATIONS AND WARRANTIES OF SELLER SET FORTH IN SECTION 3 BELOW, THE SALE OF THE PURCHASED ASSETS SUBJECT TO THE INTERCREDITOR AGREEMENT AS CONTEMPLATED HEREBY SHALL BE MADE ON AN “AS-IS”, “WHERE-IS” AND “WITH ALL FAULTS” BASIS.

f. In connection therewith, Buyer, contemporaneously with Seller’s receipt of Buyer’s payment of the Purchase Price on the Effective Date, will be deemed to have assumed any and all of Seller’s rights and obligations with respect to the Loans and the Purchased Assets and other obligations of Seller under the Amended Operative Documents and the Intercreditor Agreement arising from and after the Effective Date.

| |

2. |

Documentation. On or prior to the Effective Date, Seller shall deliver, duly executed where appropriate, to Buyer or its designee the following documents: |

| |

|

|

| |

a. |

The original Note, assigned without recourse by Seller in favor of Buyer by operation of an Allonge dated as of the Effective Date and otherwise in the form of Exhibit A. |

| |

|

|

| |

b. |

An as-executed copy of each of the other Amended Operative Documents. |

| |

|

|

| |

c. |

Such other documents and instruments as may be necessary to effect the sale, assignment and assumption contemplated by this Agreement and as may be reasonably requested by Buyer, provided that Buyer makes such request in writing at least five (5) business days prior to the anticipated Effective Date. |

| |

3. |

Warranties of Seller. Seller hereby warrants and represents to Buyer as follows with respect to the Loans and Amended Operative Documents: |

| |

|

|

| |

a. |

Seller is the sole owner of the Note and the Loans, free and clear of liens and encumbrances, and there has been no prior assignment, sale or pledge thereof by Seller. |

| |

|

|

| |

b. |

Seller does not intend to retain any rights under the Note or the other Amended Operative Documents associated with or related to the Project, other than such as may comprise the Excluded Assets, following the Effective Date. |

| |

|

|

| |

c. |

Seller has full power and authority to execute and deliver this Agreement and to effect the transactions contemplated hereby. This Agreement constitutes a legal, valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law. |

Except as set forth above, Seller makes no warranty or representation about the Loans, the Amended Operative Documents, any other Purchased Assets, or the Intercreditor Agreement. Without limiting the generality of the foregoing, Seller makes no representation or warranty as to the collectability of the Loans, the creditworthiness of Borrower, the adequacy of the Collateral securing the Loans, any financial statements submitted by or for Borrower, or any risk of loss with respect to this transaction.

| |

4. |

Warranties of Buyer. Buyer hereby warrants and represents to Seller as follows with respect to the Loans and the Amended Operative Documents: |

| |

|

|

| |

a. |

Buyer has full power and authority to execute and deliver this Agreement and to effect the transactions contemplated hereby. This Agreement constitutes a legal, valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law. |

| |

|

|

| |

b. |

Buyer has received a copy of the Note and such other documents and information as it deems appropriate to make its own decision to enter into this Agreement and to purchase the Loans and the other Purchased Assets. Buyer has, independently and without reliance on Seller and based on such documents and information as it has deemed appropriate, made its own decision to enter into this Agreement and to purchase the Loans and the other Purchased Assets. |

| |

5. |

Waiver of Limitations on Senior Loan Obligations. Seller hereby waives, but only from the date of this Agreement through and including the Effective Date, the limitation on the Senior Loan Obligations (as defined in the Intercreditor Agreement) referred to in Section 11(b) of the Intercreditor Agreement. The foregoing waiver shall expire on the Outside Date if the Effective Date has not then occurred, whereupon such limitation shall be deemed to be in full force and effect from and after the Outside Date with effect as if such limitation had never been so waived. |

| |

|

|

| |

6. |

Miscellaneous. |

| |

|

|

| |

a. |

Notices. Any notice required or permitted to be given by any party is given in accordance with this Agreement if it is directed to the party and either delivered or mailed to such party at its address, as follows: |

