- Current report filing (8-K)

December 23 2009 - 7:57AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 22, 2009

____________________

Exact Name of Registrant as

Specified in Its Charter: CALAMP CORP.

___________________________________

DELAWARE 0-12182 95-3647070

_____________________________ ____________ _____________

State or Other Jurisdiction of Commission I.R.S. Employer

Incorporation or Organization File Number Identification No.

Address of Principal Executive Offices: 1401 N. Rice Avenue

Oxnard, CA 93030

_________________________

Registrant's Telephone Number, Including

Area Code: (805) 987-9000

_________________________

Former Name or Former Address,

if Changed Since Last Report: Not applicable

_____________________________

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14.a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01. Regulation FD Disclosure

On December 22, 2009, CalAmp Corp. (the "Company") paid in full the

$13.95 million outstanding principal balance of its credit facility with Bank

of Montreal and two other banks, which had a maturity date of December 31,

2009. The funds for this payoff were provided by a drawdown of $7.77 million

under a new revolving credit facility with Square 1 Bank of Durham, North

Carolina, supplemented by aggregate proceeds of $6.18 million from the

private placement of common stock and subordinated debt. The Square 1 Bank

credit facility has a two-year term and provides for borrowings up to the

lesser of $12 million or 85% of the Company's eligible accounts receivable.

Outstanding borrowings under this facility bear interest at Square 1's prime

rate plus 2.0%, subject to a minimum effective interest rate of 6.0%.

The Company also raised $4.25 million from the sale of approximately

1,932,000 shares of common stock and $1.93 million from the issuance of

subordinated debt. The subordinated notes bear interest at 12% per annum and

have a maturity date of December 22, 2012. The Company also issued a total

of 192,500 common stock purchase warrants to the subordinated note investors

at an exercise price of $4.02 per share, which represents a 20% premium to

the average closing price of the Company's common stock for the 20

consecutive trading days prior to the closing of the refinancing. The

Company agreed to file a registration statement with the Securities and

Exchange Commission to register the privately-issued shares and the shares of

common stock underlying the warrants.

On December 23, 2009, the Company issued a press release announcing the

refinancing of its bank debt. A copy of the press release is attached as

Exhibit 99.1.

ITEM 9.01. Financial Statements and Exhibits

(c) Exhibits

99.1 Press release of the Registrant dated December 23, 2009

announcing the bank debt refinancing

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as

amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CALAMP CORP.

December 23, 2009 By: /s/ Richard K. Vitelle

_________________ _________________________

Date Richard K. Vitelle,

Vice President-Finance

(Principal Financial Officer)

|

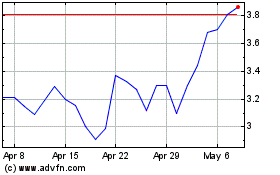

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jul 2023 to Jul 2024