Proprietary Online Content and Market

Expansion Coupled with Customer Additions Driving Continued

Growth

Reiterates Full Year 2022 Guidance for

Revenue of €68-72 million (USD $76-80 Million) and Adjusted EBITDA

of €9.5-10.5 million (USD $10.5-11.7 Million)

Bragg Gaming Group (NASDAQ: BRAG, TSX: BRAG) ("Bragg" or the

"Company"), a global B2B gaming technology and content provider,

today reported record financial results for the fourth quarter and

full year ended December 31, 2021. The Company also provided an

update on its strategic growth initiatives and reiterated its full

year 2022 revenue and Adjusted EBITDA guidance.

Summary of Q4-21 and FY-21 Financial

and Operational Highlights

Euros (millions)

Q4-21

Q4-20

Change

Revenue

€15.8

€13.8

14.4%

Gross profit

€8.0

€6.0

33.3%

Gross profit margin

51.0%

43.8%

720bps

Adjusted EBITDA

€1.5

€1.3

22.2%

Adjusted EBITDA margin

9.8%

9.1%

70bps

Wagering revenue

€3.1B

€3.4B

-8.4%

Euros

FY-21

FY-20

Change

Revenue

€ 58.3

€ 46.4

25.6%

Adjusted EBITDA

€7.2

€5.5

29.8%

Wagering revenue

€14.3B

€11.8B

21.1%

Management Commentary “The 2021 fourth quarter concluded

an active and productive year for Bragg as continued execution on

our key strategic initiatives drove significant operational

accomplishments and strong financial results,” said Yaniv

Spielberg, Chief Strategy Officer for Bragg Gaming. “In the fourth

quarter we went live with our iGaming offering in the newly

regulated Netherlands market and also went live in the U.K, the

world’s largest iGaming market. Since the beginning of 2021, we

have introduced player-popular content in six regulated European

markets, increasing our total addressable market (“TAM”) by more

than $10 billion to approximately USD$13.5 billion. We have also

made significant progress towards our entry into additional new

markets and expect to go live with our games in the U.S. and Canada

later this year. Furthermore, we have also made substantial

progress on our initiative to offer more new high-performing

propriety and exclusive third-party online content through our June

2021 acquisition of Wild Streak, the recent introduction of our

first new internally developed games and new exclusive content

licensing agreements with leading game developers. Bragg’s

continued progress with its new market and content monetization

initiatives, combined with 42% growth in new customers in 2021,

drove our strong fourth quarter and full year financial

results.

“Fourth quarter revenue of EUR €15.8 million (USD $17.5 million)

and Adjusted EBITDA of EUR €1.5 million (USD $1.7 million)

surpassed the preliminary results we provided last month and were

both fourth quarter records. As a result, 2021 full year revenue

and Adjusted EBITDA rose 26% and 30%, respectively to records of

EUR €58.3 million (USD $64.7 million) and EUR €7.2 million (USD

$8.0 million). In addition, the growing mix of higher gross margin

in-house content and platform revenue contributed to a record

quarterly gross profit margin of 51% in the fourth quarter,

reflecting a 720 basis point year-over-year improvement. Our strong

margin performance in the quarter highlights the significant

progress we’ve made against our goal to grow gross profit margin to

approximately 60% by 2024.

“Our operating momentum has continued in the early months of

2022. We also continue to make progress on closing our acquisition

of Spin Games as Bragg has completed all of its regulatory

requirements. We are now awaiting final review by the sole

remaining regulatory body which is expected to be complete in the

next few months. Importantly, we have made substantial progress on

the integration of the Spin Games technology platform with our ORYX

platform and have already submitted the integrations for

certification by various approved U.S. gaming laboratories. As

such, once we receive the remaining required regulatory approval to

complete this acquisition, we expect to be able to introduce our

iGaming content to players in a number of U.S. states very quickly.

Importantly, the pace of U.S. deployments will benefit from Spin

Games’ existing relationships with more than 30 U.S. iGaming

operators.”

