Career Education Corporation (NASDAQ: CECO) today reported total

revenue of $431.3 million, and net income of $10.6 million, or

$0.14 per diluted share, for the third quarter of 2011 compared to

total revenue of $524.1 million and net income of $26.1 million, or

$0.33 per diluted share, for the third quarter of 2010.

CONSOLIDATED RESULTS

Quarter Ended September 30, 2011

- Total revenue was $431.3 million for

the third quarter of 2011, a 17.7 percent decrease from $524.1

million for the third quarter of 2010.

- Operating income was $15.8 million for

the third quarter of 2011, versus operating income of $39.5 million

for the third quarter of 2010. The operating margin was 3.7 percent

for the third quarter of 2011, compared to an operating margin of

7.5 percent for the third quarter of 2010. Operating income for the

third quarter of 2011 included $11.4 million of legal costs related

to various regulatory matters. Operating income for the third

quarter of 2010 included a $40.0 million charge related to the

settlement of a legal matter and $8.3 million of additional bad

debt expense for increases in reserve rates associated with certain

extended student payment plans.

- Income from continuing operations for

the quarter ended September 30, 2011, was $11.3 million, or $0.15

per diluted share, compared to $27.9 million, or $0.35 per diluted

share, for the quarter ended September 30, 2010.

Year to Date Ended September 30, 2011

- Total revenue was $1,471.9 million for

the year to date ended September 30, 2011, compared to $1,581.3

million for the year to date ended September 30, 2010.

- Operating income decreased to $211.7

million for the year to date ended September 30, 2011, from $225.7

million for the year to date ended September 30, 2010. The

operating margin remained relatively constant at 14.4 percent and

14.3 percent for the years to date ended September 30, 2011 and

2010, respectively. Operating income for the year to date ended

September 30, 2011 included $11.4 million of legal costs related to

various regulatory matters, a $7.0 million insurance recovery

related to previously settled legal matters and $2.7 million in

non-cash goodwill and asset impairment charges. Operating income

for the year to date ended September 30, 2010 included a $40.0

million charge related to the settlement of a legal matter,

additional bad debt expense of $16.4 million for the increase in

the allowance for doubtful accounts associated with certain

extended student payment plans, and a $3.7 million lease

termination charge in connection with the Company’s move to its new

campus support center.

- Income from continuing operations was

$140.6 million for the year to date ended September 30, 2011

compared to $151.3 million for the year to date ended September 30,

2010, or $1.86 per diluted share for both the year to dates ended

September 30, 2011 and 2010.

CONSOLIDATED CASH FLOWS AND FINANCIAL POSITION

Cash Flows

- Net cash flows provided by operating

activities totaled $209.4 million for the year to date ended

September 30, 2011, compared to $217.5 million for the year to date

ended September 30, 2010.

- Capital expenditures decreased to $67.4

million for the year to date ended September 30, 2011, from $81.9

million during the year to date ended September 30, 2010. Capital

expenditures represented 4.6 percent and 5.2 percent of total

revenue during the years to date ended September 30, 2011 and 2010,

respectively. The decrease over the prior year to date was

primarily driven by investments in our new campus support center in

the prior year to date.

Financial Position

- As of September 30, 2011 and

December 31, 2010, cash and cash equivalents and short-term

investments totaled $449.1 million and $449.2 million,

respectively.

Stock Repurchase Program

During the quarter ended September 30, 2011, the Company

repurchased 0.3 million shares of its common stock for

approximately $7.2 million at an average price of $21.87 per share.

During the year to date ended September 30, 2011, the Company

repurchased approximately 6.2 million shares of its common

stock for approximately $137.0 million at an average price of

$21.94 per share.

As of September 30, 2011, approximately $153.3 million was

available under the Company’s authorized stock repurchase program

to repurchase outstanding shares of its common stock. Stock

repurchases under this program may be made on the open market or in

privately negotiated transactions from time to time, depending on

various factors, including market conditions and corporate and

regulatory requirements.

