Carver Bancorp, Inc. (the "Company") (Nasdaq:CARV), the holding

company for Carver Federal Savings Bank ("Carver" or the "Bank"),

today announced financial results for its fourth quarter and fiscal

year ended March 31, 2012 ("fiscal 2012").

The Company reported a net loss of $7.1 million or a loss per

share of $1.93 for the fourth quarter of fiscal 2012, compared to a

net loss of $5.5 million or a loss per share of $33.15, for the

prior year period. The Company reported a net loss of $23.4

million, or loss per share of $14.26, for fiscal 2012 compared to a

net loss of $39.5 million, or loss per share of $242.25, for fiscal

2011.

"Carver continues to make progress on improving the performance

and quality of our loan portfolio. While there is more work to be

done, we are pleased to report that non-performing assets decreased

by 35% to $86.4 million since the June 2011 peak of $133.5 million

(including an 8% reduction in non-performing assets during the

quarter)," said Chairman and CEO Deborah C. Wright. "Notably,

delinquencies in the 30-89 day period declined 61% this quarter

compared to the prior year period, decreasing to $22.4 million from

$57.8 million."

Ms. Wright continued: "As a result of our previously reported

$55 million capital raise, Carver's capital level continues to

exceed regulatory requirements, with a Tier 1 leverage capital

ratio of 9.83% versus the required 9.00%, and a total risk-based

capital ratio of 16.94% versus the required 13.00%."

"While compression of the net interest margin continue this

quarter, we have reduced Carver's cost of fund by prepaying $40

million in higher-cost borrowings. Our higher level of cash and

cash equivalents position Carver to grow earning assets, which have

declined significantly during this cycle. We are focused on

rebuilding Carver's loan portfolio, though this process will take

time given the challenging lending and economic environment. We are

also working to increase fee income, principally through 'Carver

Community Cash,' our well received product line designed to serve

the unbanked," noted Ms. Wright.

Income Statement Highlights

Fourth Quarter Results

The Company reported a net loss for the three months ended March

31, 2012 of $7.1 million compared to a net loss of $5.5 million for

the prior year period. The primary drivers of the current quarter

loss are charge offs taken on loans transferred to held for sale

during the period and lower interest income on loans.

Net Interest Income

Interest income decreased $2.3 million, or 26.8%, to $6.4

million in the fourth quarter, compared to the prior year quarter,

the variance primarily attributed to a $130.2 million or 19.1%

decrease in the average balance of interest earning assets. The

average yield on mortgage-backed securities fell 60 basis points to

2.42% from 3.02% during the quarter, as higher yielding securities

experienced early payoffs and were replaced with lower yielding

securities. The average yield on loans fell 39 basis points to

5.01% from 5.40%. The decline in average loan balances was the

direct result of management's continuing efforts to reduce the

level of non-performing real estate loans through transfer to loans

held-for-sale ("HFS") and ultimately disposition through sales. The

reduction in real estate loans will continue over the next several

quarters until troubled debt restructures are complete and the

Company rebuilds its loan production capacity.

Interest expense increased $0.4 million, or 19.0%, to $2.5

million for the fourth quarter, compared to $2.1 million for the

prior year quarter. The increase is attributed to prepayment fees

incurred as the Company made the strategic decision to prepay $30

million of repurchase agreements and $10 million of fixed rate

borrowings. The average yield on interest earning liabilities fell

6 basis points to 1.35% at March 31, 2012, primarily due to

management's decision to lower rates on deposits.

Provision for Loan Losses

The Company recorded a $4.1 million provision for loan losses

for the fourth quarter compared to $6.8 million for the prior year

quarter. For the three months ended March 31, 2012, net charge-offs

of $4.6 million were recognized during the period compared to $5.0

million in the prior period. The charge-offs in the quarter were

primarily related to loans moved to HFS.

Non-interest Income

Non-interest income decreased $0.3 million, or 21.1%, to $1.2

million for the fourth quarter, compared to $1.5 million for the

prior year quarter, primarily due to $0.6 million of New Market Tax

Credit (NMTC) fees and a gain on loan sales of $0.1 million, offset

by $1.0 million of held for sale valuation adjustments incurred in

the current period.

