East West Bancorp, Inc. (Nasdaq:EWBC), parent company of East

West Bank, today reported financial results for the first quarter

2009 with a net loss of $22.5 million. The net loss for the first

quarter was largely a result of a $78.0 million provision for loan

losses.

During the quarter, East West achieved strong deposit momentum,

growing core deposits by $467.8 million, or 14% quarter over

quarter, while decreasing the cost of deposits by 33 basis points

to 1.81%. East West�s core profitability remains solid with total

revenue of $93.7 million offset by $51.4 million in noninterest

expense.

�From the onset of this prolonged economic downturn, our focus

has remained on ensuring the safety and soundness of the Bank and

our responsibility to customers and shareholders,� stated Dominic

Ng, Chairman, President and Chief Executive Officer of East West.

�Throughout 2008 we took decisive actions to do just that. We grew

excess liquidity to $3.3 billion. We increased our allowance for

loan losses by 101%. We raised over $500 million in capital and

ended 2008 with total risk-based capital of 15.83%, more than $600

million above the �well capitalized� regulatory requirement.�

�During the first quarter of 2009, we continued to take prudent

and appropriate measures to ensure that our balance sheet remains

strong,� continued Ng. �We actively grew core deposits by $467.8

million during the quarter and aggressively reduced credit

exposures while building the allowance for loan losses to 2.42% at

March 31, 2009. We believe that our strong core profitability,

along with strong capital, liquidity and allowance for loan losses

will serve as a foundation for strong earnings and growth when the

market turns,� concluded Ng.

First Quarter 2009 Highlights

- Strong Increase in Core

Deposits � Total deposits increased by $312.1 million, or 4%

quarter over quarter, to a record $8.5 billion at March 31, 2009,

primarily due to a $467.8 million, or 14% quarter over quarter

increase in core deposits. Since September 2008, we have

experienced strong deposit momentum through both our retail branch

network and our commercial deposit platforms.

- Strong Decrease in Cost of

Deposits - The cost of deposits decreased 33 basis points to

1.81% for the first quarter of 2009, largely due to the increase in

core deposits. The cost of deposits as of the month ended March 31,

2009 was 1.59%, a 42 basis point or 21% decrease from the cost of

deposits as of the month ended December 31, 2008.

- Improved Net Interest Income

�Net interest income for the first quarter totaled $79.7

million, a 4% or $2.8 million increase over fourth quarter of 2008.

The net interest margin for the quarter also increased to

2.74%.

- Allowance for Loan Losses

Strengthened � Total allowance for loan losses increased to

$195.5 million, or 2.42% of outstanding loans. We continued to

increase the allowance for loan losses, recording provision for

loan losses of $78.0 million and total net loan charge-offs of

$59.6 million for the quarter.

- Nonperforming Assets �

Nonperforming assets were $303.8 million or 2.42% of total assets,

a $39.9 million or 15% increase from $263.9 million or 2.12% of

total assets at December 31, 2008.

- Loan to Deposit Ratio �

Throughout the course of 2008 and 2009, East West decreased the

loan to deposit ratio in an effort to strengthen the balance sheet.

As of March 31, 2009, the loan to deposit ratio decreased

substantially to 95%, from 101% as of December 31, 2008 and 122% at

December 31, 2007.

- Loan Originations �

$305.6 million in loans to new and existing customers were made in

the first quarter of 2009, primarily to homeowners and small and

mid-sized businesses.

- Decrease in Borrowings �

FHLB advances decreased $120.0 million or 9% from December 31, 2008

as we continued to pay down higher cost borrowings. Cost of funds

decreased to 2.44% for the first quarter of 2009, a 33 basis point

decrease from 2.77% for the fourth quarter of 2008. We intend to

pay down higher cost FHLB advances for the remainder of 2009,

paying down $60.0 million at 5.05% in the second quarter, $250.0

million at 5.14% in the third quarter and $200.0 million at 4.43%

in the fourth quarter.

