Charges to Weigh on Leggett's Earnings - Analyst Blog

December 29 2011 - 6:45AM

Zacks

Leggett & Platt Inc. (LEG) now expects its

earnings per share for full-year 2011 in the range of 99 cents to

$1.04, due to a non-cash and pre-tax charge of nearly $36 million

planned in the fourth quarter of 2011. The charge is expected to

mainly relate to restructuring activity, including the

discontinuation of some manufacturing facilities.

The Carthage, Missouri-based company said the restructuring

mainly comprises of closure of four underperforming manufacturing

facilities. Leggett & Platt embarked on the restructuring plan

due to the continued demand weakness seen in certain markets, which

led it to conclude that the headwinds for the U.S. economy will

extend beyond its previous expectation.

As part of the restructuring, the manufacturing company is in

the process of closing some production facilities and is also

taking steps to trim costs. However, the company’s operational

results are expected to be at par with the forecasts in the

company’s October release.

The $36 million charge, per the company, should lower its 2011

after-tax earnings by roughly 16 cents per share. However,

excluding these charges, the company’s previous provided guidance

range of $1.15 to $1.20 remains unchanged.

Moreover, Leggett & Platt expects these

restructuring-related activities to boost its 2012 EPS by nearly 7

- 10 cents.

Leggett & Platt Inc., the manufacturer of diversified

engineered products and components, is scheduled to release its

fourth quarter and full-year 2011 financial results on February 6,

2012. The Zacks consensus estimates for the fourth quarter and

full-year 2011 remain 21 cents and $1.19 per share,

respectively.

Leggett & Platt faces stiff competition from its rivals,

such as Flexsteel Industries Inc. (FLXS),

Genuine Parts Company (GPC) and Steelcase

Inc. (SCS). The company currently retains a Zacks #3 Rank,

which translates into a short-term Hold rating. However, our

long-term recommendation on the stock remains Underperform.

GENUINE PARTS (GPC): Free Stock Analysis Report

LEGGETT & PLATT (LEG): Free Stock Analysis Report

STEELCASE INC (SCS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

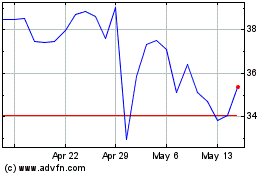

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From May 2024 to Jun 2024

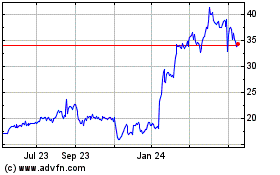

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jun 2023 to Jun 2024