- Securities Registration Statement (S-1/A)

January 24 2012 - 6:02AM

Edgar (US Regulatory)

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on January 23, 2012

Registration No. 333-177054

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CARVER BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

6712

(Primary Standard Industrial

Classification Code Number)

|

|

13-3904174

(I.R.S. Employer

Identification No.)

|

75 West 125

th

Street, New York, New York 10027-4512

(718) 230-2900

(Address, including zip code, telephone number,

including area code, of registrant's principal executive offices)

|

|

|

|

|

Copies of all correspondence to:

|

Mark A. Ricca

Executive Vice President and Chief Financial Officer

Carver Bancorp, Inc.

75 West 125

th

Street

New York, New York 10027-4512

(212) 360-8820

(212) 426-6213 Facsimile

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

|

|

Larry M.F. Spaccasi, Esq.

Luse Gorman Pomerenk & Schick, P.C.

5335 Wisconsin Avenue, N.W.

Suite 780

Washington, D.C. 20015

(202) 274-2000

(202) 362-2902 Facsimile

|

Approximate date of commencement of proposed sale to the public:

From time to time after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

ý

|

CALCULATION OF REGISTRATION FEE

[to be updated]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities

to be registered

|

|

Amount to be

registered

|

|

Proposed maximum

offering price per security

|

|

Proposed maximum

aggregate offering price

|

|

Amount of

registration fee

|

|

|

|

Series D Preferred Stock, $0.01 par value per shares

|

|

45,118 shares

|

|

$1,000.00(3)

|

|

$45,118,000

|

|

$5,171

|

|

|

|

Common Stock, $0.01 par value per share

|

|

9,047,331 shares(1)(2)

|

|

$8.85(4)

|

|

80,068,879

|

|

9,176

|

|

|

|

Total

|

|

|

|

|

|

$125,186,879

|

|

$14,347

|

|

|

-

(1)

-

Represents

(i) 3,529,325 shares of common stock currently outstanding and (ii) 5,518,006 shares of common stock that may be issued to the

holders of the Registrant's Series D Preferred Stock upon the occurrence of certain transfers that cause the conversion of the Series D Preferred Stock. The Series D Preferred

Stock will convert automatically upon the occurrence of certain transfers, including some sales by the selling stockholders. Shares of common stock issued to persons who purchase Series D

Preferred Stock from the selling shareholders are offered by, and will be issued by, the Registrant.

-

(2)

-

In

the event of a stock split, reverse stock split, stock dividend, anti-dilution adjustment or similar transaction involving common stock of

the Registrant, the number of shares registered shall be automatically increased to cover the additional shares or decreased to reflect the event in accordance with Rule 416(b) under the

Securities Act.

-

(3)

-

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act based upon the initial price of

the Company's Series C Preferred Stock, a portion of which converted on a 1-to-1 basis into Series D Preferred Stock.

-

(4)

-

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act based upon the last reported

trading price of the Registrant's common stock on the Nasdaq Capital Market on January 19, 2012.

-

*

-

A

filing fee of $16,898 was previously paid in connection with the Registrant's Registration Statement on Form S-1 filed on

September 28, 2011.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may

determine.

Table of Contents

Prospectus

Carver Bancorp, Inc.

45,118 Shares of Series D Preferred Stock

9,047,331 Shares of Common Stock

This prospectus relates to the offering of two categories of our securities. The securities may be resold from time to time by and for the

accounts of certain selling stockholders named in this prospectus. See "

Plan of Distribution

" for important information regarding the methods of resale

of the securities offered pursuant to this prospectus. We will not receive any of the proceeds of such resales.

•

Common Stock

The first category of securities that this prospectus relates to is 3,529,325 shares of Common Stock held by certain selling stockholders.

•

Series D Preferred Stock and Common Stock Issuable Upon Conversion of Series D Preferred Stock

The second category of securities that this prospectus relates to is 45,118 shares of our Series D Preferred Stock held by

certain selling stockholders and up to 5,518,006 shares of Common Stock that may be issued from time to time upon the subsequent conversion of shares of the Series D Preferred Stock. In the

event of certain subsequent transfers of the Series D Preferred Stock, which may include sales pursuant to this prospectus, the Series D Preferred Stock will automatically convert into

shares of Common Stock. See "

Description of Securities—Series D Preferred Stock—Conversion

" for more information

regarding the conversion of the Series D Preferred Stock into shares of Common Stock.

In most circumstances, a purchaser of Series D Preferred Stock pursuant to

this prospectus will receive Common Stock instead of Series D Preferred Stock.

In the event of such a transfer, shares of Common Stock issued to persons who purchase

Series D Preferred Stock from the selling stockholders are offered by and will be issued by us. The conversion price of the Series D Preferred Stock is $8.1765, subject to

anti-dilution adjustments.

The shares of Common Stock will not be available until such time as particular shares of Series D Preferred Stock are sold in one

or more transactions that cause the conversion of the Series D Preferred Stock.

This prospectus and the registration statement of which this prospectus forms a part may be amended from time to time, including to reflect changes in the

number of shares of each of the above categories that may be resold by the selling stockholders pursuant to this prospectus and the price at which such shares may be resold by the selling

stockholders.

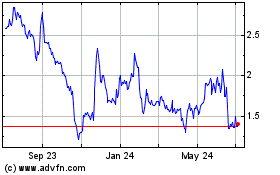

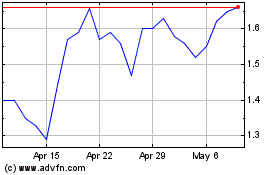

Our shares of Common Stock are currently traded on the NASDAQ Capital Market under the symbol "CARV." On January 19, 2012, the last reported sales price of our Common Stock was

$8.85 per share. Our shares of Series D Preferred Stock are not currently listed or traded on any exchange.

The Selling Shareholders may sell all or a portion of the securities from time to time, in amounts, at prices and on terms determined at the time of offering. The selling stockholders

may sell the securities by any means described in the section of this Prospectus entitled "

Plan of Distribution

," including in ordinary broker

transactions or in negotiated transactions, and they may pay broker commissions in connection with such transactions. The selling stockholders and any broker dealer executing sell orders on behalf of

or purchasing from the selling stockholders may be deemed to be an "underwriter" within the meaning of the Securities Act of 1933. Commissions received by any such broker dealer may be deemed to be

underwriting commissions or discounts under the Securities Act of 1933.

The shares offered pursuant to this prospectus will be held in book-entry form with our registrar and transfer agent. No certificates will be issued with respect to such

shares, and such shares will not be held in global form at The Depository Trust Company. If you wish to have your shares held through The Depository Trust Company, you will need to make arrangements

with your broker to transfer your shares into the name of The Depository Trust Company or its nominee.

Investing in our securities involves a high degree of risk. See "

Risk Factors

" beginning on

page 10 to read about factors you should consider before buying shares of our Series D Preferred Stock or Common Stock.