Non-interest Expense

Non-interest expense increased $0.2 million to $8.2 million

compared to $8.0 million in the prior year quarter. The increase is

primarily due to charge offs of escrow and carrying costs on loans

HFS of $1 million, which were offset by $0.3 million in lower FDIC

insurance premiums, $0.2 million in lower expenses on fixed assets

and occupancy charges and a $0.2 million decrease in consulting

fees, in the current period.

Income Taxes

The income tax benefit was $34 thousand for the fourth quarter

compared to a $1.3 million expense for the prior year period.

Fiscal Year 2012 Results

The Company reported a net loss for fiscal 2012 of $23.4 million

compared to a net loss of $39.5 million for the prior year period.

The lower net loss is primarily the result of $16.3 million in

provision for loan losses in the current period, which is $10.8

million less than the provision recorded in the prior year period,

and the full valuation allowance taken against the deferred tax

asset in the prior year period.

Net Interest Income

Interest income decreased $8.3 million to $27.9 million compared

to $36.2 million in the prior year period. The decrease is

primarily due to the drop in yields on interest bearing

assets and the decrease in the average balance of interest

earning assets, $5.7 million of the decrease in interest income was

due to lower average balances and $2.6 million was due to lower

yields. The average yield on mortgaged-backed securities fell 94

basis points to 2.70% from 3.64%. The average yield on loans fell

45 basis points to 4.93% from 5.38%. The current low interest rate

environment, combined with the reduction in interest earning

assets, continues to negatively impact interest income.

Interest expense decreased $1.4 million, or 14.8%, to $8.1

million compared to $9.5 million in the prior year period. The

decrease was primarily due to a decline in deposit interest expense

of $1.5 million. Borrowing expense increased during the fiscal year

as the Company incurred prepayment fees following the early

termination of $40 million in borrowings. The average yield on

interest bearing liabilities fell 4 basis points to 1.43% at March

31, 2012 primarily due to management's decision to lower rates on

certain deposits products. Termination of high coupon borrowings

and lower deposit rates are expected to result in funding costs

over the next several quarters.

Provision for Loan Losses

The Company recorded a $16.3 million provision for loan losses

for the fiscal year, compared to $27.1 million for the prior year

period. For the period ended March 31, 2012, net charge-offs were

$19.7 million compared to $16.0 million for the prior year period,

as the Company continues to execute our strategy to resolve

troubled loans.

Non-interest Income

Non-interest income decreased $3.7 million, or 50.2%, to $3.7

million compared to $7.3 million for the prior year period. The

decline is primarily due to $1.9 million of non-recurring fees that

were earned on New Market Tax Credit (NMTC) transactions and a $0.8

million gain on sale of securities in the prior period. In addition

the current period recognized a valuation adjustment on loans

held-for-sale ("HFS") of $1.0 million.

Non-interest Expense

Non-interest expense remained essentially flat to prior

fiscal year at $30.9 million. Increased charge offs of $ 1.4

million, the majority of which were related to escrow on loans HFS,

were primarily offset by a $0.4 million reduction in federal

deposit insurance premiums and an $0.8 million reduction

consulting expenses.

Income Taxes

The income tax benefit was $1.0 million for the fiscal year

compared to an expense of $15.7 million for the prior year period.

The income tax benefit is primarily due to net operating loss

carrybacks following management's reevaluating of its tax position.

Tax expense in the prior year period resulted from the full reserve

taken on the Company's deferred tax asset.

Financial Condition Highlights

At March 31, 2012, total assets decreased $68.0 million, or

9.6%, to $641.2 million, compared to $709.2 million at March 31,

2011. Total loans receivable decreased $167.4 million, investment

securities increased $24.9 million and premises and equipment

decreased by $1.5 million. These decreases were partially offset by

cash and cash equivalents and restricted cash, which increased

$54.0 million, loans held for sale increased by $20.4 million and

the allowance for loan losses decreased by $3.3 million.

Cash and cash equivalents and restricted cash increased $54.0

million, to $98.1 million at March 31, 2012, compared to $44.1

million at March 31, 2011. This increase was primarily driven by

the capital raise inflow of $55 million, loan payoff and sales

proceeds of $145.5 million, and an increase in money market

deposits of $35 million. These inflows were offset by the repayment

of institutional deposits of $95.5 million, early termination of

borrowings of $40 million, investment purchases of $30 million and

loan originations of $21.3 million.

