- Net income improves to $1.1 million EAST AURORA, N.Y., Feb. 9

/PRNewswire-FirstCall/ -- Astronics Corporation (NASDAQ:ATRO), a

leading manufacturer of advanced, high-performance lighting,

electronics and electrical power systems for the global aerospace

industry, reported sales of $20.4 million in the fourth quarter of

2005 compared with $8.3 million in the fourth quarter of 2004. The

increase in sales for the quarter was driven by a 51% increase in

its organic sales and the addition of Astronics AES, which was

acquired in February 2005. The growth in organic sales was related

to increased volume as aircraft build rates have increased, and the

expanding number of aircraft platforms for which the Company

provides products. In addition, during the fourth quarter of 2005,

the Company shipped $1.7 million for its Republic of Korea F-16

NVIS program, which was concluded in 2005. Astronics AES had sales

of $7.9 million in the fourth quarter of 2005. Net income for the

fourth quarter 2005 was $1.1 million, or $0.13 per diluted share,

compared with a net loss of $0.7 million, or $0.08 per diluted

share, in the same period the prior year. The improvement in net

income in the fourth quarter of 2005 as compared with the fourth

quarter of 2004 was attributable primarily to the contribution from

the increase in organic sales and the addition of Astronics AES.

Also adding to the bottom line improvement in the fourth quarter of

2005 was the recognition of approximately $0.2 million pre tax as

"other income" from the settlement of a legal dispute. At the end

of the fourth quarter 2005, Astronics made final adjustments to the

purchase price and the related purchase price allocation for the

assets acquired in the February 2005 acquisition of Astronics AES.

These adjustments resulted in $0.3 million reduction in pretax

income. The acquisition earn-out liability, based on sales of

Astronics AES, was reversed in the fourth quarter of 2005 as the

sales threshold was not achieved. As a result, no additional

payment on the acquisition is required. Fourth quarter 2005

operating income increased to $1.7 million compared with a $1.1

million loss in the fourth quarter of 2004. Astronics AES'

operating profit for the 2005 fourth quarter was $0.7 million.

Astronics' organic business improved operating margins to $1.0

million from a 2004 fourth quarter loss of $1.1 million. Peter J.

Gundermann, President and CEO noted, "During 2005, we had strong

growth across the board and saw improved profits during the second

half of the year. We have made solid progress on our various

development programs and enjoyed the benefits of strong market

conditions across each of our markets. The Astronics AES

acquisition has worked out well also, contributing from day one.

With only eleven months included in 2005, it accounted for almost

40% of our 2005 revenue, provided excellent operating margins and

contributed to more than half of our year-end backlog. The

integration of Astronics AES products, employees and culture was a

relatively seamless process and has created more opportunities for

Astronics as a whole." He added, "For the last six months of the

year our annualized shipping rate was a healthy $80 million.

Operating margins improved during the last six months and we are

beginning to see the bottom line improvements that we have been

anticipating as our top line grows." Full Year Review Sales in 2005

increased to $75.4 million compared with $34.7 million in 2004.

Organic sales increased $12 million to $46.7 million, a 34%

increase compared 2004 sales. Astronics AES added an additional

$28.6 million in sales during 2005. As a result of higher volume

and the addition of Astronics AES, operating income improved to

$5.3 million in 2005 compared with a loss in 2004 of $0.9 million.

Astronics AES contributed $3.0 million to operating profit, while

the organic business contributed $2.3 million. Net income in 2005

grew to $2.7 million, or $0.33 per diluted share, compared with a

loss of $0.7 million, or $0.09 per diluted share, in 2004. Outlook

Bookings for the fourth quarter 2005 were very strong at $37.9

million. Contributing heavily to bookings was the $12.0 million Air

Canada program announced in December 2005. For the year, bookings

were $96.5 million, resulting in a book-to-bill ratio of 1.28:1.

Astronics backlog at the end of 2005 was $95.1 million, an increase

of $17.5 million from the end of the third quarter of 2005. Mr.

Gundermann continued, "We are anticipating 2006 revenue to be in

the range of $85 million to $90 million, an increase of 13% - 20%

over 2005. However, 2006 is a difficult year for us to predict. A

large number of the major aircraft programs in which we are

involved are nearing critical stages of their certification

efforts. If during the year, these programs achieve certification

and transition to production smoothly, we could potentially exceed

our expectations. Conversely, if these programs encounter

challenges and delays, our delivery schedule could be delayed, and

likewise our 2006 shipments will be affected. Overall, we expect

our profitability in 2006 to be consistent with what we have seen

during the past two quarters." Webcast and Conference Call The

release of the financial results on February 9, 2006, will be

followed by a company-hosted teleconference at 11:00 a.m. ET.

