This is a firm commitment offering of 5,470,000 ordinary shares, par

value $0.0001 per share (the “Ordinary Shares”). We are also offering to each purchaser whose purchase of Ordinary Shares

in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning

more than 4.99%, or, at the election of the purchaser, 9.99% of our outstanding Ordinary Shares immediately following the consummation

of this offering, the opportunity to purchase 6,530,000 pre-funded warrants (the “Pre-Funded Warrants”), in lieu of Ordinary

Shares that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99%, or, at the election of the purchaser,

9.99% of our outstanding Ordinary Shares. Each Pre-Funded Warrant will be immediately exercisable for one Ordinary Share and may be exercised

at any time until all of the Pre-Funded Warrants are exercised in full. This offering also relates to the Ordinary Shares issuable upon

exercise of any Pre-Funded Warrants sold in this offering. See “Description of the Offered Securities” for more information.

There is no established public trading market for our Pre-Funded Warrants and we do not expect a market to develop. We do not intend to

apply for a listing of the Pre-Funded Warrants on any national securities exchange.

We refer to the Ordinary Shares being offered hereby,

as well as the Pre-Funded Warrants, if any, collectively, as the Securities.

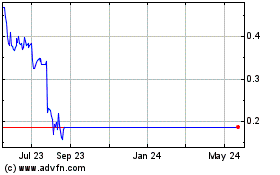

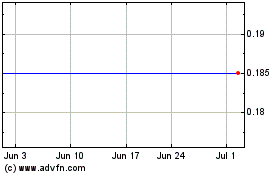

Our Ordinary Shares are listed on the Nasdaq Capital Market under the

symbol “GMVD”. On March 30, 2023, the last reported sale price of our Ordinary Shares on Nasdaq was $1.66 per share. The public

offering price per Ordinary Share and per Pre-Funded Warrant was determined between us and the representative of the underwriters at the

time of pricing based on market conditions and other factors at the time of pricing and was at a discount to the current market price

of our Ordinary Shares.

We are an “emerging growth company”, as defined in the

Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and a “foreign private issuer”, as defined in Rule 405 of the

U.S. Securities Act of 1933, as amended, or the Securities Act, and are eligible for reduced public company reporting requirements.

We have granted the underwriters an option exercisable within 45-days

from the date of this prospectus to purchase up to 1,800,000 additional Ordinary Shares and/or Pre-Funded Warrants on the same terms set

forth above solely to cover over-allotments, if any. If the underwriters exercise this option in full, the total underwriting discounts

and commissions payable by us will be $0.9 million, and the total proceeds to us, before expenses, will be $10.2 million (inclusive of

the non-accountable expense allowance equal to 1.0% the public offering price payable to the underwriters). In addition, we will issue

to the representative of the underwriters warrants, or the Underwriter’s Warrants, to purchase 600,000 Ordinary Shares (equal to

an aggregate of 5.0% of the Ordinary Shares and Pre-Funded Warrants sold in the offering). See “Underwriting”.

The underwriters expect to deliver the Securities to purchasers on

or about April 4, 2023.

The date of this prospectus is March 31, 2023.

PROSPECTUS

SUMMARY

This summary highlights information contained

elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Securities.

Before you decide to invest in our Securities, you should read the entire prospectus carefully, including the “Risk Factors”

section starting on page 10 of this prospectus, as well the financial statements and related notes and other information found elsewhere

in this prospectus.

Our Company

We are a next-generation

mobile health, or mHealth, and digital health company that develops and markets clinical and consumer medical-grade health monitoring

solutions and offers end-to-end support for remote monitoring and telemedicine projects. With extensive experience in the field of medical

devices, digital health and patients monitoring, we are committed to raising the global level of healthcare by empowering caregivers

and patients to better monitor, manage and improve clinical and personal health outcomes. We believe that we are at the forefront of

the digital health revolution in developing the next generation of mobile technologies and services that are designed to empower consumers,

patients, and providers to better monitor, manage and improve clinical and personal health outcomes, especially for those who suffer

from cardiovascular disease, or CVD, pulmonary disease and diabetes. Our business and future revenue stream can be broken down into two

business areas: monitoring services and home collection kits for lab testing.

Monitoring Services

We possess innovative

Mobile Cardiac Telemetry, or MCT, monitors that utilize sophisticated Deep Neural Network based Artificial Intelligence (AI) backend

electrocardiogram processing software--Cardiologs, which is used as a powerful secondary analysis tool. This dual analysis approach is

not offered by most of our competitors. Further, we have two U.S. Centers for Medicare & Medicaid Services, or CMS, -approved independent

diagnostic testing facilities, or IDTFs, each staffed with experienced clinical staff and billing teams, nationwide insurance contracts,

and a full portfolio of diagnostic monitoring tools, including the G-Patch devices for extended holter (AECG), the Spider device for

mobile cardiac telemetry (MCT), and the Prizma device for remote patient monitoring (RPM).

As medicine and technology

become integrated, we believe we are well positioned to capture market share and grow in this business area. Our product line consists

of our Prizma medical device, a clinical grade device that can transform a smartphone into a medical monitoring device, enabling both

healthcare providers and individuals to monitor, manage and share a wide range of vital signs and biometric indicators. In addition,

we are developing a Wireless Vital Signs Monitoring System, or VSMS, which is expected to provide full, continuous, and real time monitoring

of a wide range of vital signs and biometrics. The monitoring services include IDTF monitoring services and private monitoring services.

Home Collection Kits for Lab Testing

In the second half of

2022, we took a strategic decision to divert to more comprehensive home testing solutions as an expansion of our patient services and

as part of our vision to move towards a home-based health care system. On July 13, 2022, we announced that our wholly owned subsidiary,

G Medical Health and Wellness, Inc., has developed seven different at-home tests to collect samples of blood, saliva, stool, urine or

a vaginal swab each of which we expect will be available to be purchased privately by the user in a retail store or online. Once purchased,

the user will be able to collect the sample in the privacy and comfort of his or her home and send the sample to our Clinical Laboratory

Improvement Amendments, or CLIA, certified lab for analysis. We are currently in the process of transferring our CLIA certified lab operations

from California to Texas, which we expect to occur in the second quarter of 2023. Once operational, a sample that arrives at the lab

will be analyzed, and results typically will be available to the customer within days in our secured and HIPAA compliant portal. In addition,

on October 6, 2022, we introduced a Monkeypox consumer home health test kit, along with 23 additional new direct to consumer home collection

kits with 24 to 48 hours results, all of which are expected to be available to consumers the third quarter of 2023 through popular big-box

retailers, pharmacies and online. The collection kits are developed for testing health issues related to hormones, sexual transferred

disease, nutrition, colon cancer, food sensitivity, and allergies, with results going directly to the user within days. The entire data,

from both vital signs and laboratory tests, is collected, and managed under one database and give the user the ability to create, manage

and control their medical data, or EMR, with the ability to retrieve and share it with third parties anywhere and anytime. The prices

for our at-home testing kits will range from $49 to $259.