STUDENT POPULATION AND NEW STUDENT STARTS

Student Population

Total student population by reportable segment as of September

30, 2011 and 2010, was as follows:

As of September 30, %

Change 2011 2010 2011 vs. 2010

Student

Population

CTU 25,100 29,900 -16% AIU 17,100 21,000 -19% Health Education

28,100 31,100 -10% Culinary Arts 15,400 16,300 -6% Art & Design

10,300 12,600 -18% International 8,400 7,300 15%

Total Student

Population 104,400 118,200 -12%

New Student Starts

New student starts by reportable segment for the quarters ended

September 30, 2011 and 2010, were as follows:

For the Quarters Ended

September 30, % Change 2011 2010

2011 vs. 2010

New Student

Starts

CTU 6,510 9,180 -29% AIU 4,590 6,760 -32% Health Education 7,710

9,440 -18% Culinary Arts 5,480 7,360 -26% Art & Design 1,870

3,130 -40% International 5,070 4,130 23%

Total New Student

Starts 31,230 40,000 -22%

UPDATE REGARDING INTERNAL INVESTIGATION RELATED TO THE

DETERMINATION OF STUDENT PLACEMENT RATES

As previously reported, the Company’s Board of Directors

directed outside independent legal counsel, Dewey & LeBoeuf

(“Dewey”), to conduct an investigation into the determination of

placement rates at its Health Education segment schools and also

directed counsel to review placement rate determination practices

at all of the Company’s domestic schools. Outside independent legal

counsel has substantially completed its investigation of the

placement rate determination practices at the Company’s Health

Education segment schools, as well as its review of the placement

rate determination practices at the Company’s Art & Design

segment schools.

Counsel’s investigation confirmed the existence of improper

placement determination practices at certain of the Company’s

Health Education segment schools, and, for the Company’s Health

Education and Art & Design segment schools, Dewey identified

certain placements that lacked sufficient supporting documentation

or otherwise did not meet applicable placement guidelines

established by the Company. In accordance with their annual

reporting schedule, the Company’s Health Education and Art &

Design segment schools recently reported 2010-2011 placement rates

to their accreditor, the Accrediting Counsel for Independent

Colleges and Schools (“ACICS”), taking into account Dewey’s

findings. The ACICS placement rate standard is 65%. Placement rates

below this minimum standard may subject an institution to increased

accreditation oversight, which may include increased reporting

requirements, a requirement that the institution submit a

corrective action plan or undergo an on-site evaluation, or

restrictions on the addition of new locations or programs. ACICS

may also initiate accreditation proceedings such as a show-cause

directive, an action to defer or deny action related to an

institution’s application for a new grant of accreditation, or an

action to suspend an institution’s accreditation if it fails to

meet this standard. Based on their recently reported 2010-2011

placement rates, 13 of the Company’s 49 ACICS-accredited Health

Education and Art & Design segment schools met ACICS’ 65%

minimum placement rate standard for the 2010-2011 reporting period.

ACICS could determine that additional schools do not meet its

minimum placement rate standard. The Company has scheduled a

meeting with ACICS to address these reported rates.

At the direction of the Board of Directors, in the third quarter

Career Education commenced corrective action and has implemented

enhanced controls and procedures with respect to the determination

of placement rates by its Health Education and Art & Design

segment schools. As part of this effort, the Company has adopted

new career services policies and procedures and trained all of the

career services employees in its Health Education and Art &

Design segment schools on those new policies and procedures.

UPDATE REGARDING NYAG INVESTIGATION

As also previously reported, Career Education received a

subpoena from the Attorney General of the State of New York

(“NYAG”) relating to the NYAG’s investigation of whether the

Company and certain of its schools have complied with certain New

York state consumer protection, securities, finance and other laws.

The Company has reported the preliminary results of its internal

investigation of placement rate determination practices to the NYAG

as they relate to the Company’s New York-based ground schools. The

Company continues to fully cooperate with the NYAG with a view

towards satisfying their inquiries as promptly as possible.

CONFERENCE CALL INFORMATION

Career Education Corporation will host a conference call on

Wednesday November 2, 2011 at 8:30 a.m. Eastern time. Interested

parties can access the live webcast of the conference call at

www.careered.com in the Investor Relations section of the website.

Participants can also listen to the conference call by dialing

800-580-9478 (domestic) or 630-691-2769 (international) and citing

code 31100876. Please log-in or dial-in at least 10 minutes prior

to the start time to ensure a connection. An archived version of

the webcast will be accessible for 90 days at www.careered.com in

the Investor Relations section of the website. A replay of the call

will also be available for seven days by calling 888-843-7419

(domestic) or 630-652-3042 (international) and citing code

31100876.

