MORNING UPDATE: Man Securities Issues Alerts for INTC, SGP, CECO, VOD, and SWIR

June 23 2004 - 10:21AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for INTC, SGP, CECO,

VOD, and SWIR CHICAGO, June 23 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EDT with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for INTC, SGP, CECO, VOD, and SWIR,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "I think we're having the summer doldrums a

little early this year." -- Neil Massa, equity trader, John Hancock

Funds New PriceWatch Alerts for INTC, SGP, CECO, VOD, and SWIR...

PRICEWATCH ALERTS - HIGH RETURN COVERED CALL OPTIONS ----------- --

Intel Corp. (NASDAQ:INTC) Last Price 28.04 - OCT 27.50 CALL OPTION@

$2.05 -> 5.8 % Return assigned* -- Schering-Plough Corp.

(NYSE:SGP) Last Price 17.75 - NOV 17.50 CALL OPTION@ $1.35 ->

6.7 % Return assigned* -- Career Education Corp. (NASDAQ:CECO) Last

Price 58.58 - AUG 50.00 CALL OPTION@ $10.70 -> 4.4 % Return

assigned* -- Vodafone Group, Plc (NYSE:VOD) Last Price 22.60 - OCT

22.50 CALL OPTION@ $1.25 -> 5.4 % Return assigned* -- Sierra

Wireless Inc. (NASDAQ:SWIR) Last Price 32.12 - JUL 30.00 CALL

OPTION@ $3.40 -> 4.5 % Return assigned* * To learn more about

how to use these alerts and for our FREE report, "The 18 Warning

Signs That Tell You When To Dump A Stock ", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "The Secrets of Smart Election Year Investing -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEelection NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW Overseas markets are once

again demonstrating some divergence from U.S. futures trade,

seemingly hanging their hats on the strong finish is U.S. markets

of yesterday. Currently 12 of the 15 markets that we track are

positive. The cumulative average return on the group stands at a

positive 0.341 percent. The Mortgage Bankers Association (MBA)

Refinancing Index for the week ending June 19 resumed its decline

posting a minus 1.7 percent. Recall that in the prior week an 8.5

percent rise broke a five-week string of declines. The MBA Purchase

index managed a 1.1 percent rise, supporting the MBA Market index

at a positive 0.1 percent. I am afraid that's all we got as the

market continues to consolidate, transfixed upon next week's

Federal Open Market Committee meeting. With just one week left in

this quarter, there seems to be too much uncertainty for portfolio

managers to make major shifts at this point in time. Bed Bath &

Beyond (BBBY), FedEx Corp. (FDX) and Micron Tech (MU) represent the

key earnings reports on tap for today. Be prepared for the

investing week ahead with Bernie Schaeffer's FREE Monday Morning

Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES Despite OPEC increasing oil production by 2.5 million

barrels per day by August, the U.S. is still looking at an oil

crisis. When you consider the world currently consumes about 80

million barrels of oil per day, that means by next August OPEC will

have given the world 912 extra million barrels to plow through. If

we keep this usage up, 29.2 billion barrels will be emptied by

August of 2005. OPEC's addition was a drop in the ocean, so there's

a major problem. This is a good time to be watching the volume

charts of oil companies, as this kind of information can often lead

to some pretty lucrative profits. The trading adage "volume leads

price" applies particularly well here, because for investors, fear

translates to profits. Speculating in small oil and gas stocks is

one of the best ways to cash in on the oil supply/demand crunch.

Fortunes will be made over the next 12-24 months trading oil

stocks. The Taipan investment group's William Colburn has already

proved there's money to be made from the oil industry using this

trading strategy. Since advising his readers to buy shares of

small-cap oil company PetroQuest at $3.35 in late May, he's watched

the stock climb steadily to close Tuesday at $4.17 - a 24% gain in

less than a month. Receive incisive economic/market commentary,

profitable advice and access to a network of leading investment

exports. Simply follow this link:

http://www.investorsobserver.com/agora2 TODAY'S ECONOMIC CALENDAR

7:00 a.m.: MBA Refinancing Index for the week ending June 19 (last

plus 8.5 percent). Man Financial Inc is one of the world's major

futures and options brokers and has been recognized as a leading

option order execution firm for individuals and institutions.

Member CBOE/NASD/SIPC (CRD#6731). For more information and a free

CD with educational tools to help you invest smarter, see

http://www.investorsobserver.com/mancd This Morning Update was

prepared with data and information provided by:

InvestorsObserver.com - Better Strategies for Making Money ->

For Investors With a Sense of Humor. Only $1 for your first month

plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

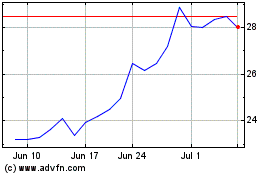

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2024 to Jul 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jul 2023 to Jul 2024