- Current report filing (8-K)

January 09 2009 - 2:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 6, 2009

____________________

Exact Name of Registrant as

Specified in Its Charter: CALAMP CORP.

___________________________________

DELAWARE 0-12182 95-3647070

_____________________________ ____________ _____________

State or Other Jurisdiction of Commission I.R.S. Employer

Incorporation or Organization File Number Identification No.

Address of Principal Executive Offices: 1401 N. Rice Avenue

Oxnard, CA 93030

_________________________

Registrant's Telephone Number, Including

Area Code: (805) 987-9000

_________________________

Former Name or Former Address,

if Changed Since Last Report: Not applicable

_____________________________

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14.a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01. Entry into a Material Definitive Agreement

On January 6, 2009, the Company reached an out-of-court settlement of

litigation with Rogers Corporation pursuant to which Rogers agreed to make a

cash payment to the Company of $9 million by January 12, 2009. The

litigation related to product performance issues involving laminate supplied

by Rogers that was included in certain products manufactured by CalAmp and

sold to a Direct Broadcast Satellite customer. In the settlement agreement

the parties acknowledged that Rogers admitted no wrongdoing or liability for

any claim, and that Rogers agreed to settle this litigation to avoid the

time, expense and inconvenience of continued litigation. Both parties agreed

to file stipulations with the court to dismiss the litigation, and gave

mutual releases of all claims and demands existing as of the settlement date.

Under the terms of CalAmp's bank credit agreement, CalAmp is required to use

approximately $4 million of the settlement proceeds to pay down its bank term

loan. CalAmp is currently in discussions with the banks on the possibility

of making an additional term loan reduction above and beyond this amount.

ITEM 9.01. Financial Statements and Exhibits

(c) Exhibits

10.1 Settlement Agreement dated January 6, 2009 between CalAmp Corp.,

and Rogers Corporation.

99.1 Press release of the Registrant dated January 9, 2009

announcing the settlement with Rogers Corporation.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as

amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CALAMP CORP.

January 9, 2009 By: /s/ Richard K. Vitelle

___________________ _________________________

Date Richard K. Vitelle

Vice President - Finance

Chief Financial Officer

|

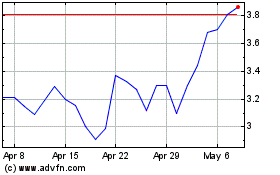

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

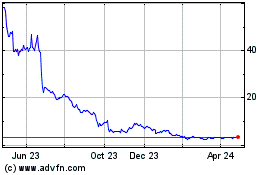

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jul 2023 to Jul 2024