Flexsteel Industries, Inc. (NASDAQ:FLXS) today reported sales and

earnings for its second quarter and fiscal year-to-date ended

December 31, 2007. The Company reported net sales for the quarter

ended December 31, 2007 of $106.0 million compared to the prior

year quarter of $105.7 million, an increase of 0.3%. Net income for

the current quarter was $1.9 million or $0.28 per share compared to

$1.4 million or $0.21 per share in the prior year quarter. Net

sales for the six months ended December 31, 2007 and 2006 were

$206.9 million and $207.0 million, respectively. Net income for the

six months ended December 31, 2007 was $3.1 million or $0.46 per

share, an increase of 55% from net income of $2.0 million or $0.30

per share for the six months ended December 31, 2006. For the

quarter ended December 31, 2007, residential net sales were $67.5

million compared to $67.0 million, an increase of 0.8% from the

prior year quarter. Recreational vehicle net sales were $14.9

million in the current and prior year quarters. Commercial net

sales were $23.6 million compared to $23.8 million in the prior

year quarter, a decrease of 0.7%. For the six months ended December

31, 2007, residential net sales were $130.2 million, an increase of

1.1% from the six months ended December 31, 2006. Recreational

vehicle net sales were $30.6 million, a decrease of 0.9% from the

six months ended December 31, 2006. Commercial net sales were $46.1

million, a decrease of 2.8% from the six months ended December 31,

2006. Gross margin for the quarter ended December 31, 2007 was

20.8% compared to 18.7% in the prior year quarter. For the six

months ended December 31, 2007, the gross margin was 20.2% compared

to 18.4% for the prior year six-month period. The gross margin

improvement for the quarter and the six-month period is primarily

due to the impact of changes in product mix and better cost

control, as compared to the prior year periods. Selling, general

and administrative expenses were 17.8% and 16.4% of net sales for

the quarters ended December 31, 2007 and 2006, respectively. The

increase in quarterly SG&A expenses was due primarily to an

increase in selling expenses of approximately $1.2 million and an

increase in bad debt expense of approximately $0.3 million. For the

six months ended December 31, 2007 and 2006, selling, general and

administrative expenses were 17.6% and 16.7% of net sales,

respectively. The increase in SG&A expenses for the six-month

period was due primarily to an increase in selling expenses of

approximately $1.3 million and an increase in bad debt expense of

approximately $0.5 million. Working capital (current assets less

current liabilities) at December 31, 2007 was $102.7 million. Net

cash provided by operating activities was $3.7 million for the six

months ended December 31, 2007. Significant changes in working

capital from June 30, 2007 to December 31, 2007 included decreased

accounts receivable of $8.8 million, increased inventory of $9.3

million and decreased accounts payable of $0.9 million. The

decrease in receivables is related to the timing of shipments to

customers and the related payment terms. The increase in inventory

is due primarily to the timing of purchases of finished goods to

meet our forecasted customer requirements and new product

introductions. Capital expenditures were $0.9 million during the

first six months of fiscal year 2008. Depreciation and amortization

expense was $2.4 million and $2.7 million in the six-month periods

ended December 31, 2007 and 2006, respectively. The Company expects

that capital expenditures will be approximately $1.5 million for

the remainder of the fiscal year, primarily for manufacturing

equipment. The Company believes that existing credit facilities are

adequate for its capital requirements for the remainder of fiscal

year 2008. All earnings per share amounts are on a diluted basis.

Outlook Events on national and international economic and political

fronts have put a significant damper on consumer confidence in the

United States. A slumping housing market impacted greatly by

sub-prime mortgage defaults and rising oil prices leading to

increased cost for materials and transportation are two principal

contributors to a general slowdown of the overall economy and the

furniture market in particular. Although industry-wide trends

indicate a soft market environment for residential products, orders

for the Company�s residential products have remained constant

throughout the first half of fiscal 2008. The Company expects order

levels to remain comparable to the prior year levels throughout

fiscal year 2008. However, further industry-wide declines could

result in lower order levels for the Company. Orders for

recreational vehicle products continue to be down, and we expect

this to continue through the remainder of fiscal year 2008. Our

orders for products into commercial hospitality applications slowed

in the first half of the 2008 fiscal year as compared to the

relatively high levels experienced in the first half of fiscal year

2007, and we expect orders to be lower than the prior year period

into the second half of fiscal year 2008. The Company anticipates

continued modest increases in commercial office orders and

shipments through the balance of fiscal year 2008. The Company

continues to review capital allocation in relation to business

conditions and to explore cost control opportunities in all facets

of its business. The Company believes it has the necessary

inventories, product offerings and marketing strategies in place to

take advantage of opportunities for expansion of market share. We

believe that consumers will continue to value a broad selection of

designs, as well as a wide range of fabrics and leathers. Based on

this, the Company anticipates continuing its strategy of providing

furniture from a wide selection of domestically manufactured and

imported products. Analysts Conference Call We will host a

conference call for analysts on Friday, February 8, 2008, at 10:30

a.m. Central Time. To access the call, please dial 1-888-275-4480

and provide the operator with ID# 25554745. A replay will be

available for two weeks beginning approximately two hours after the

conclusion of the call by dialing 1-800-642-1687 and entering ID#

25554745. Forward-Looking Statements Statements, including those in

this release, which are not historical or current facts, are

�forward-looking statements� made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

There are certain important factors that could cause our results to

differ materially from those anticipated by some of the statements

made in this press release. Investors are cautioned that all

forward-looking statements involve risk and uncertainty. Some of

the factors that could affect results are the cyclical nature of

the furniture industry, the effectiveness of new product

introductions and distribution channels, the product mix of sales,

pricing pressures, the cost of raw materials and fuel, foreign

currency valuations, actions by governments including taxes and

tariffs, the amount of sales generated and the profit margins

thereon, competition (both foreign and domestic), changes in

interest rates, credit exposure with customers and general economic

conditions. Any forward-looking statement speaks only as of the

date of this press release. We specifically decline to undertake

any obligation to publicly revise any forward-looking statements

that have been made to reflect events or circumstances after the

date of such statements or to reflect the occurrence of anticipated

or unanticipated events. About Flexsteel Flexsteel Industries, Inc.

is headquartered in Dubuque, Iowa, and was incorporated in 1929.

