false

0001277250

0001277250

2024-03-06

2024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 7, 2024 (March 6, 2024)

| |

CHARGE ENTERPRISES, INC.

|

|

| |

(Exact name of registrant as specified in its charter)

|

|

|

Delaware

|

|

001-41354

|

|

90-0471969

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

125 Park Avenue, 25th Floor

New York, NY

|

|

10017

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(212)921-2100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None*

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.0001

|

|

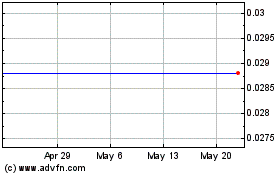

CRGE

|

|

*

|

* Charge Enterprises' securities began trading exclusively on the over-the-counter market on February 29, 2024.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter):

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, on February 27, 2024, Charge Enterprises, Inc. (sometimes referred to herein as “Company,” “we,” “us,” “our,” “Charge” or the “Debtor”) entered into a Restructuring and Plan Support Agreement (including all exhibits, annexes and schedules thereto, the “RSA”) with two affiliate entities of Arena Investors, LP (“Arena”) that are holders of, among other securities of the Company, the Company’s notes payable dated May 19, 2021 and December 17, 2021 (collectively, the “Notes”), which RSA provides for a comprehensive restructuring of the Debtor through a prepackaged plan of reorganization (the “Plan”) to be implemented through the commencement of the voluntary chapter 11 case (the “Chapter 11 Case”) by the Company in the U.S. Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) pursuant to chapter 11 (“Chapter 11”) of title 11 of the United States Code (the “Bankruptcy Code”) set forth below.

The information in Item 1.03 below under the heading “DIP Financing” is incorporated by reference into this Item 1.01.

Item 1.03. Bankruptcy or Receivership.

Chapter 11 Filing

On March 7, 2024, the Company filed a voluntary petition for relief under Chapter 11 in the Bankruptcy Court. Charge continues to operate its business as a “debtor-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. The Company sought approval of a variety of “first day” motions containing customary relief intended to assure the Debtor’s ability to continue its ordinary course operations, and a hearing on the first-day motions was held on March 8, 2024.

Orders granting all of the requested “first day” relief were entered on March 11, 2024, and, as to the first order, March 12, 2024. Included among the approved orders were:

| |

1.

|

an order approving debtor-in-possession financing and use of cash collateral on an interim basis (the “Interim DIP Order”) [Dkt. 59], described in more detail below;

|

| |

2.

|

an order (a) scheduling a hearing to seek approval of the Debtor’s combined disclosure statement (the “Disclosure Statement”) and the Plan (the Plan, together with the Disclosure Statement, the “Combined DS & Plan”), (b) establishing an objection deadline for the Combined DS & Plan, (c) approving solicitation and notice procedures for the Combined DS & Plan, (d) approving notice and objection procedures for executory contracts, and (e) addressing the requirements regarding the filing of the Debtor’s statements of assets and liabilities and schedules of financial affairs (the “Solicitation Procedures Order”) [Dkt. 58], described in more detail below;

|

| |

3.

|

an order establishing notification procedures and approving restrictions on certain transfers of, or worthless stock deductions with respect to, stock of the Debtor on an interim basis (the “Interim Stock Procedures Order”) [Dkt. 54], described in more detail below;

|

| |

4.

|

an order authorizing the Debtor to pay certain claims of trade creditors [Dkt. 51];

|

| |

5.

|

an order authorizing the Debtor to pay outstanding pre-petition employee obligations and continue employee benefit programs [Dkt. 53];

|

| |

6.

|

an order allowing the Debtor to continue to use its existing bank accounts and cash management system [Dkt. 55];

|

| |

7.

|

an order authorizing the Debtor to redact certain personally identifiable information and modifying certain notice requirements related to equity security holders [Dkt. 52] (the “Notice Procedures Order”); and

|

| |

8.

|

an order approving Epiq Corporate Restructuring, LLC (“Epiq”) as the Claims and Noticing Agent, including maintaining the publicly-available website for the Bankruptcy Case available at: https://dm.epiq11.com/case/charge-enterprises/info [Dkt. 50]. The documents and other information available via website or elsewhere are not part of this Form 8-K and shall not be deemed incorporated herein.

|

DIP Financing

Pursuant to the Interim DIP Order (the “Interim DIP Order”), formally titled the Interim Order (A) Authorizing the Debtor to (I) Use Cash Collateral, (II) Obtain Senior Secured Superpriority Postpetition Financing and Granting Liens and Superpriority Administrative Claims, and (III) Provide Adequate Protection; (B) Scheduling a Final Hearing; and (C) Granting Related Relief, the Company and AI Amped I, LLC, an affiliate of Arena (the “DIP Lender”) have agreed to enter into a multiple-draw secured term loan credit facility in an maximum principal amount of up to $10.0 million (or such greater amount as approved by the DIP Lender in its sole discretion) subject to the terms and conditions set forth in a term sheet executed by the Debtor and the DIP Lender. Per the Interim DIP Order, and subject to entry of a final order approving the DIP Facility and the execution of definitive documentation, the Company anticipates it will have sufficient capital to continue operations through the conclusion of the Chapter 11 Case.

The foregoing summary of the Interim DIP Order and the DIP Term Sheet does not purport to be complete and is qualified in its entirety by reference to the Interim DIP Order, including the DIP Term Sheet as Exhibit 1 thereto, which is filed as Exhibit 10.1 to this Form 8-K and incorporated herein by reference.

Solicitation Procedures Order

Under the Solicitation Procedures Order, formally titled the Order (I) Scheduling a Combined Disclosure Statement Approval and Plan Confirmation Hearing, (II) Establishing a Plan and Disclosure Statement Objection Deadline and Related Procedures, (III) Approving Solicitation and Related Procedures, (IV) Approving the Notice Procedures, (V) Approving Notice and Objection Procedures for the Assumption Assignment, and Rejection of Executory Contracts and Unexpired Leases, and (VI) Extending the Time and, Upon Confirmation, Waiving the Requirements that Statements and Schedules be Filed and a Creditors’ Meeting be Convened, the Bankruptcy Court will hold a hearing on April 23, 2024 at 1:00 p.m. (prevailing Eastern Time) to consider, among other things, the adequacy and confirmation of the Combined DS & Plan. Any objections to the Combined DS & Plan must:

| |

●

|

comply with the Bankruptcy Rules and the Local Rules;

|

| |

●

|

state the name and address of the objecting party and the amount and nature of the Claim or Interest beneficially owned by such entity (as each such term is defined by the Bankruptcy Code);

|

| |

●

|

state with particularity the legal and factual basis for such objections, and, if practicable, a proposed modification to the Combined D.S. and Plan that would resolve such objection; and

|

| |

●

|

be filed with the Bankruptcy Court with proof of service thereof and served so as to be actually received no later than 4:00 p.m. (prevailing Eastern Time) on April 12, 2024, by (i) proposed counsel to the Debtor, Faegre Drinker Biddle & Reath LLP, 222 Delaware Ave., Suite 1410, Wilmington, DE 19801, Attn: Patrick Jackson (patrick.jackson@faegredrinker.com), Ian Bambrick (ian.bambrick@faegredrinker.com) and Sarah Silveira (sarah.silveira@faegredrinker.com); (ii) counsel to any official committee of unsecured creditors appointed in this Chapter 11 Case; (iii) the Office of the United States Trustee for the District of Delaware, J. Caleb Boggs Federal Building, 844 King Street, Suite 2207, Lockbox 35, Wilmington, DE 19801, Attn: Rosa Sierra-Fox, Esq. (rosa.sierra-fox@usdoj.gov); and (iv) counsel to the DIP Lender, White & Case LLP, 1221 Avenue of the Americas, New York, New York 10020, Attn: Harrison Denman (harrison.denman@whitecase.com), Laura Garr (laura.garr@whitecase.com), and Trudy Smith (trudy.smith@whitecase.com), and Richards, Layton & Finger, P.A., 920 N. King Street | Wilmington, DE 19801, Attn: Paul N. Heath (heath@rlf.com) and Amanda R. Steele (steele@rlf.com).

|

The foregoing summary of the Solicitation Procedures Order does not purport to be complete and is qualified in its entirety by reference to the Solicitation Procedures Order, which is furnished as Exhibit 99.1 to this Form 8-K.