ABOUT CAREER EDUCATION CORPORATION

The colleges, schools and universities that are part of the

Career Education Corporation (“CEC”) family offer high-quality

education to a diverse student population of more than 100,000

students across the world in a variety of career-oriented

disciplines through online, on-ground and hybrid learning program

offerings. The more than 90 campuses that serve these students are

located throughout the United States and in France, Italy, the

United Kingdom and Monaco, and offer doctoral, master’s, bachelor’s

and associate degrees and diploma and certificate programs.

CEC is an industry leader whose institutions are recognized

globally. Those institutions include, among others, American

InterContinental University (“AIU”); Brooks Institute; Colorado

Technical University (“CTU”); Harrington College of Design; INSEEC

Group (“INSEEC”) Schools; International University of Monaco

(“IUM”); International Academy of Design & Technology

(“IADT”); Istituto Marangoni; Le Cordon Bleu North America (“LCB”);

and Sanford-Brown Institutes and Colleges. Through its schools, CEC

is committed to providing high-quality education, enabling students

to graduate and pursue rewarding career opportunities.

For more information, see CEC’s website at www.careered.com. The

website includes a detailed listing of individual campus locations

and web links to CEC’s colleges, schools, and universities.

Except for the historical and present factual information

contained herein, the matters set forth in this release, including

statements identified by words such as “anticipate,” “believe,”

“plan,” “expect,” “intend,” “project,” “will,” “potential” and

similar expressions, are forward-looking statements as defined in

Section 21E of the Securities Exchange Act of 1934, as

amended. These statements are based on information currently

available to us and are subject to various risks, uncertainties and

other factors that could cause our actual growth, results of

operations, financial condition, cash flows, performance, business

prospects, and opportunities to differ materially from those

expressed in, or implied by, these statements. Except as expressly

required by the federal securities laws, we undertake no obligation

to update such factors or to publicly announce the results of any

of the forward-looking statements contained herein to reflect

future events, developments, or changed circumstances, or for any

other reason. These risks and uncertainties, the outcome of which

could materially and adversely affect our financial condition and

operations, include, but are not limited to, the following:

availability of Title IV and other student financial aid or loans

for our students; Congress’ willingness or ability to maintain or

increase funding for Title IV Programs; our ability to maintain

continued eligibility to participate in Title IV Programs,

including under the “90-10 Rule” under the Higher Education Act of

1965, as amended; the impacts of the U.S. Department of Education’s

regulations addressing certain aspects of administration of Title

IV federal financial aid programs, (including among other matters,

gainful employment, the 90/10 Rule and limits on cohort default

rates, certain compensation related to recruiting and admission of

students, more stringent state approval criteria that may affect

current state approval and licensing processes applicable to

postsecondary education institutions and distance learning

programs, and misrepresentation liability) on our business model,

marketing strategies and practices, costs of compliance, costs of

developing and implementing changes in operations, student

recruitment and enrollments, student and program mix and program

offerings that may have significant or material effects on our

operations, business and profitability; increased competition;

other regulatory developments; the effectiveness of our regulatory

compliance efforts; the outcome of any state attorney general

investigations, including those underway in Florida and New York;

the outcome of our investigation into the determination and

reporting of placement rates at our domestic schools, including any

claims, sanctions, operational limitations or adverse accreditation

or regulatory action initiated as a result of any adverse findings

from such investigation; our ability to successfully attract and

retain qualified personnel to fill key senior management positions,

including the position of president and chief executive officer;

changes in the overall U.S. or global economy; any impairment of

goodwill and other intangible assets as we continue to redefine the

company and manage our brands and marketing to improve

effectiveness and reduce costs; charges and expenses associated

with exiting excess facility space; our ability to comply with

accrediting agency requirements or obtain accrediting agency

approvals for existing or new programs; the outcome of any reviews

and audits conducted by accrediting, state and federal agencies;

our dependence on information technology systems; our ownership or

use of intellectual property; costs and impacts of regulatory,

legal and administrative actions, proceedings and investigations,

governmental regulations, and class action and other lawsuits; our

ability to manage growth; and other factors discussed in our Annual

Report on Form 10-K for the year ended December 31, 2010, our

Quarterly Reports on Form 10-Q for the most recent fiscal quarters,

and from time to time in our current reports filed with the

Securities and Exchange Commission.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS (In thousands)

