0001069157false00010691572024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 23, 2024

EAST WEST BANCORP, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

000-24939

(Commission File Number)

95-4703316

(IRS Employer Identification No.)

135 North Los Robles Ave., 7th Floor, Pasadena, California 91101

(Address of principal executive offices) (Zip code)

(626) 768-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

| Common Stock, par value $0.001 per share | | EWBC | | The Nasdaq Global Select Market | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On July 23, 2024, East West Bancorp, Inc. (the “Company”) announced its financial results for the quarter ended June 30, 2024. A copy of the Company’s press release (the “Press Release”) is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference in this Item 2.02. The Press Release is “furnished” pursuant to General Instruction B.2 of Form 8-K and the information provided in Item 2.02 of this report, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of such Section. The information provided in Item 2.02 of this report, including Exhibit 99.1, shall not be deemed incorporated by reference into any filings the Company has made or may make under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as otherwise expressly stated in such filing.

Item 7.01. Regulation FD Disclosure

On July 23, 2024, the Company will hold a conference call to discuss its financial results for the quarter ended June 30, 2024 and other matters relating to the Company. The Company has also made available on its website, www.eastwestbank.com, presentation materials containing certain historical and forward-looking information relating to the Company (the “Presentation Materials”). The Presentation Materials are furnished as Exhibit 99.2 and are incorporated by reference in this Item 7.01. All information in Exhibit 99.2 is presented as of the particular date or dates referenced therein, and the Company does not undertake any obligation to, and disclaims any duty to, update any of the information provided. The information provided in Item 7.01 of this report, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such Section, nor shall such information be deemed incorporated by reference into any filings the Company has made or may make under the Securities Act or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Press Release, dated July 23, 2024. |

| Presentation Materials, dated July 23, 2024. |

| 104 | Cover Page Interactive Data (formatted in Inline XBRL). |

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | EAST WEST BANCORP, INC. |

| | |

| Date: July 23, 2024 | By: | /s/ Christopher J. Del Moral-Niles | |

| | Christopher J. Del Moral-Niles | |

| | | Executive Vice President and Chief Financial Officer |

| | | | | |

| |

| |

| |

| East West Bancorp, Inc. |

| 135 N. Los Robles Ave., 7th Fl. |

| Pasadena, CA 91101 |

| Tel. 626.768.6000 |

| | | | | |

| FOR INVESTOR INQUIRIES, CONTACT: |

Christopher Del Moral-Niles, CFA | Adrienne Atkinson |

Chief Financial Officer | Director of Investor Relations |

T: (626) 768-6860 | T: (626) 788-7536 |

E: chris.delmoralniles@eastwestbank.com | E: adrienne.atkinson@eastwestbank.com |

EAST WEST BANCORP REPORTS NET INCOME FOR SECOND QUARTER OF 2024

OF $288 MILLION AND DILUTED EARNINGS PER SHARE OF $2.06

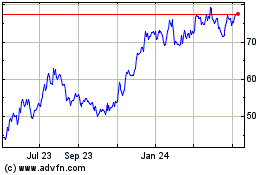

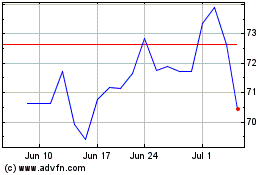

Pasadena, California – July 23, 2024 – East West Bancorp, Inc. (“East West” or the “Company”) (Nasdaq: EWBC), parent company of East West Bank, reported its financial results for the second quarter of 2024. Second quarter 2024 net income was $288 million, or $2.06 per diluted share. Return on average assets was 1.63%, return on average common equity was 16.4%, and return on average tangible common equity1 was 17.5%. Book value per share grew 3% quarter-over-quarter and 14% year-over-year.

“The strength of East West’s diversified business model continued to deliver for our shareholders in the second quarter,” said Dominic Ng, Chairman and Chief Executive Officer. “Total loans and deposits each grew by 2% quarter-over-quarter, complemented by record fee income which grew 8%. We strategically grew loans in C&I and residential mortgage, and experienced solid growth in business and consumer deposit balances. East West posted growth in all fee categories quarter-over-quarter, with notable continued strength in foreign exchange income and wealth management.”

“Our net charge-offs remained broadly stable quarter-over-quarter at 0.18% of average loans, while criticized loans decreased 10%,” continued Ng. “We are confident that our diversified lending approach and disciplined underwriting and monitoring standards will serve us well through the cycle. East West continues to operate from a position of capital strength and remains committed to delivering top-tier shareholder returns.”

“East West was selected again as the best performing bank above $50 billion in assets by Bank Director, marking our second consecutive year and third title in the past four years,” stated Ng. “This recognition is a testament to the steady execution of our colleagues and underscores our industry-leading profitability and conservatively managed balance sheet.”

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | | | Quarter-over-Quarter Change |

| | | | | | | | | | | | | | | |

| ($ in millions, except per share data) | | June 30, 2024 | | March 31, 2024 | | | | | | | | | | $ | | % |

| | | | | | | | | | | | | | | | | |

| Revenue | | $638 | | $644 | | | | | | | | | | $(6) | | (1)% |

| Pre-tax, Pre-provision Income2 | | 401 | | 397 | | | | | | | | | | 4 | | 1 |

| Net Income | | 288 | | 285 | | | | | | | | | | 3 | | 1 |

| Diluted Earnings per Share | | $2.06 | | $2.03 | | | | | | | | | | $0.03 | | 1 |

| Book Value per Share | | $52.06 | | $50.48 | | | | | | | | | | $1.58 | | 3 |

| Tangible Book Value per Share1 | | $48.65 | | $47.09 | | | | | | | | | | $1.56 | | 3% |

| Return on Average Common Equity | | 16.36% | | 16.40% | | | | | | | | | | -4 bps | | — |

| | | | | | | | | | | | | | | | | |

| Return on Average Tangible Common Equity1 | | 17.54% | | 17.60% | | | | | | | | | | -6 bps | | — |

| Tangible Common Equity Ratio1 | | 9.37% | | 9.31% | | | | | | | | | | 6 bps | | — |

| Total Assets | | $72,468 | | $70,876 | | | | | | | | | | $1,592 | | 2% |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

|

|

1 Return on average tangible common equity, tangible book value per share, and tangible common equity ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13. |

2 Pre-tax, pre-provision income is a non-GAAP financial measure. See reconciliation of GAAP to non-GAAP financial measures in Table 12.

|

BALANCE SHEET

•Assets – Total assets were $72.5 billion as of June 30, 2024, an increase of $1.6 billion from $70.9 billion as of March 31, 2024, primarily reflecting increases of $0.8 billion in loans and $0.5 billion in available-for-sale (“AFS”) debt securities. Year-over-year, total assets grew $3.9 billion, or 6%, from $68.5 billion as of June 30, 2023.

Second quarter 2024 average interest-earning assets remained stable compared with the first quarter at $68.1 billion, reflecting a $1.9 billion increase in average AFS debt securities holdings offset by a $1.8 billion decrease in average cash and deposits with banks.

•Loans – Total loans were $52.8 billion as of June 30, 2024, an increase of $0.8 billion from $52.0 billion as of March 31, 2024. Year-over-year, total loans were up $3.0 billion, or 6%, from $49.8 billion as of June 30, 2023.

Second quarter 2024 average loans remained stable compared with the first quarter at $51.9 billion.

•Deposits – Total deposits were $60.0 billion as of June 30, 2024, an increase of $1.4 billion, or 2%, from $58.6 billion as of March 31, 2024, reflecting growth across all customer groups. Noninterest-bearing deposits made up 25% of total deposits as of June 30, 2024, remaining broadly stable quarter-over-quarter. Year-over-year, total deposits increased $4.3 billion from $55.7 billion as of June 30, 2023.

Second quarter 2024 average deposits of $58.7 billion increased $1.2 billion from the first quarter of 2024, with growth in average time and money market deposits offset by declines in other categories.

•Capital – As of June 30, 2024, stockholders’ equity was $7.2 billion, up 3% quarter-over-quarter. The stockholders’ equity to assets ratio was 9.96% as of June 30, 2024, compared with 9.91% as of March 31, 2024.

Book value per share was $52.06 as of June 30, 2024, up 3% quarter-over-quarter and 14% year-over-year. As of June 30, 2024, tangible book value per share3 was $48.65, up 3% quarter-over-quarter and 15% year-over-year. The tangible common equity ratio3 was 9.37%, compared with 9.31% as of March 31, 2024.

All of East West’s regulatory capital ratios are well in excess of regulatory requirements for well-capitalized institutions, and well above regional bank averages. The common equity tier 1 (“CET1”) capital ratio increased quarter-over-quarter to 13.74%, and the total risk-based capital ratio increased by 21 basis points to 15.05% as of June 30, 2024.

OPERATING RESULTS

Second Quarter Earnings – Second quarter 2024 net income was $288 million or $2.06 per diluted share, both up 1% quarter-over-quarter. Pre-tax, pre-provision income totaled $401 million in the second quarter, an increase of 1% from $397 million in the first quarter of 2024.

Second Quarter 2024 Compared to First Quarter 2024

Net Interest Income and Net Interest Margin

Net interest income totaled $553 million in the second quarter, a decrease of 2% from $565 million in the first quarter of 2024. Net interest margin (“NIM”) was 3.27%, a 7 basis point decline from the first quarter.

•NIM declined primarily due to a higher cost of interest-bearing deposits and continued deposit mix shift, partly offset by higher asset yields.