Capital Strength(Dollars in millions)

3/31/2009 � �

Well

CapitalizedRegulatoryRequirement

�

Total Excess AboveWell

CapitalizedRequirement

Leverage Capital Ratio 11.47 % 5.0 % 795.7 Tier 1 Capital Ratio

13.67 % 6.0 % 791.3 Total Risk-Based Capital Ratio 15.65 % 10.0 %

583.3 Tangible Capital Ratio 9.64 % N/A N/A

Tangible Common Equity Ratio

5.76 % N/A N/A �

East West has always been committed to maintaining strong

capital levels and has been well capitalized throughout this

economic cycle. As of the end of the first quarter, East West

significantly exceeds well capitalized minimums under all

regulatory guidelines.

Managing Through the Credit Cycle

The $78.0 million provision for loan losses taken during the

first quarter of 2009 compared to $43.0 million in the fourth and

third quarters of 2008, $85.0 million in the second quarter of 2008

and $55.0 million in the first quarter of 2008. At March 31, 2009,

the allowance for loan losses increased to $195.5 million or 2.42%

of outstanding loans, compared to $178.0 million or 2.16% of

outstanding loans at December 31, 2008. For the first quarter of

2009, East West had net charge-offs of $59.6 million, compared to

$41.5 million during the fourth quarter of 2008.

Our loan portfolio continues to be impacted by the real estate

downturn and recessionary economy in California, as evidenced by

the increased level of net charge-offs, nonperforming assets and

delinquent loans. We believe that credit challenges will continue

throughout 2009, particularly for our residential construction and

land loan portfolios. Throughout the course of 2008 and the first

quarter of 2009, we have actively reduced exposure to land and

construction loans. We reduced outstanding loan balances on land

and construction loans by $137.6 million and total commitments on

construction loans by $202.0 million during the first quarter. This

reduction in land and construction loans was in addition to the

$1.0 billion decrease in total commitments on construction and land

loans in 2008.

Total nonperforming assets as of March 31, 2009 were $303.8

million or 2.42% of total assets, compared to $263.9 million or

2.12% of total assets at December 31, 2008. The increase in

nonperforming assets was largely driven by an increase in

nonaccrual loans of $33.4 million. Nonperforming assets as of March

31, 2009 included nonaccrual loans totaling $248.0 million, other

real estate owned totaling $38.6 million and loans modified or

restructured totaling $17.2 million.

Total nonaccrual loans as of March 31, 2009 were $248.0 million,

compared to $214.6 million at December 31, 2008. We believe that

the collateral values for the $248.0 million nonaccrual loans are

strong and have updated values totaling $344.5 million. All

nonaccrual loans are recorded at the lesser of the outstanding loan

balance or net realizable value.

The increase in nonaccrual loans was primarily due to one

lending relationship comprised of several loans, where the borrower

filed for bankruptcy towards the end of the first quarter. Although

payments on substantially all of these loans were current or under

90 days delinquent, these loans were classified as nonaccrual loans

as of the end of the first quarter. As of March 31, 2009, the net

book value of the total loans for this lending relationship was

$49.2 million and the collateral is comprised of 23 different

properties, all land, residential and income producing commercial

real estate located in the downtown Los Angeles region.

The quarter-to-date increase in nonaccrual commercial real

estate loans was $30.5 million from $24.7 million at December 31,

2008. The lending relationship noted in the paragraph above

comprised $34.8 million of the nonaccrual commercial real estate

loans at March 31, 2009. Excluding these loans, nonaccrual

commercial real estate loans would have decreased $4.3 million

quarter-to-date. The nonaccrual commercial real estate loans as of

March 31, 2009 were well collateralized, comprised of 25 loans and

had an average loan balance of $2.2 million.

Deposit Summary

Total deposits as of March 31, 2009 increased to a record $8.5

billion, up $312.1 million or 4% from $8.1 billion at December 31,

2008. The increase in deposits stemmed from a strong increase in

core deposits of $467.8 million or 14% quarter over quarter. Since

mid-2008, we have focused on attracting new customers and growing

deposits through our retail branch network and commercial deposit

platforms. Along with growing core deposits, we have also focused

on shifting our deposit base from higher cost time deposits to

lower cost core deposits. We successfully introduced new core

deposit products and substantially increased money market deposits

during the quarter.

Given the growth in core deposits and shift away from time

deposits, we were able to reduce our cost of deposits for the first

quarter of 2009 to 1.81%, a 33 basis point decrease from the fourth

quarter of 2008.

