CalAmp Corp. (Nasdaq:CAMP), a leading provider of wireless products

and engineering services, today reported results for its fiscal

2007 first quarter ended May 31, 2006. Key elements include: --

Revenues of $46.3 million within guidance -- Net loss of $34.1

million includes non-cash charges of $36.7 million for in-process

research and development (IPR&D) and goodwill impairment --

Operating cash flow of $4.7 million during first quarter, improved

15% over prior year Fred Sturm, CalAmp's President and Chief

Executive Officer, commented, "Overall, operating results from our

core business in the first quarter were solid and within our

expectations. During the quarter we benefited from revenue growth

in our wireless data communications product line, which has now

been significantly enhanced with our recent acquisitions of

Dataradio and TechnoCom. Resulting profitability, after adjusting

out the effects of non-cash charges for the IPR&D write-off

associated with the Dataradio acquisition and a goodwill impairment

charge related to our Solutions Division, was driven by solid

operating margins and was within expectations." Sturm added, "We

continue to execute on our strategy of building a significant

business in the wireless datacom industry, where we believe there

is an expanding market opportunity for revenue growth at higher

gross margins, and which provides for further customer

diversification. Additionally, we are focused on maintaining our

leading position in our core DBS product line. Steady progress was

achieved during the quarter on product development initiatives in

support of customers' requirements for integrated multiple

satellite reception equipment as they roll out expanded service

offerings including HDTV programming. These products are expected

to begin shipping during the second half of fiscal 2007." Fiscal

2007 First Quarter Results Revenue in the fiscal 2007 first quarter

(14 weeks of operations) was $46.3 million, compared to $47.6

million for the first quarter of last year (13 weeks of

operations). The decrease was the result of lower Solutions

Division revenue and DBS product sales in the latest quarter,

partially offset by growth in the Company's wireless data

communications business for public safety and machine-to-machine

(M2M) applications. Gross profit for the first quarter of fiscal

2007 was $10.9 million, or 23.6% of revenues, compared to $10.7

million, or 22.5% of revenues, for the same period last year. The

increase in gross margin was primarily the result of improved

operating efficiencies and increased sales of higher margin

products of the Products Division. As previously announced, in late

May 2006 the Company acquired Dataradio and the mobile resource

management (MRM) product line of TechnoCom. CalAmp's results of

operations for the fiscal 2007 first quarter include both of these

acquisitions for a one week period. During this period Dataradio

generated revenue of $721,000 and gross profit of $469,000, while

the MRM product line accounted for revenue of $87,000 and gross

profit of $37,000. Dataradio and the MRM product line are included

in the Company's Products Division. Results of operations for the

fiscal 2007 first quarter as determined in accordance with United

States Generally Accepted Accounting Principles ("GAAP") was a net

loss of $34.1 million, or $1.47 per diluted share. During the

fiscal 2007 first quarter, in connection with the acquisition of

Dataradio, the Company recorded a non-cash charge of $6.9 million

for the write-off of IPR&D and recorded a non-operating gain of

$689,000 associated with foreign currency hedging activities. In

addition, as a result of the annual impairment test of the

Solutions Division goodwill conducted during the fiscal 2007 first

quarter, the Company recorded a non-cash impairment charge of $29.8

million. Excluding the effects of the IPR&D write-off, the

foreign currency hedging gain and the Solutions Division impairment

charge, in the fiscal 2007 first quarter the Company generated net

income of $2.2 million, or $.09 per diluted share ("Adjusted

Earnings"), compared to GAAP basis net income of $2.0 million, or

$.09 per diluted share, in the first quarter of last year. A

reconciliation of the adjustments made to GAAP-basis earnings to

compute Adjusted Earnings is contained in the financial tables of

this press release. Results of operations for the fiscal 2007 first

quarter on both a GAAP basis and an Adjusted Earnings basis include

stock-based compensation expense of $260,000 net of tax or $.01 per

diluted share, which has been recorded in the first quarter of

fiscal 2007 under the newly adopted Statement of Financial

Accounting Standards No. 123R, "Share-Based Payment". During the