•The average loan yield was 6.73%, up 2 basis points from the first quarter. The average interest-earning asset yield was 6.11%, up 7 basis points from the first quarter.

•The average cost of funds was 3.11%, up 14 basis points from the first quarter. The average cost of deposits was 2.96%, up 12 basis points from the first quarter.

| | | | | | | | | | | | | | |

3 Tangible book value per share and tangible common equity ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13. |

Noninterest Income

Noninterest income totaled $85 million in the second quarter, an increase of $6 million, or 7%, from $79 million in the first quarter. Net gains on AFS debt securities were $2 million in the second quarter. Mark-to-market and credit valuation adjustments on customer and other derivatives was a gain of $2 million in the second quarter, compared with a gain of $1 million in the first quarter. Other investment income decreased $2 million quarter-over-quarter, reflecting lower income from Community Reinvestment Act (“CRA”) and other investments in the second quarter.

•Fee income4 of $77 million was up $6 million, or 8%, from $71 million in the first quarter.

•Every fee business category increased by approximately $1 million in the second quarter, primarily reflecting higher customer activity.

Noninterest Expense

Noninterest expense totaled $236 million in the second quarter, a decrease of over $10 million, or 4%, from $247 million in the first quarter. Noninterest expense included $2 million of Federal Deposit Insurance Corporation (“FDIC”) Special Assessment-related expense5 (the “FDIC charge”) in the second quarter and $10 million for the FDIC charge in the first quarter. Second quarter noninterest expense consisted of $219 million of adjusted noninterest expense6, and $16 million in amortization expenses related to tax credit and CRA investments.

•Adjusted noninterest expense of $219 million decreased nearly $5 million, or 2%, from $223 million in the first quarter.

•Compensation and employee benefits was $134 million, a decrease of $8 million, or 6%, largely due to higher seasonal costs in the first quarter.

•Other operating expense was $38 million, an increase of $4 million, or 12%, primarily reflecting a valuation write-down on other real estate owned.

•Amortization of tax credit and CRA investments was $16 million in the second quarter, up $3 million from the first quarter.

•The efficiency ratio was 37.1% in the second quarter, compared with 38.3% in the first quarter, and the adjusted efficiency ratio6 was 34.3% in the second quarter, compared with 34.7% in the first quarter.

TAX RELATED ITEMS

Second quarter 2024 income tax expense was $76 million, and the effective tax rate was 20.9%, compared with income tax expense of $87 million and an effective tax rate of 23.4% for the first quarter of 2024. The lower effective tax rate in the second quarter was primarily due to greater tax credit investment benefits.

ASSET QUALITY

As of June 30, 2024, the credit quality of our loan portfolio remained strong.

•The criticized loans ratio decreased 25 basis points quarter-over-quarter to 2.05% of loans held-for-investment (“HFI”) as of June 30, 2024, compared with 2.30% as of March 31, 2024. Criticized loans decreased $115 million quarter-over-quarter to $1.1 billion as of June 30, 2024. The special mention loans ratio decreased 22 basis points quarter-over-quarter to 0.83% of loans HFI as of June 30, 2024, compared with 1.05% as of March 31, 2024, and the classified loans ratio decreased 3 basis points to 1.22%.

•Nonperforming assets increased $31 million to $196 million as of June 30, 2024, from $165 million as of March 31, 2024. The nonperforming assets ratio was 0.27% of total assets as of June 30, 2024, compared with 0.23% of total assets as of March 31, 2024. The quarter-over-quarter changes reflect increases related to C&I loans, residential mortgage loans, and other real estate owned.

•Second quarter 2024 net charge-offs were $23 million, or annualized 0.18% of average loans HFI, compared with $23 million, or annualized 0.17% of average loans HFI, for the first quarter of 2024.

•The allowance for loan losses increased to $684 million, or 1.30% of loans HFI, as of June 30, 2024, compared with $670 million, or 1.29% of loans HFI, as of March 31, 2024.

•Second quarter 2024 provision for credit losses was $37 million, compared with $25 million in the first quarter of 2024.

| | | | | | | | | | | |

| | | |

4 Fee income includes deposit account and lending fees, foreign exchange income, wealth management fees, and customer derivative revenue. Refer to Table 3 for additional fee and noninterest income information. |

5 In November 2023, the FDIC approved a final rule to implement a special deposit insurance assessment to recover estimated losses to the Deposit Insurance Fund arising from the protection of uninsured depositors following the receiverships of failed institutions in the spring of 2023. In March 2024, the FDIC updated the loss estimate to $22.5 billion. As losses to the DIF are estimates, the FDIC may periodically adjust the amount, resulting in longer or shorter assessment periods, and/or additional special assessments. |

6 Adjusted noninterest expense and adjusted efficiency ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 12. |

|

CAPITAL STRENGTH

Capital levels for East West remained strong as of June 30, 2024. The following table presents capital metrics as of June 30, 2024, March 31, 2024 and June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| EWBC Capital | | |

| ($ in millions) | | June 30, 2024 (a) | | March 31, 2024 (a) | | June 30, 2023 (a) | | | | | | |

| | | | | | | | | | | | |

Risk-Weighted Assets (“RWA”) (b) | | $53,967 | | $53,448 | | $51,696 | | | | | | |

| Risk-based capital ratios: | | | | | | | | | | | | |

| Total capital ratio | | 15.05% | | 14.84% | | 14.60% | | | | | | |

| CET1 capital ratio | | 13.74% | | 13.53% | | 13.17% | | | | | | |

| Tier 1 capital ratio | | 13.74% | | 13.53% | | 13.17% | | | | | | |

| | | | | | | | | | | | |

| Leverage ratio | | 10.36% | | 10.05% | | 10.03% | | | | | | |

Tangible common equity ratio (c) | | 9.37% | | 9.31% | | 8.80% | | | | | | |

|

(a)The Company has elected to use the 2020 Current Expected Credit Losses (CECL) transition provision in the calculation of its June 30, 2024, March 31, 2024 and June 30, 2023 regulatory capital ratios. The Company’s June 30, 2024 regulatory capital ratios and RWA are preliminary.

(b)Under regulatory guidelines, on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk categories based on the nature of the obligor, or, if relevant, the guarantor or the nature of any collateral. The aggregate dollar value in each risk category is then multiplied by the risk weight associated with that category. The resulting weighted values from each of the risk categories are aggregated for determining total RWA.

(c)Tangible common equity ratio is a non-GAAP financial measure. See reconciliation of GAAP to non-GAAP measures in Table 13.

DIVIDEND PAYOUT AND CAPITAL ACTIONS

East West’s Board of Directors has declared third quarter 2024 dividends for the Company’s common stock. The common stock cash dividend of $0.55 per share is payable on August 16, 2024 to shareholders of record as of August 2, 2024.

East West repurchased approximately 560 thousand shares of common stock during the second quarter of 2024 for $41 million. $49 million of East West’s share repurchase authorization remains available.

Conference Call

East West will host a conference call to discuss second quarter 2024 earnings with the public on Tuesday, July 23, 2024, at 2:00 p.m. PT/5:00 p.m. ET. The public and investment community are invited to listen as management discusses second quarter 2024 results and operating developments.

•The following dial-in information is provided for participation in the conference call: calls within the U.S. – (877) 506-6399; calls within Canada – (855) 669-9657; international calls – (412) 902-6699.

•A presentation to accompany the earnings call, a listen-only live broadcast of the call, and information to access a replay one hour after the call will all be available on the Investor Relations page of the Company’s website at www.eastwestbank.com/investors.

About East West

East West provides financial services that help customers reach further and connect to new opportunities. East West Bancorp, Inc. is a public company (Nasdaq: “EWBC”) with total assets of $72.5 billion as of June 30, 2024. The Company’s wholly-owned subsidiary, East West Bank, is the largest independent bank headquartered in Southern California, and operates over 110 locations in the United States and Asia. The Bank’s markets in the United States include California, Georgia, Illinois, Massachusetts, Nevada, New York, Texas, and Washington. For more information on East West, visit www.eastwestbank.com.

Forward-Looking Statements

Certain matters set forth herein (including any exhibits hereto) contain “forward-looking statements” that are intended to be covered by the safe harbor for such statements provided by the Private Securities Litigation Reform Act of 1995. East West Bancorp, Inc. (referred to herein on an unconsolidated basis as “East West” and on a consolidated basis as the “Company,” “we,” “us,” “our” or “EWBC”) may make forward-looking statements in other documents that it files with, or furnishes to, the United States (“U.S.”) Securities and Exchange Commission (“SEC”) and management may make forward-looking statements to analysts, investors, media members and others. Forward-looking statements are those that do not relate to historical facts and that are based on current assumptions, beliefs, estimates, expectations and projections, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Forward-looking statements may relate to various matters, including the Company’s financial condition, results of operations, plans, objectives, future performance, business or industry, and usually can be identified by the use of forward-looking words, such as “anticipates,” “assumes,” “believes,” “can,” “continues,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “likely,” “may,” “might,” “objective,” “plans,” “potential,” “projects,” “remains,” “should,” “target,” “trend,” “will,” “would,” or similar expressions or variations thereof, and the negative thereof, but these terms are not the exclusive means of identifying such statements. You should not place undue reliance on forward-looking statements, as they are subject to risks and uncertainties.