First Quarter 2009 Operating Results(In thousands, except

per share amounts)

Quarter Ended March 31, 2009 Total Amount �

Per

Share Amount � Interest and dividend income $ 144,923 $ 2.30

Interest expense � (65,242 ) � (1.04 ) Net interest income before

provision for loan losses 79,681 1.26 Noninterest income before

impairment writedown on investment securities 13,994 0.22

Noninterest expense � (51,406 ) � (0.82 ) Income before provision

for loan losses and impairment writedown on investment securities

42,269 0.66 Provision for loan losses (78,000 ) (1.24 ) Impairment

writedown on investment securities � (200 ) � - � Loss before

benefit for income taxes (35,931 ) (0.58 ) Benefit for income taxes

� 13,465 � � 0.21 � Net loss (22,466 ) (0.37 ) Preferred stock

dividend and amortization of preferred stock discount � (8,743 ) �

(0.13 ) Net (loss) available to common stockholders $ (31,209 ) $

(0.50 )

Net Interest Income

Net interest income for the first quarter totaled $79.7 million,

a 4% increase over fourth quarter of 2008. The net interest margin

for the quarter totaled 2.74%, an increase from 2.72% in the prior

quarter. Overall, our continuing efforts to improve the margin

through growing core deposits, focusing on pricing, and increasing

loan and investment security yields have proven to be

successful.

The increase in the margin, which resulted from increased yields

on interest earning assets combined with the decreased cost of

deposits, was partially offset by the reversal of interest income

on nonperforming loans. Excluding the impact of $1.9 million in

reversals of interest income, the net interest margin would have

been seven basis points higher, at 2.81% for the first quarter.

Throughout the first quarter of 2009, we continued to drive down

the cost of deposits, as shown in the table below which shows the

monthly cost of deposits at March 31, 2009 and December 31,

2008:

As of the Month Ended March 31, 2009 �

December

31, 2008 Cost of Deposits 1.59 % 2.01 %

Currently, we estimate that the net interest margin will

approximate 2.85% for the second quarter of 2009.

Noninterest Income

Noninterest income for the first quarter totaled $13.8 million,

compared to a loss of $863 thousand in the fourth quarter of

2008.

In the first quarter of 2009, we recorded a $200 thousand

write-down of investment securities through earnings for

other-than-temporary impairment (OTTI), in accordance with FSP FAS

115-2 and FAS 124-2 issued by the FASB on April 9, 2009. This new

guidance requires that credit-related OTTI be recognized through

earnings while noncredit-related OTTI be recognized through equity.

Noncredit-related OTTI on securities of $9.7 million pre-tax was

recognized through equity.

Excluding the impact of credit-related impairment write-downs on

investment securities, noninterest income for the first quarter of

2009 totaled $14.0 million, an increase of $5.2 million or 59% from

$8.8 million in the fourth quarter of 2008. The increase from the

prior quarter was primarily due to increased gain on sale of

investment securities of $2.3 million, increased loan fees of $1.5

million and increased branch fees of $546 thousand.

Noninterest Expense

Noninterest expense totaled $51.4 million for the first quarter

2009, an increase of $7.2 million from the fourth quarter of 2008.

The primary driver for the increase in noninterest expense was an

increase in OREO expense of $4.5 million for the first quarter of

2009, due to higher write-downs and loss on sale of OREOs.

Additionally, deposit insurance premium expense increased to $3.3

million in the first quarter, in line with higher FDIC assessment

rates in 2009 across the industry. We will continue to manage down

base operating costs throughout 2009; however, these decreases may

be offset by higher FDIC assessment and OREO costs.

Dividend Payout

East West Bank�s Board of Directors has declared second quarter

dividends on the common and non-cumulative perpetual convertible

preferred stock, series A. The Board reduced the common stock cash

dividend from $0.02 to $0.01 per share as an additional measure of

preserving capital. The common stock cash dividend is payable on or

about May 26, 2009 to shareholders of record on May 18, 2009. The

dividend on the non-cumulative perpetual convertible preferred

stock, series A of $20.00 per depository share is payable on May 1,

2009 to shareholders of record on April 15, 2009. We will continue

to review the dividend policy quarterly, in light of the current

economic environment.

