- Current report filing (8-K)

August 17 2009 - 6:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 12, 2009

____________________

Exact Name of Registrant as

Specified in Its Charter: CALAMP CORP.

___________________________________

DELAWARE 0-12182 95-3647070

_____________________________ ____________ _____________

State or Other Jurisdiction of Commission I.R.S. Employer

Incorporation or Organization File Number Identification No.

Address of Principal Executive Offices: 1401 N. Rice Avenue

Oxnard, CA 93030

_________________________

Registrant's Telephone Number, Including

Area Code: (805) 987-9000

_________________________

Former Name or Former Address,

if Changed Since Last Report: Not applicable

_____________________________

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14.a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01. Regulation FD Disclosure

On August 12, 2009, CalAmp Corp. ("CalAmp" or the "Company") sold its

preferred stock holding in MIR3, Inc., a privately-held company, to a group of

private investors not affiliated with CalAmp. The sales price was $1,015,000.

After giving effect to transaction costs, the Company recognized a pre-tax loss

of approximately $1 million on this sale.

Pursuant to the Ninth Amendment to the Company's bank credit agreement,

in which the banks consented to this asset sale, $1 million of the sales

proceeds were applied to the outstanding balance of the bank term loan, thereby

reducing the scheduled principal payment due September 30, 2009 from $1.6

million to $600,000. The balance of the term loan is $13.0 million after

giving effect to this $1 million payment.

The information in this Item 7.01 of the Company's Current Report on

Form 8-K is being furnished and shall not be deemed to be "filed" for the

purposes of Section 18 of the Exchange Act or otherwise subject to the

liabilities of that section. Furthermore, the information in this Item 7.01

of the Company's Current Report on Form 8-K shall not be deemed to be

incorporated by reference into any registration statement or other document

pursuant to the Securities Act of 1933, as amended, unless such subsequent

filing specifically references this Current Report on Form 8-K.

ITEM 9.01. Financial Statements and Exhibits

(c) Exhibits

99.1 Ninth Amendment and Consent to Credit Agreement between

CalAmp Corp., Bank of Montreal and other lenders party thereto

dated August 4, 2009

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CALAMP CORP.

August 14, 2009 By: /s/ Richard Vitelle

___________________ _________________________

Date Richard Vitelle,

VP Finance & Chief Financial Officer

|

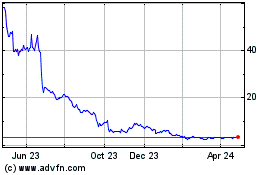

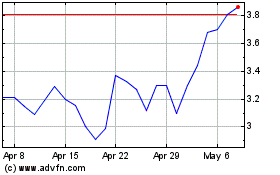

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jul 2023 to Jul 2024