During the first half of 2022, we operated six locations

performing point-of-care tests in communities in Southern and Northern California. The volume of COVID-19 testing has decreased significantly

since April 2022. Given the decrease in COVID-19 cases, in the second half of fiscal year 2022 we decided to discontinue our COVID-19

related business activities. We expect to write off inventory related to our COVID-19 business for the fiscal year ended December 31,

2022.

Our management team is led by individuals with

over 25 years of experience in developing mobile embedded medical sensors and software, algorithms and ambulatory medical devices, and

with extensive experience filing for, and obtaining approval from, U.S. Food and Drug Administration (the “U.S. FDA”) for

medical devices, including devices approved when the members of our management team were employed at other companies. Our management

has proven their ability to execute our go-to-market strategy as described below, with a proven track record of medical device development

and commercialization experience in the United States, China, Europe, Australia, South Africa, Japan, the Asia Pacific region and Brazil.

Preliminary Unaudited Estimates Regarding our 2022 Results

Below is a summary of certain preliminary estimates

regarding our cash and cash equivalents as of December 31, 2022 and our revenue for the year ended December 31, 2022. This preliminary

unaudited financial information is based upon our estimates and is subject to completion of our financial closing procedures. Moreover,

this preliminary unaudited financial information has been prepared solely on the basis of information that is currently available to,

and that is the responsibility of, management. Our independent registered public accounting firm has not audited or reviewed, and does

not express an opinion with respect to this information. This preliminary unaudited financial information is not a comprehensive statement

of our cash and cash equivalents as of December 31, 2022 or our revenue for the year ended December 31, 2022 and remains subject to,

among other things, the completion of our financial closing procedures, final adjustments, and completion of our internal review for

the year ending December 31, 2022, which may materially impact the results and expectations set forth below.

Our preliminary unaudited cash and cash equivalents

as of December 31, 2022 were approximately $295 thousand.

Our preliminary unaudited revenue for the year

ended December 31, 2022 was approximately $4.4 million and our estimated unaudited revenue from discontinued operations for the year

ended December 31, 2022 was approximately $361 thousand.

Recent Financing and Developments

Nasdaq Notice of Delisting

On February 16, 2023, we received a letter from

the listing qualifications department staff of the Nasdaq (the “Staff”) notifying us that Nasdaq had determined to delist

our Ordinary Shares and tradeable warrants from Nasdaq based on (i) our non-compliance with the minimum $2,500,000 stockholders’

equity requirement for continued listing set forth in Nasdaq Listing Rule 5550(b) and (ii) providing the Staff a submission of information

that contained material misrepresentations, in violation of Nasdaq Listing Rule 5250(a)(1), in relation to our extraordinary general

meeting of shareholders, which was adjourned on February 9, 2023 and ultimately held and concluded on February 16, 2023. We originally

believed and communicated to the Staff that we had met the quorum requirement on February 9, 2023 and believed that an adjournment would

not be necessary. However, the meeting was adjourned due to lack of the required quorum present to open and conduct the meeting, and

on February 16, 2023, a quorum was present and our shareholders voted upon and approved all agenda items at the meeting.

On February 23, 2023, we requested a hearing before

a Nasdaq Hearings Panel (the “Panel”), which stays any delisting or suspension action pending the hearing and the expiration

of any additional extension period granted by the Panel following the hearing. See also “Risk Factors—Risks Related to

an Investment in Our Securities and this Offering—Failure to meet Nasdaq’s continued listing requirements could result in

the delisting of our Ordinary Shares, negatively impact the price of our Ordinary Shares and negatively impact our ability to raise additional

capital.”

September 2022 At-the-Market Offering

On September 16, 2022, we entered into a sales

agreement, the Sales Agreement, with A.G.P./Alliance Global Partners, or the Agent, pursuant to which we could offer and sell, from time

to time, our Ordinary Shares, through the Agent in an “at-the-market” offering, as defined in Rule 415(a)(4) promulgated

under the Securities Act, for an aggregate offering price of up to $3 million. The Agent was entitled to compensation at a commission

rate of 3.0% of the gross sales price per share sold pursuant to the terms of the Sales Agreement. As of January 15, 2023, sales of our

Ordinary Shares under the Sales Agreement were completed and we have received net proceeds of approximately $2.9 under this “at-the-market”

offering.

October 2022 Private Placement

On October 20, 2022,

we entered into an agreement with Jonathan B. Rubini, or the Investor, in connection with a private placement investment for 79,365 post

reverse split Ordinary Shares, par value $3.15 per share, and 79,366 post reverse split warrants exercisable at $6.30 to purchase 79,366

Ordinary Shares with price of $6.30 per share and associated warrant, for aggregate consideration of $500,000. The warrants are exercisable

at any time beginning 30 days after issuance with a term of five years from issuance. In connection with this private placement, we agreed,

inter alia, to amend the 10% convertible debenture, originally dated April 7, 2021, as amended and restated on June 1, 2022 (such debenture,

the April 2021 Financing Debentures), such that the applicable interest rate is 18% per annum with effect from October 1, 2022 until

the extended maturity date of October 7, 2023 and to amend the conversion price adjustment date to October 7, 2023. We expect to repay

the April 2021 Financing Debentures with a portion of the proceeds from this offering.

Shareholder Financing Commitment

On October 6, 2022, our

major shareholder, Chief Executive Officer Dr. Yacov Geva, committed to finance our operations for the next 12 months and until November

30, 2023, under the following conditions: (1) he continues to be a controlling shareholder; (2) we cannot be financed externally from

any other sources; and/or (3) until a sum of $10 million is received by us for our operations in 2023, whichever is earlier. In exchange

for providing this commitment, Dr. Geva was issued 71,428 Ordinary Shares and 71,429 warrants to purchase Ordinary Shares (cashless)

at an exercise price of $7.70. On January 30, 2023, our major shareholder and Chief Executive Officer, Dr. Yacov Geva, extended his commitment

to finance our operations up to February 28, 2024. On March 24, 2023, our major shareholder and Chief Executive Officer, Dr. Yacov Geva,

extended his commitment to finance our operations up to April 30, 2024.

On December 29, 2022, our Board of Directors approved a loan agreement,

dated December 21, 2022 (the “Loan Agreement”), between the Company and Dr. Geva. Under the terms of the Loan Agreement, the

total amount of the loan provided by Dr. Geva to the Company is $999,552, with an annual interest rate of 12%. The following installments

have been made under the terms of the Loan Agreement and advanced to the Company: $198,582 on October 9, 2022; $85,106 on October 11,

2022; $252,596 on November 10, 2022; $175,000 on December 1, 2022 (which is attributed to waived compensation to which Dr. Geva was entitled

as Chief Executive Officer of the Company); and $288,268 on December 20, 2022. In addition, Dr. Geva was granted 515,233 Ordinary Shares

of the Company and 515,233 warrants to purchase Ordinary Shares of the Company with an exercise price of $1.94 per Ordinary Share.