Total securities increased $24.9 million, or 35.0%, to $96.2

million at March 31, 2012, compared to $71.2 million at March 31,

2011. This change reflects an increase of $31.6 million in

available-for-sale securities and a $6.6 million decrease in

held-to-maturity securities as the Company diversified its

investment portfolio.

Total loans receivable decreased $167.4 million, or 28.9%, to

$412.9 million at March 31, 2012, compared to $580.3 million at

March 31, 2011, $110.2 million of principal repayments and loan

payoffs across all loan classifications contributed to the majority

of the decrease, with the largest impact from Commercial Real

Estate, Construction and Business loans. Additionally $63.6 million

of loans were transferred from held for investment to HFS.

Principle charge offs for the fiscal year totaled $16.9 million.

Decreases were partially offset by loan originations and advances

of $23.1 million.

HFS loans increased $20.4 million. The Company has taken

aggressive steps to increase troubled loan resolution. During the

period the portfolio experienced a net increase of $52.8 million

(net of charge offs), which was offset by $32.4 million of

sales and paydowns.

Total liabilities decreased $96.9 million, or 14.2%, to $584.6

million at March 31, 2012, compared to $681.5 million at March 31,

2011.

Deposits decreased $28.1 million, or 5.0%, to $532.6 million at

March 31, 2012, compared to $560.7 million at March 31, 2011.

Reductions in institutional deposits impacted certificates of

deposit and non interest bearing checking account balances. These

declines were offset by growth in money market accounts following a

promotional campaign held in the last quarter.

Advances from the Federal Home Loan bank of New York (FHLB-NY)

and other borrowed money decreased $69.2 million, or 61.4%, to

$43.4 million at March 31, 2012, compared to $112.6 million at

March 31, 2011; $40 million of the decrease is a direct result of

management's decision to prepay borrowings and a repurchase

agreement before maturity. The remaining $30 million is attributed

to scheduled maturities during the year.

Total equity increased $28.9 million, or 104.3%, to $56.6

million at March 31, 2012, compared to $27.7 million at March 31,

2011. The key component of this increase was a $55 million capital

raise closed on June 29, 2011 as previously reported in a

Form 8-K filed with the Securities and Exchange Commission on

June 29, 2011. The increase in equity from the capital raise was

partially offset by expenses of approximately $3.6 million related

to the capital raise and the net loss for the fiscal year of $23.4

million.

Asset Quality

At March 31, 2012, non-performing assets totaled $86.4 million,

or 13.5% of total assets, compared to $93.9 million or 14.0% of

total assets at December 31, 2011. Non-performing assets at March

31, 2012 were comprised of $31.5 million of loans 90 days or more

past due and non-accruing, $21.0 million of loans classified as a

troubled debt restructuring, $2.1 million of loans that are either

performing or less than 90 days past due and have been deemed to be

impaired, $2.2 million of Real Estate Owned (REO), and $29.6

million of loans classified as HFS.

The allowance for loan losses was $19.8 million at March 31,

2012, which represents a ratio of the allowance for loan losses to

non-performing loans of 36.3% compared to 29.46% at December 31,

2011. The ratio of the allowance for loan losses to total loans was

4.8% at March 31, 2012 compared to 4.45% at December 31, 2011.

About Carver Bancorp, Inc.

Carver Bancorp, Inc. is the holding company for Carver Federal

Savings Bank, a federally chartered stock savings bank, founded in

1948 to serve African-American communities whose residents,

businesses and institutions had limited access to mainstream

financial services. Carver, the largest African- and

Caribbean-American run bank in the United States, operates nine

full-service branches in the New York City boroughs of Brooklyn,

Manhattan and Queens. For further information, please visit the

Company's website at www.carverbank.com.

Certain statements in this press

release are "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act. These statements are

based on management's current expectations and are subject to

uncertainty and changes in circumstances. Actual results may differ

materially from those included in these statements due to a variety

of factors, risks and uncertainties. More information about

these factors, risks and uncertainties is contained in our filings

with the Securities and Exchange Commission.

| |

| CARVER BANCORP, INC.

AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF FINANCIAL CONDITION |

| (In thousands, except

per share data) |

| |

|

|

| |

March

31, |

March

31, |

| |

2012 |

2011 |

| |

|

|

| ASSETS |

|

|

| Cash and cash equivalents: |

|

|

| Cash and due from banks |

$ 89,872 |

$ 36,725 |

| Money market investments |

1,825 |

7,352 |

| Total cash and cash equivalents |

91,697 |

44,077 |

| Restricted Cash |

6,415 |

-- |

| Investment securities: |

|

|

| Available-for-sale, at fair value |

85,106 |

53,551 |

| Held-to-maturity, at amortized

cost (fair value of $11,774 and $18,124 at March 31, 2012

and March 31, 2011, respectively) |

11,081 |

17,697 |

| Total investments |

96,187 |

71,248 |

| |

|

|

| Loans held-for-sale ("HFS") |

29,626 |

9,205 |

| |

|

|

| Loans receivable: |

|

|

| Real estate mortgage loans |

367,611 |

525,894 |

| Commercial business loans |

43,989 |

53,060 |

| Consumer loans |

1,258 |

1,349 |

| Loans, net |

412,858 |

580,303 |

| Allowance for loan losses |

(19,821) |

(23,147) |

| Total loans receivable, net |

393,037 |

557,156 |

| Premises and equipment, net |

9,573 |

11,040 |

| Federal Home Loan Bank of New York

("FHLB-NY") stock, at cost |

2,168 |

3,353 |

| Accrued interest receivable |

2,256 |

2,854 |

| Other assets |

10,271 |

10,282 |

| Total assets |

641,230 |

709,215 |

| |

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

| LIABILITIES: |

|

|

| Deposits: |

|

|

| Savings |

101,079 |

106,906 |

| Non-Interest Bearing Checking |

67,202 |

123,706 |

| NOW |

28,325 |

27,297 |

| Money Market |

109,404 |

74,329 |

| Certificates of Deposit |

226,586 |

228,460 |

| Total Deposits |

532,597 |

560,698 |

| Advances from the FHLB-New York and other

borrowed money |

43,429 |

112,641 |

| Other liabilities |

8,585 |

8,159 |

| Total liabilities |

584,611 |

681,498 |

| |

|

|

| Stockholders' equity: |

|

|

| Preferred stock, (par value $0.01, per

share), 45,118 Series D shares, with a liquidation preference of

$1,000 per share, issued and outstanding |

45,118 |

-- |

| Preferred stock (par value $0.01 per share,

2,000,000 shares authorized; 18,980 Series B shares, with a

liquidation preference of $1,000 per share, issued and

outstanding. |

-- |

18,980 |

| * Common stock (par value $0.01 per share:

10,000,000 shares authorized; 3,697,264 and 168,312 shares issued;

3,695,174 and 165,618 shares outstanding at March 31, 2012 and

March 31, 2011, respectively) |

61 |

25 |

| Additional paid-in capital |

54,068 |

27,026 |

| Accumulated deficit |

(45,091) |

(21,464) |

| Non-controlling interest |

2,751 |

4,038 |

| Treasury stock, at cost (2,090 shares at

March 31, 2012 and 2,695 and March 31, 2011, respectively) |

(447) |

(569) |

| Accumulated other comprehensive

income/(loss) |

159 |

(319) |

| Total stockholders equity |

56,619 |

27,717 |

| Total liabilities and stockholders

equity |

641,230 |

709,215 |

| |

|

|

| (*) Common stock shares reflect 1

for 15 reverse stock split which was effective on October 27, 2011

|

| |

| |

| CARVER BANCORP, INC.

AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF OPERATIONS |

| (In thousands, except

per share data) |

| |

|

|

|

|

| |

Three Months

Ended |

Fiscal Year

Ended |

| |

March

31, |

March

31, |

| |

2012 |

2011 |

2012 |

2011 |

| Interest Income: |

|

|

|

|

| Loans |

$ 5,854 |

$ 8,136 |

$ 25,930 |

$ 33,792 |

| Mortgage-backed securities |

284 |

421 |

1,302 |

1,993 |

| Investment securities |

149 |

94 |

489 |

357 |

| Money market investments |

64 |

26 |

215 |

103 |

| Total interest income |

6,351 |

8,677 |

27,936 |

36,245 |

| Interest expense: |

|

|

|

|

| Deposits |

1,011 |

1,143 |

4,023 |

5,529 |

| Advances and other borrowed money |

1,470 |

942 |

4,030 |

3,926 |

| Total interest expense |

2,481 |

2,085 |

8,053 |

9,455 |

| |

|

|

|

|

| Net interest income |

3,870 |

6,592 |

19,883 |

26,790 |

| Provision for loan losses |

4,052 |

6,802 |

16,342 |

27,114 |

| Net interest income after provision for loan

losses |

(182) |

(210) |

3,541 |

(324) |

| |

|

|

|

|

| Non-interest income: |

|

|

|

|

| Depository fees and charges |

778 |

712 |

2,990 |

2,936 |

| Loan fees and service charges |

206 |

404 |

895 |

1,022 |

| Gain on sale of securities, net |

-- |

-- |

-- |

764 |

| Gain on sale of loans, net |

103 |

2 |

257 |

8 |

| Loss on sale of real estate owned |

-- |

-- |

(216) |

(202) |

| New Market Tax Credit ("NMTC") fees |

625 |

286 |

625 |

1,940 |

| Lower of Cost or market adjustment on loans

held for sale |

(965) |

(200) |

(1,870) |

(200) |

| Other |

434 |

292 |

973 |

1,062 |

| Total non-interest income |

1,181 |

1,496 |

3,654 |

7,330 |

| |

|

|

|

|

| Non-interest expense: |

|

|

|

|

| Employee compensation and benefits |

2,899 |

2,933 |

12,087 |

11,704 |

| Net occupancy expense |

887 |

974 |

3,692 |

3,855 |

| Equipment, net |

477 |

600 |

2,102 |

2,272 |

| Consulting fees |

106 |

269 |

475 |

1,312 |

| Federal deposit insurance premiums |

354 |

686 |

1,531 |

1,938 |

| Other |

3,516 |

2,558 |

11,047 |

9,677 |

| Total non-interest expense |

8,239 |

8,020 |

30,934 |

30,758 |

| |

|

|

|

|

| Loss before income taxes |

(7,240) |

(6,735) |

(23,739) |

(23,752) |

| Income tax (benefit) expense |

(34) |

(1,301) |

(961) |

15,718 |

| Net loss before attribution of

noncontrolling interests |

(7,206) |

(5,434) |

(22,778) |

(39,470) |

| Non Controlling interest, net of taxes |

(58) |

57 |

629 |

57 |

| Net loss |

(7,148) |

(5,491) |

(23,407) |

(39,527) |

| |

|

|

|

|

| Loss per common share: |

|

|

|

|

| Basic (*) |

$ (1.93) |

$ (33.15) |

$ (14.26) |

$ (242.25) |

| |

|

|

|

|

| (*) Common stock

shares for all periods presented reflects a 1 for 15 reverse stock

split which was effective on October 27, 2011 |

| |

| |

| CARVER BANCORP, INC.

AND SUBSIDIARIES |

| Non Performing Asset

Table |

| (In

thousands) |

| |

|

|

|

|

|

| |

March 2012 |

December

2011 |

September

2011 |

June 2011 |

March

2011 |

| Loans accounted for on a non-accrual basis

(1): |

|

|

|

|

|

| Gross loans receivable: |

|

|

|

|

|

| One-to-four family |

$ 6,988 |

$ 12,863 |

$ 14,335 |

$ 16,421 |

$ 15,993 |

| Multi-family |

2,923 |

2,619 |

9,106 |

9,307 |

6,786 |

| Commercial real estate |

24,467 |

26,313 |

16,088 |

25,893 |

10,078 |

| Construction |

11,325 |

17,651 |

31,526 |

54,425 |

37,218 |

| Business |

8,862 |

9,825 |

7,831 |

9,159 |

7,289 |

| Consumer |

23 |

4 |

36 |

22 |

42 |

| Total non-performing loans |

$ 54,588 |

$ 69,275 |

$ 78,922 |

$ 115,227 |

$ 77,406 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Other non-performing assets (2): |