Mr. Spielberg concluded, “Our planned entry into the U.S. and

Canada as well as additional regulated European markets this year

has Bragg on track to grow our year-end 2022 TAM to more than

USD$21 billion. The strong performance we have achieved in a number

of our recently entered markets as well as our existing markets in

the early months of 2022, and the ongoing roll-out of our new

proprietary games, amplifies our confidence for continued operating

momentum. As a result, we are reiterating our outlook for 2022 full

year revenue of EUR €68-72 million (USD $76-80 million) and

Adjusted EBITDA of EUR €9.5-10.5 million (USD $10.5-11.7 million).

The midpoints of these ranges represent growth of 20% and 39%,

respectively, over reported full year 2021 revenue and Adjusted

EBITDA. We believe the ongoing execution of our operating

priorities favourably positions Bragg to both further accelerate

this growth in 2023 and create new near- and long-term shareholder

value.”

Fourth Quarter 2021 Financial Results and other Key Metrics

Highlights

- Revenue increased by 14.4% to EUR €15.8 million (USD $17.5

million) in Q4 2021 compared to EUR €13.8 million (USD $15.3

million) in Q4 2020.

- Wagering revenue generated by customers decreased 8.8% to EUR

€3.1 billion (USD $3.4 billion) compared to EUR €3.4 billion (USD

$3.8 billion) in Q4 2020 as a result of changes in the product mix,

towards PAM, managed services and proprietary content which drove

improved gross profit and Adjusted EBITDA.

- Gross profit increased by 33.3% to EUR €8.0 million (USD $8.9

million) from EUR €6.0 million (USD $6.7 million) in Q4 2020,

reflecting higher revenue and a 720 basis point margin improvement

to 51.0%.

- The margin expansion is primarily the result of the continued

shift towards a higher proportion of revenues from iGaming and

turnkey services, which have lower associated cost of sales when

compared to games and content.

- Net loss for the period was EUR €1.6 million (USD $1.8

million), a decline from a net loss of EUR €5.3 million (USD $5.9

million) in Q4 2020, primarily due to higher gross profit and a

reduction in costs related to deferred consideration payable,

partially offset by the incremental increase in employee costs and

professional fees as a result of the Nasdaq listing.

- Adjusted EBITDA was EUR €1.5 million (USD $1.7 million), an

increase of 22.2% compared to EUR €1.3 million (USD $1.4 million)

in Q4 2020. Adjusted EBITDA margin increased by 70 basis points to

9.8%.

- Cash and cash equivalents as of December 31, 2021 was EUR €16.0

million (USD $17.8 million).

2021 Full Year Financial Results and other Key Metrics

Highlights

- Revenue increased by 25.6% to EUR €58.3 million (USD $64.7

million) for 2021 compared to EUR €46.4 million (USD $51.5 million)

in 2020.

- Wagering revenue generated by customers increased 21.1% to EUR

€14.3 billion (USD $15.9 billion) compared to EUR €11.8billion (USD

$13.1 billion) in 2020.

- The number of unique players using Bragg games via its Oryx Hub

distribution platform and content increased by 11.2% to 6.5

million, from 5.9 million in 2020.

- Gross profit increased by 40.3% to EUR €28.3million (USD $31.4

million) from EUR €20.2million (USD $22.4 million) in 2020,

reflecting a 510 basis point margin improvement to 48.6%.

- Net loss for the period was EUR €7.5 million (USD $8.3

million), an improvement from the net loss of EUR €14.6 million

(USD $16.2 million) in 2020.

- Adjusted EBITDA was EUR €7.2 million (USD $8.0 million), an

increase of 29.8% compared to EUR €5.5 million (USD $6.1 million)

in 2020. Adjusted EBITDA margin increased by 40 basis points to

12.3%.