September 30, December 31, 2011 2010

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 289,101 $ 289,482 Short-term investments

159,971 159,671 Total cash and cash

equivalents and short-term investments 449,072 449,153

Student receivables, net 57,471 62,287 Receivables, other, net

3,598 4,132 Prepaid expenses 36,130 52,077 Inventories 10,691

13,142 Deferred income tax assets, net 31,665 31,665 Other current

assets 21,524 6,246 Assets of discontinued operations 4,929

6,742 Total current assets 615,080

625,444

NON-CURRENT ASSETS:

Property and equipment, net 360,802 366,775 Goodwill 381,319

381,476 Intangible assets, net 108,664 118,763 Student receivables,

net 10,459 12,522 Deferred income tax assets, net 4,960 5,092 Other

assets, net 32,269 42,752 Assets of discontinued operations

18,783 19,055

TOTAL ASSETS $

1,532,336 $ 1,571,879

LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT

LIABILITIES: Current maturities of capital lease obligations $

851 $ 783 Accounts payable 47,571 56,013 Accrued expenses: Payroll

and related benefits 41,292 73,608 Advertising and production costs

20,859 18,846 Income taxes 11,541 - Earnout payments 9,600 17,439

Other 53,191 98,113 Deferred tuition revenue 215,367 176,102

Liabilities of discontinued operations 13,434

15,100 Total current liabilities 413,706

456,004

NON-CURRENT LIABILITIES:

Capital lease obligations, net of current maturities 315 1,223

Deferred rent obligations 103,751 103,996 Earnout payments - 7,690

Other liabilities 38,653 30,853 Liabilities of discontinued

operations 28,952 37,576 Total

non-current liabilities 171,671 181,338

SHARE-BASED AWARDS SUBJECT TO REDEMPTION 111 153

STOCKHOLDERS' EQUITY: Preferred stock - - Common

stock 824 812 Additional paid-in capital 592,929 576,853

Accumulated other comprehensive loss (310 ) (81 ) Retained earnings

496,055 356,991 Cost of shares in treasury (142,650 )

(191 ) Total stockholders' equity 946,848

934,384

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$ 1,532,336 $ 1,571,879

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share amounts and

percentages)

For the Quarters Ended September

30, % of % of Total Total

2011

Revenue

2010(1)

Revenue REVENUE: Tuition and registration fees

$ 420,302 97.4 % $ 497,110 94.8 % Other 11,012 2.6 %

27,032 5.2 % Total revenue 431,314

524,142

OPERATING EXPENSES: Educational services and facilities

155,597 36.1 % 158,112 30.2 % General and administrative 237,477

55.1 % 308,386 58.8 % Depreciation and amortization 22,446 5.2 %

17,783 3.4 % Goodwill and asset impairment - 0.0 %

354 0.1 % Total operating expenses 415,520

96.3 % 484,635 92.5 % Operating income

15,794 3.7 % 39,507 7.5 %

OTHER

INCOME: Interest income 270 0.1 % 190 0.0 % Interest expense

(43 ) 0.0 % (30 ) 0.0 % Miscellaneous (expense) income (38 )

0.0 % 764 0.1 % Total other income 189

0.0 % 924 0.2 %

PRETAX INCOME 15,983

3.7 % 40,431 7.7 % Provision for income taxes 4,708

1.1 % 12,567 2.4 %

INCOME FROM

CONTINUING OPERATIONS 11,275 2.6 % 27,864 5.3 % Loss

from discontinued operations, net of tax (641 ) -0.1 %

(1,733 ) -0.3 %

NET INCOME $

10,634 2.5 %

$ 26,131 5.0 %

NET INCOME (LOSS) PER SHARE - DILUTED: Income from

continuing operations $ 0.15 $ 0.35 Loss from discontinued

operations (0.01 ) (0.02 ) Net income per share $

0.14 $ 0.33

DILUTED WEIGHTED AVERAGE SHARES

OUTSTANDING 74,058 79,819

(1)

In December 2010, the Transitional Schools

segment ceased to exist as the Company completed the teach out of

its last remaining Transitional School, AIU-Los Angeles, CA, whose

results for all periods presented are now reflected as a component

of discontinued operations.