fiscal 2007 first quarter the Company continued to focus on

realizing value from the 2004 Vytek acquisition by transferring the

design engineering services business out of the Solutions Division

into the Products Division, in order to more effectively integrate

the product design and product manufacturing activities. The

Company also plans to phase out some non-strategic portions of the

Solutions business during the second quarter in order to focus on

the core Solutions business which now is comprised of the industry

leading TelAlert urgent messaging applications as well as media

download management software. Liquidity At May 31, 2006, the

Company had total cash of $30.8 million, with $38 million in total

outstanding debt. Net cash provided by operating activities was

$4.7 million during the first quarter, up 15% over the prior year.

Inventories were $30.6 million at the end of the first quarter,

which includes $5.5 million associated with Dataradio. Accounts

receivable outstanding at the end of the first quarter represents a

43 day average collection period. Business Outlook Commenting on

the Company's fiscal 2007 second quarter outlook, Mr. Sturm said,

"Based on our most recent projections, which include contributions

for the full quarter from our recent acquisitions of Dataradio and

the MRM product line, we estimate that fiscal 2007 second quarter

revenues will be in the range of $55 to $60 million, with earnings

in the range of $0.05 to $0.09 per diluted share which includes an

estimate of $800,000 for amortization of intangible assets related

to the recent acquisitions of Dataradio and the MRM product line,

FAS 123R stock option expense of $370,000 net of tax, and net

interest expense of $300,000, versus net interest income of

$301,000 in the fiscal 2007 first quarter." Conference Call,

Webcast and 10-Q filing A conference call and simultaneous webcast

to discuss fiscal 2007 first quarter financial results and business

outlook will be held today at 4:30 p.m. Eastern / 1:30 p.m.

Pacific. The live webcast of the call is available on CalAmp's web

site at www.calamp.com. Participants are encouraged to visit the

web site at least 15 minutes prior to the start of the call to

register, download and install any necessary audio software.

CalAmp's President and CEO Fred Sturm and CFO Rick Vitelle will

host the conference call. After the live webcast, a replay will

remain available until the next quarterly conference call in the

Investor Relations section of CalAmp's web site. The reader is also

referred to the Company's quarterly report on Form 10-Q as filed

today with the Securities and Exchange Commission. About CalAmp

Corp. CalAmp is a leading provider of wireless equipment,

engineering services and software that enable anytime/anywhere

access to critical information, data and entertainment content.

With comprehensive capabilities ranging from product design and

development through volume production, CalAmp delivers

cost-effective high quality solutions to a broad array of customers

and end markets. CalAmp is the leading supplier of Direct Broadcast

Satellite (DBS) outdoor customer premise equipment to the U.S.

satellite television market. The Company also provides wireless

connectivity solutions for the telemetry and asset tracking

markets, private wireless networks, public safety communications

and critical infrastructure and process control applications. For

additional information, please visit the Company's website at

www.calamp.com. Forward-Looking Statement Statements in this press

release that are not historical in nature are forward-looking

statements, which involve known and unknown risks and

uncertainties. Words such as "may", "will", "expect", "intend",

"plan", "believe", "seek", "could", "estimate", "judgment",

"targeting", "should", and variations of these words and similar

expressions, are intended to identify forward-looking statements.

Actual results could differ materially from those implied by such

forward-looking statements due to a variety of factors, including

general and industry economic conditions, competition, development

factors, operating costs, the Company's ability to eliminate

operating losses in its Solutions Division and make this business

segment profitable, the Company's ability to efficiently and

cost-effectively integrate its acquired businesses, and other risks

and uncertainties that are detailed from time to time in the

Company's filings with the Securities and Exchange Commission.

Although the Company believes the expectations reflected in such

forward-looking statements are based upon reasonable assumptions,

it can give no assurance that its expectations will be attained.