|

|

|

|

|

| Real estate owned |

$ 2,183 |

$ 2,183 |

$ 275 |

$ 237 |

$ 564 |

| Loans held for sale |

29,626 |

22,490 |

39,369 |

18,068 |

9,205 |

| Total other non-performing assets |

31,809 |

24,673 |

39,644 |

18,305 |

9,769 |

| Total non-performing assets (3): |

$ 86,397 |

$ 93,948 |

$ 118,566 |

$ 133,532 |

$ 87,175 |

| |

|

|

|

|

|

| Non-performing loans to total loans |

13.22 % |

15.12 % |

16.14 % |

21.18 % |

13.34 % |

| Non-performing assets to total assets |

13.47 % |

14.01 % |

17.49 % |

19.68 % |

12.29 % |

| |

|

|

|

|

|

| |

|

|

|

|

|

| (1) Non-accrual status denotes

any loan where the delinquency exceeds 90 days past due and in

the opinion of management the collection of additional interest

and/or principal is doubtful. Payments received on a non-accrual

loan are either applied to the outstanding principal balance or

recorded as interest income, depending on assessment of the ability

to collect on the loan. |

| (2) Other non-performing

assets generally represent loans that the Bank is in the process of

selling and has designated held for sale or property acquired by

the Bank in settlement of loans less costs to sell (i.e., through

foreclosure, repossession or as an in-substance

foreclosure). These assets are recorded at the lower of their

cost or fair value. |

| (3) Troubled debt

restructured loans performing in accordance with their modified

terms for less than six months and those not performing in

accordance with their modified terms are considered non-accrual and

are included in the non-accrual category in the table above. At

March 31, 2012 there were $3.5 million TDR loans that had performed

in accordance with their modified terms for a period of at least

six months. These loans are generally considered performing loans

and are not presented in the table above. |

| |

| |

| CARVER BANCORP, INC.

AND SUBSIDIARIES |

| CONSOLIDATED AVERAGE

BALANCES |

| (In

thousands) |

| |

|

|

|

|

|

|

| |

For the Three

Months Ended March 31, |

| |

2012 |

2011 |

| |

Average |

|

Average |

Average |

|

Average |

| |

Balance |

Interest |

Yield/Cost |

Balance |

Interest |

Yield/Cost |

| |

|

|

|

|

|

|

| Interest Earning Assets: |

|

|

|

|

|

|

| Loans (1) |

$ 467,382 |

$ 5,854 |

5.01 % |

$ 602,234 |

$ 8,136 |

5.40 % |

| Mortgage-backed securities |

46,953 |

284 |

2.42 % |

55,777 |

421 |

3.02 % |

| Investment securities |

27,583 |

94 |

1.36 % |

14,897 |

43 |

1.15 % |

| Restricted Cash Deposit |

6,415 |

-- |

0.03 % |

-- |

-- |

-- % |

| Equity Securities (2) |

2,968 |

113 |

15.31 % |

3,398 |

72 |

8.59 % |

| Other investments and federal funds sold |

1,822 |

5 |

1.15 % |

7,066 |

5 |

0.29 % |

| Total interest-earning assets |

553,123 |

6,351 |

4.59 % |

683,372 |

8,677 |

5.08 % |

| Non-interest-earning assets |

99,834 |

|

|

57,230 |

|

|

| Total assets |

$ 652,957 |

|

|

$ 740,602 |

|

|

| |

|

|

|

|

|

|

| Interest Bearing Liabilities: |

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

| Now demand |

$ 26,776 |

10 |

0.15 % |

$ 35,026 |

17 |

0.19 % |

| Savings and clubs |

101,003 |

66 |

0.26 % |

105,985 |

69 |

0.26 % |

| Money market |

99,914 |

230 |

0.93 % |

74,271 |

193 |

1.04 % |

| Certificates of deposit |

209,992 |

697 |

1.33 % |

261,616 |

856 |

1.31 % |

| Mortgagors deposits |

1,853 |

8 |

1.74 % |

2,061 |

9 |

1.75 % |

| Total deposits |

439,538 |

1,011 |

0.93 % |

478,959 |

1,144 |

0.96 % |

| Borrowed money (3) |

83,542 |

748 |

3.60 % |

112,584 |

942 |

3.35 % |

| Total interest-bearing liabilities |

523,080 |

1,759 |

1.35 % |

591,543 |

2,086 |

1.41 % |

| Non-interest-bearing liabilities: |

|

|

|

|

|

|

| Demand |

60,421 |

|

|

97,644 |

|

|

| Other liabilities |

6,657 |

|

|

17,528 |

|

|

| Total liabilities |

590,158 |

|

|

706,715 |

|

|

| Stockholders' equity |

62,799 |

|

|

33,887 |

|

|

| Total liabilities & stockholders'