Additional information is set forth in the Notice of (A) Commencement of Prepackaged Chapter 11 Bankruptcy Cases, (B) Combined Hearing on the Debtor’s Combined Disclosure Statement and Prepackaged Chapter 11 Plan of Reorganization, and Related Matters, (C) Assumption of Executory Contracts and Unexpired Leases and Cure Costs, (D) Objection Deadlines, and (E) Summary of the Plan of Reorganization (the “Combined Hearing Notice”). The Combined Hearing Notice is furnished as Exhibit 99.2 to this Form 8-K.

Interim Stock Procedures Order

Under the Interim Stock Procedures Order, formally titled the Interim Order (I) Establishing Notification Procedures and Approving Restrictions on Certain Transfers of Shares of, or Worthless Stock Deductions with Respect to, Stock of the Debtor and (II) Granting Related Relief, the Bankruptcy Court established procedures surrounding certain transfers of common stock of the Debtor and restricting the ability of certain shareholders to take worthless stock deductions on their income tax returns with respect to their shares in the Debtor. Under the Interim Stock Procedures Order, any purchase, sale, or other transfer of, or claim of worthlessness with respect to, the common stock of the Debtor in violation of the procedures set forth therein will be null and void. All registered holders of common stock of the Debtor have been served with a copy of the Combined Hearing Notice as required by the Interim Stock Procedures Order. For a full description of these procedures, a copy of the Interim Stock Procedures Order, as well as all other orders entered in the Chapter 11 Case including the Interim DIP Order and the Solicitation Procedures Order, is available free of charge on the Debtor’s restructuring website at https://dm.epiq11.com/ChargeEnterprises, via PACER on the Court’s website at https://ecf.deb.uscourts.gov for a fee, or may be obtained upon request of the Debtor’s proposed counsel by contacting Cathy Greer, paralegal, at 302-467-4216 or cathy.greer@faegredrinker.com). The documents and other information available via website or elsewhere are not part of this Form 8-K and shall not be deemed incorporated herein.

The foregoing summary of the Interim Stock Procedures Order does not purport to be complete and is qualified in its entirety by reference to the Interim Stock Procedures Order, which is furnished as Exhibit 99.3 to this Form 8-K.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.03 below under the heading “DIP Financing” is incorporated by reference into this Item 2.03.

Item 2.04. Triggering Events that Accelerate or Increase a Direct Financial Obligation or and Obligation under an Off-Balance Sheet Arrangement

As previously disclosed, Charge received a foreclosure notice from an affiliate of Arena related to the Notes. In connection with the entry into RSA, Arena suspended further foreclosure efforts. In addition, any efforts to enforce the payment obligations under the Notes, including the commencement of the auction sale, are automatically stayed as a result of the commencement of the Chapter 11 Case described in Item 1.03 above, and the lenders’ rights of enforcement in respect of the Notes are subject to the applicable provisions of the Bankruptcy Code.

The commencement of the Chapter 11 Case may also constitute a cross-default under certain other of the Company’s debt instruments and agreements that contain cross-default provisions, including the Loan Agreement dated October 21, 2022, by and between the Company’s wholly-owned subsidiaries, Nextridge, Inc. and ANS Advanced Network Services, Inc. and Pioneer Bank (the “ANS Facility”) and the Business Loan Agreement dated June 19, 2007 by and between B W Electrical Services LLC and Provident Bank, as amended (the “BW Facility”). There are currently no amounts outstanding under the ANS Facility or the BW Facility.

Item 7.01. Regulation FD Disclosure

Disclosure Statement

Pursuant to the RSA, the Company commenced and concluded the solicitation of votes on the Plan (the “Solicitation”) on March 6, 2024. In connection with the Solicitation, the Combined Plan & DS has been distributed to certain creditors of the Company that are entitled to vote under the Plan, a copy of which is furnished as Exhibit 99.4 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference. This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor a solicitation of consents from any holders of securities, nor shall there be any sale of securities or solicitation of consents in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Any solicitation or offer will only be made pursuant to the Combined DS & Plan and only to such persons and in such jurisdictions as is permitted under applicable law.

The Plan

As detailed in the Combined DS & Plan filed with the Bankruptcy Court, the Plan effects a balance-sheet restructuring of the Debtor by cancelling all existing preferred and common stock in the Debtor and converting funded secured debt of the Debtor into new common stock of the post-effective date Debtor, while providing for payment in full of all administrative, priority (if any), secured (if any), and general unsecured (i.e., non-subordinated) claims against the Debtor that have been allowed pursuant to the Plan or under the Bankruptcy Code.

Pursuant to the Plan, the Debtor must timely file its Schedule E/F, which will alert creditors whether and in what amount the Debtor has scheduled their claims, and whether such claims are scheduled as contingent, unliquidated, or disputed so as to provide creditors with the information necessary for such creditor to determine whether it wants to file a proof of claim form by the applicable bar date under the Plan.

Once the Plan has gone effective, and except as explicitly provided for in the Plan, the Debtor will be discharged of all claims and all interests of the Debtor will be terminated.

Additional Information on the Chapter 11 Case

Court filings and information about the Chapter 11 Case, including the as-entered orders, can be found at a website maintained by the Debtors’ claims agent, Epiq, at htpps://dm.epiq11.com/ChargeEnterprises. The documents and other information available via website or elsewhere are not part of this Form 8-K and shall not be deemed incorporated herein.

The information contained in this Item 7.01, including Exhibit 99.4, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 8.01 Other Events

In accordance with the Notice Procedures Order and the Interim Stock Procedures Order referred to in Item 1.03, on March [12], 2024, the Company filed this report to publicly furnish notice of the commencement of the Chapter 11 Case and notice of the entry of the Interim Stock Procedures Order, a description of the relief granted therein, and an explanation as to how interested parties may receive a copy of the Interim Stock Procedures Order.

Cautionary Note Regarding the Company’s Securities

The Company cautions that trading in its securities, including the Common Stock, during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 Cases. In particular, the Company expects that its stockholders could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 Cases.

Notice Regarding Forward-Looking Information

This report contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect current expectations or beliefs regarding future events or Charge's future performance. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", “potential”, "continues", "forecasts", "projects", "predicts", "intends", "anticipates", "targets" or "believes", or variations of, or the negatives of, such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. All forward-looking statements, including those herein, are qualified by this cautionary statement. Although Charge believes that the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements involve risks and uncertainties, and actual results may differ materially from any future results expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the ability to confirm and consummate a plan of reorganization in accordance with the terms of the RSA; the bankruptcy process, the Company’s ability to obtain approval from the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 Case; the effects of the Chapter 11 Case on the liquidity, results of operations and business of the Company and its subsidiaries; the possibility and timing of a foreclosure auction of Company assets; the Company’s ability to negotiate with its secured lenders or enter into agreements for strategic alternatives; the Company’s ability to continue as a going concern during the Chapter 11 Case and going forward, the potential for governmental investigations and inquiries, regulatory actions and lawsuits; and other risks discussed in Charge’s filings with the U.S. Securities and Exchange Commission ("SEC"). Readers are cautioned that the foregoing list of risks and uncertainties is not exhaustive of the factors that may affect forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this report speak only as of the date of this press release or as of the date or dates specified in such statements. For more information on us, investors are encouraged to review our public filings with the SEC, including the factors described in the section captioned “Risk Factors” of Charge’s Annual Report on Form 10-K filed with the SEC on March 15, 2023, and subsequent reports we file from time to time with the SEC, including Charge’s Quarterly Report on Form 10-Q filed with the SEC on November 8, 2023, which are available on the SEC's website at www.sec.gov. Charge disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this Form 8-K to be signed on its behalf by the undersigned duly authorized.