Factors that might cause future results to differ materially from historical performance and any forward-looking statements include, but are not limited to: changes in local, regional and global business, economic and political conditions and natural or geopolitical events; the soundness of other financial institutions and the impacts related to or resulting from bank failures and other industry volatility, including potential increased regulatory requirements, FDIC insurance premiums and assessments, and deposit withdrawals; changes in laws or the regulatory environment, including trade, monetary and fiscal policies and laws and current or potential disputes between the U.S. and the People’s Republic of China; changes in the commercial and consumer real estate markets; changes in consumer or commercial spending, savings and borrowing habits, and patterns and behaviors; the Company’s ability to compete effectively against financial institutions and other entities, including as a result of emerging technologies; the success and timing of the Company’s business strategies; the Company’s ability to retain key officers and employees; changes in key variable market interest rates, competition, regulatory requirements and product mix; changes in the Company’s costs of operation, compliance and expansion; disruption, failure in, or breach of, the Company’s operational or security systems or infrastructure, or those of third party vendors with which the Company does business, including as a result of cyber-attacks, and the disclosure or misuse of confidential information; the adequacy of the Company’s risk management framework; future credit quality and performance, including expectations regarding future credit losses and allowance levels; adverse changes to the Company’s credit ratings; legal proceedings, regulatory investigations and their resolution; the Company’s capital requirements and its ability to generate capital internally or raise capital on favorable terms; the impact on the Company’s liquidity due to changes in the Company’s ability to receive dividends from its subsidiaries; any strategic acquisitions or divestitures and the introduction of new or expanded products and services or other events that may directly or indirectly result in a negative impact on the financial performance of the Company and its customers.

For a more detailed discussion of some of the factors that might cause such differences, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 29, 2024 (the “Company’s 2023 Form 10-K”) under the heading Item 1A. Risk Factors. You should treat forward-looking statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake, and specifically disclaims any obligation to update or revise any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |

| CONDENSED CONSOLIDATED BALANCE SHEET | |

| ($ and shares in thousands, except per share data) | |

| (unaudited) | |

| Table 1 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | June 30, 2024 % or Basis Point Change | |

| | | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 | | Qtr-o-Qtr | | Yr-o-Yr | | |

| Assets | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 4,365,691 | | $ | 4,210,801 | | $ | 6,377,887 | | 3.7 | % | | (31.5) | % | | |

| | Interest-bearing deposits with banks | | 24,530 | | 24,593 | | 17,169 | | (0.3) | | | 42.9 | | | |

| | Securities purchased under resale agreements (“resale agreements”) | | 485,000 | | 485,000 | | 635,000 | | — | | | (23.6) | | | |

| | Available-for-sale (“AFS”) debt securities (amortized cost of $9,644,377, $9,131,953 and $6,820,569) | | 8,923,528 | | 8,400,468 | | 5,987,258 | | 6.2 | | | 49.0 | | | |

| Held-to-maturity (“HTM”) debt securities, at amortized cost (fair value of $2,405,227, $2,414,478 and $2,440,484) | | 2,938,250 | | 2,948,642 | | 2,975,933 | | (0.4) | | | (1.3) | | | |

| | | | | | | | | | | | | |

| | Loans held-for-sale (“HFS”) | | 18,909 | | 13,280 | | 2,830 | | 42.4 | | | 568.2 | | | |

| | Loans held-for-investment (“HFI”) (net of allowance for loan losses of $683,794, $670,280 and $635,400) | | 52,084,115 | | 51,322,224 | | 49,192,964 | | 1.5 | | | 5.9 | | | |

| | | | | | | | | | | | | |

| Affordable housing partnership, tax credit and Community Reinvestment Act (“CRA”) investments, net | | 956,428 | | 933,187 | | 815,471 | | 2.5 | | | 17.3 | | | |

| | Goodwill | | 465,697 | | 465,697 | | 465,697 | | — | | | — | | | |

| Operating lease right-of-use assets | | 81,941 | | 87,535 | | 100,500 | | (6.4) | | | (18.5) | | | |

| | Other assets | | 2,124,183 | | 1,984,243 | | 1,961,972 | | 7.1 | | | 8.3 | | | |

| | Total assets | | $ | 72,468,272 | | $ | 70,875,670 | | $ | 68,532,681 | | 2.2 | % | | 5.7 | % | | |

| | | | | | | | | | | | | |

| Liabilities and Stockholders’ Equity | | | | | | | | | | | | |

| | Deposits | | $ | 59,999,785 | | $ | 58,560,624 | | $ | 55,658,786 | | 2.5 | % | | 7.8 | % | | |

| | | | | | | | | | | | | |

| Short-term borrowings | | — | | 19,173 | | — | | | (100.0) | | | — | | | |

| | | | | | | | | | | | | |

| Bank Term Funding Program (“BTFP”) borrowings | | — | | — | | 4,500,000 | | — | | | (100.0) | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Federal Home Loan Bank (“FHLB”) advances | | 3,500,000 | | 3,500,000 | | — | | | — | | | 100.0 | | | |

| | | | | | | | | | | | | |

| | Long-term debt and finance lease liabilities | | 36,141 | | 36,428 | | 152,951 | | (0.8) | | | (76.4) | | | |

| Operating lease liabilities | | 89,644 | | 95,643 | | 110,383 | | (6.3) | | | (18.8) | | | |

| | Accrued expenses and other liabilities | | 1,627,588 | | 1,640,570 | | 1,648,864 | | (0.8) | | | (1.3) | | | |

| | Total liabilities | | 65,253,158 | | 63,852,438 | | 62,070,984 | | 2.2 | | | 5.1 | | | |

| | Stockholders’ equity | | 7,215,114 | | 7,023,232 | | 6,461,697 | | 2.7 | | | 11.7 | | | |

| | Total liabilities and stockholders’ equity | | $ | 72,468,272 | | $ | 70,875,670 | | $ | 68,532,681 | | 2.2 | % | | 5.7 | % | | |

| | | | | | | | | | | | | |

| | Book value per share | | $ | 52.06 | | $ | 50.48 | | $ | 45.67 | | 3.1 | % | | 14.0 | % | | |

| | Tangible book value (1) per share | | $ | 48.65 | | $ | 47.09 | | $ | 42.33 | | 3.3 | | | 14.9 | | | |

| | Number of common shares at period-end | | 138,604 | | 139,121 | | 141,484 | | (0.4) | | | (2.0) | | | |

| Total stockholders’ equity to assets ratio | | 9.96 | % | | 9.91 | % | | 9.43 | % | | 5 | | bps | 53 | | bps | |

| Tangible common equity (“TCE”) ratio (1) | | 9.37 | % | | 9.31 | % | | 8.80 | % | | 6 | | bps | 57 | | bps | |

| | | | | | | |

(1)Tangible book value and the TCE ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| TOTAL LOANS AND DEPOSITS DETAIL |

| ($ in thousands) |

| (unaudited) |

| Table 2 |

|

| | | | | | | | | June 30, 2024 % Change |

| | | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 | | Qtr-o-Qtr | | Yr-o-Yr |

| Loans: | | | | | | | | | | |

Commercial: | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Commercial and industrial (“C&I”) | | $ | 16,875,009 | | | $ | 16,350,191 | | | $ | 15,670,084 | | | 3.2 | % | | 7.7 | % |

| Commercial real estate (“CRE”): | | | | | | | | | | |

| CRE | | 14,562,595 | | | 14,609,655 | | | 14,373,385 | | | (0.3) | | | 1.3 | |

| Multifamily residential | | 5,100,210 | | | 5,010,245 | | | 4,764,180 | | | 1.8 | | | 7.1 | |

| Construction and land | | 664,793 | | | 673,939 | | | 781,068 | | | (1.4) | | | (14.9) | |

| Total CRE | | 20,327,598 | | | 20,293,839 | | | 19,918,633 | | | 0.2 | | | 2.1 | |

Consumer: | | | | | | | | | | |

| Residential mortgage: | | | | | | | | | | |

| Single-family residential | | 13,747,769 | | | 13,563,738 | | | 12,308,613 | | | 1.4 | | | 11.7 | |

| Home equity lines of credit (“HELOCs”) | | 1,761,379 | | | 1,731,233 | | | 1,862,928 | | | 1.7 | | | (5.5) | |

| Total residential mortgage | | 15,509,148 | | | 15,294,971 | | | 14,171,541 | | | 1.4 | | | 9.4 | |

| Other consumer | | 56,154 | | | 53,503 | | | 68,106 | | | 5.0 | | | (17.5) | |

Total loans HFI (1) | | 52,767,909 | |

| 51,992,504 | |

| 49,828,364 | | | 1.5 | | | 5.9 | |

Loans HFS | | 18,909 | | | 13,280 | | | 2,830 | | | 42.4 | | | 568.2 | |

| Total loans (1) | | 52,786,818 | | | 52,005,784 | | | 49,831,194 | | | 1.5 | | | 5.9 | |

| Allowance for loan losses | | (683,794) | | | (670,280) | | | (635,400) | | | 2.0 | | | 7.6 | |

| Net loans (1) | | $ | 52,103,024 | | | $ | 51,335,504 | | | $ | 49,195,794 | | | 1.5 | % | | 5.9 | % |

| | | | | | | | | | | |

Deposits: | | | | | | | | | | |

| Noninterest-bearing demand | | $ | 14,922,741 | | | $ | 14,798,927 | | | $ | 16,741,099 | | | 0.8 | % | | (10.9) | % |

| Interest-bearing checking | | 7,758,081 | | | 7,570,427 | | | 8,348,587 | | | 2.5 | | | (7.1) | |