equity |

$ 652,957 |

|

|

$ 740,602 |

|

|

| Net interest income |

|

4,592 |

|

|

6,591 |

|

| |

|

|

|

|

|

|

| Average interest rate spread |

|

|

3.24 % |

|

|

3.67 % |

| |

|

|

|

|

|

|

| Net interest margin |

|

|

3.32 % |

|

|

3.86 % |

| |

|

|

|

|

|

|

| (1) Includes non-accrual

loans |

|

|

|

|

|

| (2) Includes FHLB-NY stock |

|

|

|

|

|

|

| (3) Prepayment fees of $722k from

a FHLB Advance and other borrowed money were excluded from the

calculations |

|

| |

|

| |

| CARVER BANCORP, INC.

AND SUBSIDIARIES |

| CONSOLIDATED AVERAGE

BALANCES |

| (In

thousands) |

| |

|

|

|

|

|

|

| |

For the Fiscal

year ended March 31, |

| |

2012 |

2011 |

| |

Average |

|

Average |

Average |

|

Average |

| |

Balance |

Interest |

Yield/Cost |

Balance |

Interest |

Yield/Cost |

| |

|

|

|

|

|

|

| Interest Earning

Assets: |

|

|

|

|

|

|

| Loans (1) |

$ 525,902 |

$ 25,931 |

4.93 % |

$ 628,314 |

$ 33,792 |

5.38 % |

| Mortgage-backed securities |

48,214 |

1,302 |

2.70 % |

54,725 |

1,993 |

3.64 % |

| Investment securities |

23,195 |

313 |

1.35 % |

12,315 |

153 |

1.24 % |

| Restricted Cash Deposit |

5,275 |

2 |

0.04 % |

-- |

-- |

-- |

| Equity Securities (2) |

2,928 |

372 |

12.72 % |

3,566 |

286 |

8.02 % |

| Other investments and federal funds sold |

2,030 |

17 |

0.84 % |

4,904 |

21 |

0.43 % |

| Total interest-earning assets |

607,544 |

27,937 |

4.60 % |

703,824 |

36,245 |

5.15 % |

| Non-interest-earning assets |

62,290 |

|

|

73,551 |

|

|

| Total assets |

$ 669,834 |

|

|

$ 777,375 |

|

|

| |

|

|

|

|

|

|

| Interest Bearing

Liabilities: |

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

| Now demand |

26,532 |

42 |

0.16 % |

45,187 |

101 |

0.22 % |

| Savings and clubs |

104,090 |

274 |

0.26 % |

109,503 |

286 |

0.26 % |

| Money market |

82,120 |

838 |

1.02 % |

71,053 |

795 |

1.12 % |

| Certificates of deposit |

201,568 |

2,831 |

1.40 % |

298,355 |

4,306 |

1.44 % |

| Mortgagors deposits |

2,258 |

38 |

1.68 % |

2,549 |

41 |

1.61 % |

| Total deposits |

416,568 |

4,023 |

0.97 % |

526,647 |

5,529 |

1.05 % |

| Borrowed money (3) |

95,762 |

3,308 |

3.45 % |

115,938 |

3,925 |

3.39 % |

| Total interest-bearing liabilities |

512,330 |

7,331 |

1.43 % |

642,585 |

9,454 |

1.47 % |

| Non-interest-bearing liabilities: |

|

|

|

|

|

|

| Demand |

92,465 |

|

|

73,459 |

|

|

| Other liabilities |

7,803 |

|

|

11,301 |

|

|

| Total liabilities |

612,598 |

|

|

727,345 |

|

|

| Stockholders' equity |

57,236 |

|

|

50,030 |

|

|

| Total liabilities & stockholders'

equity |

$ 669,834 |

|

|

$ 777,375 |

|

|

| Net interest income |

|

20,606 |

|

|

26,791 |

|

| |

|

|

|

|

|

|

| Average interest rate spread |

|

|

3.17 % |

|

|

3.68 % |

| |

|

|

|

|

|

|

| Net interest margin |

|

|

3.39 % |

|

|

3.81 % |

| |

|

|

|

|

|

|

| (1) Includes non-accrual

loans |

|

|

|

|

|

| (2) Includes FHLB-NY stock |

|

|

|

|

|

|

| (3) Prepayment fees of $722k from

a FHLB Advance and other borrowed money were excluded from the

calculations |

|

|

| |

| CARVER BANCORP, INC.