Dated: March 12, 2024

| |

CHARGE ENTERPRISES, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Leah Schweller

|

|

| |

|

Leah Schweller

Chief Financial Officer

|

|

Exhibit 10.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

|

In re:

CHARGE ENTERPRISE, INC.

Debtor.

|

)

)

)

)

)

)

)

|

Chapter 11

Case No. 24-10349 (TMH)

|

INTERIM ORDER PURSUANT TO

SECTIONS 105, 361, 362, 363, AND 364 OF THE BANKRUPTCY

CODE AND RULES 2002, 4001, 6004 AND 9014 OF THE FEDERAL RULES

OF BANKRUPTCY PROCEDURE (A) AUTHORIZING THE DEBTOR TO (I) USE

CASH COLLATERAL, (II) OBTAIN SENIOR SECURED SUPERPRIORITY

POSTPETITION FINANCING AND GRANTING LIENS AND SUPERPRIORITY

ADMINISTRATIVE CLAIMS, AND (III) PROVIDE ADEQUATE PROTECTION,

(B) SCHEDULING A FINAL HEARING, AND (C) GRANTING RELATED RELIEF

Upon the motion, dated March 7, 2024 (the “Motion”) of Charge Enterprises, Inc., as debtor and debtor in possession (the “Debtor” or “Borrower”) in the above-captioned chapter 11 case (the “Chapter 11 Case”), for the entry of an order pursuant to sections 105, 361, 362, 363, and 364 of title 11 of the United States Code (as amended, the “Bankruptcy Code”), rules 2002, 4001, 6004, and 9014 of the Federal Rules of Bankruptcy Procedure (as amended, the “Bankruptcy Rules”) and rules 2002-1, 4001-2, 9006-1, and 9013-1 of the Local Rules of Bankruptcy Practice and Procedure for the District of Delaware (the “Local Rules”) (A) authorizing the Debtor to (I) use cash collateral, (II) obtain senior secured superpriority postpetition financing and granting liens and superpriority administrative expenses claims and, and (III) provide adequate protection, (B) scheduling interim and final hearings, and (C) granting related relief, the Debtor sought, among other things, the following relief:

(i) the Court’s authorization, pursuant to sections 363 and 364(c)(1), (2), (3), and (d)(1) of the Bankruptcy Code, for the Debtor (in such capacity, the “DIP Borrower”) to obtain a senior secured superpriority debtor-in-possession financing facility (the “DIP Facility”) consisting of a multiple-draw senior secured priming term loan facility pursuant to the terms herein, the terms and conditions set forth in the term sheet attached hereto as Exhibit 1 (as may be amended, restated, supplemented or otherwise modified from time to time, in each case with the consent of the DIP Lender (as defined below), the “DIP Term Sheet”), and, if and when applicable in accordance with the DIP Term Sheet, a credit agreement governing the DIP Facility on the terms and conditions set forth in the DIP Term Sheet and as otherwise agreed to by the Debtor and DIP Secured Parties (as defined below) (the “DIP Credit Agreement” and, collectively with this order, this “Interim Order”, the Final Order (as defined below), the DIP Budget (as defined below), and all other agreements, documents, and instruments delivered or executed in connection therewith to the extent that the DIP Agent (as defined below) and the DIP Lenders determine there is a need for such other agreements, documents, and instruments, in each case as amended, restated, supplemented, or otherwise modified from time to time, the “DIP Loan Documents”) provided by AI Amped I, LLC (as successor and assignee, “Amped I”), as administrative agent and collateral agent (collectively, in such capacities, together with any successor administrative agents and collateral agents, the “DIP Agent”), and as a lender (in such capacity, together with any successors and assigns permitted under the DIP Loan Documents, the “DIP Lender” and, together with the DIP Agent, the “DIP Secured Parties”), which DIP Facility shall be available, subject to the terms and conditions set forth in this Interim Order and the other DIP Loan Documents, (1) during the period (the “Interim Period”) from the date hereof through and including the earlier to occur of (x) the date of entry of the Final Order by this Court and (y) the Termination Date (as defined below) in a single draw in an aggregate principal amount not to exceed $4,000,000 (the “Initial DIP Loan”) and (2) with the remaining amount to be drawn in subsequent draws upon or after entry of the Final Order (the “Subsequent DIP Loans”), in an aggregate principal amount not to exceed $10,000,000 (less the aggregate principal amount drawn with respect to the Initial DIP Loan), provided that the Borrower may not borrow less than $500,000 in any individual subsequent borrowing, and no Subsequent DIP Loan shall be requested or made within three (3) business days of a prior Subsequent DIP Loan (the Initial DIP Loan and each Subsequent DIP Loan, collectively, the “DIP Loans”);

(ii) the Court’s authorization for the Debtor to execute, deliver, and perform, as applicable, under the DIP Term Sheet and all other DIP Loan Documents, and to perform such other and further acts as may be necessary or appropriate in connection therewith;

(iii) the Court’s authorization for the Debtor to use proceeds of the DIP Loans solely in accordance with the budget and cash flow forecast prepared by the Debtor and annexed hereto as Exhibit 2 (as updated from time to time in accordance with the terms of the DIP Term Sheet and the other DIP Loan Documents, subject to the prior approval of the DIP Lender in its sole discretion, the “DIP Budget”), subject to the variances permitted under the DIP Term Sheet and as otherwise provided herein and in the other DIP Loan Documents;

(iv) the Court’s authorization to grant to the DIP Agent, for the benefit of the DIP Secured Parties, in respect of the DIP Obligations (as defined below), a superpriority administrative claim pursuant to section 364(c)(1) of the Bankruptcy Code and first priority priming liens on and security interests in substantially all assets and property of the Debtor (now owned or hereafter acquired) pursuant to sections 364(c)(2), (c)(3), and (d)(1) of the Bankruptcy Code, in each case as and to the extent, set forth more fully below and in the DIP Loan Documents (including the DIP Term Sheet);

(v) the Court’s authorization for the Debtor to use “cash collateral” as such term is defined in section 363 of the Bankruptcy Code in which the Prepetition Secured Parties (as defined below) or the DIP Secured Parties has an interest (the “Cash Collateral”) solely in accordance with the DIP Budget and the DIP Term Sheet, subject to the variances permitted under the DIP Term Sheet;

(vi) the Court’s authorization to grant, as of the Petition Date, adequate protection for the benefit of the Prepetition Secured Parties, as set forth more fully below, including the Adequate Protection Superpriority Claim, Adequate Protection Liens, and Adequate Protection Payments (each as defined below), to the extent of and as compensation for any Diminution in Value (as defined below), the payment of fees and expenses of the Prepetition Agent (as defined below) and the Prepetition Secured Parties;

(vii) the modification or waiver by the Court of the automatic stay imposed by section 362 of the Bankruptcy Code and any other applicable stay (including Bankruptcy Rule 6004) to the extent necessary to implement and effectuate the terms and provisions of the DIP Facility and this Interim Order and the other DIP Loan Documents, and to provide for the immediate effectiveness of this Interim Order;

(viii) the scheduling by the Court of an interim hearing (the “Interim Hearing”) to consider entry of this Interim Order;

(ix) the scheduling by the Court of a final hearing (the “Final Hearing”) to consider entry of an order (the “Final Order”) granting the relief requested in the Motion on a final basis and approving the form of notice with respect to the Final Hearing and the transactions contemplated by the Motion; and

(x) approval of the Final Order.