The securities are not savings accounts, deposits or other obligations of any bank and are not insured or guaranteed by

the Federal Deposit Insurance Corporation or any other government agency.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2012

Table of Contents

TABLE OF CONTENTS

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere, or incorporated by reference, in this prospectus. As a

result, it does not contain all the information that may be important to you. To understand this transaction fully, you must read this entire prospectus carefully, including the risk factors beginning

on page 10 and the documents incorporated by reference into this prospectus.

The Company

Carver Bancorp, Inc., a Delaware corporation (the "Company") is the holding company for Carver Federal Savings Bank ("Carver

Federal" or the "Bank"), a federally chartered savings bank, and, on a parent-only basis, had minimal results of operations. The Company is headquartered in New York, New York. The Company

conducts business as a unitary savings and loan holding company, and the principal business of the Company consists of the operation of its wholly-owned subsidiary, Carver Federal. Carver Federal was

founded in 1948 to serve African-American communities whose residents, businesses and institutions had limited access to mainstream financial services. The Bank remains headquartered in Harlem, and

predominantly all its nine branches and nine stand-alone 24/7 ATM Centers are located in low- to moderate-income neighborhoods. Many of these historically underserved communities have

experienced unprecedented growth and diversification of incomes, ethnicity and economic opportunity, after decades of public and private investment.

Carver Federal is the largest African-American operated bank in the United States. The Bank remains dedicated to expanding wealth enhancing opportunities in the communities it serves by

increasing access to capital and other financial services for consumers, businesses and non-profit organizations, including faith-based institutions. A measure of its progress in achieving

this goal includes the Bank's "Outstanding" rating, awarded by the Office of Thrift Supervision following its most recent Community Reinvestment Act ("CRA") examination in 2009. The examination report

noted that 76.1% of the Bank's community development lending and 55.4% of the Bank's Home-Owners Mortgage Disclosure Act ("HMDA") reportable loan originations were within low-

to moderate-income geographies, which far exceeded peer institutions. The Bank had approximately $678.0 million in assets as of September 30, 2011 and employed approximately 135

employees as of September 30, 2011.

Carver

Federal engages in a wide range of consumer and commercial banking services. Carver Federal provides deposit products including demand, savings and time deposits for consumers,

businesses, and governmental and quasi-governmental agencies in its local market area within New York City. In addition to deposit products, Carver Federal offers a number of other consumer and

commercial banking products and services, including debit cards, online banking including online bill pay, and telephone banking.

Carver

Federal offers loan products covering a variety of asset classes, including commercial, multi-family and residential mortgages, construction loans and business loans. The Bank

finances mortgage and loan products through deposits or borrowings. Funds not used to originate mortgages and loans are invested primarily in U.S. government agency securities and mortgage-backed

securities. The Bank's primary market area for deposits consists of the areas served by its nine branches in the Brooklyn, Manhattan and Queens boroughs of New York City. The neighborhoods in which

the Bank's branches are located have historically been low- to moderate-income areas. The Bank's primary lending market includes Bronx, Kings, New York and Queens counties in New York

City, and lower Westchester County, New York. Although the Bank's branches are primarily located in areas that were historically underserved by other financial institutions, the Bank faces significant

competition for

deposits and mortgage lending in its market areas. Management believes that this competition has become more intense as a result of increased examination emphasis by federal banking regulators on

financial institutions' fulfillment of their responsibilities under the CRA and more recently due to the decline in

1

Table of Contents

demand

for loans by qualified borrowers. Carver Federal's market area has a high density of financial institutions, many of which have greater financial resources, name recognition and market

presence, and all of which are competitors to varying degrees. The Bank's competition for loans comes principally from mortgage banking companies, commercial banks, and savings institutions. The

Bank's most direct competition for deposits comes from commercial banks, savings institutions and credit unions. Competition for deposits also comes from money market mutual funds, corporate and

government securities funds, and financial intermediaries such as brokerage firms and insurance companies. Many of the Bank's competitors have substantially greater resources and offer a wider array

of financial services and products. This combined with competitors' larger presence in the New York market add to the challenges the Bank faces in expanding its current market share and growing its

near-term profitability.

Carver

Federal's more than 60 year history in its market area, its community involvement and relationships, targeted products and services and personal service consistent with

community banking, help the Bank compete with other competitors that have entered its market.

The

Bank formalized its many community focused investments on August 18, 2005, by forming Carver Community Development Company ("CCDC"). CCDC oversees the Bank's participation in

local economic development and other community-based initiatives, including financial literacy activities. CCDC coordinates the Bank's development of an innovative approach to reach the unbanked

customer market in Carver Federal's communities. Importantly, CCDC spearheads the Bank's applications for grants and other resources to help fund these important community activities. In this

connection, Carver Federal has successfully competed with large regional and global financial institutions in a number of competitions for government grants and other awards. In June 2006, Carver

Federal was selected by the United States Department of the Treasury to receive an award of $59 million in New Markets Tax Credits ("NMTC"). In May 2009, Carver Federal won another NMTC award

in the amount of $65 million and in February 2011, the Company announced that Carver Federal had been

selected to receive a third NMTC award in the amount of $25 million. The NMTC award is used to stimulate economic development in low- to moderate-income communities. The NMTC award

enables the Bank to invest with community and development partners in economic development projects with attractive terms including, in some cases, below market interest rates, which may have the

effect of attracting capital to underserved communities and facilitating revitalization of the community, pursuant to the goals of the NMTC program. The NMTC award provides a credit to Carver Federal

against federal income taxes when the Bank makes qualified investments. In addition to the tax credit awards recognized, the Company may transfer rights to an investor in a NMTC project and recognize

a gain on the transfer of rights. The Company's ability to realize the benefit of the tax credits is dependent upon the Company generating sufficient taxable income. As of March 31, 2011, the

2006 and 2009 awards allocations have been fully utilized in qualifying projects.

A description of our business and operations is included in our definitive proxy statement filed with the SEC on September 16, 2011, our Annual Report on

Form 10-K for the year ended March 31, 2011, filed with the SEC on June 30, 2011, and our Quarterly Reports on Form 10-Q and

Form 10-Q/A for the period ended June 30, 2011, filed with the SEC on August 15, 2011 and August 16, 2011, respectively, and for the period ended

September 30, 2011, filed with the SEC on November 14, 2011, all of which are incorporated herein by reference.

Cease-and-Desist Orders

On February 7, 2011, the Company and the Bank consented to the Office of Thrift Supervision ("OTS") issuing an Order to Cease

and Desist against the Company (the "Company Order") and against the Bank (the "Bank Order") (together the "Orders"). The OTS issued the Orders based upon its findings that the Company and the Bank

were operating with an inadequate level of capital for the volume, type and quality of assets held by the Company and the Bank, that they were operating with an

2

Table of Contents

excessive level of adversely classified assets and that earnings were inadequate to augment capital. The Orders impose significant restrictions on the operations of the Company and the Bank.