|

If to Seller: |

Lakes Jamul Development, LLC |

|

|

c/o Golden Entertainment, Inc. |

|

|

6595 Jones Blvd. |

|

|

Las Vegas, NV 89118 |

|

|

Attn: Matthew Flandermeyer |

|

|

|

|

|

|

|

If to Buyer: |

William J. Fair, EVP and Chief Development Officer |

|

|

Penn National Gaming, Inc. |

|

|

825 Berkshire Blvd. |

|

|

Wyomissing, PA 19610 |

|

|

With a copy to Penn National Gaming, Inc., c/o General Counsel |

|

|

|

|

|

Any party may change its address for the service of notice by giving written notice of such change to the other party, in any manner above specified. |

| |

b. |

Captions. The paragraph headings or captions appearing in this Agreement are for convenience only, are not a part of this Agreement and are not to be considered in interpreting this Agreement. |

| |

c. |

Entire Agreement; Modification. This written Agreement constitutes the complete agreement between the parties and supersedes any prior oral or written agreements between the parties regarding the subject matter of this Agreement. There are no verbal agreements that change this Agreement and no waiver of any of its terms will be effective unless in a written agreement executed by the parties. |

| |

d. |

Controlling Law. This Agreement has been made under the laws of the State of New York, and such laws will control its interpretation. Any dispute between the parties arising out of or related to this Agreement must be brought in the State Courts of New York or, to the fullest extent permitted by applicable law, the Federal Courts of New York. |

| |

d. |

Counterparts. It is understood and agreed that this Agreement may be executed in separate counterparts, each of which shall, for all purposes, be deemed an original, and all of such counterparts, taken together, shall constitute one and the same agreement, even though all of the parties hereto may not have executed the same counterpart of this Agreement. |

| |

e. |

Successors and Assigns. This Agreement is binding upon the parties and their successors and assigns. |

| |

f. |

Cooperation. The parties each agree to execute and deliver, or to cause to be executed and delivered, such documents and to do, or cause to be done, such other acts and things as might reasonably be requested by any party to this Agreement to assure that the benefits of this Agreement are realized by the parties. |

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date and year first above-written.

|

SELLER: |

|

| |

|

|

LAKES JAMUL DEVELOPMENT, LLC |

|

|

|

|

|

By /s/ Matthew W. Flandermeyer |

|

|

Its Chief Financial Manager, Treasurer and Secretary |

|

|

BUYER: |

|

| |

|

| SAN DIEGO GAMING VENTURES, LLC |

|

|

|

|

|

By PENN NATIONAL GAMING, INC., |

|

|

its sole member |

|

| |

|

|

By /s/ Carl Sottosanti |

|

|

Its SVP, General Counsel, Secretary |

|

CONSENT

The undersigned, the holder, directly or indirectly, of all outstanding membership interests or other equity interests in or of Seller, solely in such capacity and not as a party to the foregoing Agreement, hereby executes and delivers this Consent solely for the purpose of confirming that it consents to the foregoing Agreement and the transactions contemplated thereby.

|

GOLDEN ENTERTAINMENT, INC. |

|

|

|

|

|

By /s/ Matthew W. Flandermeyer |

|

|

Its Executive Vice President and Chief Financial Officer |

|

GUARANTY

The undersigned, the holder, directly or indirectly, of all outstanding membership interests or other equity interests in or of Buyer, solely in such capacity and not as a party to the foregoing Agreement, in consideration of the significant benefit, direct and indirect, it will derive from and as a result of the consummation of the transaction contemplated by the foregoing Agreement, hereby unconditionally guarantees the prompt payment and performance by Buyer of its obligations under the foregoing Agreement.

|

PENN NATIONAL GAMING, INC. |

|

|

|

|

|

By /s/ Timothy J. Wilmott |

|

| Its CEO and President |

|

ACKNOWLEDGMENT

Borrower hereby acknowledges the dispositions contemplated by the foregoing Agreement. In connection therewith, and effective as of the Effective Date, (i) Borrower confirms that Borrower has no defense to payment of the Loans, and (ii) each of Borrower and Seller confirm that it is not aware of any breach by the other party under or with respect to the Loans, the Note, the other Amended Operating Documents, any other Purchased Assets, or the Intercreditor Agreement.

