Century Casinos Reports Earnings for the Fourth Quarter and the

Year Ended December 31, 2003 CRIPPLE CREEK, Colo., March 9

/PRNewswire-FirstCall/ -- Century Casinos, Inc. today reported net

earnings of $826,000 or $0.06 per share for the fourth quarter

ended December 31, 2003 compared to $598,000 or $0.04 per share for

the same period in 2002. For the year ended December 31, 2003 net

earnings were $3,246,000 or $0.24 per share compared to $3,079,000,

or $0.23 per share for the year ended December 31, 2002. Details of

results for these periods are summarized below: Fourth Quarter 2003

The Company reported net operating revenue of $8,190,000 for the

fourth quarter ended December 31, 2003 compared to $7,131,000

during the same period in 2002, a 14.9% increase. The casino

revenues, for the Company, were $8,199,000 in the fourth quarter of

2003 compared to $7,350,000 in the fourth quarter of 2002. The

casino expenses were $3,169,000 and $2,591,000 for the fourth

quarters of 2003 and 2002, respectively. General and administrative

expense was $1,999,000 for 2003 compared to $1,643,000 in 2002.

Depreciation expense increased to $682,000 in the fourth quarter

2003 from $538,000 in the fourth quarter 2002. Casino revenue at

Womacks was $4,830,000 in the fourth quarter of 2003 and $5,355,000

in 2002, a $525,000 decrease. The Cripple Creek market was flat,

quarter over quarter, and Womacks continues to be impacted by the

competitive pressures of other casinos in the city. Casino expenses

decreased to $1,659,000 from $1,758,000, or 5.6%. The decrease in

casino margin is attributable to the relative fixed costs of

operating the casino versus the decline in revenue. General and

administrative expense was $847,000 in the fourth quarter of 2003

and $856,000 in the fourth quarter of 2002, a decrease of 1.0%.

Depreciation expense decreased to $316,000 in the fourth quarter of

2003 compared to $335,000 during the same period in 2002. Caledon

reported $2,936,000 in casino revenue in the fourth quarter of 2003

or a 65.6% increase compared to $1,773,000 in the same period 2002.

Excluding the effect of the change in the Rand/Dollar conversion

rate from year to year, Caledon casino revenue increased by 16.4%.

This increase is attributable tothe introduction of cash couponing

and other successful marketing efforts, an expanded smoking

section, improved management and employee training. Caledon's

casino expenses increased to $1,384,000 in the fourth quarter

compared to $679,000 in the 2002. Excluding the effect of the

change in the Rand/Dollar conversion rate from year to year,

Caledon casino expenses increased by 42.5%. Relatively higher

expenses are primarily attributed to the increased costs of

marketing the casino and the effects of inflation. General and

administrative expense increased to $475,000 in the fourth quarter

of 2003 from $416,000 in the same period in 2002. Excluding the

effect of the change in the Rand/Dollar conversion rate, the

general and administrative expenseincreased decreased by 19.4%.

Depreciation increased to $299,000 in 2003 from $159,000 in 2002.

The cruise ships' casino revenue increased $211,000, or 95.0%, to

$433,000 in the fourth quarter of 2003 from $222,000 in the fourth

quarter of 2002. Cruise ship casino expenses increased to $326,000

from $154,000 when comparing the fourth quarter of 2003 and 2002.

During the fourth quarter of 2003, the Company operated casinos

aboard six ships. During the same period in 2002, it operated

casinos on four ships. Depreciation expense increased to $18,000

for the fourth quarter of 2003 from $3,000 in 2002, as a result of

additional ships in operation. The total Company earnings from

operations for the fourth quarter 2003 were $1,663,000 compared to

$1,882,000 reported in the same period in 2002. This primarily

represents an increase in earnings from operations from Caledon of

$413,000, Casino Millennium technical services fees of $138,000 and

a decrease from Womacks of $490,000. EBITDA for the Company was

$2,301,000 in the fourth quarter 2003, compared to $2,475,000 in

2002. Tax expense was $386,000 in the current quarter compared to

$906,000 in the fourth quarter of 2002. The decrease in tax expense

is attributable to lower pre-tax earnings in2003, lower effective

tax rate on ship income in 2003 and lower effective tax rates in

South Africa in 2003. The net earnings for the fourth quarter 2003

increased 38.1% to $826,000, or $0.06 per share compared to net

earnings of $598,000, or $0.04 per share for the same quarter in

2002. Year-End 2003 The Company reported net operating revenue of

$31,402,000 for the year ended December 31, 2003 compared to

$29,337,000 in 2002, a 7.0% increase. The casino revenue, for the

Company, was $31,869,000 in 2003 compared to $30,607,000 in 2002.

The casino expenses were $11,667,000 and $9,897,000 for 2003 and

2002, respectively. General and administrative expense was

$7,745,000 for 2003 compared to $7,191,000 in 2002. Depreciation

expense increased to $2,668,000 in 2003 from $2,304,000 in 2002.

Casino revenue at Womacks was $20,981,000 in 2003 and $23,922,000

in 2002. Management attributes the decrease to a number of factors

which include the impact of construction and the effect of

competitors' covered parking garages during inclement weather.