The Company Order requires, among other things, the Company to a notify and receive the written permission of the OTS prior to (i) declaring, making or paying any dividends or

other capital distributions, or repurchasing or redeeming any capital stock; (ii) incurring, issuing, renewing, repurchasing or rolling over any debt, increasing any current lines of credit or

guaranteeing the debt of any entity; (iii) making certain changes to its directors or senior executive officers; (v) entering into, renewing, extending or revising any contractual

arrangement related to compensation or benefits with any of its directors or senior executive officers; and (vi) making any golden parachute payments or prohibited indemnification payments. The

Company Order also requires the Company to submit and adhere to a written plan to maintain and enhance the capital of the Company.

The Bank Order requires, among other things, the Bank (i) attain and maintain, a Tier 1 Core Capital Ratio equal to or greater than nine percent (9%) and a Total

Risk-Based Capital Ratio equal to or greater than thirteen percent (13%); (ii) revise and adhere to a written plan to identify, monitor and control risk associated with

concentrations of assets; (iii) adhere to a detailed written plan with specific strategies, targets and timeframes to reduce the Bank's level of problem assets, which include all criticized and

classified assets; and (iv) ensure that the Bank's financial reports and statements are timely and accurately prepared and filed. The Bank Order also provides that, unless the Bank first

receives the prior written non-objection of the OTS, the Bank may not (i) originate or purchase, refinance, extend or otherwise modify any commercial real estate loan as defined in

the Bank Order, unless the refinance, modification or extension meets certain criteria, including improving the credit quality and collectability of the loan; (ii) increase its asset size in

any quarter greater than an amount equal to the net interest credited on deposit liabilities during the prior quarter; (iii) declare or pay dividends or make any capital distributions;

(iv) make certain changes to its directors or senior executive officers; (v) enter into, renew, extend or revise any contractual arrangement related to compensation or benefits with any

of its directors or senior executive officers; (vi) make any golden parachute or prohibited indemnification payments; (vii) enter into certain transactions with affiliates; and

(xiii) enter into any arrangement or contract with a third party service provider that is significant or outside the normal course of business. Finally, without prior approval of the Federal

Deposit Insurance Corporation (the "FDIC"), the Bank may not roll over or renew any brokered deposit or accept any new brokered deposits.

The Company and the Bank complied with the requirements of the Orders related to the submission of various plans and documentation by the April 30, 2011 deadlines set forth in the

Orders. The Company and the Bank are actively working to rectify the following matters set forth in the Orders.

-

•

-

The Company and the Bank were operating with an inadequate level of

capital.

The Company completed a private placement of $55 million of preferred stock that closed on June 30, 2011, and

contributed $37 million to the Bank. See "

—Recapitalization Transaction

." The Bank's Tier 1 Core Capital Ratio was 10.34% at

June 30, 2011 and 9.1% at September 30, 2011, compared to 5.38% at March 31, 2011. The Banks Total Risk-Based Capital Ratio was 16.26% at June 30, 2011 and

14.38% at September 30, 2011, compared to 9.6% at March 31, 2011. In an effort to maintain the capital ratios at or above the minimum of 9.0% Tier 1 Core Capital Ratio and 13.0%

Total Risk-Based Capital Ratio set forth in the Orders, the Company is actively marketing to fund new loans, reduce non-performing assets and grow non-interest

income via additional product offerings (e.g. "Carver Community Cash").

-

•

-

The Company and the Bank were operating with an excessive level of adversely classified

assets.

In order to reduce classified assets, the Company has continued to pursue the sale of certain loans. In the six months ended September 30, 2011, the Company

moved $38.4 million of

3

Table of Contents

non-performing

loans into the held-for-sale category, and sold $8.2 million of loans. The Company has also engaged in loan resolution activities, which,

together with the movement of non-performing loans into the held-for-sale category, has resulted in a decrease in non-performing loans to

$78.9 million, or 16.14% of total loans, at September 30, 2011from $115.2 million, or 21.18% of total loans, at June 30, 2011. The Company's resolution activities have also

resulted in a decrease in non-performing assets to $118.6 million, or 17.49% of total assets, at September 30, 2011from $133.5 million, or 19.68% of total assets, at

June 30, 2011. In addition, the Company is taking action diversify its portfolio to reduce concentration risk, including efforts to decrease construction loans, focus on owner-occupied

commercial real estate loans, and increase small business, non-profit, and consumer loans.

-

•

-

Earnings were inadequate to augment the Company's and the Bank's

capital.

In order to offset the decrease in yields experienced by the Company in recent quarters, the Company and the Bank are engaged

in marketing efforts to attract more core deposits and make more loans, using the proceeds of the recapitalization transaction as well as the new deposit funds. In addition, the Company launched

Carver Community Cash, a product line designed to meet the daily transaction needs of the unbanked, which generates direct revenues and which the Company believes will result in increased banking

relationships with existing institutional customers and relationships with a new segment of retail customers.

Effective July 21, 2011, supervisory authority with respect to the Company Order was transferred from the OTS to the Board of Governors of the Federal Reserve System (the "Federal

Reserve") and the supervisory authority with respect to the Bank Order was transferred from the OTS to the Office of the Comptroller of the Currency (the "OCC").

The Company Order and the Bank Order are filed as exhibits to our Current Report on Form 8-K filed with the SEC on February 10, 2011, which are incorporated

herein by reference.

Recapitalization Transaction

On June 29, 2011, the Company completed a private placement of 55,000 shares of the Company's Mandatorily Convertible

Non-Voting Participating Preferred Stock, Series C (the "Series C Preferred Stock") to several institutional investors (the "Investors") for an aggregate purchase price of

$55.0 million. After the payment of fees of $3.2 million to our financial advisor in connection with the recapitalization transaction, and approximately $400,000 of legal, accounting and

other fees related to the recapitalization transaction, our net proceeds were approximately $51.4 million.

Effective October 28, 2011, the Series C Preferred Stock converted into:

-

•

-

an aggregate of 1,208,039 shares of Common Stock, at a conversion price of $8.1765 (which reflects the

1-for-15 reverse stock split that was effective as of October 27, 2011); and

-

•

-

an aggregate of 45,118 shares of the Company's Convertible Non-Cumulative Non-Voting Participating

Preferred Stock, Series D (the "Series D Preferred Stock"), at a ratio of 1:1.

In connection with the private placement, the Company entered into an Exchange Agreement (the "Exchange Agreement") with the United States Department of the Treasury ("Treasury"),

pursuant to which Treasury agreed to exchange the 18,980 shares of the Company's Fixed Rate Cumulative Perpetual Preferred Stock, Series B (the "Series B Preferred Stock") that it held

for shares of Common Stock at the same conversion price applicable to the conversion of the Series C Preferred Stock (the "Exchange"). The Exchange was effective October 28, 2011, and

the Series B Preferred Stock was exchanged for 2,321,286 shares of Common Stock.