About East West

East West Bancorp is a publicly owned company with $12.6 billion

in assets and is traded on the Nasdaq Global Select Market under

the symbol �EWBC�. The Company�s wholly owned subsidiary, East West

Bank, is the second largest independent commercial bank

headquartered in Southern California with 71 branch locations. East

West Bank serves the community with 69 branch locations across

Southern and Northern California and a branch location in Houston,

Texas. East West Bank has three international locations in Greater

China, including a full-service branch in Hong Kong and

representative offices in Beijing and Shanghai. For more

information on East West Bancorp, visit the Company�s website at

www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the �safe harbor� provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp�s Annual

Report on Form 10-K for the year ended Dec. 31, 2008 (See Item I --

Business, and Item 7 -- Management�s Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC�s ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses;�effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state�s Franchise Tax Board regarding the taxation of Registered

Investment Companies; and regional and general economic conditions.

Actual results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank�s expectations of results or any change in event.

EAST WEST BANCORP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands,

except per share amounts) (unaudited) � � �

March 31,

2009 December 31, 2008 % Change Assets Cash and

cash equivalents $ 541,066 $ 878,853 (38 ) Short-term investments

329,288 228,441 44 Securities purchased under resale agreements

50,000 50,000 0 Investment securities held-to-maturity, at

amortized cost 734,799 122,317 501 Investment securities

available-for-sale, at fair value 1,994,403 2,040,194 (2 ) Loans

receivable (net of allowance for loan losses of $195,450 and

$178,027) 7,865,925 8,069,377 (3 ) Other real estate owned, net

38,634 38,302 1 Premiums on deposits acquired, net 20,065 21,190 (5

) Goodwill 337,438 337,438 0 Other assets � 652,906 � � 636,704 � 3

Total assets $ 12,564,524 � $ 12,422,816 � 1 � Liabilities and

Stockholders' Equity Deposits $ 8,454,059 $ 8,141,959 4 Federal

funds purchased 22 28,022 (100 ) Federal Home Loan Bank advances

1,233,269 1,353,307 (9 ) Securities sold under repurchase

agreements 998,061 998,430 (0 ) Notes payable 14,597 16,506 (12 )

Long-term debt 235,570 235,570 0 Accrued expenses and other

liabilities � 93,753 � � 98,256 � (5 ) Total liabilities 11,029,331

10,872,050 1 Stockholders' equity � 1,535,193 � � 1,550,766 � (1 )

Total liabilities and stockholders' equity $ 12,564,524 � $

12,422,816 � 1 Book value per common share $ 16.60 $ 16.92 (2 )

Number of common shares at period end 63,952 63,746 0 �

Ending

Balances March 31, 2009 December 31, 2008 %

Change Loans receivable Real estate - single family $ 517,844 $

491,315 5 Real estate - multifamily 689,728 677,989 2 Real estate -

commercial 3,510,749 3,472,000 1 Real estate - land 544,892 576,564

(5 ) Real estate - construction 1,154,782 1,260,724 (8 ) Commercial

1,128,903 1,210,260 (7 ) Trade finance 292,816 343,959 (15 )

Consumer � 224,601 � � 216,642 � 4 Total gross loans receivable

8,064,315 8,249,453 (2 ) Unearned fees, premiums and discounts

(2,940 ) (2,049 ) 43 Allowance for loan losses � (195,450 ) �

(178,027 ) 10 Net loans receivable $ 7,865,925 $ 8,069,377 (3 ) �

Deposits Noninterest-bearing demand $ 1,297,151 $ 1,292,997 0

Interest-bearing checking 352,334 363,285 (3 ) Money market

1,806,985 1,323,402 37 Savings � 411,104 � � 420,133 � (2 ) Total

core deposits 3,867,574 3,399,817 14 Time deposits less than

$100,000 1,211,480 1,521,988 (20 ) Time deposits $100,000 or

greater � 3,375,005 � � 3,220,154 � 5 Total time deposits �

4,586,485 � � 4,742,142 � (3 ) Total deposits $ 8,454,059 $

8,141,959 4 � �

EAST WEST BANCORP, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(In thousands, except per share

amounts)

(unaudited)