| Money market | | 13,775,908 | | | 13,585,597 | | | 11,486,473 | | | 1.4 | | | 19.9 | |

| Savings | | 1,772,368 | | | 1,834,393 | | | 2,102,850 | | | (3.4) | | | (15.7) | |

| | | | | | | | | | | |

| Time deposits | | 21,770,687 | | | 20,771,280 | | | 16,979,777 | | | 4.8 | | | 28.2 | |

| | | | | | | | | | |

| Total deposits | | $ | 59,999,785 | | | $ | 58,560,624 | | | $ | 55,658,786 | | | 2.5 | % | | 7.8 | % |

| | | | | | | | | | | |

| Deposits by type: | | | | | | | | | | |

| Commercial and business banking | | $ | 33,572,624 | | | $ | 32,690,771 | | | $ | 31,240,428 | | | 2.7 | % | | 7.5 | % |

| Consumer and private banking | | 21,236,669 | | | 20,543,473 | | | 17,960,113 | | | 3.4 | | | 18.2 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Greater China (2) | | 3,376,971 | | | 3,282,218 | | | 2,833,531 | | | 2.9 | | | 19.2 | |

| Wholesale | | 1,813,521 | | | 2,044,162 | | | 3,624,714 | | | (11.3) | | | (50.0) | |

| Total deposits | | $ | 59,999,785 | | | $ | 58,560,624 | | | $ | 55,658,786 | | | 2.5 | % | | 7.8 | % |

| | | | | | | | | | | |

Loan-to-deposit ratio | | 88 | % | | 89 | % | | 90 | % | | (1.1) | % | | (2.2) | % |

|

(1)Includes $53 million, $63 million and $74 million of net deferred loan fees and net unamortized premiums as of June 30, 2024, March 31, 2024 and June 30, 2023, respectively.

(2)Includes deposits at the Bank’s Hong Kong branch and foreign subsidiary, East West Bank (China) Limited.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | | |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME | | |

| ($ and shares in thousands, except per share data) | | |

| (unaudited) | | |

| Table 3 | | |

| | | |

| | | Three Months Ended | | June 30, 2024 % Change | | |

| | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 | | Qtr-o-Qtr | | Yr-o-Yr | | |

| Interest and dividend income | | $ | 1,034,414 | | | $ | 1,023,617 | | | $ | 906,134 | | | 1.1% | | 14.2% | | |

Interest expense | | 481,185 | | | 458,478 | | | 339,388 | | | 5.0 | | 41.8 | | |

| Net interest income before provision for credit losses | | 553,229 | | | 565,139 | | | 566,746 | | | (2.1) | | (2.4) | | |

| Provision for credit losses | | 37,000 | | | 25,000 | | | 26,000 | | | 48.0 | | 42.3 | | |

| Net interest income after provision for credit losses | | 516,229 | | | 540,139 | | | 540,746 | | | (4.4) | | (4.5) | | |

Noninterest income: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Deposit account fees | | 25,649 | | | 24,948 | | | 23,369 | | | 2.8% | | 9.8% | | |

| | Lending fees | | 24,340 | | | 22,925 | | | 20,901 | | | 6.2 | | 16.5 | | |

| | Foreign exchange income | | 12,924 | | | 11,469 | | | 12,167 | | | 12.7 | | 6.2 | | |

| | Wealth management fees | | 9,478 | | | 8,637 | | | 6,944 | | | 9.7 | | 36.5 | | |

| Customer derivative revenue | | 4,230 | | | 3,137 | | | 5,979 | | | 34.8 | | (29.3) | | |

| Total fee income | 76,621 | | | 71,116 | | | 69,360 | | | 7.7 | | 10.5 | | |

| Mark-to-market and credit valuation adjustments | | 1,534 | | | 613 | | | 1,394 | | | 150.2 | | 10.0 | | |

| | Net gains (losses) on sales of loans | | 56 | | | (41) | | | (7) | | | NM | | NM | | |

| | Net gains on AFS debt securities | | 1,785 | | | 49 | | | — | | | NM | | 100.0 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other investment income | | 586 | | | 2,815 | | | 4,003 | | | (79.2) | | (85.4) | | |

| Other income | | 4,091 | | | 4,436 | | | 3,881 | | | (7.8) | | 5.4 | | |

| Total noninterest income | | 84,673 | | | 78,988 | | | 78,631 | | | 7.2% | | 7.7% | | |

| Noninterest expense: | | | | | | | | | | | | |

| Compensation and employee benefits | | 133,588 | | | 141,812 | | | 124,937 | | | (5.8)% | | 6.9% | | |

| Occupancy and equipment expense | | 15,031 | | | 15,230 | | | 16,088 | | | (1.3) | | (6.6) | | |

| Deposit insurance premiums and regulatory assessments | | 10,708 | | | 19,649 | | | 8,262 | | | (45.5) | | 29.6 | | |

| Deposit account expense | | 12,050 | | | 12,188 | | | 10,559 | | | (1.1) | | 14.1 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Computer software and data processing expenses | | 11,392 | | | 11,344 | | | 10,692 | | | 0.4 | | 6.5 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other operating expense | | 37,613 | | | 33,445 | | | 35,337 | | | 12.5 | | 6.4 | | |

| Amortization of tax credit and CRA investments | | 16,052 | | | 13,207 | | | 55,914 | | | 21.5 | | (71.3) | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total noninterest expense | | 236,434 | | | 246,875 | | | 261,789 | | | (4.2)% | | (9.7)% | | |

Income before income taxes | | 364,468 | | | 372,252 | | | 357,588 | | | (2.1) | | 1.9 | | |

Income tax expense | | 76,238 | | | 87,177 | | | 45,557 | | | (12.5) | | 67.3 | | |

Net income | | $ | 288,230 | | | $ | 285,075 | | | $ | 312,031 | | | 1.1% | | (7.6)% | | |

| | | | | | | | | | | | | |

Earnings per share (“EPS”) | | | | | | | | | | | | |

- Basic | | $ | 2.07 | | | $ | 2.04 | | | $ | 2.21 | | | 1.4% | | (6.0)% | | |

- Diluted | | $ | 2.06 | | | $ | 2.03 | | | $ | 2.20 | | | 1.4 | | (6.3) | | |

Weighted-average number of shares outstanding | | | | | | | | | | | | |

- Basic | | 138,980 | | | 139,409 | | | 141,468 | | | (0.3)% | | (1.8)% | | |

- Diluted | | 139,801 | | | 140,261 | | | 141,876 | | | (0.3) | | (1.5) | | |

| | |

NM - Not meaningful.

| | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME |

| ($ and shares in thousands, except per share data) |

| (unaudited) |

| Table 4 |

|

| | | | Six Months Ended | | June 30, 2024 % Change |

| | | | June 30, 2024 | | June 30, 2023 | | Yr-o-Yr |

| Interest and dividend income | | $ | 2,058,031 | | | $ | 1,741,640 | | | 18.2% |

Interest expense | | 939,663 | | | 575,033 | | | 63.4 |

| Net interest income before provision for credit losses | | 1,118,368 | | | 1,166,607 | | | (4.1) |

| Provision for credit losses | | 62,000 | | | 46,000 | | | 34.8 |

| Net interest income after provision for credit losses | | 1,056,368 | | | 1,120,607 | | | (5.7) |

| Noninterest income: | | | | | | |

| Deposit account fees | | 50,597 | | | 46,423 | | | 9.0% |

| Lending fees | | 47,265 | | | 41,487 | | | 13.9 |

| Foreign exchange income | | 24,393 | | | 23,476 | | | 3.9 |

| Wealth management fees | | 18,115 | | | 13,291 | | | 36.3 |

| Customer derivative income | | 7,367 | | | 11,025 | | | (33.2) |

| Total fee income | 147,737 | | | 135,702 | | | 8.9 |

| Mark-to-market and credit valuation adjustments | | 2,147 | | | (1,088) | | | NM |

| Net gains (losses) on sales of loans | | 15 | | | (29) | | | NM |

| Net gains (losses) on AFS debt securities | | 1,834 | | | (10,000) | | | NM |

| | | | | | | |

| | | | | | | |

| Other investment income | | 3,401 | | | 5,924 | | | (42.6) |

| Other income | | 8,527 | | | 8,100 | | | 5.3 |

| Total noninterest income | | 163,661 | | | 138,609 | | | 18.1% |

| Noninterest expense | | | | | | |

| Compensation and employee benefits | | 275,400 | | | 254,591 | | | 8.2% |

| Occupancy and equipment expense | | 30,261 | | | 31,675 | | | (4.5) |

| Deposit insurance premiums and regulatory assessments | | 30,357 | | | 16,172 | | | 87.7 |

| Deposit account expense | | 24,238 | | | 20,168 | | | 20.2 |

| | | | | | | |

| | | | | | | |

| Computer software and data processing expenses | | 22,736 | | | 21,399 | | | 6.2 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other operating expense (1) | | 71,058 | | | 70,207 | | | 1.2 |

| Amortization of tax credit and CRA investments | | 29,259 | | | 66,024 | | | (55.7) |

| | | | | | | |

| Total noninterest expense | | 483,309 | | | 480,236 | | | 0.6% |

Income before income taxes | | 736,720 | | | 778,980 | | | (5.4) |

Income tax expense | | 163,415 | | | 144,510 | | | 13.1 |

Net income | | $ | 573,305 | | | $ | 634,470 | | | (9.6)% |

| | | | | | | |

| EPS | | | | | | |

- Basic | | $ | 4.12 | | | $ | 4.49 | | | (8.3)% |

- Diluted | | $ | 4.09 | | | $ | 4.47 | | | (8.4) |

Weighted-average number of shares outstanding | | | | | | |

- Basic | | 139,195 | | | 141,291 | | | (1.5)% |

- Diluted | | 140,047 | | | 141,910 | | | (1.3) |

| | | | | | | |

| | | | | |

| | | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | |

|

NM - Not meaningful.