The Exchange Agreement grants Treasury the right to include the shares of Common Stock received in exchange for the shares of Series B Preferred Stock pursuant to the Exchange

Agreement

4

Table of Contents

in any registration statement filed by the Company, including with respect to registration of securities held by other selling stockholders. In the event that an underwriter advises the Company that

it is necessary to reduce the number of securities included in any registered offering initiated by the Company, the securities shall be included in the following order of priority: first, shares of

Common Stock held by Treasury; second, shares being issued by the Company; third, shares of Common Stock held by any person to whom Treasury has transferred such securities; and fourth, any other

securities proposed to be included in the registration statement. In addition, in the event that an underwriter advises the Company that it is necessary to reduce the number of securities included in

any registered offering initiated upon demand of holders of the Series D Preferred Stock or Common Stock issued upon conversion of the Series D Preferred Stock, the securities shall be

included in the following order of priority: first, shares of Common Stock held by Treasury; second, shares being issued by the Company; and third, any other securities proposed to be included in the

registration statement.

In connection with the private placement and the Exchange, the Company held a meeting of its stockholders on October 25, 2011, at which the stockholders approved the following

proposals related to the recapitalization transaction: an increase in the number of shares of authorized Common Stock (which was not effected because of the 1-for-15 reverse

stock split); the conversion of the Series C Preferred Stock into shares of Series D Preferred Stock and Common Stock; the issuance of the Series D Preferred Stock; the subsequent

conversion of the Series D Preferred Stock into shares of Common Stock in the event of certain transfers; the exchange of the Series B Preferred Stock for Common Stock; and an amendment

of the Company's certificate of incorporation that permits Treasury to vote shares of Common Stock that it holds in excess of 10% of the Company's outstanding Common Stock. In addition, the

stockholders approved a 1-for-15 reverse stock split pursuant to which each 15 shares of the Company's Common Stock would be converted into one share of Common Stock. The

1-for-15 reverse stock split was effective as of October 27, 2011, resulting in a reduction in the number of outstanding shares of the Company's Common Stock from

2,510,238 to 166,975, an increase of the conversion price of the Series C Preferred Stock and the Series D Preferred Stock and the exchange ratio of the Series B Preferred Stock

from $0.5451 to $8.1765, and a corresponding decrease in the number of shares of Common Stock issued to the Investors and Treasury.

Corporate Information

Our principal executive offices are located at 75 West 125

th

Street, New York, New York, 10027-4512.

Our telephone number is (718) 230-2900. Our internet address is

www.carverbank.com

. Information contained on, or that is accessible through, our website

should not be considered to be part of this prospectus.

Listing

Our shares of Common Stock are currently traded on the NASDAQ Capital Market under the symbol "CARV." On January 19, 2012, the

last reported sales price of our Common Stock was $ 8.85 per share. Our shares of Series D Preferred Stock are not listed or traded on any market or exchange.

5

Table of Contents

Resale of Common Stock by Selling Stockholders

A total of 3,529,325 shares of Common Stock are offered pursuant to this prospectus. These shares of Common Stock are offered for sale

by the selling stockholders identified in this prospectus, and not by us. Please see "

Description of Securities—Common Stock

" for important

information regarding our Common Stock.

We will not receive any proceeds from the sale by the selling stockholders of the any of these shares of Common Stock.

|

|

|

|

|

Shares of Common Stock outstanding prior to the offering of Common Stock

|

|

3,697,264 shares of Common Stock

(1)

|

Shares of Common Stock outstanding after the completion of the offering of shares of Common Stock by the selling stockholders

|

|

3,697,264 shares of Common Stock

(2)

|

Proceeds and Use of Proceeds

|

|

We will not receive any proceeds from the sale by the selling stockholders of these shares of Common Stock.

|

-

(1)

-

As

of January 19, 2012, after giving effect to the 1-for-15 reverse stock split that was effective as of

October 27, 2011.

-

(2)

-

Does

not give effect to the issuance of 5,518,006 shares of Common Stock upon conversion of the Series D Preferred Stock. If all of the

Series D Preferred Stock also converts, there would be 9,215,270 shares of Common Stock outstanding.

6

Table of Contents

Resale of Series D Preferred Stock and Common Stock by Selling Stockholders

A total of 45,118 shares of our Series D Preferred Stock and 5,518,006 shares of Common Stock issuable upon conversion of the

Series D Preferred Stock are offered pursuant to this prospectus. The shares of Series D Preferred Stock are offered for sale by the selling stockholders identified in this prospectus,

and not by us. In the event of certain transfers resulting in the conversion of the Series D Preferred Stock, shares of Common Stock issued to persons who purchase Series D Preferred

Stock from the selling stockholders are offered by, and will be issued by, us. Please see "

Description of Securities—Series D Preferred

Stock

" and "—

Common Stock

" for important information regarding the Series D Preferred Stock and the Common

Stock into which the Series D Preferred Stock may be converted.

In

the event of certain transfers of the Series D Preferred Stock, including certain sales by selling stockholders pursuant to this prospectus, the Series D Preferred Stock

will automatically convert into shares of Common Stock, and the purchaser will not receive shares of Series D Preferred Stock.

We

will not receive any proceeds from the sale by the selling stockholders of the any of the shares of Series D Preferred Stock or the issuance by us of Common Stock into which

the Series D Preferred Stock may convert.

|

|

|

|

|

Shares of Series D Preferred Stock outstanding prior to the offering

|

|

45,118 shares of Series D Preferred Stock

|

Shares of Series D Preferred Stock outstanding after the offering

|

|

45,118 shares of Series D Preferred Stock

(1)

|

Shares of Common Stock outstanding prior to the offering of Common Stock underlying Series D Preferred Stock

|

|

3,697,264 shares of Common Stock

(2)

|

Shares of Common Stock outstanding after the conversion of the Series D Preferred Stock and the offering of Common Stock issuable upon the conversion of the Series D Preferred Stock

|

|

9,215,270 shares of Common Stock

(3)

|

Proceeds and Use of Proceeds

|

|

We will not receive any proceeds from the sale by the selling stockholders of the Series D Preferred Stock or any of the shares of Common Stock issuable upon conversion of the Series D Preferred

Stock.

|

-

(1)

-

Assumes

that all shares of Series D Preferred Stock are sold in transfers that do not cause the Series D Preferred Stock to

convert into shares of Common Stock. If some of the shares of Series D Preferred Stock are sold in transfers that result in the conversion of the Series D Preferred Stock into shares of

Common Stock, there will be fewer shares of Series D Preferred Stock outstanding after the offering.

-

(2)

-

As

of January 19, 2012, after giving effect to the 1-for-15 reverse stock split that was effective as of

October 27, 2011.

-

(3)

-

Assumes

that all shares of Series D Preferred Stock are sold in transfers that cause the Series D Preferred Stock to convert

into shares of Common Stock. If some of the shares of Series D Preferred Stock are sold in transfers that do not result in the conversion of the Series D Preferred Stock into shares of

Common Stock, there will be fewer shares of Common Stock outstanding after the offering.

7

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus includes statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that

are intended as "forward-looking statements" under the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate strictly to historical or

current facts. They use words such as "anticipate," "estimate," "project," "forecast," "may," "will," "should," "could," "expect," "believe," "intend" and other words of similar meaning.