The Court having considered the Motion, the terms of the DIP Facility and the DIP Loan Documents (including the DIP Term Sheet), the Declaration of Craig Harper-Denson in Support of Debtor’s Chapter 11 Petition and First Day Motions and Applications, the Karotkin Declaration, and the evidence submitted at the Interim Hearing held before this Court on March 8, 2024, to consider entry of this Interim Order; and it appearing that approval of the interim relief requested in the Motion is necessary to avoid immediate and irreparable harm to the Debtor pending the Final Hearing and is otherwise fair and reasonable and in the best interests of the Debtor, its creditors, and its estate, and essential for the continued operation of the Debtor’s business; and all objections, if any, to the entry of this Interim Order having been withdrawn, resolved, or overruled by the Court; and after due deliberation and consideration, and for good and sufficient cause appearing therefor:

THE COURT HEREBY MAKES THE FOLLOWING FINDINGS OF FACT AND CONCLUSIONS OF LAW:

A. Petition Date. On March 7, 2024, (the “Petition Date”), the Debtor filed voluntary petitions under Chapter 11 of the Bankruptcy Code with the United States Bankruptcy Court for the District of Delaware (the “Court”). The Debtor has continued in the management and operation of its business and property as a debtor in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. No trustee or examiner has been appointed in the Chapter 11 Case.

B. Jurisdiction and Venue. The Court has jurisdiction over this proceeding, pursuant to 28 U.S.C. §§ 157 and 1334 and the Amended Standing Order of Reference dated February 29, 2012, from the United States District Court for the District of Delaware. Consideration of the Motion constitutes a core proceeding under 28 U.S.C. § 157(b)(2), and the Court may enter a final order consistent with Article III of the United States Constitution. Venue for the Chapter 11 Case and the proceeding on the Motion is proper in this district pursuant to 28 U.S.C. §§ 1408 and 1409.

C. Committee Formation. As of the date hereof, no official committee of unsecured creditors has been appointed in the Chapter 11 Case pursuant to section 1102 of the Bankruptcy Code (a “Committee”).

D. Notice. The Interim Hearing was held pursuant to Bankruptcy Rule 4001(b)(2) and (c)(2). Notice per the Local Rules of the Interim Hearing and the relief requested in the Motion has been provided to (a) the Office of the United States Trustee for the District of Delaware (the “U.S. Trustee”), (b) counsel to the Prepetition Secured Parties and DIP Secured Parties, (c) all other parties asserting a lien on or a security interest in the assets of the Debtor to the extent reasonably known to the Debtor, (d) the Office of the United States Attorney General for the State of Delaware, (e) the Internal Revenue Service, (f) those creditors holding the 30 largest unsecured claims against the Debtor’s estate (excluding insiders), (g) the Securities and Exchange Commission, and (h) all parties who have filed a notice of appearance and request for service of papers pursuant to Bankruptcy Rule 2002 (the “Notice Parties”). Under the circumstances, such notice of the Interim Hearing and the relief requested in the Motion is appropriate notice and complies with section 102(1) of the Bankruptcy Code, Bankruptcy Rules 2002 and 4001(b) and (c), and the Local Rules.

E. Prepetition Indebtedness.

(i) Prepetition Notes. The Borrower, as Issuer, is a party to the following:

| |

(a)

|

that certain Securities Purchase Agreement dated as of May 8, 2020 (as amended, modified, supplemented, and restated prior to the date hereof, the “May 2020 SPA”) pursuant to which the Debtor (f/k/a GoIP Global, Inc.) agreed to issue, among other things, certain Original Issue Discount Senior Secured Convertible Promissory Notes due May 8, 2023 (the “May 2020 Convertible Notes”) to AI Amped II, LLC (as successor and assignee, “AI Amped II” and, collectively with AI Amped I and the Prepetition Agent (as defined below), the “Prepetition Secured Parties”) in the amounts and manner set forth in the May 2020 SPA;

|

| |

(b)

|

that certain Securities Purchase Agreement dated as of November 3, 2020 (as amended, modified, supplemented, and restated prior to the date hereof, the “November SPA”) pursuant to which the Debtor (f/k/a Transworld Holdings, Inc.) agreed to issue, among other things, certain Original Issue Discount Senior Secured Convertible Promissory Notes due November 3, 2023 (the “November Notes”) to AI Amped II in the amounts and manner set forth in the November SPA;

|

| |

(c)

|

that certain Securities Purchase Agreement dated as of May 19, 2021 (as amended, modified, supplemented, and restated prior to the date hereof, the “May 2021 SPA”) pursuant to which the Debtor issued that certain Original Issue Discount Senior Secured Non-Convertible Promissory Notes due November 19, 2023 (the “May 2021 Non-Convertible Notes”) to AI Amped I and Original Issue Discount Senior Secured Convertible Promissory Notes due May 19, 2024, to AI Amped II (the “May 2021 Convertible Notes” and, together with the May 2020 Convertible Notes and November Notes, the “Prepetition Convertible Notes”) in the amounts and manner set forth in the May 2021 SPA;

|

| |

(d)

|

that certain Securities Purchase Agreement dated as of December 17, 2021 (as amended, modified, supplemented, and restated prior to the date hereof, the “December SPA,” and together with the May 2020 SPA, the November SPA, and the May 2021 SPA, the “Prepetition Securities Purchase Agreements”) pursuant to which the Debtor agreed to issue (1) certain Original Issue Discount Senior Secured Non-Convertible Promissory Notes due November 19, 2023, (the “December Non-Convertible Notes” and together with the May 2021 Non-Convertible Notes, the “Prepetition Non-Convertible Notes” and, collectively with the Convertible Notes, the “Prepetition Notes”) to AI Amped I and (2) 2,370,370 shares of Series C preferred stock and warrants to purchase the Debtor’s common stock in the amounts and manner set forth in the December SPA;

|

| |

(e)

|

that certain Exchange Agreement dated as of June 30, 2022 (as amended, modified, supplemented, and restated prior to the date hereof, the “Prepetition Exchange Agreement”); and

|

| |

(f)

|

that certain Security Agreement dated as of December 17, 2021 (as amended, modified, and supplemented from time to time, the “Security Agreement” and, together with the Prepetition Securities Purchase Agreements, Prepetition Exchange Agreement, the Prepetition Notes, and all other agreements, documents, and instruments executed or delivered in connection therewith, including, without limitation, all notes, guarantees, mortgages, Uniform Commercial Code financing statements, and fee letters, each as may be amended, restated, supplemented or otherwise modified prior to the Petition Date, collectively, the “Prepetition Notes Documents”) pursuant to which the Debtor and certain of its direct and indirect subsidiaries granted to AI Amped I (in its capacity as agent, the “Prepetition Agent”), on behalf of the Prepetition Secured Parties, a security interest in and lien (the “Prepetition Liens”) on all Prepetition Collateral (as defined below) to secure the prompt payment, performance, and discharge in full of all of the Debtor’s Prepetition Obligations (as defined below) under the Prepetition Notes Documents.

|

(ii) Certain direct and indirect subsidiaries of the Debtor are guarantors under that certain Guaranty Agreement dated as of December 17, 2021, (as amended, modified, and supplemented from time to time) (collectively, the “Prepetition Notes Guarantors”) and have guaranteed as co-obligors the prompt payment of all outstanding amounts (including without limitation all costs and expenses, principal, premiums, and interest) owed to the Prepetition Secured Parties under the Prepetition Notes.

F. Stipulations as to Prepetition Obligations. Without limiting the rights of any party in interest as and to the extent set forth in paragraph 11 hereof, after consultation with its attorneys, the Debtor permanently, immediately, and irrevocably acknowledges, represents, stipulates, and agrees with the provisions set forth in this paragraph F, the “Stipulations”:

(i) Prepetition Obligations. As of the Petition Date, the Debtor is indebted and liable to the Prepetition Secured Parties under the Prepetition Notes Documents, without objection, defense, counterclaim, or offset of any kind, in the aggregate amount of not less than $51,000,000.00 with respect to the Prepetition Notes (on account of principal and certain accrued and unpaid prepetition interest, fees and damages), plus accrued and accruing (both before and after the Petition Date) and unpaid interest (including at the default rate), interest late fees, liquidated damages, other fees and expenses, and all other obligations under the Prepetition Notes Documents, including any and all attorneys’, accountants’, consultants’, appraisers’ and financial and other advisors’ fees that are chargeable or reimbursable under the Prepetition Notes Documents (collectively, the “Prepetition Obligations”).

