Leggett's Risk-Reward Balances - Analyst Blog

May 11 2011 - 4:30AM

Zacks

We have maintained our long-term

'Neutral' recommendation on Leggett & Platt

Incorporated (LEG) with a target price of $27.00 per

share. Moreover, the company has a Zacks #2 Rank, implying a

short-term 'Buy' rating on the stock.

Headquartered in Carthage,

Missouri, Leggett is a global manufacturer of engineered components

and products used in many homes, offices, retail stores and

automobiles. The company has a well-diversified customer base and

sound research and development (R&D) division, which offer a

competitive edge and strengthen its pricing power in the

market.

Furthermore, Leggett has taken

strategic steps to optimize its capital allocation and concentrate

on core business activities. Consequently, the company has divested

underperforming business units including Storage Products, Coated

Fabrics, Aluminum Products, Wood Products and Fibers, Plastics,

dealer portion of Commercial Vehicle Products, and Prime Foam

Products between 2007 and 2010.

Apart from this, Leggett is in the

midst of its three-part strategic plan announced in November 2007.

The company has till date successfully completed the first

two-parts of its strategic plan. The first part was to divest low

performing businesses while the second part comprised improvement

in margins and returns. At present, Leggett is moving towards the

third part of its strategic plan for achieving an annual growth

rate of 4.0% to 5.0%. Moreover, Leggett has significant operating

leverage to accomplish the third part of its strategic plan as the

company has a considerable amount of retained spare production to

meet the demand of $4.0 billion. Hence, the company will not

require any large capital investment.

Besides, the company has increased

its sales guidance for fiscal 2011 in the range of $3.5 to $3.8

billion from $3.4 to $3.6 billion in anticipation of a steady

revival in the U.S. economy. On the back of promising sales,

Leggett also increased its forecasted 2011 EPS in the range of

$1.25 to $1.50 per share from $1.20 to $1.40 per share.

However, Leggett's operating

performance is heavily dependent on the price of raw materials,

particularly steel. Global steel markets are cyclical in nature and

the commodity has witnessed extreme volatility in the recent years,

leading to significant swings in pricing and margins for the

company. Moreover, higher raw material prices have prompted some of

Leggett's customers to prefer lower cost components over higher

cost ones, thereby adversely affecting margins. A continuation of

this trend is likely to affect the company's operating

performance.

Moreover, Leggett's significant

international presence exposes it to unfavorable foreign currency

translations. Doing business in foreign countries may have a

substantial effect on Leggett's operations and financial

performance, as almost 25% of the company's revenue is generated

from its international operations.

Above all, the company faces

intense competition from its rivals, such as Flexsteel

Industries Inc. (FLXS), Genuine Parts Co.

(GPC), Steelcase Inc. (SCS), The Rowe Companies,

and Knape & Vogt Manufacturing Co. Leggett and Platt also faces

competition from local and regional players in the respective

foreign countries where it operates. Operating in such a high

competitive industry, Leggett may find it difficult to execute and

implement new business strategies, which in turn, may impact its

operations adversely.

GENUINE PARTS (GPC): Free Stock Analysis Report

LEGGETT & PLATT (LEG): Free Stock Analysis Report

STEELCASE INC (SCS): Free Stock Analysis Report

Zacks Investment Research

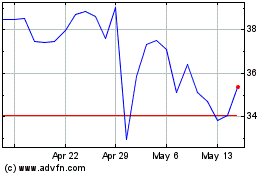

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jun 2024 to Jul 2024

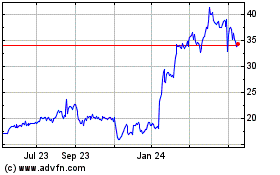

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jul 2023 to Jul 2024