Each of the undersigned hereby acknowledges that, from and after the Effective Date, Seller shall not have any rights or obligations with regard to the Purchased Assets, Buyer being the sole party entitled to the benefits and burdens thereof after giving effect to the consummation of the transaction contemplated by the foregoing Agreement.

|

BORROWER: |

|

|

|

|

|

JAMUL INDIAN VILLAGE |

|

|

(f.k.a., Jamul Indian Village of California) |

|

|

|

|

|

By /s/ Erica Pinto |

|

|

Its Chairwoman |

|

|

|

|

|

SELLER: |

|

|

|

|

|

LAKES JAMUL DEVELOPMENT, LLC |

|

|

|

|

|

By /s/ Matthew W. Flandermeyer |

|

|

Its Chief Financial Manager, Treasurer and Secretary |

|

|

|

|

|

SENIOR LENDER: |

|

|

|

|

|

PENN NATIONAL GAMING, INC. |

|

|

|

|

| By /s/ Timothy J. Wilmott |

|

|

Its President and CEO |

|

EXHIBIT A

ALLONGE

This ALLONGE is affixed to and made a part of that certain Consolidated Restated Promissory Note dated April 24, 2014 (effective as of August 29, 2012) of Jamul Indian Village (f.k.a., Jamul Indian Village of California), a federally recognized Indian tribe, payable to the order of Lakes Jamul Development, LLC, a Minnesota limited liability company.

PAY TO THE ORDER OF SAN DIEGO GAMING VENTURES, LLC (“BUYER”), WITHOUT RECOURSE, REPRESENTATION OR WARRANTY WHATSOEVER, EXPRESS OR IMPLIED, EXCEPT AS EXPRESSLY PROVIDED IN THAT CERTAIN NOTE SALE AND PURCHASE AGREEMENT, DATED AS OF [DECEMBER __, 2015], BETWEEN LAKES JAMUL DEVELOPMENT, LLC AND BUYER.

|

Dated: ______________ 1 |

|

|

|

|

|

SELLER: |

|

|

|

|

|

LAKES JAMUL DEVELOPMENT, LLC |

|

|

|

|

|

By________________________________ |

|

|

Its________________________________ |

|

1 Insert Effective Date.

EXHIBIT 99.1

Golden Entertainment Sells

Promissory Note Related to Jamul Indian Village

LAS VEGAS – December 10, 2015 – Golden Entertainment, Inc. (NASDAQ:GDEN) (“Golden” or the “Company”) today announced that it has sold its subordinated promissory note from the Jamul Indian Village (the “Note”), to San Diego Gaming Ventures, LLC, a subsidiary of Penn National Gaming, Inc. (the “Buyer”), for $24.0 million in cash.

Under the terms of the January 2015 merger agreement between Lakes Entertainment, Inc. and Sartini Gaming, Inc. (the “Merger Agreement”), the proceeds received from the sale of the Note, net of related costs, will be distributed to the Company’s shareholders. In addition, under the terms of the Merger Agreement, Sartini Gaming’s sole shareholder, for itself and any related party transferees of its shares (together, the “Sartini Shareholders”), which total approximately 8.0 million shares, waived their right to receive such distribution with respect to their shares, except for a potential tax distribution, if any, unless their shares are sold to an unaffiliated third party. Also in connection with the merger, holders of an additional 0.5 million shares waived their right to receive such distribution, unless such shares are sold to an unaffiliated third party.

“With the formation of the Jamul disposition committee as part of the Merger Agreement, it has been our intention to monetize this non-core asset for the benefit of our shareholders. We are pleased the committee has successfully executed this transaction,” said Blake L. Sartini, Chief Executive Officer of the Company. “As we move forward into 2016, we remain focused on pursuing our strategy by further scaling our business and fulfilling our growth initiatives.”