(ii) Enforceability, Etc. of the Prepetition Obligations. The Prepetition Notes Documents and the Prepetition Obligations are (a) legal, valid, binding, and enforceable against the Debtor and (b) not subject to any contest, attack, objection, recoupment, defense, counterclaim, offset, subordination, re-characterization, avoidance, or other claim, cause of action, or other challenge of any kind or nature under the Bankruptcy Code, under applicable non-bankruptcy law or otherwise.

(iii) Validity, Perfection, and Priority of the Prepetition Liens. The Prepetition Liens granted by the Debtor under the Prepetition Notes Documents to the Prepetition Agent for the benefit of the Prepetition Secured Parties as security for the Prepetition Obligations encumber all Collateral (as defined in the Security Agreement), which includes substantially all assets of the Debtor, including but not limited to all personal property of the Debtor of every kind and nature, wherever located, including goods, instruments, documents, accounts, chattel paper, deposit accounts, letter-of-credit rights, commercial tort claims, securities and other investment property, intellectual property, computer software, intercompany obligations, general intangibles, supporting obligations and all proceeds thereof (collectively, the “Prepetition Collateral”). The Prepetition Liens on the Prepetition Collateral have been properly recorded and perfected under applicable law and are legal, valid, binding, enforceable, non-avoidable, and not subject to contest, avoidance, attack, offset, recharacterization, subordination, or other challenge of any kind or nature under the Bankruptcy Code, under applicable nonbankruptcy law, or otherwise, and were granted to or for the benefit of the Prepetition Secured Parties for fair consideration and reasonably equivalent value. As of the Petition Date, (a) the Prepetition Liens are senior in priority over any and all other liens on the Prepetition Collateral, subject only to any liens that were permitted under the Prepetition Securities Purchase Agreements, which, as of the Petition Date, were senior to the Prepetition Liens (solely to the extent any such Prepetition Permitted Liens were (i) valid, properly perfected, and non-avoidable as of the Petition Date or (ii) perfected after the Petition Date solely to the extent permitted by section 546(b) of the Bankruptcy Code), (b) the Prepetition Obligations constitute legal, valid, binding, and non-avoidable obligations of the Debtor enforceable in accordance with the terms of the Prepetition Notes Documents, (c) no offsets, recoupments, challenges, objections, defenses, claims, or counterclaims of any kind or nature to any of the Prepetition Liens or Prepetition Obligations exist, and no portion of the Prepetition Liens or Prepetition Obligations is subject to any challenge or defense including avoidance, disallowance, disgorgement, recharacterization, or subordination (equitable or otherwise) pursuant to the Bankruptcy Code or any other applicable law, and (d) the Debtor and its estate have no claims, objections, challenges, causes of action, and/or choses in action, including avoidance claims under Chapter 5 of the Bankruptcy Code or applicable state law equivalents or actions for recovery or disgorgement, against any of the Prepetition Secured Parties or any of its respective affiliates, agents, attorneys, advisors, professionals, officers, directors, and employees arising out of, based upon, or related to the Prepetition Notes Documents, (e) the Debtor has waived, discharged, and released any right to challenge any of the Prepetition Obligations, the priority of the Debtor’s obligations thereunder, and the validity, extent, perfection, and priority of the liens securing the Prepetition Obligations, and (f) the Prepetition Obligations constitute allowed, secured claims within the meaning of sections 502 and 506 of the Bankruptcy Code.

(iv) Indemnity. The Prepetition Secured Parties and the DIP Secured Parties and their Related Parties (as defined below) have acted in good faith and without negligence, misconduct, or violation of public policy or law, in respect of all actions taken by them in connection with or related in any way to negotiating, implementing, documenting, or obtaining requisite approvals of the DIP Facility and the use of Cash Collateral, including in respect of the granting of the DIP Liens, the DIP Superpriority Claim, the Adequate Protection Liens, the Adequate Protection Superpriority Claim (each as defined below), and any of the other rights, privileges, remedies, and protections granted hereunder or under the DIP Loan Documents (including the DIP Term Sheet), any challenges or objections to the DIP Facility or the use of Cash Collateral, and all documents related to and all transactions contemplated by the foregoing. Accordingly, without limitation to any other right to indemnification (including any and all rights of the Prepetition Secured Parties to indemnification under the Prepetition Notes Documents), the DIP Secured Parties and, subject to paragraph 11 hereof, the Prepetition Secured Parties and each of their respective affiliates, officers, directors, fiduciaries, employees, agents, advisors, attorneys, successors, predecessors, assignors, assignees, funds, and representatives, in each case solely in their capacities as such (collectively, the “Related Parties”) shall be and hereby are indemnified and held harmless by the Debtor in respect of any claim or liability incurred in respect thereof or in any way related thereto. No exception or defense in contract, law, or equity exists as to any obligation set forth, as the case may be, in this paragraph F(iv), in the Prepetition Notes Documents, or in the DIP Term Sheet, to indemnify and/or hold harmless any Prepetition Secured Party, DIP Secured Party, and any Related Party, as the case may be, and any such defenses are hereby waived.

(v) No Control. None of the DIP Secured Parties or Prepetition Secured Parties are control persons or insiders of the Debtor or any of its affiliates by virtue of any of the actions taken with respect to, in connection with, related to, or arising from the DIP Facility, the DIP Loan Documents (including the DIP Term Sheet), and/or the Prepetition Notes Documents.

(vi) No Claims, Causes of Action. As of the date hereof, there exist no claims or causes of action against any of the Prepetition Secured Parties, the DIP Secured Parties, or their Related Parties with respect to, in connection with, related to, or arising from the Prepetition Notes Documents and/or the DIP Loan Documents (including the DIP Term Sheet) that may be asserted by the Debtor or any other person or entity.

(vii) Cash Collateral. Any and all of the Debtor’s cash, whether existing as of the Petition Date or thereafter, wherever located (including, without limitation, all cash or cash equivalents in the control of or on deposit or maintained by the Debtor in any account or accounts, any amounts generated by the sale or other disposition of Prepetition Collateral, and all income, proceeds, products, rents or profits of any Prepetition Collateral), constitutes Cash Collateral of the Prepetition Secured Parties.

(viii) Default. The Debtor is in default under the Prepetition Notes Documents, including as a result of the Chapter 11 Case, and an event of default has occurred under the Prepetition Note Documents.

(ix) Release. Effective as of the date of entry of this Interim Order, the Debtor and its estate hereby forever and irrevocably release and discharge all former, current and future (a) DIP Secured Parties, (b) Prepetition Secured Parties (subject to paragraph 11 hereof), (c) the Related Parties, (d) affiliates of the DIP Secured Parties and Prepetition Secured Parties, and (e) officers, employees, directors, agents, representatives, owners, members, partners, financial and other advisors and consultants, legal advisors, shareholders, managers, accountants, attorneys, investment committee members, sub advisors and predecessors and successors in interest of each of the DIP Secured Parties and Prepetition Secured Parties and each of their respective Affiliates, in each case acting in their respective capacities as such and for the avoidance of doubt excluding any former or current officers, directors, financial advisors and other consultants of the Debtor and Korr Acquisitions Group, Inc. (collectively, the “Releasees”) of and from any and all claims, demands, liabilities, responsibilities, disputes, remedies, causes of action, indebtedness and obligations, rights, assertions, allegations, actions, suits, controversies, proceedings, losses, damages, injuries, attorneys’ fees, costs, expenses, or judgments of every type, whether known, unknown, asserted, unasserted, suspected, unsuspected, accrued, unaccrued, fixed, contingent, pending or threatened including, without limitation, all legal and equitable theories of recovery, arising under common law, statute or regulation or by contract, of every nature and description, arising prior to the Petition Date and arising out of, in connection with, or relating to the Prepetition Notes, the DIP Facility, the DIP Loan Documents (including the DIP Term Sheet), the Prepetition Notes Documents, and/or the transactions contemplated hereunder or thereunder including, without limitation, (x) any so-called “lender liability” or equitable subordination claims or defenses, (y) any and all claims and causes of action arising under the Bankruptcy Code, and (z) any and all claims and causes of action with respect to the validity, priority, perfection, or avoidability of the liens or claims of any of the Prepetition Secured Parties or the DIP Secured Parties, except to the extent any such claim, damage, loss, liability, or expense is found in a final non-appealable judgment by a court of competent jurisdiction to have resulted from such Releasee’s actual fraud or willful misconduct; provided that nothing in this paragraph is intended to limit or release any commitments and obligations of any of the DIP Secured Parties under the DIP Term Sheet. The Debtor further waives and releases any defense, right of counterclaim, right of setoff or deduction to the payment of the Prepetition Secured Obligations and the DIP Obligations which the Debtor now has or may claim to have against the Releasees arising out of, connected with, or relating to any and all acts, omissions, or events occurring prior to the entry of this Interim Order by the Court.