(1)Includes $4 million of repurchase agreements’ extinguishment cost for the six months ended June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| SELECTED AVERAGE BALANCES |

| ($ in thousands) |

| (unaudited) |

| Table 5 | | | | | | |

| | | | | | |

| | Three Months Ended | | June 30, 2024 % Change | | Six Months Ended | | June 30, 2024 % Change |

| | | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 | | Qtr-o-Qtr | | Yr-o-Yr | | June 30, 2024 | | June 30, 2023 | | Yr-o-Yr |

Loans: | | | | | | | | | | | | | | | | |

Commercial: | | | | | | | | | | | | | | | | |

| C&I | | $ | 16,209,659 | | | $ | 16,251,622 | | | $ | 15,244,826 | | | (0.3) | % | | 6.3 | % | | $ | 16,230,641 | | | $ | 15,322,480 | | | 5.9 | % |

| CRE: | | | | | | | | | | | | | | | | |

| CRE | | 14,561,886 | | | 14,725,440 | | | 14,130,811 | | | (1.1) | | | 3.1 | | | 14,643,663 | | | 14,032,331 | | | 4.4 | |

| Multifamily residential | | 5,039,249 | | | 5,033,143 | | | 4,685,786 | | | 0.1 | | | 7.5 | | | 5,036,196 | | | 4,643,177 | | | 8.5 | |

| Construction and land | | 669,681 | | | 655,001 | | | 782,541 | | | 2.2 | | | (14.4) | | | 662,341 | | | 729,091 | | | (9.2) | |

| Total CRE | | 20,270,816 | | | 20,413,584 | | | 19,599,138 | | | (0.7) | | | 3.4 | | | 20,342,200 | | | 19,404,599 | | | 4.8 | |

Consumer: | | | | | | | | | | | | | | | | |

| Residential mortgage: | | | | | | | | | | | | | | | | |

| Single-family residential | | 13,636,389 | | | 13,477,057 | | | 12,014,513 | | | 1.2 | | | 13.5 | | | 13,556,723 | | | 11,717,644 | | | 15.7 | |

| HELOCs | | 1,750,469 | | | 1,725,288 | | | 1,928,208 | | | 1.5 | | | (9.2) | | | 1,737,878 | | | 1,989,154 | | | (12.6) | |

| Total residential mortgage | | 15,386,858 | | | 15,202,345 | | | 13,942,721 | | | 1.2 | | | 10.4 | | | 15,294,601 | | | 13,706,798 | | | 11.6 | |

| Other consumer | | 51,455 | | | 57,289 | | | 65,035 | | | (10.2) | | | (20.9) | | | 54,372 | | | 68,840 | | | (21.0) | |

| Total loans (1) | | $ | 51,918,788 | | | $ | 51,924,840 | | | $ | 48,851,720 | | | 0.0 | % | | 6.3 | % | | $ | 51,921,814 | | | $ | 48,502,717 | | | 7.0 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Interest-earning assets | | $ | 68,050,050 | | | $ | 68,122,045 | | | $ | 64,061,569 | | | (0.1) | % | | 6.2 | % | | $ | 68,086,048 | | | $ | 62,779,673 | | | 8.5 | % |

Total assets | | $ | 71,189,200 | | | $ | 71,678,396 | | | $ | 67,497,367 | | | (0.7) | % | | 5.5 | % | | $ | 71,433,798 | | | $ | 66,312,070 | | | 7.7 | % |

| | | | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | | | | |

| Noninterest-bearing demand | | $ | 14,664,789 | | | $ | 14,954,953 | | | $ | 16,926,937 | | | (1.9) | % | | (13.4) | % | | $ | 14,809,871 | | | $ | 18,310,770 | | | (19.1) | % |

| Interest-bearing checking | | 7,467,801 | | | 7,695,429 | | | 8,434,655 | | | (3.0) | | | (11.5) | | | 7,581,615 | | | 7,469,621 | | | 1.5 | |

| Money market | | 13,724,230 | | | 13,636,210 | | | 10,433,839 | | | 0.6 | | | 31.5 | | | 13,680,220 | | | 10,844,992 | | | 26.1 | |

| Savings | | 1,795,242 | | | 1,809,568 | | | 2,200,124 | | | (0.8) | | | (18.4) | | | 1,802,405 | | | 2,317,702 | | | (22.2) | |

| | | | | | | | | | | | | | | | | |

| Time deposits | | 21,028,737 | | | 19,346,243 | | | 16,289,320 | | | 8.7 | | | 29.1 | | | 20,187,490 | | | 15,674,457 | | | 28.8 | |

| Total deposits | | $ | 58,680,799 | | | $ | 57,442,403 | | | $ | 54,284,875 | | | 2.2 | % | | 8.1 | % | | $ | 58,061,601 | | | $ | 54,617,542 | | | 6.3 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| QUARTER-TO-DATE AVERAGE BALANCES, YIELDS AND RATES | | |

| ($ in thousands) | | |

| (unaudited) | | |

| Table 6 | | |

| | |

| | | Three Months Ended | | |

| | | June 30, 2024 | | March 31, 2024 | | |

| | | Average | | | | Average | | Average | | | | Average | | |

| | | Balance | | Interest | | Yield/Rate (1) | | Balance | | Interest | | Yield/Rate (1) | | |

Assets | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | |

| Interest-bearing cash and deposits with banks | | $ | 4,058,515 | | | $ | 49,406 | | | 4.90 | % | | $ | 5,861,517 | | | $ | 74,382 | | | 5.10 | % | | |

| Resale agreements | | 485,000 | | | 1,885 | | | 1.56 | % | | 725,659 | | | 6,115 | | | 3.39 | % | | |

| Debt securities: | | | | | | | | | | | | | | |

| AFS debt securities | | 8,481,948 | | | 99,242 | | | 4.71 | % | | 6,566,368 | | | 62,858 | | | 3.85 | % | | |

| HTM debt securities | | 2,941,150 | | | 12,490 | | | 1.71 | % | | 2,950,686 | | | 12,534 | | | 1.71 | % | | |

| Total debt securities | | 11,423,098 | | | 111,732 | | | 3.93 | % | | 9,517,054 | | | 75,392 | | | 3.19 | % | | |

| Loans: | | | | | | | | | | | | | | |

| C&I | | 16,209,659 | | | 322,648 | | | 8.01 | % | | 16,251,622 | | | 325,810 | | | 8.06 | % | | |

| CRE | | 20,270,816 | | | 323,106 | | | 6.41 | % | | 20,413,584 | | | 324,087 | | | 6.39 | % | | |

| Residential mortgage | | 15,386,858 | | | 221,966 | | | 5.80 | % | | 15,202,345 | | | 215,674 | | | 5.71 | % | | |

| Other consumer | | 51,455 | | | 721 | | | 5.64 | % | | 57,289 | | | 818 | | | 5.74 | % | | |

| Total loans (2) | | 51,918,788 | | | 868,441 | | | 6.73 | % | | 51,924,840 | | | 866,389 | | | 6.71 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| FHLB and FRB stock | | 164,649 | | | 2,950 | | | 7.21 | % | | 92,975 | | | 1,339 | | | 5.79 | % | | |

| Total interest-earning assets | | $ | 68,050,050 | | | $ | 1,034,414 | | | 6.11 | % | | $ | 68,122,045 | | | $ | 1,023,617 | | | 6.04 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | |

| Cash and due from banks | | 468,374 | | | | | | | 445,767 | | | | | | | |

| Allowance for loan losses | | (675,346) | | | | | | | (679,116) | | | | | | | |

| Other assets | | 3,346,122 | | | | | | | 3,789,700 | | | | | | | |

| Total assets | | $ | 71,189,200 | | | | | | | $ | 71,678,396 | | | | | | | |

| | | | | | | | | | | | | | | |

| Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | |

| Checking deposits | | $ | 7,467,801 | | | $ | 52,680 | | | 2.84 | % | | $ | 7,695,429 | | | $ | 53,821 | | | 2.81 | % | | |

| Money market deposits | | 13,724,230 | | | 135,405 | | | 3.97 | % | | 13,636,210 | | | 134,661 | | | 3.97 | % | | |

| Savings deposits | | 1,795,242 | | | 5,004 | | | 1.12 | % | | 1,809,568 | | | 4,120 | | | 0.92 | % | | |

| Time deposits | | 21,028,737 | | | 238,393 | | | 4.56 | % | | 19,346,243 | | | 213,597 | | | 4.44 | % | | |

| BTFP, short-term borrowings and federal funds purchased | | 2,889 | | | 32 | | | 4.45 | % | | 3,864,525 | | | 42,106 | | | 4.38 | % | | |

| Assets sold under repurchase agreements (“repurchase agreements”) | | 4,104 | | | 58 | | | 5.68 | % | | 2,549 | | | 35 | | | 5.52 | % | | |

| FHLB advances | | 3,500,001 | | | 48,840 | | | 5.61 | % | | 554,946 | | | 7,739 | | | 5.61 | % | | |

| Long-term debt and finance lease liabilities | | 36,335 | | | 773 | | | 8.56 | % | | 125,818 | | | 2,399 | | | 7.67 | % | | |

| Total interest-bearing liabilities | | $ | 47,559,339 | | | $ | 481,185 | | | 4.07 | % | | $ | 47,035,288 | | | $ | 458,478 | | | 3.92 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-bearing liabilities and stockholders’ equity: | | | | | | | | | | | | |

| Demand deposits | | 14,664,789 | | | | | | | 14,954,953 | | | | | | | |

| Accrued expenses and other liabilities | | 1,877,572 | | | | | | | 2,695,597 | | | | | | | |

| Stockholders’ equity | | 7,087,500 | | | | | | | 6,992,558 | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 71,189,200 | | | | | | | $ | 71,678,396 | | | | | | | |

| | | | | | | | | | | | | | | |

Interest rate spread | | | | | | 2.04 | % | | | | | | 2.12 | % | | |

| Net interest income and net interest margin | | | | $ | 553,229 | | | 3.27 | % | | | | $ | 565,139 | | | 3.34 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | |

(1)Annualized.

