CalAmp Corp. (NASDAQ: CAMP), a leading provider of wireless

products, services and solutions, today reported results for its

fiscal fourth quarter and full year ended February 28, 2011. Key

elements include:

-- Consolidated fourth quarter revenues of $28.9 million; wireless datacom

fourth quarter revenues up 48% year-over-year to $23.4 million.

-- Consolidated full year revenues of $114.3 million; wireless datacom

full year revenues up 37% year-over-year to $78.4 million.

-- Consolidated fourth quarter gross margin percentage of 28.9%, up from

20.2% in fourth quarter of prior year; consolidated full year gross

margin percentage of 25.9%, up from 20.0% in prior year.

-- Fourth quarter GAAP net income of $0.3 million, or $0.01 per diluted

share; Adjusted Basis (non-GAAP) net income of $0.7 million, or $0.02

per diluted share.

Commenting on the fiscal 2011 fourth quarter and full year

results, Rick Gold, CalAmp's Chief Executive Officer said, "CalAmp

returned to profitability on a GAAP basis this quarter for the

first time in four years. Our wireless datacom business continued

its strong momentum, with quarterly revenues increasing 48%

year-over-year. This growth is now being driven by both our mobile

resource management (MRM) products and our wireless networks

products. We are seeing strong demand for our MRM products from the

local fleet management, vehicle finance, asset tracking and stolen

vehicle recovery verticals. Our wireless networks products also

showed strong growth with contributions from projects in the public

safety, railroad and energy sectors. We are making significant

investments in R&D to expand and strengthen our footprint in

wireless data, and we're encouraged by the traction our new

products are getting in the market."

Mr. Gold continued, "In our satellite business, fourth quarter

revenue was softer than expected. During the quarter, we began the

production ramps of one older product and one new product, but

those ramps did not occur until late in the quarter. Volume

shipments of both products are now underway and are expected to

drive significantly higher satellite revenue during our fiscal 2012

first quarter. In addition, we are on track with our recently

announced plans for enhancing the operational flexibility and cost

structure of our satellite business. We are continuing to work on

additional new products that we expect to launch this year and we

expect improved financial results from this business in fiscal

2012."

Fiscal 2011 Fourth Quarter Results

Total revenue for the fiscal 2011 fourth quarter was $28.9

million compared to $34.5 million for the fourth quarter of fiscal

2010 as higher revenues in the Company's wireless datacom segment

were offset by lower satellite segment revenues. Wireless datacom

revenue increased 48% to $23.4 million from $15.8 million in the

same period last year, while satellite revenue decreased to $5.6

million from $18.7 million in the same period last year.

Consolidated gross profit for the fiscal 2011 fourth quarter was

$8.4 million, or a 28.9% gross margin, compared to gross profit of

$7.0 million, or a 20.2% gross margin, for the same period last

year. The increases in gross profit and gross margin percentage in

the latest quarter were due primarily to higher wireless datacom

revenues.

An income tax benefit of $172,000 was recorded in the fiscal

2011 fourth quarter relating to the carryback of net operating

losses of the Company's French subsidiary. Excluding this item, no

income tax provision or benefit was recorded in fiscal 2011, and no

income tax provision or benefit is expected to be recorded in

fiscal 2012 due to the existence of net operating loss

carryforwards for U.S. federal and state tax purposes.

Results of operations for the fiscal 2011 fourth quarter as

determined in accordance with GAAP was net income of $0.3 million,

or $0.01 per diluted share, compared to a net loss of $1.3 million,

or $0.05 per diluted share, in the fourth quarter of last year.

The Adjusted Basis (non-GAAP) net income for the fiscal 2011

fourth quarter was $0.7 million, or $0.02 per diluted share,

compared to Adjusted Basis net loss of $0.5 million, or $0.02 loss

per diluted share, for the same period last year. The Adjusted

Basis net income (loss) excludes intangible asset amortization and

stock-based compensation expense, and includes a pro forma income

tax provision or benefit computed without giving effect to

increases or decreases in the deferred income tax valuation

allowance that are recognized for GAAP basis financial reporting. A

reconciliation of the GAAP basis pretax income (loss) to the

Adjusted Basis net income (loss) is provided in the table at the

end of this press release.

