East West Bancorp Enters Into Definitive Agreement for the Acquisition of United National Bank

June 30 2005 - 8:00PM

PR Newswire (US)

East West Bancorp Enters Into Definitive Agreement for the

Acquisition of United National Bank SAN MARINO, Calif., June 30

/PRNewswire-FirstCall/ -- East West Bancorp, Inc. (NASDAQ:EWBC),

parent company of East West Bank, one of the nation's premier

community banks and a leading institution focused on the

Chinese-American and other niche markets, today announced that it

has entered into a definitive agreement for the acquisition of

United National Bank, a $970 million asset commercial bank

headquartered in San Marino, California. The acquisition will

further solidify East West Bank's position in the ethnic

Chinese-American market. United National Bank has a strong

franchise in this market, serving both small to mid sized

commercial enterprises, as well as an attractive base of core

retail customers. United National Bank operates 11 branches, with

eight located in Southern California, two in Northern California,

and one in Houston, Texas. Dominic Ng, Chairman, President and CEO

of East West Bank, commented, "The merger with United National Bank

is an excellent strategic opportunity for East West Bank to

significantly enhance our already strong positions in key markets

and increase value to our shareholders now and in the longer term.

This is an important collaboration for East West and we look

forward to strengthening our team with the integration of United

National Bank's officers and employees." "Just as significant as

the strong strategic fit for our institutions is the cultural fit,"

said Edward Lo, Chairman and CEO of United National Bank. "East

West Bank and United National Bank share comparable values,

operating philosophies and views of the future." Andy Yen,

President of United National Bank, said, "The increased scope and

scale will make the combined institution an even stronger industry

leader. We are very excited about going forward as a unified

institution with a strong financial position and strong balance in

our customers, people, industry markets and geographies." Under the

terms of the definitive agreement, the shareholder of United

National Bank will receive a value of 2.3 times closing book value,

subject to certain adjustments. The purchase price, if calculated

based on March 31 book value, would be approximately $164.7

million. Sixty to seventy percent of the price will be paid in

stock with the remainder in cash, at the election of the seller.

The transaction has been approved by the boards of directors of

both banks. The transaction, which is anticipated to close late in

the third quarter or in the fourth quarter of 2005, is subject to

customary closing conditions and receipt of required regulatory

approvals. The transaction will be marginally accretive to earnings

during 2005, since it is expected to close late in the year. The

estimated impact of the acquisition during 2006 is expected to be

approximately $0.08 per share. About East West East West Bancorp is

a publicly owned company, with $6.4 billion in assets, whose stock

is traded on the Nasdaq National Market under the symbol "EWBC".

The company's wholly owned subsidiary, East West Bank, is the

second largest independent commercial bank headquartered in Los

Angeles. East West Bank serves the community with 45 branch

locations throughout Los Angeles, Orange, San Francisco, Alameda,

Santa Clara, and San Mateo counties and a Beijing Representative

Office in China. It is also one of the largest financial

institutions in the nation focusing on the Chinese-American

community. For more information on East West Bancorp, visit the

company's website at http://www.eastwestbank.com/. Forward-Looking

Statements This release may contain forward-looking statements,

which are included in accordance with the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995 and

accordingly, the cautionary statements contained in East West

Bancorp's ("East West") Annual Report on Form 10-K for the year

ended Dec. 31, 2004 and other filings with the Securities and

Exchange Commission are incorporated herein by reference. These

factors include, but are not limited to: the effect of interest

rate and currency exchange fluctuations; competition in the

financial services market for both deposits and loans; East West's

ability to efficiently incorporate acquisitions into its

operations; the ability of East West and its subsidiaries to

increase its customer base; and regional and general economic

conditions. Actual results and performance in future periods may be

materially different from any future results or performance

suggested by the forward-looking statements in this release. Such

forward-looking statements speak only as of the date of this

release. East West expressly disclaims any obligation to update or

revise any forward-looking statements found herein to reflect any

changes in East West's expectations of results or any change in

events. For more information at the Company: Julia Gouw, Chief

Financial Officer (626) 583-3512 DATASOURCE: East West Bancorp,

Inc. CONTACT: Julia Gouw, Chief Financial Officer of East West

Bancorp, Inc., +1-626-583-3512 Web site:

http://www.eastwestbank.com/

Copyright

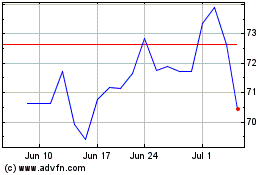

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2024 to Jul 2024

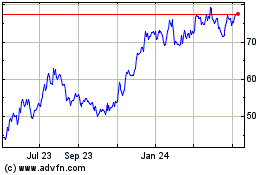

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2023 to Jul 2024