Full Year 2022 Revenue and Adjusted EBITDA Guidance Bragg

today reiterated its outlook for 2022 full year expected revenue of

EUR €68-72 million (USD $76-80 million) and Adjusted EBITDA of EUR

€9.5-10.5 million (USD $10.5-11.7 million). The midpoints of the

2022 revenue and Adjusted EBITDA guidance ranges represent growth

of 20% and 39%, respectively, over the reported full year 2021

revenue and Adjusted EBITDA.

Investor Conference Call The Company will host a

conference call today, March 10, 2022, at 8:00 a.m. Eastern Time,

to discuss its fourth quarter 2021 results. During the call,

management will review a presentation that will be made available

to download or follow as a webcast at

http://www.bragg.games/investors.

To join the call, please use the below dial-in information:

Participant Toll-Free Dial-In Number (US/CANADA): (888)

210-4227 Participant Toll Dial-In Number (INTERNATIONAL):

(646) 960-0341 United Kingdom: Toll-Free: +44 800 358 0970

Conference ID: 2522980

Or join the webcast at http://www.bragg.games/investors under

the Media section.

A replay of the call will be available until March 21, 2022

following the conclusion of the live call. In order to access the

replay, dial (647) 362-9199 or (800) 770-2030 (toll-free) and use

the passcode 2522980.

Cautionary Statement Regarding Forward-Looking

Information This news release may contain forward-looking

statements or “forward-looking information” within the meaning of

applicable Canadian securities laws (“forward-looking statements”),

including, without limitation, statements with respect to the

following: the Company’s strategic growth initiatives and corporate

vision and strategy; financial guidance for 2021 and 2022, expected

performance of the Company’s business; expansion into new markets;

the impact of the new German regulatory regime, expected future

growth and expansion opportunities; expected benefits of

transactions, including the acquisition of Wild Streak and Spin;

expected future actions and decisions of regulators and the timing

and impact thereof. Forward-looking statements are provided for the

purpose of presenting information about management’s current

expectations and plans relating to the future and allowing readers

to get a better understanding of the Company’s anticipated

financial position, results of operations, and operating

environment. Often, but not always, forward-looking statements can

be identified by the use of words such as “plans”, “expects” or

“does not expect”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates” or “does not

anticipate”, or “believes”, or describes a “goal”, or variation of

such words and phrases or state that certain actions, events or

results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved.

All forward-looking statements reflect the Company’s beliefs and

assumptions based on information available at the time the

statements were made. Actual results or events may differ from

those predicted in these forward-looking statements. All of the

Company’s forward-looking statements are qualified by the

assumptions that are stated or inherent in such forward-looking

statements, including the assumptions listed below. Although the

Company believes that these assumptions are reasonable, this list

is not exhaustive of factors that may affect any of the

forward-looking statements. The key assumptions that have been made

in connection with the forward-looking statements include the

following: the impact of COVID-19 on the business of the Company;

the closing of the acquisition of Spin; the integration of Wild

Streak; the regulatory regime governing the business of the

Company; the operations of the Company; the products and services

of the Company; the Company’s customers; the growth of Company’s

business, the meeting minimum listing requirements of Nasdaq; which

may not be achieved or realized within the time frames stated or at

all; the integration of technology; and the anticipated size and/or

revenue associated with the gaming market globally.

Forward-looking statements involve known and unknown risks,

future events, conditions, uncertainties and other factors that may

cause actual results, performance or achievements to be materially

different from any future results, prediction, projection,

forecast, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

following: risks related to the Company’s business and financial

position; that the Company may not be able to accurately predict

its rate of growth and profitability; the risks associated with the

completion of the acquisition of Spin and ability to satisfy

closing conditions; risks associated with the integration of Wild

Streak; risks associated with general economic conditions; adverse

industry events; future legislative and regulatory developments;

the inability to access sufficient capital from internal and

external sources; the inability to access sufficient capital on

favorable terms; realization of growth estimates, income tax and

regulatory matters; the increased costs associated with meeting the

minimum listing requirements on Nasdaq; the ability of the Company

to implement its business strategies; competition; economic and

financial conditions, including volatility in interest and exchange

rates, commodity and equity prices; changes in customer demand;

disruptions to our technology network including computer systems

and software; natural events such as severe weather, fires, floods

and earthquakes; and risks related to health pandemics and the

outbreak of communicable diseases, such as the current outbreak of

COVID-19. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to

be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events, or otherwise, except in accordance with

applicable securities laws.