Reverse Share Split

On November 15, 2022, our shareholders approved

a 35-for-1 consolidation of the Ordinary Shares, par value $0.09 per share, pursuant to which holders of the Ordinary Shares received

one Ordinary Share of par value $3.15 for every 35 Ordinary Shares held. The Company’s shareholders also approved an increase in

the Company’s share capital by 42,857,143 Ordinary Shares such that the Company’s total authorized share capital will be

100,000,000 Ordinary Shares going forward. All Ordinary Shares (issued and unissued) will be consolidated on the basis that every 35

Ordinary Shares of par value $0.09 will be consolidated into one Ordinary Share of par value $3.15 such that the authorized Ordinary

Share capital of the Company following such consolidation is $315,000,000 divided into 100,000,000 Ordinary Shares of a par value of

$3.15 each. The November 2022 Reverse Stock Split took effect on November 16, 2022.

New Patents and Notice of Issuance

On December 5, 2022,

we announced that we were granted two patents from the U.S. Patent and Trademark Office, or the USPTO, for our monitoring products marketed

in the U.S. market, including our Prizma medical device. The granted patents include “Method, Device and System for Non-Invasively

Monitoring Physiological Parameters” and “Jacket for Medical Module.” The patent for monitoring physiological parameters

integrates the sensing mechanism that allows the monitoring system to analyze the sensing condition (pressure, ambient temperature, light,

conductivity, etc.) prior to performing and during continuous monitoring of physiological signals from the body. This allows higher and

more accurate sensing that results in reducing false positive readings, including false alarms. The patent for the medical module jacket

takes the harness that is traditionally used for smartphone cases and converts it to a medical case allowing consumers and patients to

carry their smartphones and monitoring devices together, ensuring the ability of monitoring vital signs and other parameters, anywhere,

anytime.

On January 30, 2023, we announced

that we received a patent issue notification from the USPTO for a patent, which was issued on February 7, 2023, called “Method

and System for Vital Signs Monitoring with Earpiece”, which covers the vital signs monitoring system that we are developing using

multiple sensing mechanisms to be used on different body locations. This vital sign monitoring system will potentially provide physicians

more versatility in patients’ monitoring and would simplify in and out-patients’ monitoring.

These three patents join the growing

list of the Company’s granted patents, including five patents in the United States and two patents in China. In addition, the Company

has five more patent applications awaiting approval by the USPTO.

We believe that these patents

will strengthen our position in the market with our unique technologies and services and that obtaining these patents places us at the

forefront of the industry and provides us with a significant advantage over our competitors, specifically with regards to accurate monitoring

of patients. This will potentially allow us to increase the market size for its products and its monitoring services.

Capital Reduction

Under Cayman Islands law, we

may not issue Ordinary Shares at a price under the par value for our Ordinary Shares except in accordance with the provisions of the

Companies Act (as revised) of the Cayman Islands (which, amongst other things, requires a sanction of the Grand Court of the Cayman Islands).

Our Amended and Restated Memorandum and Articles of Association permit us to reduce our share capital in any way, including by reducing

the par value of our issued share capital, cancelling any paid-up share capital which is lost or unrepresented by available assets, and

extinguishing or reducing the liability of any of our shares, by way of special resolution and by order from the Grand Court of the Cayman

Islands confirming such reduction.

On December 23, 2022, we called an extraordinary

general meeting of shareholders to effect a reduction of our share capital and adopt a new Amended and Restated Memorandum and Articles

of Association, which would become effective simultaneously with the Capital Reduction becoming effective (the “Post-Reduction

Amended and Restated Memorandum and Articles of Association”). Due to a lack of an effective quorum, this meeting was then adjourned

to December 28, 2022. At the adjourned meeting, all resolutions proposed, as described herein, were passed. Namely, shareholders

approved to reduce the issued share capital of the Company by the cancellation of $3.1499 paid up capital on each issued share so that

each issued share shall be treated as one fully paid-up share of $0.0001 each in the capital of the Company, or the Capital Reduction.

The Capital Reduction is subject to (i) the approval of the Grand Court of the Cayman Islands, which may impose any condition in relation

to the Capital Reduction, (ii) compliance with any conditions which the Court may impose in relation to the Capital Reduction, and (iii)

the registration by the Registrar of Companies of the Cayman Islands of the order of the Grand Court of the Cayman Islands confirming

the Capital Reduction and the minutes approved by the Grand Court of the Cayman Islands containing the particulars required under the

Companies Act (as revised) of the Cayman Islands with respect to the Capital Reduction; until such conditions are met and/or satisfied,

we cannot issue Ordinary Shares for less than $3.15 per share.

Following the meeting, it

became apparent that the notice calling the general meeting on December 23, 2022 was only posted to shareholders on December 19,

2022 and shareholders may not have received sufficient notice of that meeting. In order for there to be sufficient notice under our Amended

and Restated Memorandum and Articles of Association, there needs to be five days’ clear notice of the meeting. The result of this

procedural irregularity is that the adjourned meeting on December 28, 2022 and the resolutions passed at that meeting are considered

to have a defect. To cure the irregularity, on January 24, 2023, we called a further general meeting for our shareholders to reconsider

and, if thought fit, re-approve the matters set out in the December 28, 2022 meeting and certain other matters (including amendments

to our Amended and Restated Memorandum and Articles of Association). This meeting was scheduled for February 9, 2023 and, on such date,

the meeting was adjourned to February 16, 2023 due a lack of an effective quorum. The adjourned meeting was convened on February 16,

2023, a quorum was present and our shareholders voted upon and approved all agenda items.

On March 6, 2023, we filed our application to seek an order of the

Grand Court of the Cayman Islands for confirmation and approval of the Capital Reduction, which was approved by the Grand Court of the

Cayman Islands on March 23, 2023, with no conditions attached. The Capital Reduction will therefore become effective upon registration

by the Registrar of Companies of the Cayman Islands of (1) the order of the Grand Court of the Cayman Islands confirming the Capital Reduction

and (2) the minutes approved by the Grand Court of the Cayman Islands containing the particulars required under the Companies Act (as

revised) of the Cayman Islands (together the “Capital Reduction Documents”). On March 24, 2023, we filed the Capital Reduction

Documents with the Registrar of Companies of the Cayman Islands and the Capital Reduction became effective.