Examples

of forward-looking statements include, but are not limited to, estimates with respect to the Company's financial condition, results of operations and business that are subject

to various factors which could cause actual results to differ materially from these estimates. These factors include but are not limited to the

following:

-

•

-

the Company Order and the Bank Order place restrictions on the operations of the Company and the Bank that may adversely

affect our business, financial condition and results of operations.

-

•

-

general economic conditions, either nationally or locally in some or all areas in which business is conducted, or

conditions in the real estate or securities markets or the banking industry which could affect liquidity in the capital markets, the volume of loan origination, deposit flows, real estate values, the

levels of non-interest income and the amount of loan losses;

-

•

-

changes in existing loan portfolio composition and credit quality, and changes in loan loss requirements;

-

•

-

legislative or regulatory changes which may adversely affect the Company's business, including but not limited to the

impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the regulations required to be promulgated thereunder;

-

•

-

the Company's success in implementing its new business initiatives, including expanding its product line, adding new

branches and ATM centers and successfully building its brand image;

-

•

-

changes in interest rates which may reduce net interest margin and net interest income;

-

•

-

increases in competitive pressure among financial institutions or non-financial institutions;

-

•

-

technological changes which may be more difficult to implement or expensive than anticipated;

-

•

-

changes in deposit flows, loan demand, real estate values, borrowing facilities, capital markets and investment

opportunities which may adversely affect the business;

-

•

-

changes in accounting principles, policies or guidelines which may cause conditions to be perceived differently;

-

•

-

litigation or other matters before regulatory agencies, whether currently existing or commencing in the future, which may

delay the occurrence or non-occurrence of events longer than anticipated;

-

•

-

the ability to originate and purchase loans with attractive terms and acceptable credit quality;

-

•

-

the ability to utilize deferred tax assets;

-

•

-

the ability to attract and retain key members of management; and

-

•

-

the ability to realize cost efficiencies.

8

Table of Contents

All

of the forward-looking statements, whether written or oral, are expressly qualified by these cautionary statements and any other cautionary statements that may accompany such

forward-looking statements or that are otherwise included in or incorporated by reference into this prospectus. The forward-looking statements contained in this prospectus are made as of the date

hereof, and the Company assumes no obligation to, and expressly disclaims any obligation to, update these forward-looking statements to reflect actual results, events or circumstances after the date

of this prospectus, changes in assumptions or changes in other factors affecting such forward-looking statements or to update the reasons why actual results could differ from those projected in the

forward-looking statements, except as legally required. For a discussion of additional factors that could adversely affect the Company's future performance, see "

Risk

Factors

."

9

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with

the other information contained in or incorporated by reference into this prospectus, including the risk factors previously disclosed in our Annual Report on Form 10-K for the year

ended March 31, 2011 and our Quarterly Reports on Form 10-Q for the periods ended June 30, 2011 and September 30, 2011, before making a decision to invest in

our securities. We have described in this prospectus and in the documents incorporated by reference into this prospectus all material risks associated with our operations and an investment in our

Common Stock or Series D Preferred Stock. The risks and uncertainties described below are not the only ones facing our company. Additional risks and uncertainties that are not known to us or

that we currently deem to be immaterial may also adversely affect our business, financial condition or results of operations. If any of the following risks actually occur, our business, financial

condition and results of operations could be harmed and we may not be able to achieve our expectations, projections, intentions or beliefs about future events that are intended as "forward-looking

statements" under Private Securities Litigation Reform Act of 1995. These risk factors should be read in conjunction with the section entitled "Forward-Looking Statements."

Risks Associated with our Business and Operations

The prolonged negative effect of the recession and weak economic recovery will continue to adversely affect our financial performance.

The severe recession and weak economic recovery has resulted in continued uncertainty in the financial and credit markets in general.

There is also continued concern about the possibility of another economic downturn. The Federal Reserve, in an attempt to stimulate the overall economy, has, among other things, kept interest rates

low through its targeted federal funds rate and purchased Treasury-backed and mortgage-backed securities. If the Federal Reserve increases the federal funds rate, overall interest rates will likely

rise which may negatively impact the housing markets and the U.S. economic recovery. A prolonged weakness in the economy generally, and in the financial services industry in particular, could continue

to negatively affect our operations by causing a continued deterioration of our loan portfolio and an increase in our provision for loan losses which would adversely affect our ability to originate

loans. The occurrence of any of these events could have an adverse impact on the Company's financial performance.

Our results of operations are affected by economic conditions in the New York metropolitan area.

A significant majority of the Bank's lending portfolio is concentrated in the New York metropolitan area. As a result of this

geographic concentration, our results of operations are largely dependent on economic conditions in this area. Further decreases in real estate values could adversely affect the value of property used

as collateral for loans to its borrowers. Adverse changes in the economy caused by inflation, recession, unemployment or other factors beyond the Bank's control may also continue to have a negative

effect on the ability of borrowers to make timely mortgage or business loan payments, which would have an adverse impact on earnings. Consequently, deterioration in economic conditions in the New York

metropolitan area could have a material adverse impact on the quality of the Bank's loan portfolio, which could result in increased delinquencies, decreased interest income results as well as an

adverse impact on loan loss experience with probable increased allowance for loan losses. Such deterioration also could adversely impact the demand for products and services, and, accordingly, further

negatively affect results of operations.

The

Bank is operating in a challenging and uncertain economic environment, both nationally and locally. Financial institutions continue to be affected by sharp declines in the real

estate market and constrained financial markets. Continued declines in real estate values, home sales volumes and

10

Table of Contents

financial stress on borrowers as a result of the ongoing economic recession, including job losses, could have an adverse effect on the Bank's borrowers or their customers, which could adversely affect

the Bank's financial condition and results of operations. In addition, the Bank has experienced declines in real estate values in all markets in which it lends. Such decreases in real estate values,

particularly decreases below the original appraised values, could adversely affect the value of property used as collateral for loans.

The Bank has experienced increases in loan delinquencies and charge-offs in fiscal March 31, 2011. The Bank's non-performing loans, which are comprised

primarily of construction and mortgage loans, increased $87.8 million to $77.4 million, or 13.3% of total loans, at March 31, 2011, from $47.6 million, or 7.1% of total

loans, at March 31, 2010, and further increased to $78.9 million, or 16.1% of total loans, at September 30, 2011. The Bank's net loan charge-offs totaled

$16.0 million for fiscal 2011, compared to $2.9 million for fiscal 2010, and were $9.3 million and $14.0 million, respectively, in the quarter and six-month

period ended September 30, 2011. The Bank's provision for loan losses totaled $27.1 million for fiscal 2011 compared to $7.8 million for fiscal 2010, and totaled

$7.0 million and $12.2 million, respectively, for the quarter and six-month period ended September 30, 2011. As a residential lender, Carver Federal is particularly

vulnerable to the impact of a severe job loss recession. Significant increases in job losses and unemployment will have a negative impact on the financial condition of residential borrowers and their

ability to remain current on their mortgage loans. A continuation or further deterioration in national and local economic conditions, including an accelerating pace of job losses, particularly in the

New York metropolitan area, could have a material adverse impact on the quality of The Bank's loan portfolio, which could result in further increases in loan delinquencies, causing a decrease in the

Bank's interest income as well as an adverse impact on the Bank's loan loss experience, causing an increase in the Bank's allowance for loan losses and related provision and a decrease in net income.