Non-IFRS Financial Measures Statements in this news

release make reference to “Adjusted EBITDA”, which is a non-IFRS

(as defined herein) financial measure that the Company believes is

appropriate to provide meaningful comparison with, and to enhance

an overall understanding of, the Company’s past financial

performance and prospects for the future. The Company believes that

“Adjusted EBITDA” provides useful information to both management

and investors by excluding specific expenses and items that

management believe are not indicative of the Company’s core

operating results. “Adjusted EBITDA” is a financial measure that

does not have a standardized meaning under International Financial

Reporting Standards (“IFRS”). As there is no standardized method of

calculating “Adjusted EBITDA”, it may not be directly comparable

with similarly titled measures used by other companies. The Company

considers “Adjusted EBITDA” to be a relevant indicator for

measuring trends in performance and its ability to generate funds

to service its debt and to meet its future working capital and

capital expenditure requirements. “Adjusted EBITDA” is not a

generally accepted earnings measure and should not be considered in

isolation or as an alternative to net income (loss), cash flows or

other measures of performance prepared in accordance with IFRS.

Adjusted EBITA is more fully defined and discussed, and

reconciliation to IFRS financial measures is provided, in Company’s

Management’s Discussion and Analysis (“MD&A”) for the three-

and twelve-month periods ended December 31, 2021.

About Bragg Gaming Group Bragg Gaming Group (NASDAQ:

BRAG, TSX: BRAG) is a growing global gaming technology and content

group and owner of leading B2B companies in the iGaming industry.

Since its inception in 2018, Bragg has grown to include operations

across Europe, North America and Latin America and is expanding

into an international force within the global online gaming

market.

Through its wholly-owned subsidiary ORYX Gaming, Bragg delivers

proprietary, exclusive and aggregated casino content via its

in-house remote games server (RGS) and ORYX Hub distribution

platform. ORYX offers a full turnkey iGaming solution, including

its Player Account Management (PAM) platform, as well as managed

operational and marketing services.

Nevada-based Wild Streak Gaming is Bragg's wholly owned premium

US gaming content studio. Wild Streak has a popular portfolio of

casino games that are offered across land-based, online and social

casino operators in global markets including the U.S. and U.K.

In May 2021, Bragg announced its planned acquisition of

Nevada-based Spin Games, B2B gaming technology and content provider

currently servicing the U.S. market. Spin holds licenses in key

iGaming-regulated U.S. states and supplies Tier 1 operators in the

region. Find out more.

Financial tables follow

BRAGG GAMING GROUP

INC.

CONSOLIDATED STATEMENTS OF

LOSS AND COMPREHENSIVE LOSS

(In thousands, except per

share amounts)

Three Months Ended December 31, Year Ended

December 31, EUR 000

2021

2020

2021

2020

Revenue

15,758

13,778

58,319

46,421

Cost of revenue

(7,722

)

(7,748

)

(29,998

)

(26,232

)

Gross Profit

8,036

6,030

28,321

20,189

Selling, general and administrative expenses

(9,899

)

(10,416

)

(34,832

)

(22,828

)

Gain on remeasurement of consideration receivable

50

37

98

19

Loss on remeasurement of deferred and contingent consideration

-

(947

)

-

(9,276

)

Loss on disposal of intangible assets

(89

)

-

(89

)

-

Operating Loss

(1,902

)

(5,296

)

(6,502

)

(11,896

)

Net interest expense and other financing charges

(52

)

(109

)

(184

)

(1,384

)