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share amounts and

percentages)

For the Years to Date Ended September

30, % of % of Total Total

2011 Revenue

2010(1)

Revenue REVENUE: Tuition and registration fees

$ 1,423,366 96.7 % $ 1,515,747 95.9 % Other 48,502

3.3 % 65,560 4.1 % Total revenue 1,471,868

1,581,307

OPERATING EXPENSES:

Educational services and facilities 486,027 33.0 % 474,192 30.0 %

General and administrative 708,137 48.1 % 829,446 52.5 %

Depreciation and amortization 63,319 4.3 % 51,610 3.3 % Goodwill

and asset impairment 2,676 0.2 % 354

0.0 % Total operating expenses 1,260,159 85.6 %

1,355,602 85.7 % Operating income 211,709

14.4 % 225,705 14.3 %

OTHER

INCOME: Interest income 770 0.1 % 689 0.0 % Interest expense

(93 ) 0.0 % (75 ) 0.0 % Miscellaneous income (expense) 2,031

0.1 % (501 ) 0.0 % Total other income 2,708

0.2 % 113 0.0 %

PRETAX INCOME

214,417 14.6 % 225,818 14.3 % Provision for income taxes

73,797 5.0 % 74,538 4.7 %

INCOME FROM CONTINUING OPERATIONS 140,620 9.6 % 151,280 9.6

% Loss from discontinued operations, net of tax

(1,598 ) -0.1 % (5,609 ) -0.4 %

NET INCOME

$ 139,022 9.4 %

$ 145,671

9.2 %

NET INCOME (LOSS) PER SHARE - DILUTED: Income

from continuing operations $ 1.86 $ 1.86 Loss from discontinued

operations (0.02 ) (0.07 ) Net income per share $

1.84 $ 1.79

DILUTED WEIGHTED AVERAGE SHARES

OUTSTANDING 75,518 81,195

(1)

In December 2010, the Transitional Schools

segment ceased to exist as the Company completed the teach out of

its last remaining Transitional School, AIU-Los Angeles, CA, whose

results for all periods presented are now reflected as a component

of discontinued operations.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS (In

thousands)

For the Years to Date Ended

September 30,

2011 2010 CASH FLOWS FROM OPERATING

ACTIVITIES: Net income $ 139,022 $ 145,671 Adjustments to

reconcile net income to net cash provided by operating activities:

Goodwill and asset impairment 2,676 354 Depreciation and

amortization expense 63,319 51,813 Bad debt expense 40,909 77,374

Compensation expense related to share-based awards 11,884 14,390

(Gain) loss on disposition of property and equipment (1,794 ) 546

Changes in operating assets and liabilities (46,599 )

(72,633 ) Net cash provided by operating activities 209,417

217,515

CASH FLOWS FROM INVESTING

ACTIVITIES: Purchases of available-for-sale investments

(149,234 ) (229,771 ) Sales of available-for-sale investments

148,934 271,035 Purchases of property and equipment (67,444 )

(81,944 ) Earnout payments (12,589 ) (12,729 ) Proceeds on the sale

of assets 6,259 - Business acquisition, net of acquired cash -

(6,194 ) Other 40 81 Net cash used in

investing activities (74,034 ) (59,522 )

CASH FLOWS FROM FINANCING ACTIVITIES: Purchase of treasury

stock (137,033 ) (154,913 ) Issuance of common stock 3,827 2,453

Tax benefit associated with stock option exercises 377 216 Payments

of assumed loans upon business acquisition - (4,279 ) Payments of

capital lease obligations (855 ) (2,085 ) Net cash

used in financing activities (133,684 ) (158,608 )

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE CHANGES

ON CASH AND CASH EQUIVALENTS: (2,080 ) (942 )

NET DECREASE IN CASH AND CASH EQUIVALENTS (381 )

(1,557 )

DISCONTINUED OPERATIONS CASH ACTIVITY INCLUDED

ABOVE: Add: Cash balance of discontinued operations, beginning

of the period - 738 Less: Cash balance of discontinued operations,

end of the period - 91

CASH AND CASH EQUIVALENTS, beginning of

the period 289,482 284,334

CASH

AND CASH EQUIVALENTS, end of the period $ 289,101 $

283,424

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED SELECTED SEGMENT INFORMATION (In

thousands, except percentages)

For the Quarters Ended

September 30, 2011

2010(1)