Flexsteel is a designer, manufacturer, importer and marketer of

quality upholstered and wood furniture for residential,

recreational vehicle, office, hospitality and healthcare markets.

All products are distributed nationally. For more information,

visit our web site at http://www.flexsteel.com. FLEXSTEEL

INDUSTRIES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED) � � December 31, June 30, 2007 2007 ASSETS �

CURRENT ASSETS: Cash and cash equivalents $ 2,183,824 $ 900,326

Investments 1,094,574 976,180 Trade receivables, net 47,491,746

56,273,874 Inventories 88,049,886 78,756,985 Other 5,650,014

5,609,045 Total current assets 144,470,044 142,516,410 � NONCURRENT

ASSETS: Property, plant, and equipment, net 26,686,809 28,168,244

Other assets 13,636,156 13,479,528 � TOTAL $ 184,793,009 $

184,164,182 � LIABILITIES AND SHAREHOLDERS� EQUITY � CURRENT

LIABILITIES: Accounts payable � trade $ 12,751,555 $ 13,607,485

Notes payable and current maturities of long-term debt 7,048,988

7,030,059 Accrued liabilities 21,939,851 22,540,063 Total current

liabilities 41,740,394 43,177,607 � LONG-TERM LIABILITIES:

Long-term debt 21,076,747 21,336,352 Other long-term liabilities

6,472,528 5,535,113 Total liabilities 69,289,669 70,049,072 �

SHAREHOLDERS� EQUITY 115,503,340 114,115,110 � TOTAL $ 184,793,009

$ 184,164,182 FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) � � Three Months

Ended December 31, Six Months Ended December 31, 2007 � 2006 2007 �

2006 NET SALES $ 105,985,985 $ 105,699,659 $ 206,886,348 $

207,039,215 COST OF GOODS SOLD (83,916,419 ) (85,925,703 )

(165,053,239 ) (168,860,032 ) GROSS MARGIN 22,069,566 19,773,956

41,833,109 38,179,183 SELLING, GENERAL AND ADMINISTRATIVE

(18,818,209 ) (17,326,814 ) (36,381,294 ) (34,607,791 ) OPERATING

INCOME 3,251,357 � 2,447,142 � 5,451,815 � 3,571,392 � OTHER INCOME

(EXPENSE): Interest and other income 121,380 173,287 220,962

331,007 Interest expense (414,560 ) (391,772 ) (841,950 ) (780,617

) Total (293,180 ) (218,485 ) (620,988 ) (449,610 ) INCOME BEFORE

INCOME TAXES 2,958,177 2,228,657 4,830,827 3,121,782 PROVISION FOR

INCOME TAXES (1,090,000 ) (820,000 ) (1,780,000 ) (1,150,000 ) NET

INCOME $ 1,868,177 � $ 1,408,657 � $ 3,050,827 � $ 1,971,782 �

AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: Basic 6,573,559 �

6,566,340 � 6,572,365 � 6,565,684 � Diluted 6,616,133 � 6,579,053 �

6,610,176 � 6,574,963 � EARNINGS PER SHARE OF COMMON�STOCK: Basic $

0.28 � $ 0.21 � $ 0.46 � $ 0.30 � Diluted $ 0.28 � $ 0.21 � $ 0.46

� $ 0.30 � FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) � Six Months

Ended December 31, 2007 � 2006 OPERATING ACTIVITIES: Net income $

3,050,827 $ 1,971,782 Adjustments to reconcile net income to net

cash Provided by (used in) operating activities: Depreciation and

amortization 2,363,095 2,723,279 Gain on disposition of capital

assets (43,101 ) (15,732 ) Stock-based compensation expense 186,000

274,000 Changes in operating assets and liabilities (1,841,019 )

6,348,886 � Net cash provided by operating activities 3,715,802 �

11,302,215 � � INVESTING ACTIVITIES: Net sales of investments

293,244 101,413 Proceeds from sale of capital assets 62,496 16,650

Capital expenditures (881,955 ) (2,984,043 ) Net cash used in

investing activities (526,215 ) (2,865,980 ) � FINANCING

ACTIVITIES: Net proceeds (payment) of borrowings (240,676 )

(7,641,499 ) Dividends paid (1,708,795 ) (1,706,737 ) Proceeds from

issuance of common stock 43,382 � 34,307 � Net cash used in

financing activities (1,906,089 ) (9,313,929 ) � Increase in cash

and cash equivalents 1,283,498 (877,694 ) Cash and cash equivalents

at beginning of period 900,326 � 1,985,768 � Cash and cash

equivalents at end of period $ 2,183,824 � $ 1,108,074 �

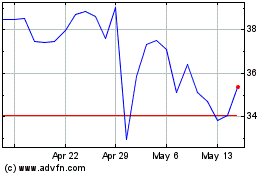

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From May 2024 to Jun 2024

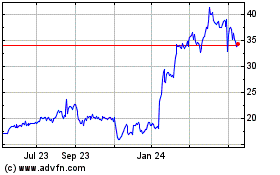

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jun 2023 to Jun 2024