East West Bancorp Announces Fourth Quarter 2009 Dividends, Date for Third Quarter Earnings Conference Call/Webcast

October 19 2009 - 5:25PM

Business Wire

East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, today announced that its Board of Directors declared a

quarterly dividend on its common stock and its Series A Preferred

Stock. The dividend of $0.01 per share on its common stock is

payable on or about November 24, 2009 to shareholders of record as

of November 10, 2009.

The dividend on the Series A Preferred Stock of $20.00 per share

is payable on November 1, 2009 to shareholders of record on October

15, 2009.

East West Bancorp will announce third quarter 2009 earnings to

the public on Thursday, October 22, 2009 at 8:30 A.M. PT/ 11:30

A.M. ET via the Company’s live quarterly earnings conference call.

The public and investment community are invited to listen as

management discusses third quarter results and operating

developments.

Financial results will be released over the news wires after the

market closes on Wednesday, October 21, 2009.

About East West

East West Bancorp (NASDAQ: EWBC) is a publicly owned

company with $12.7 billion in assets. The Company’s wholly owned

subsidiary, East West Bank, is FDIC insured and the second largest

full service commercial bank headquartered in Southern

California with 71 branch locations. East West Bank serves the

community with 69 branch locations throughout the counties of Los

Angeles, Orange, San Bernardino, Alameda, San Francisco, Santa

Clara, San Mateo and one branch location in Houston,

Texas. East West Bank has four international locations in Greater

China, which include a full service branch in Hong Kong and

representative offices in Beijing, Shanghai and Taipei. In addition

to serving the mainstream market, East West is also one of the

largest financial institutions in the nation serving the

Chinese-American community. For more information on East West

Bancorp, visit the Company’s website at www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp’s Annual

Report on Form 10-K for the year ended Dec. 31, 2008 (See Item I --

Business, and Item 7 -- Management’s Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC’s ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses; effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state’s Franchise Tax Board regarding the taxation of Registered

Investment Companies; risks inherent in possible acquisitions and

FDIC-assisted transactions; and regional and general economic

conditions. Actual results and performance in future periods may be

materially different from any future results or performance

suggested by the forward-looking statements in this release. Such

forward-looking statements speak only as of the date of this

release. East West expressly disclaims any obligation to update or

revise any forward-looking statements found herein to reflect any

changes in the Bank’s expectations of results or any change in

event.

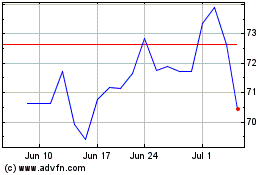

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2024 to Jul 2024

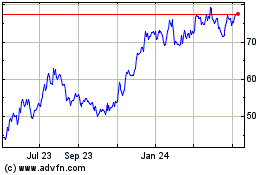

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2023 to Jul 2024