Liquidity

As of February 28, 2011, the Company had total cash of $4.2

million and total debt of $11.9 million. Total debt at that date

consisted of $7.49 million drawn under the Company's revolving bank

credit facility and subordinated debt of $4.46 million. The unused

borrowing capacity on the bank revolver was $3.8 million at

February 28, 2011. Net cash provided by operating activities during

the three- and twelve-month periods ended February 28, 2011 was

$51,000 and $857,000, respectively.

Business Outlook

Commenting on the Company's business outlook, Mr. Gold said,

"Based on our latest projections, we expect fiscal 2012 first

quarter consolidated revenues in the range of $31 to $34 million.

First quarter satellite revenues are expected to increase

significantly on a sequential quarter basis. Wireless datacom

revenues are expected to increase significantly on a year-over-year

basis, but be down slightly on a sequential basis. We expect fiscal

first quarter GAAP basis net income (loss) in the range of a $0.01

loss to $0.02 income per diluted share. The Adjusted Basis

(non-GAAP) net income for the first quarter is expected to be in

the range of breakeven to $0.03 income per diluted share."

Mr. Gold continued, "Based on our current forecast, we expect

fiscal 2012 revenue to trend higher compared to fiscal 2011 with

growth in both our satellite and wireless datacom businesses, and

we expect to be profitable on a GAAP basis for the year as a

whole."

Conference Call and Webcast

A conference call and simultaneous webcast to discuss fiscal

2011 fourth quarter and full year financial results and business

outlook will be held today at 4:30 p.m. Eastern / 1:30 p.m.

Pacific. CalAmp's CEO Rick Gold, President/COO Michael Burdiek and

CFO Rick Vitelle will host the conference call. Participants can

dial into the live conference call by calling 800-762-8779

(480-629-9771 for international callers). An audio replay will be

available through May 5, 2011, by calling 800-406-7325

(303-590-3030 for international callers) and entering the access

code 4430187.

Additionally, a live webcast of the call will be available on

CalAmp's web site at www.calamp.com. Participants are encouraged to

visit the web site at least 15 minutes prior to the start of the

call to register, download and install any necessary audio

software. After the live webcast, a replay will remain available

until the next quarterly conference call in the Investor Relations

section of CalAmp's web site.

About CalAmp

CalAmp develops and markets wireless communications solutions

that deliver data, voice and video for critical networked

communications and other applications. The Company's two business

segments are Wireless Datacom, which serves utility, governmental

and enterprise customers, and Satellite, which focuses on the North

American Direct Broadcast Satellite market. For more information,

please visit www.calamp.com.

Forward-Looking Statements

Statements in this press release that are not historical in

nature are forward-looking statements that involve known and

unknown risks and uncertainties. Words such as "may," "will,"

"expect," "intend," "plan," "believe," "seek," "could," "estimate,"

"judgment," "targeting," "should," "anticipate," "goal" and

variations of these words and similar expressions, are intended to

identify forward-looking statements. Actual results could differ

materially from those implied by such forward-looking statements

due to a variety of factors, including product demand, competitive

pressures and pricing declines in the Company's satellite and

wireless datacom markets, the timing of customer approvals of new

product designs, the length and extent of the global economic

downturn that has and may continue to adversely affect the

Company's business, and other risks or uncertainties that are

described in the Company's Report on Form 10-K for fiscal 2011 as

filed today with the Securities and Exchange Commission. Although

the Company believes the expectations reflected in such f

orward-looking statements are based upon reasonable assumptions, it

can give no assurance that its expectations will be attained. The

Company undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

CAL AMP CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands except per share amounts)

Three Months Ended Year Ended

February 28, February 28,

-------------------- --------------------

2011 2010 2011 2010

--------- --------- --------- ---------

/----(Unaudited)---/

Revenues $ 28,944 $ 34,481 $ 114,333 $ 112,113

Cost of revenues 20,576 27,499 84,775 89,723

--------- --------- --------- ---------

Gross profit 8,368 6,982 29,558 22,390

--------- --------- --------- ---------

Operating expenses:

Research and development 2,850 2,686 11,125 10,943

Selling 2,633 2,422 10,503 9,542

General and administrative 2,168 2,512 8,858 10,523

Intangible asset amortization 275 342 1,132 1,367

--------- --------- --------- ---------

7,926 7,962 31,618 32,375

--------- --------- --------- ---------

Operating income (loss) 442 (980) (2,060) (9,985)