Such deterioration could also adversely impact the demand for the Bank's products and services, and, accordingly, the Bank's results of operations.

Current economic conditions may not improve and may worsen, which could result in a decrease in the Bank's interest income or an adverse impact on loan losses.

Our business may be adversely affected by current conditions in the financial markets, the real estate market and economic conditions generally.

Beginning in the latter half of 2007 and continuing into 2011, negative developments in the capital markets resulted in uncertainty and

instability in the financial markets, and an economic downturn. The housing market declined, resulting in decreasing home prices and increasing delinquencies and foreclosures. The credit performance

of residential and commercial real estate, construction and land loans resulted in significant write-downs of asset values by financial institutions, including government-sponsored entities and major

commercial and investment banks. The

declines in the performance and value of mortgage assets encompassed all mortgage and real estate asset types, leveraged bank loans and nearly all other asset classes, including equity securities.

These write-downs have caused many financial institutions to seek additional capital or to merge with larger and stronger institutions. Some financial institutions have failed. Continued, and

potentially increased, volatility, instability and weakness could affect our ability to sell investment securities and other financial assets, which in turn could adversely affect our liquidity and

financial position. This instability also could affect the prices at which we could make any such sales, which could adversely affect our earnings and financial condition.

Concerns

over the stability of the financial markets and the economy have resulted in decreased lending by some financial institutions to their customers and to each other. This

tightening of credit has led to increased loan delinquencies, lack of customer confidence, increased market volatility and a widespread reduction in general business activity. Competition among

depository institutions for deposits has increased significantly, and access to deposits or borrowed funds has decreased for many

11

Table of Contents

institutions.

It has also become more difficult to assess the creditworthiness of customers and to estimate the losses inherent in our loan portfolio.

Current

conditions, including high unemployment, soft real estate markets, and the decline of home sales and property values, could negatively affect the volume of loan originations and

prepayments, the value of the real estate securing our mortgage loans, and borrowers' ability to repay loan obligations, all of which could adversely impact our earnings and financial condition.

Business activity across a wide range of industries and regions is greatly reduced, and local governments and many companies are in serious difficulty due to the lack of consumer spending and the lack

of liquidity in the credit markets. A worsening of current conditions would likely adversely affect our business and results of operations, as well as those of our customers. As a result, we may

experience increased foreclosures, delinquencies and customer bankruptcies, as well as more restricted access to funds.

The soundness of other financial institutions could negatively affect us.

Our ability to engage in routine funding transactions could be adversely affected by the actions and commercial soundness of other

financial institutions. Financial services institutions are interrelated as a result of trading, clearing, counterparty, or other relationships. As a result, defaults by, or even rumors or questions

about, one or more financial services institutions, or the financial services industry generally, have led to market-wide liquidity problems and could lead to losses or defaults by us or

by other institutions. Many of these transactions expose us to credit risk in the event of default of our counterparty or client. In addition, our credit risk may be

exacerbated when the collateral held by us cannot be realized upon or is liquidated at prices not sufficient to recover the full amount of the financial instrument exposure due us. Any such losses

could materially and adversely affect our results of operations.

Standard & Poor's downgrade in the U.S. government's sovereign credit rating, and in the credit ratings of instruments issued, insured or guaranteed by certain

related institutions, agencies and instrumentalities, could result in risks to us and general economic conditions that we are not able to predict.

On August 5, 2011, Standard & Poor's downgraded the United States long-term debt rating from its AAA rating

to AA+. On August 8, 2011, Standard & Poor's downgraded the credit ratings of certain long-term debt instruments issued by Fannie Mae and Freddie Mac and other U.S.

government agencies linked to long-term U.S. debt. Instruments of this nature are key assets on the balance sheets of financial institutions, including the Bank. These downgrades could

adversely affect the market value of such instruments, and could adversely impact our ability to obtain funding that is collateralized by affected instruments, as well as affecting the pricing of that

funding when it is available. Changes to these credit ratings may have a significant effect on economic conditions, which could result in a significant adverse impact to us, and could exacerbate the

other risks to which the Company is subject, including those disclosed in this prospectus or incorporated herein by reference.

The allowance for loan losses could be insufficient to cover the Company's actual loan losses.

We make various assumptions and judgments about the collectability of our loan portfolio, including the creditworthiness of our

borrowers and the value of the real estate and other assets serving as collateral for the repayment of many of our loans. In determining the amount of the allowance for loan losses, we review our

loans and our loss and delinquency experience, and we evaluate economic conditions. If our assumptions are incorrect, our allowance for loan losses may not be sufficient to cover losses inherent in

our loan portfolio, resulting in additions to our allowance. Material additions to the allowance would materially decrease net income.

In

addition, our regulators periodically review the allowance for loan losses and may require us to increase our provision for loan losses or recognize further loan

charge-offs. A material increase in the

12

Table of Contents

allowance

for loan losses or loan charge-offs as required by the regulatory authorities would have a material adverse effect on the Company's financial condition and results of operations.

The Company's concentration in multifamily loans, commercial real estate loans, and construction loans could, in a deteriorating economic climate, expose us to increased

lending risks and related loan losses.

The Company's current business strategy is to decrease the Bank's exposure to non-owner occupied commercial real estate

loans and construction loans. Execution of this strategy will involve us temporarily ceasing new originations of these types of loan products, which often have a higher interest rate than other types

of loans, including residential lending. As a result, our ability to generate sufficient net interest margin is lessened which would have a material adverse effect on the Company's financial condition

and results of operations.

Changes in interest rate environment may negatively affect the Company's net income, mortgage loan originations and valuation of available-for-sale

securities

.

The Company's earnings depend largely on the relationship between the yield on interest-earning assets, primarily mortgage,

construction and business loans and mortgage-backed securities, and the cost of deposits and borrowings. This relationship, known as the interest rate spread, is subject to fluctuation and is affected

by economic and competitive factors which influence market interest rates, the volume and mix of interest-earning assets and interest-bearing liabilities, and the level of non-performing

assets. Fluctuations in market interest rates affect customer demand for products and services. The Company is subject to interest rate risk to the degree that its interest-bearing liabilities reprice

or mature more slowly or more rapidly or on a different basis than its interest-earning assets.

In

addition, the actual amount of time before mortgage, construction and business loans and mortgage-backed securities are repaid can be significantly impacted by changes in mortgage

prepayment rates and prevailing market interest rates. Mortgage prepayment rates will vary due to a number of factors, including the regional economy in the area where the underlying mortgages were

originated, seasonal factors, demographic variables and the ability to assume the underlying mortgages. However, the major factors affecting prepayment rates are prevailing interest rates, related

loan refinancing opportunities and competition.

