Stock Market News for December 28, 2011 - Market News

December 28 2011 - 4:06AM

Zacks

Markets opted to take a pause after

a recent rally, as mixed economic data and a session featuring

light volumes meant benchmarks ended Tuesday’s session on a flat

note. Given the Christmas overhang, consolidated volumes remained

substantively low, and final minutes’ movement took the Dow

slightly lower to end its winning run of four consecutive trading

days.

The Dow Jones Industrial Average

(DJIA) slipped 2.6 points or 0.02% to finish the day at 12,291.35.

The Standard & Poor 500 (S&P 500) also remained almost

unchanged at 1,265.43, gaining 0.01%. The Nasdaq Composite Index

was up 0.3% and finished yesterday’s trading session at 2,625.20.

The fear-gauge CBOE Volatility Index (VIX) went up 5.7% to settle

at 21.91. Consolidated volumes on the New York Stock Exchange

(NYSE), NYSE Amex and Nasdaq, were roughly 3.59 billion shares,

which were significantly lower than the year's daily average of

almost 7.9 billion shares. For 50% of the advancing stocks on the

NYSE, 47% of the stocks traded lower. The remaining stocks were

left unchanged.

Since last week, investors had been

receiving Christmas gifts in the form of encouraging economic data.

Housing and the jobs markets, two of the key elements of the

economy, posted strong data last week. The jobs market showed

significant strength, as data from U.S. Department of Labor

provided investors with a welcome reprieve after initial claims

dropped to a three and half year low.

However, a 9.3% rise in housing

starts and building permits shooting up to its highest level since

March 2010 were slightly offset by home sales data from the

National Association Realtors (NAR) released on Wednesday.

Additionally, data on revised home sale counts of 2007, according

to which existing home sales were 14.3% worse than previously

reported came as a disappointment to investors last week. Monday’s

markets were also guided by economic data, which included a joint

release by the U.S. Census Bureau and the Department of Housing and

Urban Development according to which new home sales had increased

more than the consensus estimate.

It was the S&P/Case-Shiller

Home Price Index data, which took the sheen away from markets’

initial modest gains, as it reported a drop in home price in 19 of

the 20 cities. The report stated: “Data through October 2011,

released today by S&P Indices for its S&P/Case-Shiller Home

Price Indices, the leading measure of U.S. home prices, showed

decreases of 1.1% and 1.2% for the 10- and 20-City Composites in

October vs. September. Nineteen of the 20 cities covered by the

indices also saw home prices decrease over the month. The 10- and

20-City Composites posted annual returns of -3.0% and -3.4% versus

October 2010, respectively”.

Since these are a group of indexes

that track changes in home prices throughout the United States;

this data holds immense value for investors. A drop in home prices,

as reflected through the S&P/Case-Shiller Home Price Index

naturally had an adverse impact on markets. The PHLX Housing Sector

(HGX) was down 0.1% and stocks like KB Home (NYSE:KBH), DR Horton

Inc. (NYSE:DHI), Beazer Homes USA Inc. (NYSE:BZH), Comstock

Homebuilding Companies Inc. (NASDAQ:CHCI), Lennar Corp. (NYSE:LEN)

dropped 2.6%, 0.8%, 2.1%, 1.3% and 0.4%, respectively.

Earlier, strong consumer confidence

data helped stocks register modest gains. Consumer data is another

key indicator of the economy’s health. Investors received a boost

after the Commerce Department reported that U.S. consumer

confidence had increased to 64.5 in December from 55.2 in November.

The figure was also well ahead of the consensus projection of 59.3.

In the report released by The Conference Board, Lynn Franco,

Director of The Conference Board Consumer Research Center, stated:

"After two months of considerable gains, the Consumer Confidence

Index is now back to levels seen last spring (April 2011, 66.0).

Consumers’ assessment of current business and labor market

conditions improved again. Looking ahead, consumers are more

optimistic that business conditions, employment prospects, and

their financial situations will continue to get better”.

However, major retail stocks could

not garner strong gains. While stocks like J. C. Penney Company,

Inc. (NYSE:JCP), Bon-Ton Stores Inc. (NASDAQ:BONT) and Saks

Incorporated (NYSE:SKS) slipped 1.1%, 3.3% and 1.1%, respectively,

others like Macy's, Inc. (NYSE:M), Target Corp. (NYSE:TGT),

Dillard's Inc. (NYSE:DDS) and Nordstrom Inc. (NYSE:JWN) only

managed gains of 0.3%, 0.8%, 2.5% and 0.5%, respectively.

BON-TON STORES (BONT): Free Stock Analysis Report

BEAZER HOMES (BZH): Free Stock Analysis Report

COMSTOCK HMBLDG (CHCI): Free Stock Analysis Report

DILLARDS INC-A (DDS): Free Stock Analysis Report

D R HORTON INC (DHI): Free Stock Analysis Report

PENNEY (JC) INC (JCP): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

LENNAR CORP -A (LEN): Free Stock Analysis Report

MACYS INC (M): Free Stock Analysis Report

SAKS INC (SKS): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

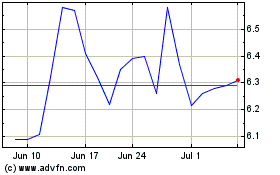

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From Apr 2024 to May 2024

Comstock Holding Companies (NASDAQ:CHCI)

Historical Stock Chart

From May 2023 to May 2024