(x) Sale and Credit Bidding. The DIP Secured Parties and the Prepetition Secured Parties shall have the right to credit bid (independently or together) up to the full amount of the applicable outstanding Prepetition Obligations (including any Adequate Protection Superpriority Claims) and the DIP Obligations, in each case including, without limitation, any accrued interest and fees, in a sale of any DIP Collateral or Prepetition Collateral, as applicable, and whether such sale is effectuated through sections 363 or 1129 of the Bankruptcy Code, or otherwise.

G. Immediate Need for Postpetition Financing and Use of Cash Collateral. The Debtor has requested immediate entry of this Interim Order pursuant to Bankruptcy Rules 4001(b)(2) and (c)(2). Good cause has been shown for entry of this Interim Order. An immediate need exists for the Debtor to use Cash Collateral on an interim basis and to obtain credit in an amount up to the Initial DIP Loan pursuant to this Interim Order and the DIP Term Sheet in order to, among other things, enable the orderly continuation of its operations and to administer and preserve the value of its estate. In the absence of the immediate availability of such funds and liquidity in accordance with the terms hereof, the ability of the Debtor to maintain business relationships with its vendors, suppliers, licensors, licensees, and customers, to retain and pay its employees and otherwise finance its operations, including to continue to operate as a going concern, would not be possible, and immediate and irreparable harm to the Debtor and its estate and creditors would occur. Thus, the ability of the Debtor to preserve and maintain the value of its assets and maximize returns for creditors requires the availability of working capital from the DIP Loans and the use of Cash Collateral.

H. No Credit Available on More Favorable Terms. The Debtor has been unable to obtain on more favorable terms and conditions than those provided in this Interim Order, including for (a) adequate unsecured credit allowable under section 503(b)(1) of the Bankruptcy Code as an administrative expense, (b) credit for money borrowed with priority over any or all administrative expenses of the kind specified in sections 503(b) or 507(b) of the Bankruptcy Code, (c) credit for money borrowed secured by a lien on property of the estate that is not otherwise subject to a lien, or (d) credit for money borrowed secured by a junior lien on property of the estate which is subject to a lien. The Debtor is unable to obtain credit for borrowed money without granting the DIP Liens and the DIP Superpriority Claim (as defined below) to (or for the benefit of) the DIP Secured Parties and without granting the adequate protection as set forth herein (in each case, subject to the Carve Out (as defined below)).

I. Use of Cash Collateral and Proceeds of the DIP Facility, DIP Collateral, and Prepetition Collateral. The Debtor represents and stipulates that all of the Debtor’s cash, cash equivalents, negotiable instruments, investment property, and securities constitute Cash Collateral of the Prepetition Agent on behalf of the Prepetition Secured Parties and the DIP Agent on behalf of the DIP Secured Parties. All Cash Collateral, all proceeds of the Prepetition Collateral and the DIP Collateral (as defined below), including proceeds realized from any sale or disposition thereof, or from payment thereon, and all proceeds of the DIP Facility (net of any amounts used to pay fees, costs, and expenses payable under the DIP Facility pursuant to this Interim Order or the Final Order) shall be used or applied in accordance with the terms and conditions of this Interim Order, the DIP Budget (subject to variances permitted under the DIP Term Sheet), and the DIP Loan Documents (including the DIP Term Sheet) and for no other purpose.

J. Adequate Protection for the Prepetition Secured Parties. The Prepetition Secured Parties have negotiated in good faith regarding the Debtor’s use of the Prepetition Collateral (including the Cash Collateral) to fund the administration of the Debtor’s estate and the continued operation of its business, in accordance with the terms hereof and the DIP Budget (subject to variances permitted under the DIP Term Sheet). The Prepetition Secured Parties have agreed to permit the Debtor to use the Prepetition Collateral, including the Cash Collateral, in accordance with the terms hereof and the DIP Budget (subject to variances permitted under the DIP Term Sheet) during the Interim Period subject to the terms and conditions set forth herein, including the protections afforded parties acting in “good faith” under section 364(e) of the Bankruptcy Code. The Prepetition Secured Parties are entitled to the adequate protection as and to the extent set forth herein pursuant to sections 361, 362, 363, and 364 of the Bankruptcy Code, subject to paragraph 11 hereof. Based on the Motion and on the record presented to the Court at the Interim Hearing, the terms of the proposed adequate protection arrangements and of the use of the Prepetition Collateral (including the Cash Collateral) are fair and reasonable, reflect the Debtor’s prudent exercise of business judgment and constitute reasonably equivalent value and fair consideration for the Prepetition Agent’s consent thereto; provided that nothing in this Interim Order shall (i) be construed as a consent by any Prepetition Secured Parties (a) that it would be adequately protected in the event debtor-in-possession financing is provided by a third party (i.e., other than the DIP Lender) or (b) to the terms of any other such financing, including the consent to any lien encumbering the Prepetition Collateral (whether senior or junior) or to the use of Cash Collateral (except under the terms hereof), or (ii) prejudice, limit, or otherwise impair the rights of the Prepetition Agent (for the benefit of the Prepetition Secured Parties) to seek new, different, or additional adequate protection under any circumstances. The Prepetition Secured Parties’ consent to the Debtor’s use of Cash Collateral and the granting of DIP Liens on the Prepetition Collateral is expressly conditioned upon entry of this Interim Order and does not and shall not constitute consent other than pursuant to this Interim Order and on the terms set forth herein.

K. Sections 506(b) and 552; Marshaling. In light of and in exchange for (i) the DIP Secured Parties’ willingness to provide the DIP Facility to the extent set forth herein, (ii) the DIP Secured Parties’ agreement that their liens and superpriority claims shall be subject to the Carve Out, as set forth herein, (ii) the Prepetition Secured Parties’ agreement that their Prepetition Liens and claims, including any adequate protection liens and claims, shall be subject to the Carve Out, as set forth herein, (iii) the consensual use of Cash Collateral consistent with the DIP Budget and the terms of this Interim Order, and (iv) the DIP Secured Parties’ and the Prepetition Secured Parties’ agreement to the payment (in a manner consistent with the DIP Budget (subject to permitted variances as provided in the DIP Term Sheet) and subject to the terms and conditions of this Interim Order) of certain expenses of administration of this Chapter 11 Case, subject to and upon entry of the Final Order granting such relief, the DIP Secured Parties the Prepetition Secured Parties shall be entitled to a waiver of any “equities of the case” exception under section 552(b) of the Bankruptcy Code and a waiver of the provisions of section 506(c) of the Bankruptcy Code and of the equitable doctrine of marshaling and other similar doctrines upon entry of the Final Order.

L. Extension of Financing. The DIP Secured Parties have indicated a willingness to provide financing to the Debtor in accordance with the DIP Loan Documents (including the DIP Term Sheet and the DIP Budget) and subject to (i) the entry of this Interim Order and the Final Order, (ii) approval of the terms and provisions of this Interim Order and the DIP Loan Documents (including the DIP Term Sheet), including the Milestones (as defined in the DIP Term Sheet) and the waivers set forth herein, and (iii) findings by this Court that such financing is essential to the Debtor’s estate, that the DIP Secured Parties are good faith financiers, and that the reversal or modification on appeal of the authorization hereunder for the Debtor to incur the debt under the DIP Facility, or the grant hereunder of the priority of the DIP Liens and the Adequate Protection Liens, does not affect the validity of such debt, or any priority of any such lien so granted as provided in section 364(e) of the Bankruptcy Code.

