East West Bank Introduces the Greater China Investment Index CD

July 26 2004 - 8:00AM

PR Newswire (US)

East West Bank Introduces the Greater China Investment Index CD

East West the First Bank in California to Offer Time Deposit

Accounts Linked to the Hang Seng China Enterprises Index SAN

MARINO, Calif., July 26 /PRNewswire-FirstCall/ -- East West

Bancorp, Inc. (NASDAQ:EWBC), parent company of East West Bank, one

of the nation's premier community banks and a leading institution

focused on the Chinese- American and other niche markets, today

announced that the Bank has continued its record of innovation in

the Chinese American banking market with the introduction of the

Greater China Investment Index CD. Now, customers may enjoy the

benefits of FDIC insurance on the certificate of deposit along with

returns linked to the Hang Seng China Enterprise Index with the

ease of opening a time deposit with East West Bank. "We are

extremely pleased to offer the Greater China Investment Index CD to

our clients," said Dominic Ng, Chairman, President and CEO of East

West Bancorp. "This product is another in many firsts we have

brought to our core Chinese American market and will provide

customers with the best of both worlds in a unique time deposit

account. Customers may now invest with the security of a CD, which

has 100% principal protection, while participating in the continued

growth of China through a return linked to the performance of the

Hang Seng China Enterprise Index. The program not only provides a

unique and secure way for our clients to invest in one of the most

widely known and trusted stock market index in Asia, but also

reinforces our position as the bridge between east and west." East

West Bank's Greater China Investment Index CD is a result of the

company's commitment to providing customers leading edge value and

service. The Greater China Investment Index CD will be offered from

July 26th, 2004 through August 16th, 2004. Purchasers of the Index

CD will have two options. Option 1 will guarantee the investor a

minimum 1.00% Annual Percentage Rate with unlimited maximum

maturity value. The returns will be based on 70% to 85% of the

quarterly average price of the Hang Seng China Enterprises Index.

Option 2 will not provide any minimum interest rate, but allow for

returns based on 85% to 95% of the quarterly average price of the

Index. Both options provide guaranteed principal amounts at

maturity with unlimited maximum returns. All returns will be summed

up and paid upon maturity and the rate of return will vary.

Penalties will apply for early withdrawal. A minimum balance of

$5,000 is required. The Hang Seng China Enterprises Index is a

capitalization-weighted index comprised of 37 state-owned Chinese

companies (H shares) listed on the Hong Kong Stock Exchange. The

Hang Seng China Enterprises Index is managed and compiled by HSI

Services Limited, a wholly-owned subsidiary of Hang Seng Bank.

Neither HIS Services Limited, nor Hang Seng Bank is affiliated with

East West Bank or the Greater China Investment Index CD. The

Greater China Investment Index CD certificates of deposit linked to

the Hang Seng China Enterprise Index are solely the obligations of

East West Bank, a California State Non- Member bank. About East

West East West Bancorp is a publicly owned company, with $4.9

billion in assets, whose stock is traded on the Nasdaq National

Market under the symbol "EWBC." The company's wholly owned

subsidiary, East West Bank, is the fourth largest independent

commercial bank headquartered in Los Angeles. East West Bank serves

the community with 40 locations throughout Los Angeles, Orange, San

Francisco, Alameda, Santa Clara, and San Mateo counties and a

Beijing Representative Office in China. It is also one of the

largest financial institutions in the nation focusing on the

Chinese-American community. For more information on East West

Bancorp, visit the company's website at

http://www.eastwestbank.com/. Forward-Looking Statements This

release may contain forward-looking statements, which are included

in accordance with the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995 and accordingly, the

cautionary statements contained in East West Bancorp's Annual

Report on Form 10-K for the year ended Dec. 31, 2003 (See Item I --

Business, and Item 7 -- Management's Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC's ability to efficiently incorporate

acquisitions into its operations; the ability of EWBC and its

subsidiaries to increase its customer base; the effect of

regulatory and legislative action, including recently enacted

California tax legislation and an announcement by the state's

Franchise Tax Board regarding the taxation of Registered Investment

Companies; and regional and general economic conditions. Actual

results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank's expectations of results or any change in events. For

further information please contact Julia Gouw, Chief Financial

Officer, +1-626-583-3512, or Steven Canup, Investor Relations,

+1-626-583-3775, both of East West Bancorp, Inc. DATASOURCE: East

West Bancorp, Inc. CONTACT: Julia Gouw, Chief Financial Officer,

+1-626-583-3512, or Steven Canup, Investor Relations,

+1-626-583-3775, both of East West Bancorp, Inc. Web site:

http://www.eastwestbank.com/

Copyright

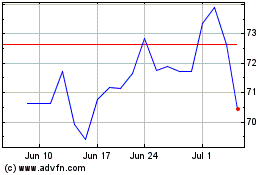

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2024 to Jul 2024

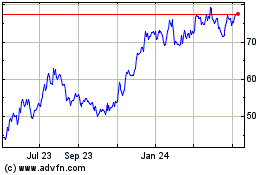

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2023 to Jul 2024