As contemplated by the Merger Agreement, the Company is seeking a private letter ruling from the Internal Revenue Service (“IRS”) to the effect that the Sartini Shareholders’ waiver of their pro rata share of such distribution will not result in gross income to the Sartini Shareholders. It is anticipated that the Golden Board of Directors will declare a dividend to shareholders of the net proceeds from the Note sale following the IRS’ determination with respect to the private letter ruling. The Company expects the dividend to be declared during the first half of 2016. Using the current outstanding shares eligible for the distribution (approximately 13.4 million shares, which excludes approximately 8.5 million outstanding shares currently subject to the distribution waiver and 0.7 million vested, in-the-money stock options), assuming a favorable IRS private letter ruling, the Company estimates the dividend would be approximately $1.75 per eligible share (or $1.48 per eligible share if a favorable IRS private letter ruling is not obtained).

The Note had been written down to zero by the Company in 2011. As a result of the sale of the Note, the Company expects to record a gain during the fourth quarter ending December 31, 2015. The Company plans to utilize a portion of its federal net operating loss carryforwards to offset any taxable income related to the gain.

Forward-Looking Statements

This press release may be deemed to contain forward-looking statements that are subject to the safe harbors created under federal securities laws. Forward-looking statements can generally be identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “plan,” “project,” “seek,” “should,” “think,” “will,” “would” and similar expressions. In addition, forward-looking statements include statements regarding the Company’s amount and timing of estimated dividends, strategies, objectives, business opportunities and plans for future expansion, developments or acquisitions, anticipated future growth or trends in the Company’s business or key markets, projections of future financial condition or operating results, as well as other statements that are not statements of historical fact. Any change in ownership of the 8.5 million shares currently subject to the distribution waiver, any exercise of stock options or other issuances of common shares by the Company prior to the record date of the distribution of net proceeds from the Jamul Note sale could materially change these estimated per share distribution amounts. In addition, forward-looking statements are subject to assumptions, risks and uncertainties that may change at any time, and readers are therefore cautioned that actual results could differ materially from those expressed in any forward-looking statements. Factors that could cause actual results to differ include: the Company’s ability to realize the anticipated cost savings, synergies and other benefits from the Merger and integration risks, changes in national, regional and local economic and market conditions, legislative and regulatory matters, increases in gaming taxes and fees, litigation, increased competition, the Company’s ability to renew its distributed gaming contracts, reliance on key personnel, the level of the Company’s indebtedness and the Company’s ability to comply with covenants in its debt facilities, terrorist incidents, natural disasters, severe weather conditions, the effects of environmental and structural building conditions, the effects of disruptions to the Company’s information technology systems, and other factors affecting the gaming, entertainment and hospitality industries generally. In addition, please refer to the risk factors contained in the Company’s SEC filings available at www.sec.gov, including the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

About Golden Entertainment, Inc.

Golden Entertainment, Inc. owns and operates gaming properties across two divisions – distributed gaming and resort and casino operations. Golden Entertainment operates more than 9,300 gaming devices and 30 table games in Nevada and Maryland. The Company owns four casino properties, nearly 50 taverns and operates more than 670 distributed gaming locations in Nevada and Maryland. Golden Entertainment is focused on maximizing the value of its portfolio by leveraging its scale, leadership position, and proven management capabilities across its two divisions. For more information, visit www.goldenent.com.

|

Investor Relations contact: |

ICR |

|

|

Jacques Cornet |

|

|

702.891.4264 |

|

|

ir@goldenent.com |

|

|

|

|

Media contact: |

B&P Public Relations |

|

|

Lenora Kaplan |

|

|

702.589.2791 |

|

|

lkaplan@bpadlv.com |

3

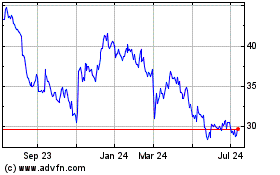

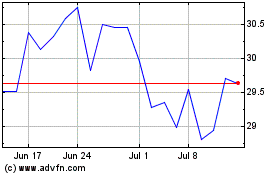

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Jul 2023 to Jul 2024