Leggett & Platt Beats by a Cent - Analyst Blog

February 07 2012 - 3:30AM

Zacks

Leggett & Platt

Inc. (LEG), the manufacturer of diversified engineered

products and components, posted fourth-quarter and full-year 2011

results, surpassing the Zacks Consensus Estimates.

Leggett's fourth-quarter earnings

of 22 cents per share, marginally inched above the Zacks Consensus

Estimate and year-ago earnings of 21 cents. The company’s full-year

2011 earnings of $1.20 per share beat the Zacks Consensus Estimate

by 1 cent per share and the year-ago earnings by 5 cents per share.

The increase in the bottom line was attributed to the company’s

share buyback program and a lower effective tax rate.

Total sales in the quarter climbed

6.5% to $854.1 million compared with $801.9 million a year ago,

benefitting from inflation and higher trade sales at the steel

mill. The company’s quarterly sales also rose above the Zacks

Consensus Estimate of $827 million. Same location sales of 6% in

the quarter were flat compared with the year-ago quarter.

For full year, Leggett reported

total sales of $3.636 billion, up 8% from the year-ago sales of

$3.359 billion. The company’s yearly sales mainly benefitted from

inflation and currency rate changes. Total sales for the year also

compared favorably with the Zacks Consensus Estimate of $3.609

billion. Yearly volumes per unit recorded a growth of 3% driven by

a shift in the sales mix at the company's steel mill.

Segment

Revenue

Residential Furnishings revenue for

the fourth quarter increased 6.2% to $434.7 million driven by

inflation and a 1% increase in unit volume. Segment revenue for

2011 was up 5% to $1.827 billion, again on the back of inflation

and currency changes.

Sales of Commercial Fixturing &

Components moved down 4% to $96.8 million. Full-year sales totaled

$502.4 million, down 5.3%, primarily due to reduced volumes in the

store fixture operations.

Fourth quarter sales for the

Industrial Materials segment was up 19.8% to $148.1 million, backed

by steel-related price inflation and higher trade sales from steel

mill. The company’s full-year sales increased 23.8% to $616.7

million.

Specialized Products segment

witnessed a growth of 3.9% to $174.5 million in the fourth quarter,

while full-year sales came in at $689.1 million, increasing 16.6%.

The increase was driven mainly by unit volume growth in all three

sectors of the segment.

Margins

Gross profit for the quarter inched

up 1.1% to $143.0 million, and gross margin contracted 90 basis

points to 16.7%, mainly due to higher cost of goods sold. Operating

income dropped 74% to $12.9 million, and operating margin shrunk

470 basis points to 1.5% due to a 10% increase in selling &

administrative expenses.

Sighting a flat demand scenario in

2011, the company remains focused on tightly managing costs,

divesture of loss making units and other elements of its strategic

plan. However, operating profit for the year declined 17% with

margins contracting 210 basis points. The 2011 margins decline

emanated from restructuring costs, inflation, and weak market

demand for some products. However, the company is hopeful of

reversing this trend in 2012.

Leggett Returns Value to

Shareholders

Leggett remains committed to

returning value to shareholders. Fiscal 2011 marked the 40th

consecutive year of a dividend hike, which has been increasing at a

CAGR of 14.0% and a yield of about 5%. The board of directors

increased the quarterly dividend by a penny to 28 cents per share

in 2011.

During 2011, the company also

repurchased 10.1 million shares and issued 3.3 million shares under

employee benefit and stock purchase plans. This brings the year-end

total shares outstanding count to 139 million, a 5% decline from

the previous year.

Other Financial

Details

Leggett exited fiscal 2011 with

cash and cash equivalents of $236.3 million, long-term debt of

$833.3 million, and shareholders' equity of $1,307.7 million.

During the year, the company produced $329 million cash from

operations, of which $231 million was used to pay dividends and

toward capital expenditure and $205 million to buy back the

company’s shares.

Guidance

Going forward, the company expects

to gain momentum as the economy expands. Anticipating a modest

economic recovery in 2012, the company is forecasting sales in the

range of $3.6-$3.8 billion. Further, the company is guiding

earnings per share in the $1.20-$1.40 range for 2012. The company’s

2012 earnings is expected to include a 7 cents to 10 cents gain

related to its restructuring activities, offset in part, by higher

anticipated interest expense and effective tax rates. The current

Zacks Consensus Estimate for fiscal 2012 is $1.36 per share.

For 2012, the company expects to

generate more than $300 million in cash from operations, with

capital spending and dividends estimated at about $100 million and

$160 million, respectively. Further, the company remains open to

capturing acquisition opportunities that fit its strategy and meet

its criteria.

Leggett faces stiff competition

from its rivals, such as Flexsteel Industries Inc.

(FLXS), Genuine Parts Company (GPC) and

Steelcase Inc. (SCS). The company currently

retains a Zacks #2 Rank, which translates to a short-term Buy

rating. However, we remain cautious on the stock and uphold our

long-term 'Underperform' recommendation. At this stage, our caution

is guided by the company's history of missing the Zacks Consensus

Estimate and we wait to see further catalysts before becoming more

positive on the stock.

GENUINE PARTS (GPC): Free Stock Analysis Report

LEGGETT & PLATT (LEG): Free Stock Analysis Report

STEELCASE INC (SCS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

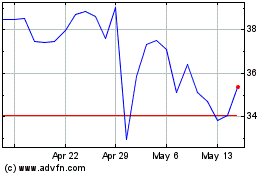

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From May 2024 to Jun 2024

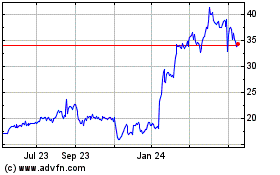

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jun 2023 to Jun 2024