Summary Risk Factors

Our business is subject to numerous risks, as

more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. You should read

these risks before you invest in the Securities. In particular, our risks include, but are not limited to, the following:

| ● | we have a limited operating history on which to assess

the prospects for our business, have generated little revenue from sales of our products,

have incurred losses since inception and we anticipate that we will continue to incur significant

losses until we are able to successfully commercialize our products and services globally; |

| | | |

| ● | we

expect that we will need to raise substantial additional funding before we can expect to

become profitable from sales of our products and services and this additional financing may

not be available on acceptable terms, or at all; |

| | | |

| ● | raising

additional capital would cause dilution to holders of our equity securities, and may affect

the rights of existing holders of equity securities; |

| | | |

| ● | we

may not succeed in completing the development and commercialization of our products and services

and generating significant revenues; |

| | | |

| ● | the

expansion of our home testing kit business presents important challenges to our ability to

manage our business; |

| | | |

| ● | our

success depends upon market acceptance of our products and services, our ability to develop

and commercialize new products and services and generate revenues and our ability to identify

new markets for our technology; |

| | | |

| ● | medical

device development is costly and involves continual technological change which may render

our current or future products obsolete; |

| ● | we will be dependent upon success

in our customer acquisition strategy and successfully integrating acquired companies and

technology; |

| | | |

| ● | we have recently invested significant

capital in our COVID-19 related services, including the purchase of COVID-19 testing kits,

however, the future of COVID-19 related services is uncertain and we have stopped operations

in our COVID-19 testing related business, which will lead to the write off of inventory and

fixed assets in our fiscal year ended December 31, 2022; |

| | | |

| ● | we

are dependent upon third-party manufacturers and suppliers making us vulnerable to supply

shortages and problems and price fluctuations, which could harm our business, and we have

no timely ability to replace our current manufacturing capabilities; |

| | | |

| ● | we

have limited manufacturing history on which to assess the prospects for our business, and

we anticipate that we will incur significant losses once we initiate our in-house manufacturing

until we are able to successfully commercialize our products globally; |

| | | |

| ● | we

have applied for various patents, but there is a risk that our patent applications will not

be granted or that we will receive enforceable patent rights, which could leave us at a competitive

disadvantage; |

| | | |

| ● | we

face intense competition in the market, and as a result we may be unable to effectively compete

in our industry; |

| | | |

| ● | the

level of our commercial success will depend in part on our ability to generate and grow sales

with our sales and marketing team, strategies and partnerships, and we may be unsuccessful

in these efforts; |

| | | |

| ● | if

third-party payors do not provide adequate coverage and reimbursement for the use of our

products and services, our revenue will be negatively impacted; |

| | | |

| ● | we

may not be able to obtain the necessary clearance(s) or approval(s) of the U.S. FDA or any

applicable state equivalents, or similar foreign regulatory agencies, such as European Economic

Area (or EEA) Notified Bodies, or the NMPA or may not be able to obtain such approvals in

a timely fashion; |

| | | |

| ● | the

operation of our monitoring centers is subject to rules and regulations governing IDTF and

state licensure requirements; failure to comply with these rules could prevent us from receiving

reimbursement from Medicare and some commercial payors; |

| | | |

| ● | changes

in the regulatory environment may constrain or require us to restructure our operations,

which may delay or prevent us from marketing our products and services and as a result harming

our revenue and operating results; |

| | | |

| ● | we

may be party to or target of lawsuits, investigations and proceedings arising out of claims

alleging negligence, product liability, breach of warranty or malpractice that may involve

large claims and significant defense costs whether or not such liability is imposed. Such

potential claims may be costly to defend, could consume management resources and could adversely

affect our reputation and business; |

| | | |

| ● | we

are a Cayman Islands exempted company with limited liability. The rights of our shareholders

may be different from the rights of shareholders governed by the laws of U.S. jurisdictions.

In addition, our shareholders may face difficulties in protecting their interests because

we are a Cayman Islands exempted company and United States civil liabilities and certain

judgments obtained against us by our shareholders may not be enforceable; |

| | | |

| ● | failure

to meet Nasdaq’s continued listing requirements could result in the delisting of our

Ordinary Shares, negatively impact the price of our Ordinary Shares and negatively impact

our ability to raise additional capital; |

| | | |

| ● | our

principal manufacturing facility is located in China and we plan to operate in the Chinese

market. Changes in the Chinese government’s macroeconomic policies or its public policy

could have a negative effect on our business and results of operations. The Chinese government

exerts substantial influence over the manner in which we must conduct our business activities.

In addition, uncertainties with respect to the Chinese legal system could adversely affect

us; |

| | | |

| ● | we

maintain material operations in Israel. It may be difficult to enforce a judgment of a U.S.

court against us and our officers and directors and the Israeli experts named in this prospectus

in Israel or the United States, to assert U.S. securities laws claims in Israel or to serve

process on our officers and directors and these experts. In addition, potential political,

economic and military instability in the State of Israel, where our management team and our

research and development facilities are located, may adversely affect our results of operations;

and |

| | | |

| ● | we

may be required to pay monetary remuneration to our Israeli employees for their inventions,

even if the rights to such inventions have been duly assigned to us. |

Corporate Information

We are a company incorporated

and registered in the Cayman Islands and were incorporated in 2014. Our Cayman Islands address is P.O. Box 10008, Willow House, Cricket

Square Grand Cayman, KY1-1001, Cayman Islands and our principal executive offices are located at 5 Oppenheimer St. Rehovot 7670105, Israel.

Our telephone number is +972.8.679.9861. Our website address is https://gmedinnovations.com/. The information contained on, or that can

be accessed through, our website is not part of this prospectus. We have included our website address in this prospectus solely as an

inactive textual reference.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,”

as defined in Section 2(a) of the Securities Act as modified by the JOBS Act. As such, we are eligible to, and intend to, take advantage

of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies”

such as not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002

(the “Sarbanes-Oxley Act”). We could remain an “emerging growth company” for up to five years, or until the earliest

of (a) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion, (b) the date that

we become a “large accelerated filer” as defined in Rule 12b-2 under the U.S. Securities Exchange Act of 1934, as amended

(the “Exchange Act”) which would occur if the market value of our Ordinary Shares that is held by non-affiliates exceeds

$700 million as of the last business day of our most recently completed second fiscal quarter or (c) the date on which we have

issued more than $1 billion in nonconvertible debt during the preceding three-year period.

Implications of being a “Foreign Private

Issuer”

We are subject to the information

reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements,

we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic

issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed

and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy

statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information

that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year

to file our annual report with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting

companies. Our officers, directors, and principal shareholders are exempt from the requirements to report transactions in our equity

securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer,

we are not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition,

as a foreign private issuer, we are permitted to follow certain home country corporate governance practices instead of those otherwise

required under the Nasdaq Stock Market rules for domestic U.S. issuers and are not required to be compliant with all Nasdaq Stock Market

rules as of the date of our initial listing on Nasdaq as would domestic U.S. issuers. These exemptions and leniencies will reduce the

frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting company.

We intend to take advantage of the exemptions available to us as a foreign private issuer during and after the period we qualify as an

“emerging growth company.”