Non-operating expense, net (311) (352) (1,395) (2,240)

--------- --------- --------- ---------

Income (loss) before income

taxes 131 (1,332) (3,455) (12,225)

Income tax benefit 172 - 172 1,374

--------- --------- --------- ---------

Net income (loss) $ 303 $ (1,332) $ (3,283) $ (10,851)

========= ========= ========= =========

Earnings (loss) per share -

basic $ 0.01 $ (0.05) $ (0.12) $ (0.43)

Earnings (loss) per share -

diluted $ 0.01 $ (0.05) $ (0.12) $ (0.43)

Shares used in basic per

share calculations 27,325 26,442 27,181 25,309

Shares used in diluted per

share calculations 28,072 26,442 27,181 25,309

BUSINESS SEGMENT INFORMATION

(In thousands)

Three Months Ended Year Ended

February 28, February 28,

-------------------- --------------------

2011 2010 2011 2010

--------- --------- --------- ---------

/----(Unaudited)---/

Revenues

Satellite $ 5,583 $ 18,700 $ 35,899 $ 54,715

Wireless DataCom 23,361 15,781 78,434 57,398

--------- --------- --------- ---------

Total revenues $ 28,944 $ 34,481 $ 114,333 $ 112,113

========= ========= ========= =========

Gross profit (loss)

Satellite $ (493) $ 1,853 $ 1,636 $ 4,258

Wireless DataCom 8,861 5,129 27,922 18,132

--------- --------- --------- ---------

Total gross profit $ 8,368 $ 6,982 $ 29,558 $ 22,390

========= ========= ========= =========

Operating income (loss)

Satellite $ (1,459) $ 740 $ (2,460) $ (111)

Wireless DataCom 2,876 (1,076) 4,922 (5,867)

Corporate expenses (975) (644) (4,522) (4,007)

--------- --------- --------- ---------

Total operating income

(loss) $ 442 $ (980) $ (2,060) $ (9,985)

========= ========= ========= =========

CAL AMP CORP.

CONSOLIDATED BALANCE SHEETS

(In thousands)

February 28, February 28,

2011 2010

---------- ----------

Assets

Current assets:

Cash and cash equivalents $ 4,241 $ 2,986

Accounts receivable, net 16,814 16,520

Inventories 9,890 10,608

Deferred income tax assets 1,961 2,656

Prepaid expenses and other current assets 5,197 4,720

---------- ----------

Total current assets 38,103 37,490

Equipment and improvements, net 1,877 2,055

Deferred income tax assets, less current portion 9,887 10,017

Intangible assets, net 4,012 5,144

Other assets 1,606 2,247

---------- ----------

$ 55,485 $ 56,953

========== ==========

Liabilities and Stockholders' Equity

Current liabilities:

Bank working capital line of credit $ 7,489 $ 5,901

Accounts payable 14,103 16,186

Accrued payroll and employee benefits 3,341 2,742

Deferred revenue 5,796 4,740

Other current liabilities 2,140 3,526

---------- ----------

Total current liabilities 32,869 33,095

---------- ----------

Long-term debt 4,460 4,170

Other non-current liabilities 554 489

Stockholders' equity:

Common stock 281 277

Additional paid-in capital 153,135 151,453

Accumulated deficit (134,948) (131,665)

Accumulated other comprehensive loss (866) (866)

---------- ----------

Total stockholders' equity 17,602 19,199

---------- ----------

$ 55,485 $ 56,953

========== ==========

CAL AMP CORP.

