MORNING UPDATE: Man Securities Issues Alerts for DELL, ADI, CECO, A, and COX

August 13 2004 - 10:07AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for DELL, ADI, CECO,

A, and COX CHICAGO, Aug. 13 /PRNewswire/ -- Man Securities issues

the following Morning Update at 8:30 AM EDT with new PriceWatch

Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for DELL, ADI, CECO, A, and COX,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "We've seen very good growth." -- Kevin B.

Rollins, chief executive officer, Dell Inc. New PriceWatch Alerts

for DELL, ADI, CECO, A, and COX... PRICEWATCH ALERTS - HIGH RETURN

COVERED CALL OPTIONS ----------- -- Dell Inc. (NASDAQ:DELL) Last

Price 33.12 - NOV 32.50 CALL OPTION@ $2.30 -> 5.5 % Return

assigned* -- Analog Devices Inc. (NYSE:ADI) Last Price 33.83 - DEC

30.00 CALL OPTION@ $5.60 -> 6.3 % Return assigned* -- Career

Education Corp. (NASDAQ:CECO) Last Price 33.00 - SEP 30.00 CALL

OPTION@ $4.40 -> 4.9 % Return assigned* -- Agilent Technologies

Inc. (NYSE:A) Last Price 19.68 - NOV 17.50 CALL OPTION@ $3.30 ->

6.8 % Return assigned* -- Cox Communications Inc. Class A

(NYSE:COX) Last Price 32.55 - DEC 32.50 CALL OPTION@ $1.40 ->

4.3 % Return assigned* * To learn more about how to use these

alerts and for our FREE report, "The 18 Warning Signs That Tell You

When To Dump A Stock ", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "The Secrets of Smart Election Year Investing -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEelection NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW The U.S. Dollar Index

fell 0.16 points yesterday. Still the old greenback managed gains

versus the yen and pound. It was really an uneventful day for the

dollar as most traders digested the day's economic data but instead

decided on waiting for further confirmation that the U.S. economy

is indeed really picking up. This is significant because should the

economy begin to rebound then the Fed will begin to raise interest

rates to make sure we don't overheat. An increase in interest rates

makes the dollar more attractive to foreign investors. To add to

the confusion we had a mixed reading from the Commerce Department,

which reported that U.S. retail sales rose 0.7 percent in July

thanks to a pick-up in auto buying. Although this was below what

most economists were expecting, upward revisions to June's numbers

helped soothe fears. The big news of the day will undoubtedly be

Dell Inc., which announced stellar performance for the last

quarter, but more importantly has a good outlook for the quarter

ahead. Dell is already up in premarket trading. Could Dell's good

news be the catalyst for a much needed bounce in this oversold

market? Be prepared for the investing week ahead with Bernie

Schaeffer's FREE Monday Morning Outlook. For more details and to

sign up, go to: http://www.investorsobserver.com/freemo DYNAMIC

MARKET OPPORTUNITIES Having declared numerous "recoveries" before

only for those hopes to be crushed, Japan's current uptrend seems

to have much more momentum. While consumer spending has weakened

slightly recently, business investment is solid and healthier

corporate earnings are leading to increased confidence in the stock

market. Unemployment is also declining, which lays strong

foundations and bodes well for a sustained economic improvement.

The International Monetary Fund has picked up on Japan's resurgence

and just raised the country's growth forecast this year from 3.4%

to 4.5%. This is quite a drastic upward revision, and time will

tell whether it's ultimately too optimistic. But the IMF justified

its decision by saying the country's long and painful deflationary

spiral is finally relenting, with deflation "ebbing to zero" by the

end of 2005. However, it's worth noting that Japan's economy faces

the same risks as many other countries: soaring oil prices and

terrorist threats. In addition, rising interest rates and/or

economic slowdowns abroad, plus high debt levels within Japan's

financial sector (although this is steadily declining) could also

block progress. Sponsored by the Taipan Group -- one of the most

successful investment teams in the United States. Follow this link

to find out how this leading team of financial experts can help you

achieve wealth and prosperity:

http://www.investorsobserver.com/agora8 TODAY'S ECONOMIC CALENDAR

8:30 a.m.: June International Trade Balance (seen at $47.0 billion,

last $45.0 billion) 8:30 a.m.: July PPI, ex-food and energy (seen

at plus 0.1 percent, last 0.2 percent) 8:30 a.m.: July PPI (seen at

plus 0.2 percent, last minus 0.3 percent) 9:45 a.m.: August

Preliminary University of Michigan Sentiment (seen at 98.0, last

105.2) Man Securities is one of the world's leading option order

execution firms. Man's in-house broker team offers a level of

personal service and experience unavailable from no-frills discount

brokers. To improve your understanding of option pricing get Man's

FREE "Margin/Option Wizard software at:

http://www.investorsobserver.com/mancd. Member CBOE/NASD/SPIC. This

Morning Update was prepared with data and information provided by:

InvestorsObserver.com - Better Strategies for Making Money ->

For Investors With a Sense of Humor. Only $1 for your first month

plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

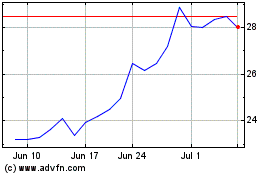

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2024 to Jul 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jul 2023 to Jul 2024