Loss Before Income Taxes

(1,954

)

(5,405

)

(6,686

)

(13,280

)

Income taxes

324

89

(826

)

(1,196

)

Net Loss from Continuing Operations

(1,630

)

(5,316

)

(7,512

)

(14,476

)

Net loss from discontinued operations after tax

-

(2

)

-

(90

)

Net Loss

(1,630

)

(5,318

)

(7,512

)

(14,566

)

Items to be reclassified to net loss: Cumulative translation

adjustment - continuing operations

677

(129

)

2,590

157

Cumulative translation adjustment - discontinued operations

-

(80

)

-

(95

)

Items that will not be reclassified to net loss:

Remeasurement of employee obligations

44

-

44

-

Net Comprehensive Loss

(909

)

(5,527

)

(4,878

)

(14,504

)

Basic and Diluted Loss Per Share Continuing

operations

(0.08

)

(0.52

)

(0.39

)

(1.69

)

Discontinued operations

0.00

(0.00

)

0.00

(0.01

)

(0.08

)

(0.52

)

(0.39

)

(1.70

)

Millions Millions Millions Millions

Weighted

average number of shares - basic and diluted

20.0

10.3

19.5

8.6

BRAGG GAMING GROUP

INC.

CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION

(in thousands)

As at As at December 31, December 31,

EUR 000

2021

2020

Cash and cash equivalents

16,006

26,102

Trade and other receivables

8,454

10,297

Prepaid expenses and other assets

2,442

263

Consideration receivable

56

148

Total Current Assets

26,958

36,810

Property and equipment

252

272

Right-of-use assets

579

708

Consideration receivable

-

44

Intangible assets

30,845

14,279

Goodwill

24,728

19,938

Other assets

28

43

Total Assets

83,390

72,094

Trade payables and other liabilities

14,357

16,968

Deferred revenue

27

102

Income taxes payable

784

1,318

Lease obligations on right of use assets - current

149

133

Deferred and contingent consideration

-

11,521

Total Current Liabilities

15,317

30,042

Deferred income tax liabilities

1,243

1,415

Non-current lease obligations on right of use assets

451

593

Other non-current liabilities

184

147

Total Liabilities

17,195

32,197

Share capital

100,285

62,304

Warrants

-

1,642

Broker warrants

38

399

Shares to be issued

13,746

22,608

Contributed surplus

18,385

14,325

Deficit

(68,743

)

(61,231

)

Accumulated other comprehensive income (loss)

2,484

(150

)

Total Equity

66,195

39,897

Total Liabilities and Equity

83,390

72,094

BRAGG GAMING GROUP

INC.

UNAUDITED SELECTED FINANCIAL

GAAP AND NON-GAAP MEASURES

(in thousands)

Three Months Ended December 31, Year Ended December

31, EUR 000

2021

2020

2021

2020

Revenue

15,758

13,778

58,319

46,421

Operating loss

(1,902

)

(5,296

)

(6,502

)

(11,896

)

EBITDA

(325

)

(4,623

)

(1,705

)

(9,023

)

Adjusted EBITDA

1,538

1,259

7,198

5,546

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220310005132/en/

Yaniv Spielberg Joseph Jaffoni, Richard Land, James Leahy Chief

Strategy Officer JCIR Bragg Gaming Group 212-835-8500 or

bragg@jcir.com info@bragg.games

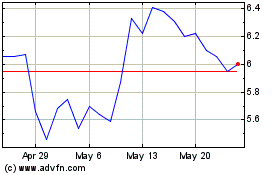

Bragg Gaming (NASDAQ:BRAG)

Historical Stock Chart

From Jun 2024 to Jul 2024

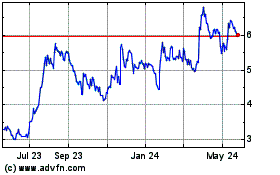

Bragg Gaming (NASDAQ:BRAG)

Historical Stock Chart

From Jul 2023 to Jul 2024