Fossil to Acquire Skagen - Analyst Blog

January 11 2012 - 8:00AM

Zacks

To expand its portfolio,

Fossil, Inc. (FOSL) has agreed to purchase the

privately held Nevada-based Skagen Designs, Ltd. and some of its

partners for approximately $225 million in cash and 150,000 Fossil

shares. The total value paid by Fossil would be approximately

$236.8 million.

Skagen Designs is an international

company engaged in the manufacture and marketing of contemporary

Danish design accessories including watches, jewelry, sunglasses

and clocks.

As per the deal, Skagen may get an

additional 100,000 Fossil shares, if Skagen products surpass

certain revenue targets. Further, the acquisition is expected to

close by February, 2012, subject to regulatory consent.

The acquisition is thus expected to

enhance Fossil’s portfolio with Skagen’s unique designs and ample

potential as a lifestyle brand. On the other hand, Skagen will also

be benefited by Fossil’s ever increasing opportunities to grow and

expand.

Skagen has company-owned retail

stores in Denmark, Germany, U.K. and Hong Kong and sells products

in 75 markets globally, whereas the watchmaker Fossil has licensing

agreements with designer brands such as Michael Kors, Marc by Marc

Jacobs, Burberry, Emporio Armani, and Karl Lagerfeld. Further,

Fossil supplies its products to wholesale customers like

Nordstrom Inc. (JWN), Target

Corp. (TGT) and Wal-Mart Stores Inc.

(WMT).

Although Fossil is associated with

a host of designer brands and also generates double-digit sales,

the company’s high production costs weigh on its margins and in

turn its earnings growth.

Earlier in November, 2011, Fossil

reported flat third-quarter 2011 adjusted earnings of $1.00 per

share compared with the prior-year, but lagged the Zacks Consensus

Estimate by 3 cents.

Fossil’s earnings were driven by

double-digit sales growth across its major brands, product

categories, and geographies, and a double-digit comparable store

sales increase. Furthermore, continuous innovation in the

assortments, implementation of growth strategies and efficient

utilization of the global distribution infrastructure led to its

solid performance in the quarter.

The strong sales growth thus led to

the increase in the company’s full-year 2011 guidance in a range of

$4.50 to $4.53 from $4.44 to $4.50 expected previously. However,

for the fourth quarter of 2011, Fossil reduced its earnings

guidance to a range of $1.75 to $1.78 per share, owing to

strengthening of dollar over the last quarter.

We are encouraged by Fossil’s

in-house team of dedicated designers and product specialists who

help steer the company ahead by following emerging lifestyles and

fashion trends to bring innovative and unique products to its

customers.

However, stiff competition from

Guess? Inc. (GES) and difficult macroeconomic

conditions are matters of concern. Thus, we currently retain a

Zacks #4 Rank on the stock, which translates into a short-term Sell

rating. On a long-term basis, we provide a Neutral recommendation

on the stock.

FOSSIL INC (FOSL): Free Stock Analysis Report

GUESS INC (GES): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

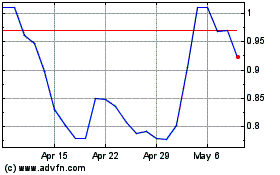

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From May 2024 to Jun 2024

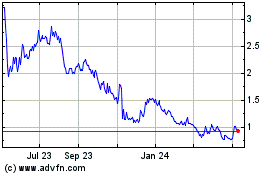

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Jun 2023 to Jun 2024