(2)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| QUARTER-TO-DATE AVERAGE BALANCES, YIELDS AND RATES | | |

| ($ in thousands) | | |

| (unaudited) | | |

| Table 7 | | |

| | |

| | | Three Months Ended | | |

| June 30, 2024 | | June 30, 2023 | | |

| Average | | | | Average | | Average | | | | Average | | |

| Balance | | Interest | | Yield/Rate (1) | | Balance | | Interest | | Yield/Rate (1) | | |

Assets | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | |

| Interest-bearing cash and deposits with banks | | $ | 4,058,515 | | | $ | 49,406 | | | 4.90 | % | | $ | 5,247,755 | | | $ | 60,995 | | | 4.66 | % | | |

| Assets purchased under resale agreements (2) | | 485,000 | | | 1,885 | | | 1.56 | % | | 641,939 | | | 3,969 | | | 2.48 | % | | |

| Debt securities: | | | | | | | | | | | | | | |

| AFS debt securities | | 8,481,948 | | | 99,242 | | | 4.71 | % | | 6,257,397 | | | 56,292 | | | 3.61 | % | | |

| HTM debt securities | | 2,941,150 | | | 12,490 | | | 1.71 | % | | 2,983,780 | | | 12,678 | | | 1.70 | % | | |

| Total debt securities | | 11,423,098 | | | 111,732 | | | 3.93 | % | | 9,241,177 | | | 68,970 | | | 2.99 | % | | |

| Loans: | | | | | | | | | | | | | | |

| C&I | | 16,209,659 | | | 322,648 | | | 8.01 | % | | 15,244,826 | | | 287,799 | | | 7.57 | % | | |

| CRE | | 20,270,816 | | | 323,106 | | | 6.41 | % | | 19,599,138 | | | 300,721 | | | 6.15 | % | | |

| Residential mortgage | | 15,386,858 | | | 221,966 | | | 5.80 | % | | 13,942,721 | | | 182,035 | | | 5.24 | % | | |

| Other consumer | | 51,455 | | | 721 | | | 5.64 | % | | 65,035 | | | 709 | | | 4.37 | % | | |

| Total loans (3) | | 51,918,788 | | | 868,441 | | | 6.73 | % | | 48,851,720 | | | 771,264 | | | 6.33 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| FHLB and FRB stock | | 164,649 | | | 2,950 | | | 7.21 | % | | 78,978 | | | 936 | | | 4.75 | % | | |

| Total interest-earning assets | | $ | 68,050,050 | | | $ | 1,034,414 | | | 6.11 | % | | $ | 64,061,569 | | | $ | 906,134 | | | 5.67 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | |

| Cash and due from banks | | 468,374 | | | | | | | 569,227 | | | | | | | |

| Allowance for loan losses | | (675,346) | | | | | | | (619,868) | | | | | | | |

| Other assets | | 3,346,122 | | | | | | | 3,486,439 | | | | | | | |

| Total assets | | $ | 71,189,200 | | | | | | | $ | 67,497,367 | | | | | | | |

| | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | |

| Checking deposits | | $ | 7,467,801 | | | $ | 52,680 | | | 2.84 | % | | $ | 8,434,655 | | | $ | 49,571 | | | 2.36 | % | | |

| Money market deposits | | 13,724,230 | | | 135,405 | | | 3.97 | % | | 10,433,839 | | | 86,419 | | | 3.32 | % | | |

| Savings deposits | | 1,795,242 | | | 5,004 | | | 1.12 | % | | 2,200,124 | | | 3,963 | | | 0.72 | % | | |

| Time deposits | | 21,028,737 | | | 238,393 | | | 4.56 | % | | 16,289,320 | | | 147,524 | | | 3.63 | % | | |

| BTFP, short-term borrowings and federal funds purchased | | 2,889 | | | 32 | | | 4.45 | % | | 4,500,566 | | | 49,032 | | | 4.37 | % | | |

| Repurchase agreements | | 4,104 | | | 58 | | | 5.68 | % | | 15,579 | | | 211 | | | 5.43 | % | | |

| FHLB advances | | 3,500,001 | | | 48,840 | | | 5.61 | % | | 1 | | | — | | | — | % | | |

| Long-term debt and finance lease liabilities | | 36,335 | | | 773 | | | 8.56 | % | | 152,760 | | | 2,668 | | | 7.01 | % | | |

| Total interest-bearing liabilities | | $ | 47,559,339 | | | $ | 481,185 | | | 4.07 | % | | $ | 42,026,844 | | | $ | 339,388 | | | 3.24 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-bearing liabilities and stockholders’ equity: | | | | | | | | | | | | |

| Demand deposits | | 14,664,789 | | | | | | | 16,926,937 | | | | | | | |

| Accrued expenses and other liabilities | | 1,877,572 | | | | | | | 2,102,590 | | | | | | | |

| Stockholders’ equity | | 7,087,500 | | | | | | | 6,440,996 | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 71,189,200 | | | | | | | $ | 67,497,367 | | | | | | | |

| | | | | | | | | | | | | | | |

Interest rate spread | | | | | | 2.04 | % | | | | | | 2.43 | % | | |

Net interest income and net interest margin | | | | $ | 553,229 | | | 3.27 | % | | | | $ | 566,746 | | | 3.55 | % | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | |

(1)Annualized.

(2)Includes the average balances and interest income for securities and loans purchased under resale agreements for the second quarter of 2023.

(3)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| YEAR-TO-DATE AVERAGE BALANCES, YIELDS AND RATES |

| ($ in thousands) |

| (unaudited) |

| Table 8 | | |

| | |

| | Six Months Ended | | |

| June 30, 2024 | | June 30, 2023 | | |

| Average | | | | Average | | Average | | | | Average | | |

| Balance | | Interest | | Yield/Rate (1) | | Balance | | Interest | | Yield/Rate (1) | | |

Assets | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | |

| Interest-bearing cash and deposits with banks | | $ | 4,960,016 | | | $ | 123,788 | | | 5.02 | % | | $ | 4,353,658 | | | $ | 96,642 | | | 4.48 | % | | |

| Assets purchased under resale agreements (2) | | 605,330 | | | 8,000 | | | 2.66 | % | | 665,229 | | | 8,472 | | | 2.57 | % | | |

| Debt securities: | | | | | | | | | | | | | | |

| AFS debt securities | | 7,524,158 | | | 162,100 | | | 4.33 | % | | 6,183,522 | | | 109,489 | | | 3.57 | % | | |

| HTM debt securities | | 2,945,918 | | | 25,024 | | | 1.71 | % | | 2,989,695 | | | 25,412 | | | 1.71 | % | | |

| Total debt securities | | 10,470,076 | | | 187,124 | | | 3.59 | % | | 9,173,217 | | | 134,901 | | | 2.97 | % | | |

| Loans: | | | | | | | | | | | | | | |

| C&I | | 16,230,641 | | | 648,458 | | | 8.03 | % | | 15,322,480 | | | 563,372 | | | 7.41 | % | | |

| CRE | | 20,342,200 | | | 647,193 | | | 6.40 | % | | 19,404,599 | | | 583,185 | | | 6.06 | % | | |

| Residential mortgage | | 15,294,601 | | | 437,640 | | | 5.75 | % | | 13,706,798 | | | 351,529 | | | 5.17 | % | | |

| Other consumer | | 54,372 | | | 1,539 | | | 5.69 | % | | 68,840 | | | 1,564 | | | 4.58 | % | | |

| Total loans (3) | | 51,921,814 | | | 1,734,830 | | | 6.72 | % | | 48,502,717 | | | 1,499,650 | | | 6.24 | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| FHLB and FRB stock | | 128,812 | | | 4,289 | | | 6.70 | % | | 84,852 | | | 1,975 | | | 4.69 | % | | |

| Total interest-earning assets | | $ | 68,086,048 | | | $ | 2,058,031 | | | 6.08 | % | | $ | 62,779,673 | | | $ | 1,741,640 | | | 5.59 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | |

| Cash and due from banks | | 457,070 | | | | | | | 595,022 | | | | | | | |

| Allowance for loan losses | | (677,231) | | | | | | | (611,358) | | | | | | | |