M. Limitation of Liability. The Debtor stipulates and, subject to paragraph 11, this Court finds that in making decisions to advance loans to the Debtor, in administering any loans, in permitting the Debtor to use Cash Collateral, in accepting the DIP Budget, or in taking any other actions permitted by this Interim Order or the DIP Loan Documents (including the DIP Term Sheet), none of the DIP Secured Parties or Prepetition Secured Parties shall be deemed to be in control of the operations of the Debtor or to be acting as a “responsible person” or “owner or operator” with respect to the operation or management of the Debtor.

N. Business Judgment and Good Faith Pursuant to Section 364(e).

(i) The terms and conditions of the DIP Facility, and the fees paid and to be paid thereunder, are fair, reasonable, and the best available under the circumstances, reflect the Debtor’s exercise of prudent business judgment, and are supported by reasonably equivalent value and consideration;

(ii) all obligations incurred, payments made, and transfers or grants of security set forth in this Interim Order and the other DIP Loan Documents (including the DIP Term Sheet) by the Debtor are granted to or for the benefit of the DIP Secured Parties for fair consideration and reasonably equivalent value and are granted contemporaneously with the making of the loans and commitments and other financial accommodations secured thereby;

(iii) the DIP Facility was negotiated in good faith and at arm’s length among the Debtor and the DIP Secured Parties; and

(iv) the use of the proceeds to be extended under the DIP Facility will be so extended in good faith and for valid business purposes and uses, as a consequence of which the DIP Secured Parties are entitled to the protection and benefits of section 364(e) of the Bankruptcy Code.

O. Relief Essential; Best Interest. The relief requested in the Motion (and provided in this Interim Order) is necessary, essential, and appropriate for the continued operation of the Debtor’s business and the management and preservation of the Debtor’s assets and property, and satisfies the requirements of Bankruptcy Rule 6003. It is in the best interest of the Debtor’s estate and consistent with the Debtor’s exercise of its fiduciary duties that the Debtor be allowed to enter into the DIP Facility, incur the DIP Obligations, grant the liens and claims contemplated herein and under the DIP Loan Documents (including the DIP Term Sheet) to the DIP Secured Parties and the Prepetition Secured Parties, and use Prepetition Collateral, including Cash Collateral, as contemplated herein.

P. Findings Regarding Corporate Authority. The Debtor has all requisite corporate power and authority to enter into, ratify, and perform all of its obligations under the DIP Loan Documents (including the DIP Term Sheet) to which it is a party.

Q. Immediate Entry. Sufficient cause exists for immediate entry of this Interim Order pursuant to Bankruptcy Rules 4001(b)(2) and (c)(2).

NOW, THEREFORE, on the Motion of the Debtor and the record before this Court with respect to the Motion, including the record made during the Interim Hearing, and with the consent of the Debtor, the Prepetition Secured Parties, and the DIP Secured Parties, and good and sufficient cause appearing therefor,

IT IS ORDERED that:

1. Motion Granted. The Motion is granted on an interim basis in accordance with the terms and conditions set forth in this Interim Order. Any objections to the Motion with respect to entry of this Interim Order, to the extent not withdrawn, waived or otherwise resolved, and all reservation of rights included therein, are hereby denied and overruled.

2. DIP Facility.

(a) DIP Obligations, Etc. The Debtor is expressly and immediately authorized and empowered to enter into the DIP Facility and to incur and to perform the DIP Obligations in accordance with and subject to this Interim Order (and, upon its entry, a Final Order) and the other DIP Loan Documents, to execute and deliver all DIP Loan Documents and all other related instruments, certificates, agreements, and documents, and to take all actions which may be reasonably required or otherwise necessary for the performance by the Debtor under the DIP Facility, including the creation and perfection of the DIP Liens described and provided for herein. The Debtor is hereby authorized and directed to pay all principal, interest, fees, expenses, indemnities, the OID/Upfront Fee (as defined in the DIP Term Sheet), Exit Fee (as defined in the DIP Term Sheet), the Make Whole Amount (as defined in the DIP Term Sheet), and other amounts described herein, in the DIP Term Sheet, and in the other DIP Loan Documents as such shall accrue and become due hereunder or thereunder, including, without limitation, the reasonable and documented fees and expenses of the attorneys and financial and other advisors and consultants of the DIP Agent and the DIP Lender subject to fee review procedures, as and to the extent provided for herein, in the DIP Term Sheet, and in the other DIP Loan Documents (collectively, all loans, advances, extensions of credit, financial accommodations, fees (which shall be fully earned and non-refundable upon entry of this Interim Order), expenses, and other liabilities and obligations (including indemnities and similar obligations) in respect of DIP Loans, the DIP Facility, the DIP Term Sheet, and the other DIP Loan Documents, including all “DIP Facility Obligations” under and as defined in the DIP Term Sheet, the “DIP Obligations”). The DIP Term Sheet, the other DIP Loan Documents, and all DIP Obligations shall represent, constitute, and evidence, as the case may be, valid and binding obligations of the Debtor, enforceable against the Debtor, its estate, and any successor thereto in accordance with their terms. All obligations incurred, payments made, and transfers or grants of security set forth in this Interim Order and in the other DIP Loan Documents by any DIP Loan Party are granted to or for the benefit of the DIP Secured Parties for fair consideration and reasonably equivalent value and are granted contemporaneously with the making of the loans and commitments and other financial accommodations secured thereby. No obligation, payment, transfer, or grant of security under the DIP Loan Documents (including the DIP Term Sheet) as approved under this Interim Order shall be voided, voidable, or recoverable under the Bankruptcy Code or under any applicable non-bankruptcy law, or subject to any defense, reduction, setoff, recoupment, or counterclaim. The term of the DIP Facility shall commence on the date of entry of this Interim Order and end on the Termination Date (as defined below), subject to the terms and conditions set forth herein and in the DIP Loan Documents (including the DIP Term Sheet).

(b) Authorization to Borrow, Etc. In order to continue to operate its business, subject to the terms and conditions of this Interim Order and the other DIP Loan Documents (including the DIP Term Sheet), the DIP Borrower is hereby authorized to borrow under the DIP Facility and incur DIP Obligations during the Interim Period.

(c) Conditions Precedent. The DIP Lenders shall have no obligation to make any DIP Loans or any other financial accommodation hereunder or under the other DIP Loan Documents (including the DIP Term Sheet) (and the Debtor shall not make any request therefor) unless all conditions precedent to making DIP Loans under the DIP Term Sheet have been satisfied or waived in accordance with the terms of the DIP Term Sheet.

(d) DIP Collateral. As used herein, “DIP Collateral” shall mean all assets, interests, rights, and property of any nature whatsoever of the Debtor, including, without limitation, all property in which the Debtor and its estate have an interest (whether tangible, intangible, real, personal or mixed), whether now owned or hereafter acquired and wherever located, before or after the Petition Date, including, without limitation, all accounts, proceeds of leases, inventory, equipment, equity interests or capital stock in subsidiaries, investment property, instruments, chattel paper, contracts, patents, copyrights, trademarks and other general intangibles, commercial litigation claims, cash, any investment of such cash, inventory, accounts receivable, including intercompany accounts (and all rights associated therewith), other rights to payment whether arising before or after the Petition Date, any deposit accounts, “core concentration accounts,” “cash collateral accounts” and the DIP Proceed Account (as defined below), and, in each case all amounts on deposit therein from time to time, the proceeds of all claims or causes of action, and all rents, products, offspring, profits, proceeds, and substitutions thereof (including, without limitation, all Prepetition Collateral and, subject to the entry of the Final DIP Order granting such relief, all claims or causes of action of the Borrower arising under sections 502(d), 542, 544, 545, 547, 548, 549, 550, and 553 of the Bankruptcy Code and any other avoidance or similar action under the Bankruptcy Code or similar state law avoidance actions under chapter 5 of the Bankruptcy Code).