Casino expenses decreased to $6,702,000 from $7,038,000, or 4.8%.

The decrease in casino margin is attributable to the relative fixed

costs of operating the casino versus the decline in revenue.

General and administrative expense was $3,686,000 in 2003 and

$3,521,000 in 2002, an increase of 4.7%. Depreciation expense

slightly increased to $1,349,000 for the year ended December 31,

2003 compared to $1,334,000 during the same period in 2002. Caledon

reported $9,211,000 in casino revenue in 2003 or a 56.1% increase

compared to $5,899,000 in the same period 2002. Excluding the

effect of the change in the Rand/Dollar conversion rate from year

to year, Caledon casino revenue increased by 11.3%. Such increase

is attributable to an increase in the number of slot machines, the

introduction of cash couponing and other successful marketing

efforts, an expanded smoking section, improved management and

employee training. Caledon's casino expenses increasedto $3,993,000

in 2003 from $2,322,000 in 2002. Excluding the effect of the change

in the Rand/Dollar conversion rate from year to year, Caledon

casino expenses increased by 21.7%. Higher expenses are primarily

attributed to the increased costs of marketing the casino and the

effects of inflation. General and administrative expense increased

to $1,552,000 in 2003 from $1,342,000 in the same period in 2002.

Excluding the effect of the change in the Rand/Dollar conversion

rate, the general and administrative expense decreased by 17.1%.

Depreciation increased to $1,070,000 in 2003 from $734,000 in 2002.

The cruise ships' casino revenue increased $891,000, or 113.4%, to

$1,677,000 in 2003 from $786,000 in 2002. Cruise ship casino

expenses increased to $1,172,000 from $537,000 when comparing 2003

and 2002. Since early 2002 the Company has grown its ship casino

operation contracts from five to seven ships. Total Company

earnings from operations for the year ended December 31, 2003 was

$6,804,000compared to $7,291,000 reported in the same period in

2002. The decrease of $487,000 from 2002 is comprised principally

of an increase in earnings from operations from Caledon of

$1,085,000, a decrease from Womacks of $2,782,000 and a charge of

$1,145,000 for property write-down and other write-offs in 2002.

EBITDA for the Company was $9,498,000 in 2003, compared to

$9,615,000 in 2002. Tax expense decreased to $1,777,000 from

$2,454,000 in 2002. The decrease is mainly attributable to lower

pre-tax income and lower effective tax rate in South Africa in

2003. The Company's net earnings for 2003 increased 5.4% to

$3,246,000, or $0.24 per share compared to net earnings of

$3,079,000 or $0.23 per share in 2002. At December 31, 2003 the

Company had$16.1 million of available liquidity consisting of cash

and cash equivalents, net of restricted cash, and borrowing

capacity under the revolving credit facility with Wells Fargo Bank.

"We continue to see year over year growth in Caledon and are

pleased with the reported results. We believe the potential of the

facilities will enable us to continue such trend in the future,"

said Erwin Haitzmann, Chairman and CEO of the Company. "At Womacks

we remain committed to solidifying our market share in Cripple

Creek through improvements in operations and growing our property

at the most opportunistic time." The Company will post a slide show

presentation on Tuesday, March 9, 2004 of the Results of Operations

for the year ended December 31, 2003 on its web site at

http://www.centurycasinos.com/ . About Century Casinos, Inc:

Century Casinos is an international casino company that owns and

operates Womacks Casino and Hotel in Cripple Creek, Colorado; owns

and operates The Caledon Hotel, Spa & Casino near Cape Town,

South Africa; operates the casinos aboard the ultra-luxury vessels

of Silversea Cruises, The World of ResidenSea, and Oceania Cruises;

and owns 50% of, and provides technical casino services to the

Casino Millennium in the Marriott Hotel in Prague, Czech Republic.

The Company continues to pursue other international projects in

various stages of development. The address for the U.S. offices is

157 E. Warren Ave. (P.O. Box 1006), Cripple Creek, CO, 80813.

Telephone: (719) 689-9100. Fax: (719) 689-5782. E-Mail: . For more

information about Century Casinos, visit the Company's web site at

http://www.centurycasinos.com/ . Century Casinos' common stock

trades on The NASDAQ Stock Market(R) under the symbol CNTY. This

release may contain forward-looking statements that involve risks

and uncertainties. Among the other important factors which could

cause actual results to differ materially from those in the

forward-looking statements are economic, competitive, and

governmental factorsaffecting the company's operations, markets,

services and prices, as well as other factors detailed in the

Company's filings with the Securities and Exchange Commission,

including its recent filings on Forms 10-K, 10-Q, and 8K. Century

Casinos disclaims any obligation to revise or update any

forward-looking statement that may be made from time to time by it

or on its behalf. CENTURY CASINOS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF EARNINGS (Dollar amounts in thousands,

except for share information) For the Three Months Ended December

31, 2003 2002 2001 Operating Revenue: Casino $8,199 $7,350 $7,187

Hotel, food and beverage 998 746 644 Other 221 109 200 9,418 8,205

8,031 Less promotional allowances (1,228) (1,074) (1,082) Net

operating revenue 8,190 7,131 6,949 Operating Costs and Expenses:

Casino 3,169 2,591 2,393 Hotel, food and beverage 712 454 377

General and administrative 1,999 1,643 1,467 Property write-down

and other write offs, net of (recoveries) (35) 23 -- Depreciation

and amortization 682 538 988 Total operating costs and expenses

6,527 5,249 5,225 Earnings from Operations 1,663 1,882 1,724

Non-operating income (expense) Interest expense (447) (494) (524)

Other income (expense), net 10 86 (9) Non-operating income

(expense), net (437) (408) (533) Earnings before Income Taxes and

Minority Interest 1,226 1,474 1,191 Provision for income taxes 386

906 363 Earnings before Minority Interest 840 568 828 Minority

interest in subsidiary (earnings) losses (14) 30 (102) Net Earnings

$826 $598 $726 Earnings Per Share, Basic $0.06 $0.04 $0.05 Earnings

Per Share, Diluted $0.06 $0.04 $0.04 Reconciliation to EBITDA* Net

earnings $826 $598 $726 Interest income (40) (61) (19) Interest

expense 447 494 524 Income taxes 386 906 363 Depreciation 682 538

988 EBITDA* $2,301 $2,475 $2,582 CENTURY CASINOS, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENT OF EARNINGS (Dollar amounts in

thousands, except for share information) For the Year Ended

December 31, 2003 2002 2001 Operating Revenue: Casino $31,869

$30,607 $30,096 Hotel, food and beverage 3,568 2,630 2,652 Other

622 524 771 36,059 33,761 33,519 Less promotional allowances

(4,657) (4,424) (4,063) Net operating revenue 31,402 29,337 29,456

Operating Costs and Expenses: Casino 11,667 9,897 9,401 Hotel, food

and beverage 2,553 1,509 1,748 General and administrative 7,745

7,191 7,530 Property write-down and other write offs, net of

(recoveries) (35) 1,145 57 Depreciation and amortization 2,668

2,304 4,564 Total operating costs and expenses 24,598 22,046 23,300

Earnings from Operations 6,804 7,291 6,156 Non-operating income

(expense) Interest expense (2,011) (1,903) (2,018) Other income,

net 252 176 79 Non-operating income (expense), net (1,759) (1,727)

(1,939) Earnings before Income Taxes and Minority Interest 5,045

5,564 4,217 Provision for income taxes 1,777 2,454 1,794 Earnings

before Minority Interest 3,268 3,110 2,423 Minority interest in

subsidiary (earnings) losses (22) (31) 32 Net Earnings $3,246

$3,079 $2,455 Earnings Per Share, Basic $0.24 $0.23 $0.18 Earnings

Per Share, Diluted $0.22 $0.20 $0.16 Reconciliation to EBITDA* Net

earnings $3,246 $3,079 $2,455 Interest income (204) (125) (90)

Interest expense 2,011 1,903 2,018 Income taxes 1,777 2,454 1,794

Depreciation 2,668 2,304 4,564 EBITDA* $9,498 $9,615 $10,741

CENTURY CASINOS, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEET (Dollar amounts in thousands, except for share

information) December 31, 2003 December 31, 2002 ASSETS Current

Assets $6,307 $5,770 Other Assets 48,510 45,373 Total Assets

$54,817 $51,143 LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities $6,471 $5,818 Non-Current Liabilities 15,298 18,222

Shareholders' Equity 33,048 27,103 Total Liabilities and

Shareholders' Equity $54,817 $51,143 *EBITDA (Earnings before

interest, taxes, depreciation and amortization) is not considered a

measure of performance recognized as an accounting principle

generally accepted in the United States of America. Management

believes that EBITDA is a valuable measure of the relative

performance amongst its operating segments. The gaming industry

commonly uses EBITDA as a method of arriving at the economic value

of a casino operation. It is also used by our lending institutions

to gauge operating performance. Management uses EBITDA to compare

the relative operating performance of separate operating units by

eliminating the interest income, interest expense, income tax

expense, and depreciation and amortization expense associated with

the varying levels of capital expenditures for infrastructure

required to generate revenue, and the oftentimes high cost of

acquiring existing operations.

http://www.newscom.com/cgi-bin/prnh/20020328/LATH096LOGO

http://photoarchive.ap.org/ DATASOURCE: Century Casinos, Inc.

CONTACT: Larry Hannappel of Century Casinos, Inc., +1-719-689-9100,

Web site: http://www.centurycasinos.com/

Copyright

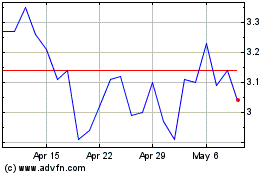

Century Casinos (NASDAQ:CNTY)

Historical Stock Chart

From May 2024 to Jun 2024

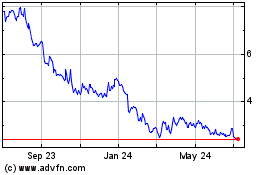

Century Casinos (NASDAQ:CNTY)

Historical Stock Chart

From Jun 2023 to Jun 2024