�

Quarter Ended �

March 31, 2009 �

December 31,

2008 �

March 31, 2008 � Interest and dividend income $

144,923 $ 149,907 $ 187,184 Interest expense � (65,242 ) � (73,053

) � (87,565 ) Net interest income before provision for loan losses

79,681 76,854 99,619 Provision for loan losses � (78,000 ) �

(43,000 ) � (55,000 ) Net interest income after provision for loan

losses 1,681 33,854 44,619 Noninterest income (loss) 13,794 (863 )

15,913 Noninterest expense � (51,406 ) � (44,199 ) � (52,890 )

(Loss) income before benefit (provision) for income taxes (35,931 )

(11,208 ) 7,642 Benefit (provision) for income taxes � 13,465 � �

13,574 � � (2,598 ) Net (loss) income $ (22,466 ) $ 2,366 $ 5,044

Preferred stock dividend and amortization of preferred stock

discount � (8,743 ) � (5,385 ) � - � Net (loss) income available to

common stockholders $ (31,209 ) $ (3,019 ) $ 5,044 Net (loss)

income per share, basic $ (0.50 ) $ (0.05 ) $ 0.08 Net (loss)

income per share, diluted $ (0.50 ) $ (0.05 ) $ 0.08 Shares used to

compute per share net (loss) income: - Basic 62,998 62,932 62,485 -

Diluted 62,998 62,932 62,949 � �

Quarter Ended March 31,

2009 December 31, 2008 March 31, 2008 Noninterest

income (loss): Impairment writedown on investment securities $ (200

) $ (9,653 ) $ - Branch fees 4,793 4,247 4,101 Net gain on sale of

investment securities available-for-sale 3,521 1,238 4,334

Ancillary loan fees 2,229 738 1,141 Letters of credit fees and

commissions 1,854 2,267 2,677 Net gain on sale of loans 8 3 1,855

Other operating income � 1,589 � � 297 � � 1,805 � Total

noninterest income (loss) $ 13,794 $ (863 ) $ 15,913 � Noninterest

expense: Compensation and employee benefits 17,108 15,658 23,268

Occupancy and equipment expense 7,391 6,627 7,008 Other real estate

owned expense 7,031 2,493 889 Deposit insurance premiums and

regulatory assessments 3,325 2,032 1,192 Legal expense 1,778 1,687

1,900 Amortization of investments in affordable housing

partnerships 1,760 1,751 1,715 Data processing 1,142 1,108 1,196

Amortization and impairment writedowns of premiums on deposits

acquired 1,125 1,125 2,737 Other operating expense � 10,746 � �

11,718 � � 12,985 � Total noninterest expense $ 51,406 $ 44,199 $

52,890 �

EAST WEST BANCORP, INC. SELECTED FINANCIAL

INFORMATION (In thousands) (unaudited) � � �

Average Balances Quarter Ended March 31, % �

2009 � �

2008 �

Change � Loans receivable Real

estate - single family $ 506,753 $ 444,153 14 Real estate -

multifamily 692,885 698,529 (1 ) Real estate - commercial 3,465,505

3,583,906 (3 ) Real estate - land 582,649 709,466 (18 ) Real estate

- construction 1,232,235 1,584,050 (22 ) Commercial 1,179,183

1,282,814 (8 ) Trade finance 309,586 465,311 (33 ) Consumer �

228,377 � � 187,028 � 22 Total loans receivable 8,197,173 8,955,257

(8 ) Investment securities held-to-maturity 422,493 -

N/A

Investment securities available-for-sale 2,280,766 1,839,080 24

Earning assets 11,802,045 11,050,809 7 Total assets 12,498,249

11,788,891 6 � Deposits Noninterest-bearing demand $ 1,238,551 $

1,359,837 (9 ) Interest-bearing checking 361,569 437,804 (17 )