| Other assets | | 3,567,911 | | | | | | | 3,548,733 | | | | | | | |

| Total assets | | $ | 71,433,798 | | | | | | | $ | 66,312,070 | | | | | | | |

| | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | |

| Checking deposits | | $ | 7,581,615 | | | $ | 106,501 | | | 2.82 | % | | $ | 7,469,621 | | | $ | 72,745 | | | 1.96 | % | | |

| Money market deposits | | 13,680,220 | | | 270,066 | | | 3.97 | % | | 10,844,992 | | | 162,521 | | | 3.02 | % | | |

| Savings deposits | | 1,802,405 | | | 9,124 | | | 1.02 | % | | 2,317,702 | | | 7,632 | | | 0.66 | % | | |

| Time deposits | | 20,187,490 | | | 451,990 | | | 4.50 | % | | 15,674,457 | | | 261,373 | | | 3.36 | % | | |

| BTFP, short-term borrowings and federal funds purchased | | 1,933,707 | | | 42,138 | | | 4.38 | % | | 2,666,249 | | | 57,857 | | | 4.38 | % | | |

| FHLB advances | | 2,027,474 | | | 56,579 | | | 5.61 | % | | 248,619 | | | 6,430 | | | 5.22 | % | | |

| Repurchase agreements | | 3,327 | | | 93 | | | 5.62 | % | | 60,931 | | | 1,263 | | | 4.18 | % | | |

| Long-term debt and finance lease liabilities | | 81,076 | | | 3,172 | | | 7.87 | % | | 152,591 | |

| 5,212 | | | 6.89 | % | | |

| Total interest-bearing liabilities | | $ | 47,297,314 | | | $ | 939,663 | | | 4.00 | % | | $ | 39,435,162 | | | $ | 575,033 | | | 2.94 | % | | |

| | | | | | | | | | | | | | | |

Noninterest-bearing liabilities and stockholders’ equity: | | | | | | | | | | | | | | |

| Demand deposits | | 14,809,871 | | | | | | | 18,310,770 | | | | | | | |

| Accrued expenses and other liabilities | | 2,286,584 | | | | | | | 2,253,266 | | | | | | | |

| Stockholders’ equity | | 7,040,029 | | | | | | | 6,312,872 | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 71,433,798 | | | | | | | $ | 66,312,070 | | | | | | | |

| | | | | | | | | | | | | | | |

Interest rate spread | | | | | | 2.08 | % | | | | | | 2.65 | % | | |

Net interest income and net interest margin | | | | $ | 1,118,368 | | | 3.30 | % | | | | $ | 1,166,607 | | | 3.75 | % | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | |

(1)Annualized.

(2)Includes the average balances and interest income for securities and loans purchased under resale agreements for the first half of 2023.

(3)Includes loans HFS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| SELECTED RATIOS |

| (unaudited) |

| Table 9 |

|

| | Three Months Ended (1) | | June 30, 2024 Basis Point Change |

| | | June 30,

2024 | | March 31,

2024 | | June 30,

2023 | | Qtr-o-Qtr | | Yr-o-Yr | |

| Return on average assets | | 1.63 | % | | 1.60 | % | | 1.85 | % | | 3 | | bps | (22) | | bps |

| Adjusted return on average assets (2) | | 1.64 | % | | 1.64 | % | | 1.85 | % | | — | | | (21) | | |

| Return on average common equity | | 16.36 | % | | 16.40 | % | | 19.43 | % | | (4) | | | (307) | | |

| Adjusted return on average common equity (2) | | 16.43 | % | | 16.81 | % | | 19.43 | % | | (38) | | | (300) | | |

| Return on average TCE (3) | | 17.54 | % | | 17.60 | % | | 21.01 | % | | (6) | | | (347) | | |

| Adjusted return on average TCE (3) | | 17.62 | % | | 18.05 | % | | 21.01 | % | | (43) | | | (339) | | |

| Interest rate spread | | 2.04 | % | | 2.12 | % | | 2.43 | % | | (8) | | | (39) | | |

| Net interest margin | | 3.27 | % | | 3.34 | % | | 3.55 | % | | (7) | | | (28) | | |

| | | | | | | | | | | | |

| Average loan yield | | 6.73 | % | | 6.71 | % | | 6.33 | % | | 2 | | | 40 | | |

| | | | | | | | | | | | |

| Yield on average interest-earning assets | | 6.11 | % | | 6.04 | % | | 5.67 | % | | 7 | | | 44 | | |

| Average cost of interest-bearing deposits | | 3.94 | % | | 3.85 | % | | 3.09 | % | | 9 | | | 85 | | |

| Average cost of deposits | | 2.96 | % | | 2.84 | % | | 2.12 | % | | 12 | | | 84 | | |

| Average cost of funds | | 3.11 | % | | 2.97 | % | | 2.31 | % | | 14 | | | 80 | | |

| | | | | | | | | | | | |

| Adjusted noninterest expense/average assets (4) | | 1.23 | % | | 1.25 | % | | 1.22 | % | | (2) | | | 1 | | |

| Efficiency ratio | | 37.06 | % | | 38.33 | % | | 40.56 | % | | (127) | | | (350) | | |

| Adjusted efficiency ratio (4) | | 34.25 | % | | 34.68 | % | | 31.83 | % | | (43) | | bps | 242 | | bps |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Six Months Ended (1) | | June 30, 2024

Basis Point Change | | | | |

| | | June 30,

2024 | | June 30,

2023 | | Yr-o-Yr | | | | | |

| Return on average assets | | 1.61 | % | | 1.93 | % | | (32) | | bps | | | |

| Adjusted return on average assets (2) | | 1.64 | % | | 1.95 | % | | (31) | | | | | | |

| Return on average common equity | | 16.38 | % | | 20.27 | % | | (389) | | | | | | |

| Adjusted return on average common equity (2) | | 16.62 | % | | 20.49 | % | | (387) | | | | | | |

| Return on average TCE (3) | | 17.57 | % | | 21.95 | % | | (438) | | | | | | |

| Adjusted return on average TCE (3) | | 17.83 | % | | 22.19 | % | | (436) | | | | | | |

| Interest rate spread | | 2.08 | % | | 2.65 | % | | (57) | | | | | | |

| Net interest margin | | 3.30 | % | | 3.75 | % | | (45) | | | | | | |

| | | | | | | | | | | | |

| Average loan yield | | 6.72 | % | | 6.24 | % | | 48 | | | | | | |

| | | | | | | | | | | | |

| Yield on average interest-earning assets | | 6.08 | % | | 5.59 | % | | 49 | | | | | | |

| Average cost of interest-bearing deposits | | 3.89 | % | | 2.80 | % | | 109 | | | | | | |

| Average cost of deposits | | 2.90 | % | | 1.86 | % | | 104 | | | | | | |

| Average cost of funds | | 3.04 | % | | 2.01 | % | | 103 | | | | | | |

| | | | | | | | | | | | |

| Adjusted noninterest expense/average assets (4) | | 1.24 | % | | 1.25 | % | | (1) | | | | | | |

| Efficiency ratio | | 37.70 | % | | 36.79 | % | | 91 | | | | | | |

| Adjusted efficiency ratio (4) | | 34.47 | % | | 31.13 | % | | 334 | | bps | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1)Annualized except for efficiency ratio and adjusted efficiency ratio.

(2)Adjusted return on average assets and adjusted return on average common equity are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 14.

(3)Return on average TCE and adjusted return on average TCE are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 13.

(4)Adjusted noninterest expense/average assets and adjusted efficiency ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 12.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| ALLOWANCE FOR LOAN LOSSES & OFF-BALANCE SHEET CREDIT EXPOSURES |

| ($ in thousands) |

| (unaudited) |

| Table 10 |

|

| | | | | | | | | | | | | | | | | | | |

|

| | | Three Months Ended June 30, 2024 |

| | | Commercial | | Consumer | | |

| | | | | CRE | | | Residential Mortgage | | | | | |

| ($ in thousands) | | | C&I | | CRE | | Multi-Family Residential | | Construction and Land | | | Single-Family Residential | | HELOCs | | | Other Consumer | | Total |

Allowance for loan losses, March 31, 2024 | | | $ | 373,631 | | | $ | 187,460 | | | $ | 37,418 | | | $ | 10,819 | | | | $ | 55,922 | | | $ | 3,563 | | | | $ | 1,467 | | | $ | 670,280 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Provision for (reversal of) credit losses on loans | (a) | | 17,783 | | | 18,287 | | | 2,628 | | | 4,422 | | | | (6,366) | | | (232) | | | | 240 | | | 36,762 | |

| Gross charge-offs | | | (13,134) | | | (11,103) | | | — | | | (920) | | | | (35) | | | — | | | | (130) | | | (25,322) | |

| Gross recoveries | | | 1,817 | | | 150 | | | 208 | | | 1 | | | | 2 | | | 9 | | | | — | | | 2,187 | |

| Total net (charge-offs) recoveries | | | (11,317) | | | (10,953) | | | 208 | | | (919) | | | | (33) | | | 9 | | | | (130) | | | (23,135) | |

| Foreign currency translation adjustment | | | (113) | | | — | | | — | | | — | | | | — | | | — | | | | — | | | (113) | |

Allowance for loan losses, June 30, 2024 | | | $ | 379,984 | | | $ | 194,794 | | | $ | 40,254 | | | $ | 14,322 | | | | $ | 49,523 | | | $ | 3,340 | | | | $ | 1,577 | | | $ | 683,794 | |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2024 | | |

| | | Commercial | | Consumer | | | | | |

| | | | | CRE | | | Residential Mortgage | | | | | | | | |

| ($ in thousands) | | | C&I | | CRE | | Multi-Family Residential | | Construction and Land | | | Single-Family Residential | | HELOCs | | | Other Consumer | | Total | | | |