The Company undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. -0- *T CAL AMP CORP. Consolidated

Statements of Operations and Reconciliation of Non-GAAP Adjustments

(Unaudited, in thousands except per share amounts) Three months

ended Three May 31, 2006 (a) months

-------------------------------- ended GAAP Non-GAAP Adjusted May

31, Basis Adjustments Basis 2005 -------- ----------- ---------

-------- Revenues $ 46,313 $ 46,313 $47,580 Cost of revenues 35,386

35,386 36,882 -------- -------- ------- Gross profit 10,927 10,927

10,698 -------- -------- ------- Operating expenses: Research and

development 2,565 2,565 2,197 Selling 1,771 1,771 1,872 General and

administrative 2,813 2,813 2,614 Intangible asset amortization 401

401 443 In-process research and development 6,850 $ (6,850)(b) 0

293 Impairment loss 29,848 (29,848)(c) 0 - -------- --------

-------- ------- 44,248 (36,698) 7,550 7,419 -------- --------

-------- ------- Operating income (loss) (33,321) 36,698 3,377

3,279 Non-operating income (expense), net: Interest income

(expense), net 301 301 68 Other, net 660 (689)(d) (29) (25)

-------- -------- -------- ------- 961 (689) 272 43 --------

-------- -------- ------- Income (loss) before income taxes

(32,360) 36,009 3,649 3,322 Income tax provision (1,691) 276 (e)

(1,415) (1,345) -------- -------- -------- ------- Net income

(loss) $(34,051) $ 36,285 $ 2,234 $ 1,977 ======== ========

======== ======= Net income (loss) per share: Basic $ (1.47) $ 0.10

$ 0.09 Diluted $ (1.47) $ 0.09 $ 0.09 Shares used in per share

calculations: Basic 23,131 23,131 22,492 Diluted 23,131 23,747

22,910 Business Segment Information Three months ended Three May

31, 2006 (a) months --------------------------------- ended GAAP

Non-GAAP Adjusted May 31, Basis Adjustments Basis 2005 ---------

----------- --------- -------- Revenue Products Division $ 42,957 $

42,957 $41,168 Solutions Division 3,356 3,356 6,412 --------

-------- ------- Total revenue $ 46,313 $ 46,313 $47,580 ========

======== ======= Gross profit Products Division $ 10,087 $ 10,087 $

8,810 Solutions Division 840 840 1,888 -------- -------- -------

Total gross profit $ 10,927 $ 10,927 $10,698 ======== ========

======= Operating income (loss) Products Division $ (857) $

6,850(b) $ 5,993 $ 5,356 Solutions Division (31,182) 29,848(c)

(1,334) (1,143) Corporate expenses (1,282) (1,282) (934) --------

-------- -------- ------- Total operating income (loss) $(33,321) $

36,698 $ 3,377 $ 3,279 ======== ======== ======== ======= CAL AMP

CORP. Consolidated Statements of Operations and Reconciliation of

Non-GAAP Adjustments (continued) (a) Because of the Company's 52-53

week fiscal year, the three month periods ended May 31, 2006 and

2005 contain 14 weeks and 13 weeks, respectively. (b) In-process

research and development write-off arising from the acquisition of

Dataradio based on the preliminary purchase price allocation. (c)

Solutions Division estimated goodwill impairment charge pursuant to

step one of the annual goodwill impairment test as of April 30,

2006. Step two of the impairment test is expected to be completed

in the fiscal 2007 second quarter, at which time the amount of the

goodwill impairment charge will be finalized. (d) Foreign currency

hedging gain realized in connection with the acquisition of

Dataradio. (e) Tax expense associated with the foreign currency

hedging gain. "GAAP" refers to financial information presented in

accordance with Generally Accepted Accounting Principles in the

United States. This press release includes historical non-GAAP

financial measures, as defined in Regulation G promulgated by the

Securities and Exchange Commission, with respect to the three

months ended May 31, 2006. CalAmp believes that its presentation of

historical non-GAAP financial measures provides useful

supplementary information to investors. The presentation of

historical non- GAAP financial measures is not meant to be

considered in isolation from or as a substitute for results

prepared in accordance with accounting principles generally

accepted in the United States. In this press release, CalAmp

reported the non-GAAP financial measures of Adjusted Basis net

income and diluted earnings per share. CalAmp uses these non-GAAP

financial measures to enhance the investor's overall understanding

of the financial performance and prospects for the future of

CalAmp's core business activities. Specifically, CalAmp believes

that a report of Adjusted Basis net income and diluted earnings per

share provides consistency in its financial reporting and

facilitates the comparison of results of core business operations

between its current, past and future periods. CAL AMP CORP.