Money market 1,487,178 1,094,698 36 Savings � 410,232 � � 471,437 �

(13 ) Total core deposits 3,497,530 3,363,776 4 Time deposits less

than $100,000 1,332,944 938,282 42 Time deposits $100,000 or

greater � 3,482,074 � � 3,027,580 � 15 Total time deposits �

4,815,018 � � 3,965,862 � 21 Total deposits 8,312,548 7,329,638 13

Interest-bearing liabilities 9,595,665 9,119,556 5 Stockholders'

equity 1,540,948 1,157,160 33 �

Selected Ratios Quarter

Ended March 31, % �

2009 � �

2008 �

Change � For The Period Return on average assets -0.72 %

0.17 % (524 ) Return on average common equity -11.69 % 1.74 % (770

) Interest rate spread (3) 2.22 % 2.96 % (25 ) Net interest margin

(3) 2.74 % 3.63 % (24 ) Yield on earning assets (3) 4.98 % 6.81 %

(27 ) Cost of deposits 1.81 % 2.86 % (37 ) Cost of funds 2.44 %

3.35 % (27 ) Noninterest expense/average assets (1) 1.55 % 1.64 %

(5 ) Efficiency ratio (4) 51.80 % 41.93 % 24 Net chargeoffs to

average loans (2) 2.91 % 1.13 % 156 Gross loan chargeoffs $ 60,140

$ 25,583 135 Loan recoveries $ (571 ) $ (200 ) 186 Net loan

chargeoffs $ 59,569 � $ 25,383 � 135 � Period End Tier 1 risk-based

capital ratio 13.67 % 8.78 % 56 Total risk-based capital ratio

15.65 % 10.59 % 48 Tier 1 leverage capital ratio 11.47 % 8.58 % 34

� (1) Excludes the amortization of intangibles, amortization and

impairment writedowns of premiums on deposits acquired, impairment

writedown on goodwill, and amortization of investments in

affordable housing partnerships. � (2) Annualized. (3) Yields on

certain securities have been adjusted upward to a "fully taxable

equivalent" basis in order to reflect the effect of income which is

exempt from federal income taxation at the current statutory tax

rate. � (4) Represents noninterest expense, excluding the

amortization of intangibles, amortization and impairment writedowns

of premiums on deposits acquired, impairment writedown on goodwill,

and investments in affordable housing partnerships, divided by the

aggregate of net interest income before provision for loan losses

and noninterest income, excluding impairment writedowns on

investment securities. � � � �

EAST WEST BANCORP, INC.

QUARTER TO DATE AVERAGE BALANCES, YIELDS AND RATES PAID (In

thousands) (unaudited) � � � � �

Quarter Ended March 31,

2009 2008 Average Average Volume

Interest Yield (1) Volume Interest

Yield (1) �

ASSETS Interest-earning

assets: Short-term investments (2) $ 731,573 $ 2,976 1.65 % $

76,540 $ 538 2.82 % Securities purchased under resale agreements

(term) 50,000 1,250 10.00 % 64,286 2,553 15.93 % Investment

securities held-to-maturity Taxable 405,851 6,695 6.60 % - - -

Tax-exempt (3) 16,642 277 6.66 % - - - Investment securities

available-for-sale (4) 2,280,766 22,493 4.00 % 1,839,080 27,445

5.99 % Loans receivable 8,197,173 110,816 5.48 % 8,955,257 155,434

6.96 % Federal Home Loan Bank and Federal Reserve Bank stocks �

120,040 � � 506 1.69 % � 115,646 � � 1,609 5.58 % Total

interest-earning assets � 11,802,045 � � 145,013 4.98 % �

11,050,809 � � 187,579 6.81 % �

Noninterest-earning assets:

Cash and due from banks 122,899 150,469 Allowance for loan losses

(186,058 ) (90,086 ) Other assets � 759,363 � � 677,699 � Total

assets $ 12,498,249 � $ 11,788,891 � � �

LIABILITIES AND

STOCKHOLDERS' EQUITY Interest-bearing

liabilities: Checking accounts 361,569 393 0.44 % 437,804 1,367

1.25 % Money market accounts 1,487,178 5,694 1.55 % 1,094,698 8,464

3.10 % Savings deposits 410,232 702 0.69 % 471,437 1,454 1.24 %

Time deposits less than $100,000 1,332,944 9,618 2.93 % 938,282

8,841 3.78 % Time deposits $100,000 or greater 3,482,074 20,666

2.41 % 3,027,580 32,127 4.26 % Federal funds purchased 2,445 3 0.49

% 165,686 1,378 3.34 % Federal Home Loan Bank advances 1,285,070

13,877 4.38 % 1,747,313 19,682 4.52 % Securities sold under

repurchase agreements 998,583 11,872 4.76 % 1,001,186 10,529 4.22 %

Long-term debt � 235,570 � � 2,417 4.10 % � 235,570 � � 3,723 6.34

% Total interest-bearing liabilities � 9,595,665 � � 65,242 2.76 %

� 9,119,556 � � 87,565 3.85 % �

Noninterest-bearing

liabilities: Demand deposits 1,238,551 1,359,837 Other

liabilities 123,085 152,338 Stockholders' equity � 1,540,948 � �

1,157,160 � Total liabilities and stockholders' equity $ 12,498,249

� $ 11,788,891 � � Interest rate spread 2.22 % 2.96 % � Net

interest income and net yield on interest-earning assets (3) $

79,771 2.74 % $ 100,014 3.63 % � � (1) Annualized (2) Quarter ended

March 31, 2008, includes short-term securities purchased under

resale agreements. (3) Amounts calculated on a fully taxable

equivalent basis using the current statutory federal tax rate. (4)

Quarter ended March 31, 2008, amounts calculated on a fully taxable

equivalent basis using the current statutory federal tax rate. �

EAST WEST BANCORP, INC. QUARTERLY ALLOWANCE FOR LOAN

LOSSES RECAP (In thousands) (unaudited) �

Quarter Ended March 31, 2009 �

December 31,

2008 �

September 30, 2008 �

June 30, 2008 �

March 31, 2008 LOANS Allowance balance, beginning of

period $ 178,027 $ 177,155 $ 168,413 $ 117,120 $ 88,407 Allowance

for unfunded loan commitments and letters of credit (1,008 ) (625 )