The Company's objective is to fund its liquidity needs primarily through lower costing deposit growth. However, from time to time Carver Federal borrows from the Federal Home Loan Bank

of New York ("FHLB-NY"). More recently, the cost of deposits and borrowings have become significantly higher with the rising interest rate environment, which has negatively impacted net

interest income.

Interest rates do and will continue to fluctuate. The Federal Open Market Committee ("FOMC") reduced the federal funds rate by 100 basis points during the second half of 2007 and then an

additional 400+ basis points during 2008 bringing the target rate to 0.00% to 0.25%. At January 20, 2012 the FOMC target rate remained at 0.00% to 0.25%. The FOMC or the Federal Reserve may

take additional actions, and other economic conditions may develop, that may cause rates to change. Further changes in interest rates or further increases in mortgage loan prepayments could have a

negative impact on net interest income, net interest rate spread or net interest margin.

The

estimated fair value of the Company's available-for-sale securities portfolio may increase or decrease depending on changes in interest rates. Carver

Federal's securities portfolio is comprised primarily of adjustable rate securities.

Strong competition within the Bank's market areas could adversely affect profits and slow growth.

The New York metropolitan area has a high density of financial institutions, of which many are significantly larger than Carver Federal

and with greater financial resources. Additionally, various large

13

Table of Contents

out-of-state

financial institutions may continue to enter the New York metropolitan area market. All are considered competitors to varying degrees.

Carver

Federal faces intense competition both in making loans and attracting deposits. Competition for loans, both locally and in the aggregate, comes principally from mortgage banking

companies, commercial banks, savings banks and savings and loan associations. Most direct competition for deposits comes from commercial banks, savings banks, savings and loan associations and credit

unions. The Bank also faces competition for deposits from money market mutual funds and other corporate and government securities funds as well as from other financial intermediaries such as brokerage

firms

and insurance companies. Market area competition is a factor in pricing the Bank's loans and deposits, which could reduce net interest income. Competition also makes it more challenging to effectively

grow loan and deposit balances. The Company's profitability depends upon its continued ability to successfully compete in its market areas.

Controls and procedures may fail or be circumvented, which may result in a material adverse effect on the Company's business.

Management regularly reviews and updates the Company's internal controls, disclosure controls and procedures, and corporate governance

policies and procedures. Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the

objectives of the system are met. Any failure or circumvention of the controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse

effect on Carver's business, results of operations and financial condition.

The Bank and the Company operate in a highly regulated industry, which limits the manner and scope of business activities.

Carver Federal is subject to extensive supervision, regulation and examination by the OCC, the FDIC, and, to a lesser extent, by the

New York State Banking Department. The Company is subject to extensive regulation by the Federal Reserve. As a result, the Bank and the Company are limited in the manner in which they conduct their

business, undertake new investments and activities and obtain financing. This regulatory structure is designed primarily for the protection of the deposit insurance funds and the Bank's depositors,

and not to benefit the Company's stockholders. This regulatory structure also gives the regulatory authorities extensive discretion in connection with their supervisory and enforcement activities and

examination policies, including policies with respect to capital levels, the timing and amount of dividend payments, the classification of assets and the establishment of adequate loan loss reserves

for regulatory purposes. In addition, the Bank must comply with significant anti-money laundering and anti-terrorism laws. Government agencies have substantial discretion to

impose significant monetary penalties on institutions which fail to comply with these laws.

On

October 4, 2006, federal bank regulatory authorities published the Interagency Guidance on Nontraditional Mortgage Product Risk, or the Guidance. In general, the Guidance

applies to all residential mortgage loan products that allow borrowers to defer repayment of principal or interest. The Guidance describes sound practices for managing risk, as well as marketing,

originating and servicing nontraditional mortgage products, which include, among other things, interest-only loans. The Guidance sets forth supervisory expectations with respect to loan

terms and underwriting standards, portfolio and risk management practices and consumer protection. For example, the Guidance indicates that originating interest-only loans with reduced

documentation is considered a layering of risk and that institutions are expected to

demonstrate mitigating factors to support their underwriting decision and the borrower's repayment capacity. Specifically, the Guidance indicates that a lender may accept a borrower's statement as to

the borrower's income without obtaining verification only if there are mitigating factors that clearly minimize the need for direct verification of repayment capacity and that, for many borrowers,

institutions should be able to readily document income.

14

Table of Contents

The Bank has evaluated the Guidance for compliance, risk management practices and underwriting guidelines as they relate to originations and purchases of the subject loans, or practices

relating to communications with consumers. The Guidance has no impact on the Bank's loan origination and purchase volumes or the Bank's underwriting procedures currently or in future periods.

Changes in laws, government regulation and monetary policy may have a material effect on results of operations.

Financial institution regulation has been the subject of significant legislation and may be the subject of further significant

legislation in the future, none of which is in the Company's control. Significant new laws or changes in, or repeals of, existing laws, including with respect to federal and state taxation, may cause

results of operations to differ materially. In addition, cost of compliance could adversely affect the Company's ability to operate profitably. Further, federal monetary policy significantly affects

credit conditions for Carver Federal, particularly as implemented through the Federal Reserve. A material change in any of these conditions could have a material impact on Carver Federal, and

therefore on the Company's results of operations.

On October 3, 2008, President Bush signed the Emergency Economic Stabilization Act of 2008 ("EESA") into law in response to the financial crises affecting the banking system and

financial markets. Pursuant to EESA, Treasury has the authority to, among other things, purchase up to $700 billion of troubled assets (including mortgages, mortgage-backed securities and

certain other financial instruments) from financial institutions for the purpose of stabilizing and providing liquidity to the U.S. financial markets. On October 14, 2008, Treasury, the Federal

Reserve and the FDIC issued a joint statement announcing additional steps aimed at stabilizing the financial markets. First, Treasury announced the Troubled Asset Relief Program ("TARP") Capital

Purchase Program ("CPP"), a $250 billion voluntary capital purchase program available to qualifying financial institutions that sell preferred shares to Treasury (to be funded from the

$700 billion authorized for troubled asset purchases.) Second, the FDIC announced that its Board of Directors, under the authority to prevent "systemic risk" in the U.S. banking system,

approved the Temporary Liquidity Guarantee Program, which is intended to strengthen confidence and encourage liquidity in the banking system by permitting the FDIC to (1) guarantee certain

newly issued senior unsecured debt issued by participating institutions under the Debt Guarantee Program and (2) fully insure non-interest bearing transaction

deposit accounts held at participating FDIC-insured institutions, regardless of dollar amount, under the Transaction Account Guarantee Program. Third, to further increase access to funding

for businesses in all sectors of the economy, the Federal Reserve announced further details of its Commercial Paper Funding Facility, or CPFF, which provides a broad backstop for the commercial paper

market. The Company currently participates in the TARP Community Development Capital Initiative ("CDCI").

The foregoing program or any other governmental program designed to provide financial or economic relief may not have the intended impact, and may have a negative impact on the financial

markets. The failure of any such program or the U.S. government to stabilize the financial markets and a continuation or worsening of current financial market conditions and the national and regional

economy is expected to materially and adversely affect the Company's business, financial condition, results of operations, access to credit and the trading price of our Common Stock.