THE

OFFERING

| Ordinary

Shares currently issued and outstanding |

|

1,971,564 Ordinary

Shares |

| |

|

|

| Ordinary

Shares offered by us |

|

5,470,000 Ordinary Shares. |

| |

|

|

Option to purchase additional

shares

|

|

We have granted the underwriters

an option exercisable within 45-days from the date of this prospectus to purchase up to 1,800,000 additional Ordinary Shares, less

underwriting discounts and commissions, solely to cover over-allotments, if any. |

| |

|

|

| Pre-Funded

Warrants |

|

We are offering to certain purchasers whose purchase of Ordinary Shares

in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning

more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares immediately following the closing of

this offering, the opportunity to purchase 6,530,000 Pre-Funded Warrants, in lieu of Ordinary Shares that would otherwise result in any

such purchaser’s beneficial ownership, together with its affiliates and certain related parties, exceeding 4.99% (or, at the election

of such purchaser, 9.99%) of our outstanding Ordinary Shares immediately following the consummation of this offering. The purchase price

of each Pre-Funded Warrant is equal to the purchase price of the Ordinary Shares in this offering minus $0.001, the exercise price of

each Pre-Funded Warrant. Each Pre-Funded Warrant is immediately exercisable and may be exercised at any time until it has been exercised

in full. This offering also relates to the Ordinary Shares issuable upon exercise of any Pre-Funded Warrants sold in this offering. |

| |

|

|

| Ordinary

Shares to be issued and outstanding after this offering |

|

7,441,564 Ordinary Shares

(or 9,241,564 Ordinary Shares if the underwriters exercise in full their option to purchase additional Ordinary Shares). |

| |

|

|

| Use

of proceeds |

|

We expect to receive approximately $8.7 million in net proceeds from the

sale of 5,470,000 Ordinary Shares and 6,530,000 Pre-Funded Warrants offered by us in this offering (approximately $10 million if

the underwriter exercises its over-allotment option in full).

We currently expect to use the net proceeds from the sale of Ordinary

Shares and Pre-Funded Warrants under this prospectus for general corporate purposes (including financing our operations, capital

expenditures and business development), the repayment in full of the April 2021 Financing Debentures and potential mergers or acquisitions.

The amounts and schedule of our actual expenditures will depend

on multiple factors. As a result, our management will have broad discretion in the application of the net proceeds of this offering.

See “Use of Proceeds” on page 43 of this prospectus. |

| |

|

|

| Risk

factors |

|

Investing in our securities

involves a high degree of risk. You should read the “Risk Factors” section starting on page 10 of this prospectus

for a discussion of factors to consider carefully before deciding to invest in the Securities. |

| |

|

|

| Nasdaq

Capital Market symbol: |

|

Our Ordinary Shares are

listed on the Nasdaq Capital Market under the symbol “GMVD”. |

The number of the Ordinary Shares to be issued

and outstanding immediately after this offering as shown above assumes that all of the Ordinary Shares offered hereby are sold and is

based on 1,971,564 Ordinary Shares issued and outstanding as of the date of this prospectus. This number excludes:

| |

● |

1,147,750 Ordinary Shares issuable

upon the exercise of warrants outstanding as of such date, at exercise prices ranging from $1.94 to A$1,231.65 (approximately $818.19),

at a weighted average exercise price of $29.37, all of which vested as of such date; |

| |

● |

98,698 Ordinary Shares issuable upon the exercise of

tradable warrants outstanding at an exercise price of $218.75 which were issued as part of the units in our Initial Public Offering; |

| |

● |

130,778 Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our Global Plan outstanding as of such date, at a weighted average exercise price of $56.92, of which 30,037 were vested as of such date; |

| |

● |

5,400 Ordinary Shares issuable upon conversion of a convertible debenture at a conversion price of $140 per share; |

| |

● |

2,437 Ordinary Shares reserved

for future issuance under our Global Plan; and |

| |

● |

114,441 Ordinary Shares issuable

pursuant to performance rights. |

Unless otherwise indicated, all information in

this prospectus assumes or gives effect to:

| |

● |

no exercise of the underwriter’s

over-allotment option; |

| |

● |

no exercise of the Pre-Funded Warrants; and |

| |

|

|

| |

● |

no exercise of the Underwriter’s Warrants. |

SUMMARY

CONSOLIDATED FINANCIAL INFORMATION

The following tables set forth our summary consolidated

financial information as of and for the periods ended on the dates indicated below. We have derived the following statements of operations

data for the years ended December 31, 2021 and 2020 from our audited consolidated financial statements included elsewhere in this prospectus

and the following statements of operations data for the six months ended June 30, 2022 and 2021 from our unaudited interim condensed

consolidated financial statements included elsewhere in this prospectus. We have derived the following summary balance sheet data as

of December 31, 2021 from our audited consolidated financial statements included elsewhere in this prospectus and the following summary

balance sheet data as of June 30, 2022 from our unaudited interim condensed consolidated financial statements included elsewhere in this

prospectus. We have prepared the unaudited consolidated financial information on the same basis as our audited consolidated financial

statements. Interim results are not necessarily indicative of the results that may be achieved in an entire fiscal year. Our historical

results are not necessarily indicative of the results that may be expected in the future. See “Risk Factors” beginning on

page 10 of this prospectus. The following summary consolidated financial data should be read in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included

elsewhere in this prospectus.

Our consolidated financial statements included

in this prospectus were prepared in accordance with IFRS, as issued by the IASB.

| |

|

Year

Ended

December 31, |

|

Six

Months Ended

June 30, |

|

| U.S.