CONSOLIDATED BALANCE SHEETS (Unaudited - In thousands) May 31, Feb.

28, 2006 2006 --------- --------- Assets Current assets: Cash and

cash equivalents $ 30,779 $ 45,783 Accounts receivable, net 28,498

28,630 Inventories 30,557 18,279 Deferred income tax assets 5,132

4,042 Prepaid expenses and other current assets 8,198 2,502

--------- --------- Total current assets 103,164 99,236 Equipment

and improvements, net 6,772 5,438 Deferred income tax assets 1,891

2,344 Goodwill 84,315 91,386 Other intangible assets, net 21,443

5,304 Other assets 1,205 638 --------- --------- $218,790 $204,346

========= ========= Liabilities and Stockholders' Equity Current

liabilities: Current portion of long-term debt $ 775 $ 2,168

Accounts payable 18,091 12,011 Accrued payroll and employee

benefits 8,344 3,608 Other accrued liabilities 5,826 2,763 Deferred

revenue 1,799 1,323 --------- --------- Total current liabilities

34,835 21,873 --------- --------- Long-term debt, less current

portion 37,253 5,511 --------- --------- Other non-current

liabilities 968 853 --------- --------- Stockholders' equity:

Common stock 233 232 Additional paid-in capital 136,051 135,022

Common stock held in escrow - (2,532) Retained earnings 10,137

44,188 Accumulated other comprehensive loss (687) (801) ---------

--------- Total stockholders' equity 145,734 176,109 ---------

--------- $218,790 $204,346 ========= ========= CAL AMP CORP.

CONSOLIDATED CASH FLOW STATEMENTS (Unaudited - In thousands) Three

Months Ended May 31, ------------------ 2006 2005 ---------

-------- Cash flows from operating activities: Net income (loss)

$(34,051) $ 1,977 Depreciation and amortization 1,119 1,080

Stock-based compensation expense 420 - Write-off of in-process

R&D 6,850 293 Goodwill impairment writedown 29,848 - Excess tax

benefit from stock-based compensation (199) - Deferred tax assets,

net 441 818 Changes in operating working capital 264 (62) Other 31

9 --------- -------- Net cash provided by operating activities

4,723 4,115 --------- -------- Cash flows from investing

activities: Capital expenditures (798) (373) Proceeds from sale of

property and equipment 17 - Acquisition of Dataradio net of cash

acquired (47,999) - Acquisition of TechnoCom product line (2,478) -

Proceeds from Vytek escrow distribution 480 - Acquisition of

Skybility assets - (4,886) --------- -------- Net cash used in

investing activities (50,778) (5,259) --------- -------- Cash flows

from financing activities: Proceeds from long-term debt 38,000 -

Debt repayments (7,651) (731) Proceeds from stock option exercises

389 13 Excess tax benefit from stock-based compensation 199 -

--------- -------- Net cash provided (used) by financing activities

30,937 (718) --------- -------- Effect of exchange rate changes on

cash 114 - --------- -------- Net change in cash (15,004) (1,862)

Cash at beginning of period 45,783 31,048 --------- -------- Cash

at end of period $ 30,779 $29,186 ========= ======== *T

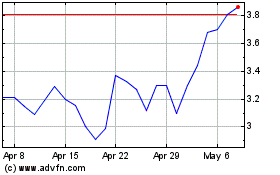

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

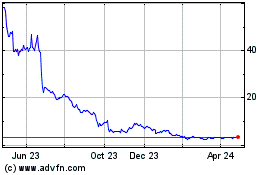

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jul 2023 to Jul 2024