Pursuant to the Company's participation in the TARP CPP and subsequent conversion to CDCI, the Company entered into certain agreements with Treasury that limit the Company's activities

in a number of ways and that give Treasury the ability to impose additional restrictions as it determines. For example, the Company's ability to declare or pay dividends on any shares of our capital

stock is restricted. Specifically, the Company is not generally permitted to increase dividends on its Common Stock without Treasury's approval until earlier of the third anniversary of the CPP

investment or at such time when Treasury ceases to own any debt or equity securities of the Company. In addition, the Company's ability to redeem, repurchase or acquire shares of its Common Stock or

other capital stock

15

Table of Contents

or is prohibited without Treasury's prior consent until the earlier of the third anniversary of the CPP investment or at such time when Treasury ceases to own any debt or equity securities of the

Company.

In

addition, the Company must also adopt Treasury's standards for executive compensation and corporate governance for the period during which Treasury holds equity issued under this

program. These standards would generally apply to the Company's CEO, CFO and the three next most highly compensated officers ("Senior Executive"). The standards include (1) ensuring that

incentive compensation for Senior Executives does not encourage unnecessary and excessive risks that threaten the value of the financial institution; (2) required claw back of any bonus or

incentive compensation paid to a Senior Executive based on statements of earnings, gains or other criteria that are later proven to be materially inaccurate; (3) prohibition on making golden

parachute payments to Senior Executives; and (4) agreement not to deduct for tax purposes executive compensation in excess of $500,000 for each Senior Executive. In particular, the change to

the deductibility limit on executive compensation would likely increase slightly the overall cost of the Company's compensation programs.

On

July 21, 2010, the President signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"). The

Dodd-Frank Act implements significant changes in the financial regulatory landscape and will impact all financial institutions. This impact may materially affect our business activities,

financial position and profitability by, among other things, increasing our regulatory compliance burden and associated costs, placing restrictions on certain products and services, and limiting our

future capital raising strategies.

Among the Dodd-Frank Act's significant regulatory changes, it creates a new financial consumer protection agency, known as the Bureau of Consumer Financial Protection (the

"Bureau"), that is empowered to promulgate new consumer protection regulations and revise existing regulations in many areas of consumer protection. The Bureau has exclusive authority to issue

regulations, orders and guidance to administer and implement the objectives of federal consumer protection laws. The Dodd-Frank Act also eliminated our primary regulator, the OTS and

designated the OCC to become the Bank's primary federal regulator and designated the Federal Reserve as the Company's primary federal regulator. Moreover, the Dodd-Frank Act permits States

to adopt stricter consumer protection laws and authorizes State attorneys general to enforce consumer protection rules issued by the Bureau. The Dodd-Frank Act also may affect the

preemption of State laws as they affect subsidiaries and agents of federally chartered banks, changes the scope of federal deposit insurance coverage, and increases the FDIC assessment payable by the

Bank. We expect that the Bureau and these other changes will significantly increase our regulatory compliance burden and costs and may restrict the financial products and services we offer to our

customers.

The Dodd-Frank Act also imposes more stringent capital requirements on bank holding companies by, among other things, imposing leverage ratios on bank holding companies and

prohibiting new trust preferred issuances from counting as Tier I capital. These restrictions will limit our future capital strategies. Under the Dodd-Frank Act, our outstanding

trust preferred securities will continue to count as Tier I capital but we will be unable to issue replacement or additional trust preferred securities that would count as Tier I

capital. Because many of the Dodd-Frank Act's provisions require subsequent regulatory rulemaking, we are uncertain as to the impact that some of the provisions will have on us. The

Dodd-Frank Act and the regulations promulgated thereunder may adversely affect our financial condition and results of operations.

Management

expects to face increased regulation and supervision of the banking industry as a result of the existing financial crisis, and there may be additional requirements and

conditions imposed on us to the extent that we participate in any of the programs established or to be established by Treasury or by the federal bank regulatory agencies. Such additional regulation

and supervision may increase the Company's costs and limit the Company's ability to pursue business opportunities.

16

Table of Contents

Future FDIC assessments will hurt our earnings.

In May 2009, the FDIC adopted a final rule imposing a special assessment on all insured institutions due to recent bank and savings

association failures. The emergency assessment amounts to 5 basis points of total assets minus Tier 1 Capital as of June 30, 2009. We recorded an expense of $0.4 million during

the quarter ended June 30, 2009, to reflect the special assessment. The assessment was collected on September 30, 2009 and was recorded against earnings for the quarter ended

June 30, 2009. The special assessment negatively impacted the Company's earnings for the year ended March 31, 2011, as compared to the year ended March 31, 2010, as a result of

this special assessment. In November 2009, the FDIC issued a rule that required all insured depository institutions, with limited exceptions, to prepay their estimated quarterly risk-based

assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. The FDIC also adopted a uniform three-basis point increase in assessment rates effective on January 1, 2011. Any

additional emergency special assessment or increases in insurance premiums imposed by the FDIC will likely negatively impact the Company's earnings.

The Company is subject to certain risks with respect to liquidity.

"Liquidity" refers to the Company's ability to generate sufficient cash flows to support operations and to fulfill obligations,

including commitments to originate loans, to repay wholesale borrowings, and to satisfy the withdrawal of deposits by customers.

The

Company's primary sources of liquidity are the cash flows generated through the repayment of loans and securities, cash flows from the sale of loans and securities, deposits gathered

organically through the Bank's branch network, from socially motivated depositors, city and state agencies and deposit brokers; and borrowed funds, primarily in the form of wholesale borrowings from

the FHLB-NY. In addition, and depending on current market conditions, the Company has the ability to access the capital markets from time to time.

Deposit

flows, calls of investment securities and wholesale borrowings, and prepayments of loans and mortgage-related securities are strongly influenced by such external factors as the

direction of interest rates, whether actual or perceived; local and national economic conditions; and competition for deposits and loans in the markets the Bank serves. Furthermore, changes to the

FHLB-NY's underwriting guidelines for wholesale borrowings may limit or restrict the Bank's ability to borrow, and could therefore have a significant adverse impact on liquidity.

A

decline in available funding could adversely impact the Bank's ability to originate loans, invest in securities, and meet expenses, or to fulfill such obligations as repaying

borrowings or meeting deposit withdrawal demands.

The Bank's ability to pay dividends or lend funds to the Company is subject to regulatory limitations which may prevent the Company from making future dividend payments or

principal and interest payments on its debt obligation.

The Company is a unitary savings and loan association holding company regulated by the Federal Reserve and almost all of its operating

assets are owned by Carver Federal. Carver relies primarily on dividends from the Bank to pay cash dividends to its stockholders, to engage in share repurchase programs and to pay principal and

interest on its trust preferred debt obligation. The OCC regulates all capital distributions by the Bank to us, including dividend payments. As the subsidiary of a savings and loan association holding

company, Carver Federal must file a notice or an application (depending on the proposed dividend amount) with the OCC prior to each capital distribution. The OCC will disallow any proposed