dollars in thousands |

|

2021 |

|

2020 |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

(Unaudited) |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

| Services |

|

|

5,008 |

|

|

4,859 |

|

|

2,224 |

|

|

|

2,875 |

|

| Products |

|

|

50 |

|

|

41 |

|

|

- |

|

|

|

50 |

|

| Total

revenues |

|

|

5,058 |

|

|

4,900 |

|

|

2,224 |

|

|

|

2,925 |

|

| Cost of

revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

services |

|

|

3,490 |

|

|

3,835 |

|

|

7,096 |

|

|

|

1,726 |

|

| Cost of

sales of products |

|

|

66 |

|

|

398 |

|

|

45 |

|

|

|

58 |

|

| Total

cost of revenues |

|

|

3,556 |

|

|

4,233 |

|

|

7,141 |

|

|

|

1,784 |

|

| Gross

profit (loss) |

|

|

1,502 |

|

|

667 |

|

|

(4,917 |

) |

|

|

1,141 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research

and development expenses |

|

|

1,680 |

|

|

1,315 |

|

|

1,189 |

|

|

|

619 |

|

| Selling,

general and administrative expenses |

|

|

11,091 |

|

|

11,652 |

|

|

14,683 |

|

|

|

4,795 |

|

| Operating

loss |

|

|

11,269 |

|

|

12,300 |

|

|

20,789 |

|

|

|

4,273 |

|

| Financial

(expenses) income, net |

|

|

(3,622 |

) |

|

(406 |

) |

|

7,515 |

|

|

|

(503 |

) |

| Loss

before taxes on income |

|

|

14,891 |

|

|

12,706 |

|

|

13,274 |

|

|

|

4,776 |

|

| Income

tax benefit (expenses), net |

|

|

3 |

|

|

18 |

|

|

(13 |

) |

|

|

5 |

|

| Other

comprehensive income |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

| Net comprehensive

loss |

|

|

14,888 |

|

|

12,688 |

|

|

13,287 |

|

|

|

4,771 |

|

| Net comprehensive

loss for the period attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling

interests |

|

|

130 |

|

|

152 |

|

|

266 |

|

|

|

77 |

|

| The Company’s

shareholders |

|

|

14,758 |

|

|

12,536 |

|

|

13,021 |

|

|

|

4,694 |

|

| |

|

|

14,888 |

|

|

12,688 |

|

|

13,287 |

|

|

|

4,771 |

|

| Basic

and diluted loss per share attributable to the Company’s shareholders in USD |

|

|

(45.5 |

)(1) |

|

(59.5 |

)(1) |

|

(25.31 |

) |

|

|

(17.85 |

) |

| (1) | After giving effect to the November 2022 Reverse

Stock Split. |

| | |

As of

June 30,

2022 | |

| | |

Actual | | |

As

Adjusted(1) | |

| U.S. dollars in thousands | |

(Unaudited) | | |

| |

| Consolidated Balance Sheet Data: | |

| | |

| |

| Cash and cash equivalents | |

$ | 1,509 | | |

$ | 9,416 | |

| Total assets | |

| 10,278 | | |

| 18,185 | |

| Long term debt | |

| 905 | | |

| 905 | |

| Accumulated deficit | |

| 103,655 | | |

| 103,713 | |

| Total shareholders’ equity (deficit) | |

| (1,240 | ) | |

| 7,359 | |

|

(1) |

As adjusted data gives effect to the issuance and sale of 5,470,000 Ordinary

Shares at the public offering price of $0.80 per Ordinary Share and 6,530,000 Pre-Funded Warrants at the price of $0.799 per Pre-Funded

Warrant in this offering, together representing 12,000,000 Ordinary Shares (assuming the full exercise of the Pre-Funded Warrants), after

deducting underwriting discounts and commissions and estimated offering expenses and the repayment in full of the April 2021 Financing

Debentures with such proceeds as described in the section entitled “Use of Proceeds”, as if the sale of the Ordinary Shares

had occurred on June 30, 2022. |

RISK

FACTORS

An investment in our Securities involves a

high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should

consider carefully the risk factors described below before deciding whether to invest in the Securities. The risks described below are

not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial

may also materially and adversely affect our business operations. If any of these risks actually occur, our business, financial condition,

operating results or cash flows could be materially adversely affected. This could cause the trading price of the Securities to decline,

and you may lose all or part of your investment.

Risks Related to Our

Financial Condition and Capital Requirements

We have a limited operating history on which

to assess the prospects for our business, have generated little revenue from sales of our products, and have incurred losses since inception.

We anticipate that we will continue to incur significant losses until we are able to successfully commercialize our products and services

globally.

Since inception, we have devoted substantially

all of our financial resources to develop our products and their related services. We have financed our operations primarily through

the issuance of equity securities and loans, have incurred losses since inception including net losses of $14.9 million in 2021, $12.7

million in 2020 and $15.5 million in 2019. Our accumulated deficit as of June 30, 2022 was $103.7 million. We have financed our operations

primarily through the issuance of equity securities. We have generated little revenue from the sale of our products to date and have

incurred significant losses. The amount of our future net losses will depend, in part, on on-going development of our products and their

related services, the success of our new home testing kit related business, the rate of our future expenditures and our ability to obtain

funding through the issuance of our securities, strategic collaborations or grants. We expect to continue to incur significant losses

until we are able to successfully commercialize our products and services globally. We anticipate that our expenses will increase substantially

if and as we:

| ● | continue the

development of our products and services, including with respect to our new home testing

kit business; |

| ● | establish

a sales, marketing and distribution infrastructure to commercialize our products and services; |

| ● | seek

to identify, assess, acquire, license and/or develop other products and services and subsequent

generations of our current products and services; |

| ● | seek

to maintain, protect and expand our intellectual property portfolio; |

| ● | seek

to attract and retain skilled personnel; and |

| ● | continue

to support our operations as a public company, our product development and planned future

commercialization efforts. |

| Our ability to generate future revenue from product and

service sales depends heavily on our success in many areas, including but not limited to: |

| ● | Successfully

establishing and our ability to manage our home testing kit business; |

| ● | addressing

any competing technological and market developments; |

| ● | negotiating

favorable terms in any collaboration, licensing or other arrangements into which we may enter; |

| ● | establishing

and maintaining resale and distribution relationships with third-parties that can provide

adequate (in amount and quality) infrastructure to support market demand for our products; |

| ● | launching

and commercializing current and future products and services, either directly or with a collaborator

or distributor; and |

| ● | maintaining,

protecting and expanding our portfolio of intellectual property rights, including patents,

trade secrets and know-how. |

We expect that we

will need to raise substantial additional funding before we can expect to become profitable from sales of our products and services.

This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may

force us to delay, limit or terminate our product development efforts or other operations.

As

of June 30, 2022, we had approximately $1.5 million in cash and cash equivalents and an accumulated deficit of $103.7 million. Based

upon our currently expected level of operating expenditures, we expect that our current existing cash and cash equivalents, future fund

raisings and the Company’s major shareholder commitment to continue and support the Company’s ongoing operation for the foreseeable

future (if other sources of funding would not be available to the Company and under certain conditions) will be sufficient to fund our

current operations for the foreseeable future. We will require substantial additional capital to fund our current operation and to grow

our business and commercialize our products and services. In addition, our operating plans may change as a result of many factors that

may currently be unknown to us, and we may need to seek additional funds sooner than planned.

We

cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the

terms of any financing may adversely affect the holdings or the rights of our stockholders and the issuance of additional securities,

whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our Ordinary Shares to decline. The

incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive

covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual

property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required

to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and

we may be required to relinquish rights to some of our technologies or products or otherwise agree to terms unfavorable to us, any of

which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient

funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific

strategic considerations.

Raising additional

capital would cause dilution to holders of our equity securities, and may affect the rights of existing holders of equity securities.

We

may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations and strategic

and licensing arrangements. To the extent that we raise additional capital through the issuance of equity or convertible debt securities,

your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights

as a holder of the Ordinary Shares.

Risks

Related to Our Business

We may not succeed in completing the

development and commercialization of our products and services and generating significant revenues.