Allowance for loan losses, December 31, 2023 | | | $ | 392,685 | | | $ | 170,592 | | | $ | 34,375 | | | $ | 10,469 | | | | $ | 55,018 | | | $ | 3,947 | | | | $ | 1,657 | | | $ | 668,743 | | | | |

| Provision for (reversal of) credit losses on loans | (a) | | 275 | | | 19,132 | | | 3,032 | | | 1,381 | | | | 899 | | | (432) | | | | (132) | | | 24,155 | | | | |

| Gross charge-offs | | | (20,998) | | | (2,398) | | | (6) | | | (1,224) | | | | — | | | — | | | | (58) | | | (24,684) | | | | |

| Gross recoveries | | | 1,710 | | | 134 | | | 17 | | | 193 | | | | 5 | | | 48 | | | | — | | | 2,107 | | | | |

| Total net (charge-offs) recoveries | | | (19,288) | | | (2,264) | | | 11 | | | (1,031) | | | | 5 | | | 48 | | | | (58) | | | (22,577) | | | | |

| Foreign currency translation adjustment | | | (41) | | | — | | | — | | | — | | | | — | | | — | | | | — | | | (41) | | | | |

Allowance for loan losses, March 31, 2024 | | | $ | 373,631 | | | $ | 187,460 | | | $ | 37,418 | | | $ | 10,819 | | | | $ | 55,922 | | | $ | 3,563 | | | | $ | 1,467 | | | $ | 670,280 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2023 |

| | | Commercial | | Consumer | | | |

| | | | | CRE | | | Residential Mortgage | | | | | | |

| ($ in thousands) | | | C&I | | CRE | | Multi-Family Residential | | Construction and Land | | | Single-Family Residential | | HELOCs | | | Other Consumer | | Total | |

Allowance for loan losses, March 31, 2023 | | | $ | 376,325 | | | $ | 155,067 | | | $ | 24,526 | | | $ | 9,322 | | | | $ | 48,007 | | | $ | 4,971 | | | | $ | 1,675 | | | $ | 619,893 | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Provision for (reversal of) credit losses on loans | (a) | | 5,259 | | | 15,685 | | | (1,604) | | | 1,995 | | | | 3,501 | | | (444) | | | | (367) | | | 24,025 | | |

| Gross charge-offs | | | (7,335) | | | (2,366) | | | — | | | — | | | | — | | | (6) | | | | (48) | | | (9,755) | | |

| Gross recoveries | | | 2,065 | | | 119 | | | 16 | | | 8 | | | | 5 | | | 5 | | | | — | | | 2,218 | | |

| Total net (charge-offs) recoveries | | | (5,270) | | | (2,247) | | | 16 | | | 8 | | | | 5 | | | (1) | | | | (48) | | | (7,537) | | |

| Foreign currency translation adjustment | | | (981) | | | — | | | — | | | — | | | | — | | | — | | | | — | | | (981) | | |

Allowance for loan losses, June 30, 2023 | | | $ | 375,333 | | | $ | 168,505 | | | $ | 22,938 | | | $ | 11,325 | | | | $ | 51,513 | | | $ | 4,526 | | | | $ | 1,260 | | | $ | 635,400 | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES |

| ALLOWANCE FOR LOAN LOSSES & OFF-BALANCE-SHEET CREDIT EXPOSURES |

| ($ in thousands) |

| (unaudited) |

| Table 10 (continued) |

|

| | | | | | | | | | | | | | | | | | | |

|

| | | Six Months Ended June 30, 2024 |

| | | Commercial | | Consumer | | |

| | | | | CRE | | | Residential Mortgage | | | | | |

| ($ in thousands) | | | C&I | | CRE | | Multi-Family Residential | | Construction and Land | | | Single-Family Residential | | HELOCs | | | Other Consumer | | Total |

Allowance for loan losses, January 1, 2024 | | | $ | 392,685 | | | $ | 170,592 | | | $ | 34,375 | | | $ | 10,469 | | | | $ | 55,018 | | | $ | 3,947 | | | | $ | 1,657 | | | $ | 668,743 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Provision for (reversal of) credit losses on loans | (a) | | 18,058 | | | 37,419 | | | 5,660 | | | 5,803 | | | | (5,467) | | | (664) | | | | 108 | | | 60,917 | |

| Gross charge-offs | | | (34,132) | | | (13,501) | | | (6) | | | (2,144) | | | | (35) | | | — | | | | (188) | | | (50,006) | |

| Gross recoveries | | | 3,527 | | | 284 | | | 225 | | | 194 | | | | 7 | | | 57 | | | | — | | | 4,294 | |

| Total net (charge-offs) recoveries | | | (30,605) | | | (13,217) | | | 219 | | | (1,950) | | | | (28) | | | 57 | | | | (188) | | | (45,712) | |

| Foreign currency translation adjustment | | | (154) | | | — | | | — | | | — | | | | — | | | — | | | | — | | | (154) | |

Allowance for loan losses, June 30, 2024 | | | $ | 379,984 | | | $ | 194,794 | | | $ | 40,254 | | | $ | 14,322 | | | | $ | 49,523 | | | $ | 3,340 | | | | $ | 1,577 | | | $ | 683,794 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2023 | | | |

| | | Commercial | | Consumer | | | | | |

| | | | | CRE | | | Residential Mortgage | | | | | | | | |

| ($ in thousands) | | | C&I | | CRE | | Multi-Family Residential | | Construction and Land | | | Single-Family Residential | | HELOCs | | | Other Consumer | | Total | | | |

Allowance for loan losses, December 31, 2022 | | | $ | 371,700 | | | $ | 149,864 | | | $ | 23,373 | | | $ | 9,109 | | | | $ | 35,564 | | | $ | 4,475 | | | | $ | 1,560 | | | $ | 595,645 | | | | |

Impact of ASU 2022-02 adoption | | | 5,683 | | | 337 | | | 6 | | | — | | | | 1 | | | 1 | | | | — | | | 6,028 | | | | |

Allowance for loan losses, January 1, 2023 | | | $ | 377,383 | | | 150,201 | | | 23,379 | | | 9,109 | | | | 35,565 | | | 4,476 | | | | $ | 1,560 | | | $ | 601,673 | | | | |

| Provision for (reversal of) credit losses on loans | (a) | | 4,581 | | | 20,361 | | | (469) | | | 2,205 | | | | 15,943 | | | 136 | | | | (212) | | | 42,545 | | | | |

| Gross charge-offs | | | (9,235) | | | (2,372) | | | — | | | — | | | | — | | | (97) | | | | (88) | | | (11,792) | | | | |

| Gross recoveries | | | 3,276 | | | 315 | | | 28 | | | 11 | | | | 5 | | | 11 | | | | — | | | 3,646 | | | | |

| Total net (charge-offs) recoveries | | | (5,959) | | | (2,057) | | | 28 | | | 11 | | | | 5 | | | (86) | | | | (88) | | | (8,146) | | | | |

| Foreign currency translation adjustment | | | (672) | | | — | | | — | | | — | | | | — | | | — | | | | — | | | (672) | | | | |

Allowance for loan losses, June 30, 2023 | | | $ | 375,333 | | | $ | 168,505 | | | $ | 22,938 | | | $ | 11,325 | | | | $ | 51,513 | | | $ | 4,526 | | | | $ | 1,260 | | | $ | 635,400 | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| ($ in thousands) | | | June 30,

2024 | | March 31,

2024 | | June 30,

2023 | | June 30,

2024 | | June 30,

2023 |

| Unfunded Credit Facilities | | | | | | | | | | | |

Allowance for unfunded credit commitments, beginning of period (1) | | | $ | 38,544 | | | $ | 37,699 | | | $ | 27,741 | | | $ | 37,699 | | | $ | 26,264 | |

| | | | | | | | | | | |

Provision for credit losses on unfunded credit commitments | (b) | | 238 | | | 845 | | | 1,975 | | | 1,083 | | | 3,455 | |

| Foreign currency translation adjustment | | | 1 | | | — | | | 12 | | | 1 | | | 9 | |

Allowance for unfunded credit commitments, end of period (1) | | | $ | 38,783 | | | $ | 38,544 | | | $ | 29,728 | | | $ | 38,783 | | | $ | 29,728 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Provision for credit losses | (a)+(b) | | $ | 37,000 | | | $ | 25,000 | | | $ | 26,000 | | | $ | 62,000 | | | $ | 46,000 | |

| | | | | | | | | | | |

(1)Included in Accrued expenses and other liabilities on the Condensed Consolidated Balance Sheet.

| | | | | | | | | | | | | | | | | | | | | | | | |

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |

| CRITICIZED LOANS, NONPERFORMING ASSETS, CREDIT QUALITY RATIOS AND COMPOSITION OF ALLOWANCE BY PORTFOLIO | |

| ($ in thousands) | |

| (unaudited) | |

| Table 11 | |

| |

| |

| Criticized Loans | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 | |

| Special mention loans | | $ | 435,679 | | | $ | 543,573 | | | $ | 330,741 | | |

| Classified loans | | 644,564 | | | 651,485 | | | 481,051 | | |

Total criticized loans (1) | | $ | 1,080,243 | | | $ | 1,195,058 | | | $ | 811,792 | | |

| |

| |

| |