REVENUE: CTU (2) $ 100,477 $ 116,311 AIU (2) 85,787

113,119 Health Education 102,195 110,421 Culinary Arts 73,686

108,305 Art & Design (2) 49,686 61,082 International 19,567

15,061 Corporate and Other (84 ) (157 )

Total

$ 431,314 $ 524,142

OPERATING INCOME

(LOSS): CTU (2) (3) $ 16,755 $ 32,414 AIU (2) (4) 12,430 23,252

Health Education (3,632 ) 12,820 Culinary Arts (5) 3,800 (23,867 )

Art & Design (2) 2,557 9,158 International (7,151 ) (6,740 )

Corporate and Other (8,965 ) (7,530 )

Total $

15,794 $ 39,507

OPERATING MARGIN

(LOSS): CTU 16.7 % 27.9 % AIU 14.5 % 20.6 % Health Education

-3.6 % 11.6 % Culinary Arts 5.2 % -22.0 % Art & Design 5.1 %

15.0 % International -36.5 % -44.8 %

Total

3.7 % 7.5 %

(1)

In December 2010, the Transitional Schools

segment ceased to exist as the Company completed the teach out of

its last remaining Transitional School, AIU-Los Angeles, CA, whose

results for all periods presented are now reflected as a component

of discontinued operations.

(2)

Prior period financial results have been

reclassified to report CTU, AIU and Art & Design as individual

segments due to a change in organizational structure in January,

2011. Previously, these results were reported on a combined basis

as the University segment.

(3) Third quarter 2011 included a $5.0 million accrual for

an estimate for potential reimbursements of government funds.

(4) Third quarter 2010 included a $7.0 million charge

related to the settlements of legal matters.

(5)

Third quarter 2010 included a $40.0

million charge related to the settlement of a legal matter and $7.3

million of additional bad debt expense for increases in reserve

rates related to our student extended payment plans.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED SELECTED SEGMENT INFORMATION (In thousands, except

percentages)

For the Years to Date Ended September

30, 2011

2010(1)

REVENUE: CTU (2) $ 330,603 $ 342,079 AIU (2) 288,092

349,934 Health Education 328,329 322,256 Culinary Arts 248,718

293,881 Art & Design (2) 170,962 186,270 International 105,509

87,378 Corporate and Other (345 ) (491 )

Total

$ 1,471,868 $ 1,581,307

OPERATING INCOME

(LOSS): CTU (2) (3) $ 87,016 $ 94,278 AIU (2) (4) 66,384 96,054

Health Education 11,379 35,434 Culinary Arts (5) 30,741 (3,267 )

Art & Design (2) 20,627 22,663 International 12,371 9,689

Corporate and Other (6) (16,809 ) (29,146 )

Total $ 211,709 $ 225,705

OPERATING

MARGIN (LOSS): CTU 26.3 % 27.6 % AIU 23.0 % 27.4 % Health

Education 3.5 % 11.0 % Culinary Arts 12.4 % -1.1 % Art & Design

12.1 % 12.2 % International 11.7 % 11.1 %

Total 14.4 % 14.3

%

(1)

In December 2010, the Transitional Schools

segment ceased to exist as the Company completed the teach out of

its last remaining Transitional School, AIU-Los Angeles, CA, whose

results for all periods presented are now reflected as a component

of discontinued operations.

(2)

Prior period financial results have been

reclassified to report CTU, AIU and Art & Design as individual

segments due to a change in organizational structure in January,

2011. Previously, these results were reported on a combined basis

as the University segment.

(3) Year to date 2011 included a $5.0 million accrual for an

estimate for potential reimbursements of government funds.

(4) Year to date 2010 included a $7.0 million charge related

to the settlements of legal matters.

(5)

Year to date 2010 included a $40.0 million

charge related to the settlement of a legal matter and $10.5

million of additional bad debt expense for increases in reserve

rates related to our student extended payment plans.

(6)

Year to date 2011 included a $7.0 million

insurance recovery related to previously settled legal matters.

Year to date 2010 included a $4.1 million charge for an increase in

the allowance for doubtful accounts related to the Company's

previously terminated recourse loan programs and a $2.4 million

lease termination charge related to the Company's former corporate

headquarters.

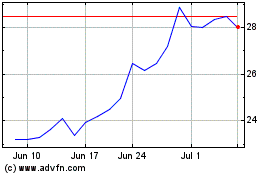

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2024 to Jul 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jul 2023 to Jul 2024