While

we recently expanded our business to provide home test kits related services, including hormones, sexual transferred diseases, nutrition,

colon cancer, food sensitivity and allergies testing, since commencing our operations, we have focused on the research and development

and limited clinical trials of our products and services. Some of our products and services are not approved for commercialization and

have never generated any revenues. Our ability to generate revenues and achieve profitability depends on our ability to successfully

complete the development of these products and services, obtain regulatory approvals and generate significant revenues. The future success

of our business cannot be determined at this time, and we do not anticipate generating revenues from some of our products and services

for the foreseeable future. In addition, we have limited experience in commercializing our products and services and we may face several

challenges with respect to our commercialization efforts, including, among others, that:

| ● | we may not

have adequate financial or other resources to complete the development of our products or

services associated with a given product; |

| |

● |

we may not have adequate financial or other resources to complete the development of our lab and the

equipment involved for such operations; |

| |

● |

we may not have adequate financial or other resources to support the ongoing operation of our lab, including

materials required for the tests analysis, physician network costs and other unforeseen expenses |

| ● | we

may not be able to manufacture our products in commercial quantities, at an adequate quality

or at an acceptable cost; |

| ● | we

may not be able to establish adequate sales, marketing and distribution channels; |

| ● | healthcare

professionals and patients may not accept our products or fully utilize our products’

services; |

| ● | we

may not be aware of possible complications from the continued use of our products or services

since we have limited clinical experience with respect to the actual use of our products

and services; |

| ● | technological

breakthroughs in the mobile and e-health solutions and services may reduce the demand for

our products; |

| ● | changes

in the market for mobile and e-health solutions and services, new alliances between existing

market participants and the entrance of new market participants may interfere with our market

penetration efforts; |

| ● | third-party

payors may not agree to reimburse patients for any or all of the purchase price of our products,

which may adversely affect patients’ willingness to purchase our products; |

| ● | uncertainty

as to market demand may result in inefficient pricing of our products and services; |

| ● | we

may face third-party claims of intellectual property infringement for any of our technologies,

services and at home testing kits; and |

| ● | we

may fail to obtain or maintain regulatory approvals for our products or services in our target

markets or may face adverse regulatory or legal actions relating to our products or services

even if regulatory approval is obtained. |

If we are unable

to meet any one or more of these challenges successfully, our ability to effectively commercialize our products and services could be

limited, which in turn could have a material adverse effect on our business, financial condition and results of operations.

The expansion of

our home testing kit business presents important challenges to our ability to manage our business.

In

July 2022, we launched our home testing kit related business with seven types of at home testing kits. In October 2022, we expanded our

business to offer an additional 24 different at-home health tests kits. Since the COVID-19 pandemic, there has been an increase in home

testing for medical conditions and there is existing competition in the home testing kit market and we expect new entrants to enter the

market, and these competitors may cause price declines or reduced market share for us. We expect this competition to intensify in the

future. We face competition from a variety of sources, including, among others, an increasing number of companies seeking to develop

and commercialize, or who have developed and commercialized home testing kit services, such as specialty and reference laboratories,

and established and emerging healthcare, information technology and service companies that may develop and sell competitive products

or services. There can be no assurance that our investments in our home testing kit business and capabilities will result in desirable

returns, and if our operating results continue to decline as a result of decreased demand, our stock price could decline.

We

may be subject to liability and our insurance may not be sufficient to cover damages.

Our

business exposes us to potential liability risks that are inherent in the marketing and sale of testing kits and diagnostics. The use

of our products may expose us to professional and product liability claims and possible adverse publicity. We may be subject to claims

resulting from incorrect results of analysis with respect to our products and services. Litigation of such claims could be costly. Further,

if a court were to require us to pay damages to a plaintiff, the amount of such damages could be significant and severely damage our

financial condition. Although we have public and product liability insurance coverage under broad form liability and professional indemnity

policies, the level or breadth of our coverage may not be adequate to fully cover any potential liability claims. In addition, we may

not be able to obtain additional liability coverage in the future at an acceptable cost. A successful claim or series of claims brought

against us in excess of our insurance coverage and the effect of professional and/or product liability litigation upon the reputation

and marketability of our technology and products, together with the diversion of the attention of key personnel, could negatively affect

our business.

Our

success depends upon market acceptance of our products and services, our ability to develop and commercialize new products and services

and generate revenues and our ability to identify new markets for our technology.

We

have developed, and are engaged in the development of, mobile and e-health solutions and services using our suite of devices and software

solutions. Our success will depend on the acceptance of our products and services in the healthcare market. We are faced with the risk

that the marketplace will not be receptive to our products and services over competing products and that we will be unable to compete

effectively. Factors that could affect our ability to successfully commercialize our current and any potential future products and services

include:

| ● | the

challenges of developing (or acquiring externally) technology solutions that are adequate

and competitive in meeting the requirements of next-generation design challenges; |

| |

● |

our ability to successfully complete the validation process of each home test kit to be able to launch

it to the market. Delays in launching kits might affect our ability to meet the sales forecast; |

| ● | the

dependence upon physicians’ acceptance of our products and their willingness to prescribe

our product to their patients for the sale of our products and provision of our services;

and |

| |

● |

retailer acceptance of our products and their interest in selling it in their stores. There might be

cases that due to private labelling of home testing kits by the retailer, the retailers won’t be interested in promoting our

product but its own product, or in case a retailer signed an exclusive agreement with a large competitor, we might receive a negative

response to our interest to work with a retailer in a specific area or stores. |

We

cannot assure that our current products or any future products, and services, will gain broad market acceptance. If the market for our

current products in development fails to develop or develops more slowly than expected, or if any of the services and standards supported

by us do not achieve or sustain market acceptance, our business and operating results would be materially and adversely affected.

Medical

device development is costly and involves continual technological change which may render our current or future products obsolete.

The

market for monitoring services and products is characterized by rapid technological change, medical advances, changing consumer requirements,

short device lifecycles and evolving industry standards. Any one of these factors could reduce the demand for our services and devices

or require substantial resources and expenditures for research, design and development to avoid technological or market obsolescence.

Our

success will depend on our ability to enhance our current technology, services and systems and develop or acquire and market new technologies

to keep pace with technological developments and evolving industry standards, while responding to changes in customer needs. A failure

to adequately develop or acquire device enhancements or new devices that will address changing technologies and customer requirements

adequately, or to introduce such devices on a timely basis, may have a material adverse effect on our business, financial condition and

results of operations.

We

might have insufficient financial resources to improve existing devices, advance technologies and develop new devices at competitive

prices. Technological advances by one or more competitors or future entrants into the field may result in our present services or devices

becoming non-competitive or obsolete, which may decrease revenues and profits and adversely affect our business and results of operations.

We

will encounter significant competition across our product lines and in each market in which we will sell our products and services from

various companies, some of which may have greater financial and marketing resources than we do. Our primary competitors include Biotelemetry,

Inc., iRhythm Technologies, Preventice Solutions, Inc., Bardy Diagnostics, Inc. and other arrhythmia service providers, as well as a

wide range of medical device companies that sell a single or limited number of competitive products and services, such as Teledoc Health,

Inc., DarioHealth Corp. and Itamar Medical, Inc., or participate in only a specific market segment.

We

will be dependent upon success in our customer acquisition strategy.