5,437 1,136 (904 ) Provision for loan losses 78,000 43,000 43,000

85,000 55,000 Net Charge-offs: Real estate - single family 3,832

1,756 1,022 632 75 Real estate - multifamily 1,624 524 1,006 436 -

Real estate - commercial 2,790 750 663 (3 ) - Real estate - land

12,523 9,039 19,128 16,337 5,078 Real estate - residential

construction 16,347 17,127 13,557 15,726 8,565 Real estate -

commercial construction 1,977 - - - - Commercial 18,146 8,054 3,474

640 11,636 Trade finance 1,032 4,026 750 922 - Consumer � 1,298 � �

227 � � 95 � � 153 � � 29 � Total net charge-offs � 59,569 � �

41,503 � � 39,695 � � 34,843 � � 25,383 � Allowance balance, end of

period $ 195,450 � $ 178,027 � $ 177,155 � $ 168,413 � $ 117,120 �

�

UNFUNDED LOAN COMMITMENTS AND LETTERS OF CREDIT: Allowance

balance, beginning of period $ 6,341 $ 5,716 $ 11,153 $ 12,289 $

11,385 Provision for unfunded loan commitments and letters of

credit � 1,008 � � 625 � � (5,437 ) � (1,136 ) � 904 � Allowance

balance, end of period $ 7,349 � $ 6,341 � $ 5,716 � $ 11,153 � $

12,289 � GRAND TOTAL, END OF PERIOD $ 202,799 � $ 184,368 � $

182,871 � $ 179,566 � $ 129,409 � � Nonperforming assets to total

assets 2.42 % 2.12 % 1.71 % 1.64 % 0.63 % Allowance for loan losses

to total gross loans at end of period 2.42 % 2.16 % 2.14 % 1.95 %

1.32 % Allowance for loan losses and unfunded loan commitments to

total gross loans at end of period 2.51 % 2.23 % 2.21 % 2.07 % 1.46

% Allowance to nonaccrual loans at end of period 78.81 % 82.95 %

99.92 % 98.59 % 202.41 % Nonaccrual loans to total loans 3.08 %

2.60 % 2.14 % 1.97 % 0.65 % �

EAST WEST BANCORP, INC

TOTAL NON-PERFORMING ASSETS AS OF MARCH 31, 2009 (in

thousands) (unaudited) � � � � �

Total Nonaccrual

Loans

90+ Days

Delinquent

Under 90+

DaysDelinquent

TotalNonaccrual

Loans

Modified

orRestructuredLoans

REO Assets

TotalNon-PerformingAssets

�

Loan Type Real estate - single family $ 18,515 $ 634 $

19,149 $ 2,793 $

671

$

22,613

Real estate - multifamily 9,863 - 9,863 4,481

887

15,231

Real estate - commercial 12,465 42,724 55,189 3,270

4,240

62,699

Real estate - land 63,052 6,233 69,285 -

17,934

87,219

Real estate - residential construction 28,433 14,196 42,629 -

13,278

55,907

Real estate - commercial construction 28,604 - 28,604 - - 28,604

Commercial 16,798 5,000 21,798 6,602

1,236

29,636

Trade Finance 177 - 177 -

270

447

Consumer � 839 � � 482 � 1,321 � - � �

118

�

1,439

Total $ 178,746 $ 69,269

$ 248,015 $ 17,146 $

38,634 $ 303,795 �

EAST WEST BANCORP,

INC TOTAL NON-PERFORMING ASSETS AS OF DECEMBER 31, 2008

(in thousands) (unaudited) �

Total Nonaccrual

Loans

90+ Days

Delinquent

Under 90+

DaysDelinquent

TotalNonaccrual

Loans

Modified

orRestructuredLoans

REO Assets

TotalNon-PerformingAssets

�

Loan Type Real estate - single family $ 13,519 $ - $ 13,519

$ 1,201 $ 419 $ 15,139 Real estate - multifamily 11,845 - 11,845

3,519 1,136 16,500 Real estate - commercial 24,680 - 24,680 2,406

4,882 31,968 Real estate - land 66,185 12,892 79,077 - 10,307

89,384 Real estate - residential construction 27,052 8,766 35,818 -

21,146 56,964 Real estate - commercial construction 30,581 - 30,581

- - 30,581 Commercial 6,570 10,604 17,174 3,866 142 21,182 Trade

Finance 65 - 65 - 270 335 Consumer � 1,654 � 194 � 1,848 � - � - �

1,848

Total $ 182,151 $ 32,456

$ 214,607 $ 10,992 $

38,302 $ 263,901 EAST WEST BANCORP, INC

DELINQUENT LOANS BY LOAN CATEGORIES AS OF MARCH 31, 2009

(in thousands) (unaudited) � � �

Loan Type

30-59 Days

Delinquent

60-89 Days

Delinquent

90+ Days

Delinquent

Total Delinquent

Loans

Real estate - single family 31,105 $ 4,226 $ 18,515 $ 53,846 Real

estate - multifamily 17,310 2,585 9,863 29,758 Real estate -

commercial 68,964 25,929 12,465 107,358 Real estate - land 12,835

8,969 63,052 84,856 Real estate - residential construction 31,166

61,286 28,433 120,885 Real estate - commercial construction 19,512

4,545 28,604 52,661 Commercial 4,317 3,751 16,798 24,866 Trade

finance 4,123 4,468 177 8,768 Consumer � 613 � 110 � 839 � 1,562

Total Delinquent Loans $ 189,945 $ 115,869 $ 178,746 $

484,560 � � � �

EAST WEST BANCORP, INC DELINQUENT LOANS

BY LOAN CATEGORIES AS OF DECEMBER 31, 2008 (in

thousands) (unaudited) �

Loan Type

30-59 Days

Delinquent

60-89 Days

Delinquent

90+ Days

Delinquent

Total Delinquent

Loans

Real estate - single family 16,708 $ 6,237 $ 13,519 $ 36,464 Real

estate - multifamily 9,372 2,382 11,845 23,599 Real estate -

commercial 21,036 18,364 24,680 64,080 Real estate - land 9,335

19,002 66,185 94,522 Real estate - residential construction 13,242

9,379 27,052 49,673 Real estate - commercial construction - -

30,581 30,581 Commercial 3,970 13,918 6,570 24,458 Trade finance

374 - 65 439 Consumer � 1,326 � 252 � 1,654 � 3,232

Total

Delinquent Loans $ 75,363 $ 69,534 $ 182,151 $ 327,048

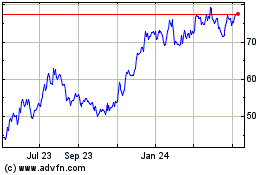

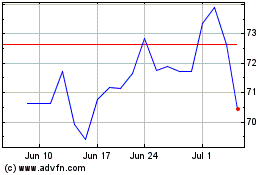

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2024 to Jul 2024

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2023 to Jul 2024