AND SUBSIDIARIES |

| CONSOLIDATED SELECTED

KEY RATIOS |

| |

|

|

|

|

| |

Three Months

Ended March 31, |

Twelve Months

Ended March 31, |

| Selected Statistical

Data: |

2012 |

2011 |

2012 |

2011 |

| |

|

|

|

|

| Return on average assets (1) |

(4.38)% |

(2.97)% |

(3.49)% |

(5.08)% |

| Return on average equity (2) |

(45.53)% |

(64.82)% |

(40.90)% |

(79.0)% |

| Net interest margin (3) |

3.32 % |

3.86 % |

3.39 % |

3.81 % |

| Interest rate spread (4) |

3.24 % |

3.68 % |

3.17 % |

3.68 % |

| Efficiency ratio (5) |

163.12 % |

99.18 % |

131.43 % |

90.15 % |

| Operating expenses to average assets (6) |

5.05 % |

4.33 % |

4.62 % |

3.96 % |

| Average equity to average assets (7) |

9.62 % |

4.58 % |

8.54 % |

6.44 % |

| |

|

|

|

|

| Average interest-earning assets to average

interest-bearing liabilities |

1.06 x |

1.16 x |

1.19 x |

1.10 x |

| |

|

|

|

|

| Net loss per share (*) |

$ (1.93) |

$ (33.15) |

$ (14.26) |

$ (242.25) |

| Average shares outstanding (*) |

3,695,507 |

165,618 |

1,662,138 |

165,572 |

| |

|

|

|

|

| |

March

31, |

|

|

| |

2012 |

2011 |

|

|

| Capital Ratios: |

|

|

|

|

| Tier I leverage capital ratio (8) |

9.83 % |

5.38 % |

|

|

| Tier I risk-based capital ratio (8) |

14.50 % |

7.36 % |

|

|

| Total risk-based capital ratio (8) |

16.94 % |

9.60 % |

|

|

| |

|

|

|

|

| Asset Quality Ratios: |

|

|

|

|

| Non performing assets to total assets

(9) |

13.47 % |

10.99 % |

|

|

| Non performing loans to total loans

receivable (9) |

13.22 % |

13.34 % |

|

|

| Allowance for loan losses to total loans

receivable |

4.80 % |

3.99 % |

|

|

| Allowance for loan losses to non-performing

loans |

36.31 % |

29.90% |

|

|

| |

|

|

|

|

| (1) Net loss, annualized,

divided by average total assets. |

|

| (2) Net loss, annualized,

divided by average total equity. |

|

| (3) Net interest income,

annualized, divided by average interest-earning assets. |

|

| (4) Combined weighted

average interest rate earned less combined weighted average

interest rate cost. |

| (5) Operating expenses

divided by sum of net interest income plus non-interest

income. |

|

| (6) Non-interest expenses,

annualized, divided by average total assets. |

|

|

|

| (7) Average equity divided

by average assets for the period ended. |

|

|

|

| (8) These ratios reflect

consolidated bank only. |

|

|

| (9) Non performing assets consist

of non-accrual loans, and real estate owned |

|

|

|

| (*) Common stock shares for all

periods presented reflects a 1 for 15 reverse stock split which was

effective on October 27, 2011 |

CONTACT: Ruth Pachman/Michael Herley

Kekst and Company

(212) 521-4800

Mark A. Ricca

Carver Bancorp, Inc.

(212) 360-8820

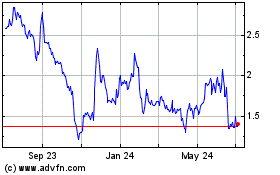

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From May 2024 to Jun 2024

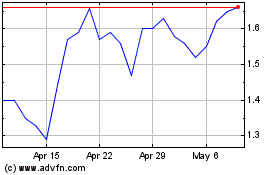

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Jun 2023 to Jun 2024