Our

business will be dependent upon success in our customer acquisition strategy. If we fail to maintain a high quality of service or a high

quality of device technology, we may fail to retain existing users or add new users. If users decrease their level of engagement, our

revenue, financial results and business may be significantly harmed. Our future success depends upon building a commercial operation

in the United States and China, as well as entering additional markets to commercialize our products and services. We believe that our

expanded growth will depend on the further development, regulatory approval and commercialization of our products and services, which

we anticipate that can be used by nearly all targeted individuals. If we fail to expand the use of our product and services in a timely

manner, we may not be able to expand our markets or to grow our revenue, and our business may be adversely impacted. The size of our

user base and our users’ level of engagement are critical to our success. Our financial performance will be significantly determined

by our success in adding, retaining and engaging active users. If people do not perceive our products or services to be useful, reliable

and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their

engagement. A decrease in user retention, growth or engagement could render less attractive to developers, which may have a material

and adverse impact on our revenue, business, financial condition and results of operations.

Any

number of factors could negatively affect user retention, growth and engagement, including:

| ● | users

increasingly engaging with competing products; |

| ● | users

not actively using the services associated with each of our respective services; |

| ● | failure

to introduce new and improved products and services; |

| ● | inability

to successfully balance efforts to provide a compelling user experience with the decisions

made with respect to the added value services provided; |

| ● | inability

to continue to develop products for mobile devices that users find engaging, that work with

a variety of mobile operating systems and networks and that achieve a high level of market

acceptance; |

| ● | changes

in user sentiment about the quality or usefulness of our products and services or concerns

related to privacy and sharing, safety, security or other factors; |

| ● | inability

to manage and priorities information to ensure users are presented with content that is interesting,

useful and relevant to them; |

| ● | adverse

changes in our products that are mandated by legislation or regulatory agencies, both in

the United States and across the globe; or |

| ● | technical

or other problems preventing us from delivering products or services in a rapid and reliable

manner or otherwise affecting the user experience. |

We

have recently invested significant capital in our COVID-19 related services, including the purchase of COVID-19 testing kits, however,

the future of COVID-19 related services is uncertain and we have stopped operations in our COVID-19 testing related business, which will

lead to the write off of inventory and fixed assets in our fiscal year ended December 31, 2022.

In December 2021 we launched our COVID-19 testing

business, which entailed a significant investment of capital, including, among others, to establish several of testing facilities and

laboratories throughout the state of California and the purchase of COVID-19 testing kits. We also entered into various agreements and

arrangements regarding our COVID-19 testing business. The level of demand for COVID-19 testing has varied depending on, among other things,

changes in the number of reported cases of COVID-19, discoveries of new variants or subvariants of the virus, different COVID-19 mitigation

efforts and policies adopted by various governments or businesses, all of which are subject to change and beyond our control. Moreover,

the future of COVID-19 related services may be dependent on changes to laws and regulations governing healthcare service providers,

including measures to control costs, or reductions in reimbursement levels from government payors or insurance companies. These changes

are difficult to predict and may also impact our revenue recognition or collecting accounts receivables. We currently have no expectations

to open any new COVID-19 testing centers as the volume of COVID-19 testing has decreased significantly since April 2022. Given the decrease

in COVID-19 cases, in the second half of fiscal year 2022 we decided to stop our COVID-19 testing related business and have closed all

the locations performing point-of-care tests in communities in Southern and Northern California. We intend to write off our COVID-19

test inventory and fixed assets in our audited financial statements for the year ended December 31, 2022.

If

we are unable to successfully integrate acquired companies and technology, we may not realize the benefits anticipated and our future

growth may be adversely affected.

We

have grown through acquisitions of companies and technology, including our acquisitions of CardioStaff, in November 2017 and Telerhythmics

in November 2018. Acquisitions bring risks associated with our assumption of the liabilities of an acquired company, which may be liabilities

that we were or are unaware of at the time of the acquisition, potential write-offs of acquired assets and potential loss of the acquired

company’s key employees or customers. Physician, patient and customer satisfaction or performance problems with an acquired business,

technology, service or device could also have a material adverse effect on our reputation. Additionally, potential disputes with the

seller of an acquired business or its employees, suppliers or customers could adversely affect our business, operating results and financial

condition. If we fail to properly evaluate and execute acquisitions, our business may be disrupted and our operating results and prospects

may be harmed.

Furthermore,

integrating acquired companies or new technologies into our business may prove more difficult than we anticipate. We may encounter difficulties

in successfully integrating our operations, technologies, services and personnel with that of the acquired company, and our financial

and management resources may be diverted from our existing operations. Offices in multiple states create a strain on our ability to effectively

manage our operations and key personnel. If we elect to consolidate our facilities, we may lose key personnel unwilling to relocate to

the consolidated facility, may have difficulty hiring appropriate personnel at the consolidated facility and may have difficulty providing

continuity of service through the consolidation.

We

are dependent upon third-party manufacturers and suppliers making us vulnerable to supply shortages and problems and price fluctuations,

which could harm our business.

We

do not manufacture our products in-house. Rather, we rely on a limited number of third parties to manufacture and assemble our products.

Our suppliers and manufacturers may encounter problems during manufacturing for a variety of reasons, including, for example, failure

to follow specific protocols and procedures, failure to comply with applicable legal and regulatory requirements, equipment malfunction

and environmental factors, failure to properly conduct their own business affairs, and infringement of third-party intellectual property

rights, any of which could delay or impede their ability to meet our requirements. Our reliance on these third-party suppliers also subjects

us to other risks that could harm our business, including:

| ● | we

are not a major customer of many of our suppliers and manufacturers, and these third parties may therefore give other customers’

needs higher priority than ours; |

| ● | third

parties may threaten or enforce their intellectual property rights against our suppliers, which may cause disruptions or delays in shipment,

or may force our suppliers to cease conducting business with us; |

| ● | we

may not be able to obtain an adequate supply in a timely manner or on commercially reasonable terms; |

| ● | our

suppliers and manufacturers, especially new suppliers and manufacturers, may make errors in manufacturing that could negatively affect

the efficacy or safety of our products or cause delays in shipment; |

| ● | we

may have difficulty locating and qualifying alternative suppliers and manufacturers; |

| ● | switching

components, suppliers or manufacturers may require product redesign and possibly submission to the U.S. FDA, the European Medicines Agency,

EEA Notified Bodies, and the Chinese National Medical Products Administration (or NMPA) or other similar foreign regulatory agencies,

which could significantly impede or delay our commercial activities; |

| ● | the

occurrence of a fire, natural disaster or other catastrophe impacting one or more of our suppliers and manufacturers may affect their

ability to deliver products to us in a timely manner; and |

| ● | our

suppliers and manufacturers may encounter financial or other business hardships unrelated to our demand, which could inhibit their ability

to fulfill our orders and meet our requirements. |

We expect that our Prizma

device and Extended Holter Patch System will be primarily manufactured by a third party in China. However, due to the current complexities

of traveling to China as a result of the COVID-19 pandemic, we use a contract manufacturer in Israel to meet our manufacturing requirements.