(e) DIP Liens. Effective immediately upon the entry of this Interim Order and subject to the Carve-Out, as set forth more fully in this Interim Order, the DIP Agent for the benefit of the DIP Secured Parties is hereby granted the following security interests and liens, which shall immediately be valid, binding, perfected, continuing, enforceable, and non-avoidable without the need for execution by the Borrower or the recordation or other filing by the DIP Secured Parties of security agreements, control agreements, pledge agreements, financing statements, or other similar documents or the possession or control by the DIP Secured Parties of any DIP Collateral (all liens and security interests granted to the DIP Agent for the benefit of the DIP Secured Parties pursuant to this Interim Order, any Final Order, and the DIP Term Sheet, the “DIP Liens”):

| |

(i)

|

pursuant to section 364(c)(2) of the Bankruptcy Code, valid, binding, continuing, enforceable, fully perfected first-priority liens on and security interests in all DIP Collateral that is not subject to any liens or encumbrances immediately prior to the Petition Date, including, without limitation, the DIP Proceeds Account (as defined in the DIP Term Sheet), subject only to the Carve Out; and

|

| |

(ii)

|

pursuant to section 363(c)(3) and 364(d)(1) of the Bankruptcy Code, valid, binding, continuing, enforceable, fully perfected first priority, priming liens on and security interests in all other DIP Collateral, which liens and security interests shall be subject only to (a) any valid, enforceable, perfected, and non-avoidable lien or security interest in favor of any person other than the Prepetition Secured Parties that was in existence immediately prior to the Petition Date or that is perfected as permitted by Section 546(b) of the Bankruptcy Code, in each case, with respect to any DIP Collateral comprised of Prepetition Collateral, solely to the extent such lien is senior to the Prepetition Liens (a “Permitted Encumbrance”) and (b) the Carve-Out, and senior to all other liens and encumbrances in respect of the DIP Collateral ((i) – (ii), collectively, the “DIP Liens”).

|

(f) Other Provisions Relating to the DIP Liens. Effective immediately upon entry of this Interim Order, the DIP Liens shall secure all of the DIP Obligations, to the extent and subject to the priorities set forth herein, and such liens (and any superpriority claims and other senior liens, including adequate protection liens, granted hereunder) shall at all times have a higher priority and shall remain senior to the rights of the Debtor, any chapter 7 or chapter 11 trustee, and any secured, administrative priority, unsecured or other claims of any party in this Case under the Bankruptcy Code (except as (and solely to the extent) expressly provided herein), and the DIP Liens, the DIP Superpriority Claims, the Adequate Protection Claims, and the Adequate Protection Liens granted herein shall not be made or become subject, junior, or subordinated to any “priming” or other liens, nor made pari passu with any other lien, security interest, or claim heretofore or hereafter granted under Bankruptcy Code section 364 or otherwise, in this Case (except as (and solely to the extent) expressly provided herein) or any Successor Case, including to (i) any lien or security interest that is avoided and preserved for the benefit of the Debtor and its estate under section 551 of the Bankruptcy Code, (ii) any lien or security interest existing on or arising on or after the Petition Date, including, without limitation, any lien or security interests granted in favor of any federal, state, municipal or other domestic or foreign governmental unit (including any regulatory body), commission, board or court for any liability of the Debtor, (iii) any intercompany or affiliate lien or claim; or (iv) any other lien, claim, or security interest under sections 361, 363, or 364 of the Bankruptcy Code or otherwise, in each case other than as (and solely to the extent) expressly set forth herein. The DIP Liens and the Adequate Protection Liens shall be valid and enforceable against any trustee appointed in the Chapter 11 Case, upon the conversion of the Chapter 11 Case to a case under chapter 7 of the Bankruptcy Code or in any other proceedings related to any of the foregoing (such case or proceeding, a “Successor Case”), and/or upon the dismissal of the Chapter11 Case. Subject to and upon entry of the Final Order granting such relief, the DIP Liens and the Adequate Protection Liens shall not be subject to section 510 of the Bankruptcy Code, to the “equities of the case” exception of section 552 of the Bankruptcy Code, or to section 506(c) of the Bankruptcy Code, or sections 549, 550, or 551 of the Bankruptcy Code.

(g) Superpriority Administrative Claim Status. The DIP Obligations shall, pursuant to section 364(c)(1) of the Bankruptcy Code, at all times constitute an allowed superpriority claim (the “DIP Superpriority Claim”) of the DIP Agent for the benefit of the DIP Secured Parties against the Debtor, and be payable from and have recourse to all assets and properties of the Debtor, with priority over any and all other administrative expenses, adequate protection claims, diminution in value claims, and all other claims asserted against the Debtor now existing or hereafter arising of any kind whatsoever, including, without limitation, all administrative expenses of the kind specified in sections 503(b) and 507(b) of the Bankruptcy Code, and over any and all other administrative expenses or other claims arising under any other provisions of the Bankruptcy Code, including sections 105, 326, 327, 328, 330, 331, 363, 364, 365, 503, 506(b), 506(c), 507(a), 507(b), 507(d), 546, 726, 1113, or 1114 of the Bankruptcy Code, whether or not such expenses or claims may become secured by a judgment lien or other nonconsensual lien, levy, or attachment, subject only to the Carve Out, which DIP Superpriority Claim shall for purposes of section 1129(a)(9)(A) of the Bankruptcy Code be considered an administrative expense allowed under section 503(b) of the Bankruptcy Code and shall be payable from and have recourse to all pre- and postpetition assets and property, whether existing on the Petition Date or thereafter acquired, of the Debtor and all proceeds thereof. The DIP Superpriority Claim shall be subject only to the Carve-Out. Other than as expressly provided herein, including in paragraph 13 hereof with respect to the Carve-Out, no costs or expenses of administration, including, without limitation, professional fees allowed and payable under sections 328, 330, and 331 of the Bankruptcy Code, or otherwise, that have been or may be incurred in this proceeding or in any Successor Case and no priority claims are or will be senior to, prior to, or pari passu with the DIP Liens, the DIP Superpriority Claim, or any of the DIP Obligations or with any other claims of the DIP Secured Parties arising hereunder or under the DIP Loan Documents (including the DIP Term Sheet), or otherwise in connection with the DIP Facility.

(h) Proceeds of DIP Loans. All proceeds of the DIP Loans shall be funded and held in the DIP Proceeds Account, in accordance with the terms of the DIP Loan Documents (including the DIP Term Sheet) and as otherwise agreed by the DIP Secured Parties, which DIP Proceeds Account shall be maintained as a segregated account by the Borrower as set forth in the DIP Loan Documents (including the DIP Term Sheet), and such account (and any funds therein) shall be subject to a first-priority senior security interest and lien in favor of the DIP Agent, and shall be subject to a deposit control agreement in favor of the DIP Agent.

(i) Professional Fees and Expenses.

(I) Subject to the Fee Review Procedures set forth in clause (II) below, the Debtor shall pay in cash and in full (x) on the Funding Date and (y) thereafter, from time to time, all reasonable and documented out of pocket fees, costs and expenses of the DIP Agent and the DIP Lenders (including, without limitation, fees and disbursements of counsel, including White & Case LLP and Richards, Layton & Finger, PA, financial and accounting advisors, and any other advisors) in connection with the Bankruptcy Case, including, without limitation (i) the negotiation, preparation, execution, and entry, as applicable, of the Restructuring Support Agreement, Plan Term Sheet, and this DIP Term Sheet, (ii) any litigation, contest, dispute, suit, proceeding or action (whether instituted by DIP Agent, the Borrower or any other person) in any way relating to the Restructuring Support Agreement, Plan Term Sheet, or this DIP Term Sheet, and (iii) the enforcement of any rights and remedies under the DIP Term Sheet, including, without limitation, any accrued and unpaid fees, costs, and expenses of the DIP Agent and the DIP Lenders (including, without limitation, any fees and disbursements of counsel and any other advisors to the DIP Agent and to the DIP Lenders) prior to the Petition Date. Payment of any amounts set forth in this clause (i)(I) shall not be subject to disgorgement.