CONSOLIDATED CASH FLOW STATEMENTS

(In thousands)

Year Ended

February 28,

----------------------

2011 2010

---------- ----------

Cash flows from operating activities:

Net loss $ (3,283) $ (10,851)

Depreciation and amortization 2,543 2,522

Stock-based compensation expense 2,109 1,981

Amortization of debt issue costs and discount 536 -

Loss on sale of investment - 1,008

Deferred tax assets, net 807 39

Changes in operating working capital (1,835) 7,792

Other (20) 104

---------- ----------

Net cash provided by operating activities 857 2,595

---------- ----------

Cash flows from investing activities:

Capital expenditures (1,245) (1,066)

Proceeds from sale of investment - 992

Collections on note receivable 428 325

Other 32 (36)

---------- ----------

Net cash (used in) provided by investing

activities (785) 215

---------- ----------

Cash flows from financing activities:

Net proceeds from line of credit borrowing 1,588 7,551

Proceeds from issuance of subordinated debt - 5,000

Net proceeds from sale of common stock - 3,968

Debt repayments - (22,728)

Payment of debt issue costs - (544)

Taxes paid related to net share settlement of

vested equity awards (405) (123)

---------- ----------

Net cash provided by (used in) financing

activities 1,183 (6,876)

---------- ----------

Effect of exchange rate changes on cash - 139

---------- ----------

Net change in cash and cash equivalents 1,255 (3,927)

Cash and cash equivalents at beginning of period 2,986 6,913

---------- ----------

Cash and cash equivalents at end of period $ 4,241 $ 2,986

========== ==========

CAL AMP CORP.

NON-GAAP EARNINGS RECONCILIATION

(Unaudited, in thousands except per share amounts)

Non-GAAP Earnings Reconciliation

"GAAP" refers to financial information presented in accordance

with Generally Accepted Accounting Principles in the United States.

This press release includes historical non-GAAP financial measures,

as defined in Regulation G promulgated by the Securities and

Exchange Commission. CalAmp believes that its presentation of

historical non-GAAP financial measures provides useful

supplementary information to investors. The presentation of

historical non-GAAP financial measures is not meant to be

considered in isolation from or as a substitute for results

prepared in accordance with GAAP.

In this press release, CalAmp reports the non-GAAP financial

measures of Adjusted Basis Net Income (Loss) and Adjusted Basis Net

Income (Loss) Per Diluted Share. CalAmp uses these non-GAAP

financial measures to enhance the investor's overall understanding

of the financial performance and future prospects of CalAmp's core

business activities. Specifically, CalAmp believes that a report of

Adjusted Basis Net Income (Loss) and Adjusted Basis Net Income

(Loss) Per Diluted Share provides consistency in its financial

reporting and facilitates the comparison of results of core

business operations between its current and past periods.

The reconciliation of the GAAP Basis Pretax Income (Loss) to

Adjusted Basis (non-GAAP) Net Income (Loss) is as follows:

Three Months Ended Year Ended

February 28, February 28,

-------------------- --------------------

2011 2010 2011 2010

--------- --------- --------- ---------

GAAP basis pretax income (loss) $ 131 $ (1,332) $ (3,455) $ (12,225)

Amortization of intangible assets 275 342 1,132 1,367

Stock-based compensation expense 550 565 2,109 1,981

--------- --------- --------- ---------

Pretax income (loss) (non-GAAP

basis) 956 (425) (214) (8,877)

Income tax benefit (provision)

(non-GAAP basis) (a) (288) (29) 29 3,919

--------- --------- --------- ---------

Non-GAAP net income (loss) $ 668 $ (454) $ (185) $ (4,958)

========= ========= ========= =========

Non-GAAP net income (loss) per

diluted share $ 0.02 $ (0.02) $ (0.01) $ (0.20)

Non-GAAP weighted average common

shares outstanding on diluted

basis 28,072 26,442 27,181 25,309

(a) The non-GAAP income tax benefit (provision) is computed using the

Company's combined U.S. federal and state statutory tax rate of 40.0%

and 40.7% in fiscal 2011 and 2010, respectively, excluding the pretax

losses of foreign operations for which no income tax benefit is

recognized and excluding the effects of increases and decreases in the

deferred income tax valuation allowance.

AT THE COMPANY: Rick Vitelle Chief Financial Officer (805)

987-9000 AT FINANCIAL RELATIONS BOARD: Lasse Glassen General

Information (213) 486-6546 lglassen@mww.com

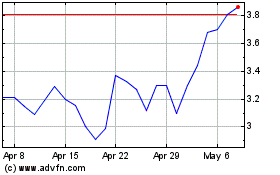

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

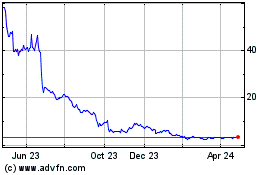

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jul 2023 to Jul 2024