During the teleconference, Peter J. Gundermann, President and CEO,

and David C. Burney, Vice President and CFO, will review the

financial and operating results for the period and discuss

Astronics' corporate strategy and outlook. A question- and-answer

session will follow. The Astronics conference call can be accessed

the following ways: * The live webcast can be found at

http://www.astronics.com/. Participants should go to the website 10

- 15 minutes prior to the scheduled conference in order to register

and download any necessary audio software. * The teleconference can

be accessed by dialing (303) 262-2211 approximately 5 - 10 minutes

prior to the call. To listen to the archived call: * The archived

webcast will be at http://www.astronics.com/. A transcript will

also be posted once available. * A replay can also be heard by

calling (303) 590-3000, and entering passcode 11051202#. The

telephonic replay will be available through Thursday, February 16,

2006 at 11:59 p.m. ET. ABOUT ASTRONICS CORPORATION Astronics

Corporation is a leading manufacturer of advanced, high-

performance lighting and electrical power distribution systems for

the global aerospace industry. Its strategy is to expand the value

and content it provides to various aircraft platforms through

product development and acquisition. Astronics Corporation, and its

wholly-owned subsidiaries Astronics Advanced Electronic Systems

Corp. and Luminescent Systems Inc., have a reputation for high

quality designs, exceptional responsiveness, strong brand

recognition and best-in-class manufacturing practices. For more

information on Astronics and its products, visit its website at

http://www.astronics.com/. Safe Harbor Statement This press release

contains forward-looking statements as defined by the Securities

Exchange Act of 1934. One can identify these forward-looking

statements by the use of the words "expect," "anticipate," "plan,"

"may," "will," "estimate" or other similar expression. Because such

statements apply to future events, they are subject to risks and

uncertainties that could cause the actual results to differ

materially from those contemplated by the statements. Important

factors that could cause actual results to differ materially

include the state of the aerospace industry, the market acceptance

of newly developed products, the ability to cross sell products and

expand markets, internal production capabilities, the timing of

orders received, the status of customer certification processes,

the demand for and market acceptance of new or existing aircraft

which contain the Company's products, such as the Airbus A380; the

Eclipse 500; the Air Canada's CRJ705, A320, and several

configurations of B767; Cessna single engine aircraft; Cessna

Mustang; Hawker Horizon; the V22 Osprey; Lockheed Martin F-35 JSF;

China Eastern Airlines Corp. Limited's upgrade of 15 Airbus

A330-300's and five Airbus A330- 200's; Air China Limited's

upgrades of 20 Airbus A330-200's; and F-22 Raptor; customer

preferences, and other factors which are described in filings by

Astronics with the Securities and Exchange Commission. The Company

assumes no obligation to update forward-looking information in this

press release whether to reflect changed assumptions, the

occurrence of unanticipated events or changes in future operating

results, financial conditions or prospects, or otherwise. ASTRONICS

CORPORATION CONSOLIDATED INCOME STATEMENT DATA (unaudited) (in

thousands except per share data) Three months Twelve months ended

ended 12/31/2005 12/31/2004 12/31/2005 12/31/2004 Sales $20,436

$8,338 $75,352 $34,696 Cost of products sold 16,198 7,846 59,852

30,087 Selling general and administrative 2,554 1,598 10,246 5,477

Interest expense, net 216 63 735 282 Other (income) expense (265)

32 (278) 32 Income (loss) before tax 1,733 (1,201) 4,797 (1,182)

Income taxes 676 (543) 2,144 (448) Net Income (loss) $1,057 $(658)

$2,653 $(734) Basic earnings (loss) per share: $0.14 $(0.08) $0.34

$(0.09) Diluted earnings (loss) per share: $0.13 $(0.08) $0.33

$(0.09) Weighted average diluted shares outstanding 8,136 7,791

8,038 7,766 Capital Expenditures 707 457 2,472 1,136 Depreciation

and Amortization 444 279 2,486 1,273 ASTRONICS CORPORATION

CONSOLIDATED BALANCE SHEET DATA (unaudited) (in thousands)

12/31/2005 12/31/2004 ASSETS: Cash and cash equivalents $4,473

$8,476 Short -term investments - 1,000 Accounts receivable 12,635

5,880 Inventories 19,013 7,110 Other current assets 1,401 2,016

Property, plant and equipment, net 20,461 15,221 Other assets 7,874

5,533 Total Assets $65,857 $45,236 LIABILITIES AND SHAREHOLDERS'

EQUITY: Current maturities of long term debt $914 $908 Note payable

7,000 - Accounts payable and accrued expenses 15,843 4,937 Current

liabilities of discontinued operations - 533 Long-term debt 10,304

11,154 Other liabilities 5,962 5,044 Shareholders' equity 25,834

22,660 Total liabilities and shareholders' equity $65,857 $45,236

ASTRONICS CORPORATION NET SALES BY MARKET ($, in thousands) Three

Months Ended Twelve Months Ended 12/31/2005 12/31/2004 %change

12/31/2005 12/31/2004 %change 2005 YTD Military $8,038 $3,263

146.34% $27,538 $15,929 72.88% 36.55% Commercial Transport 8,708

1,662 423.95% 31,242 6,622 371.79% 41.46% Business Jet 3,488 3,064

13.84% 15,402 10,706 43.86% 20.44% Other 202 349 -42.12% 1,170

1,439 -18.69% 1.55% Total $20,436 $8,338 145.09% $75,352 $34,696

117.18% 100.00% ASTRONICS CORPORATION NET SALES BY PRODUCT ($, in

thousands) Three Months Ended Twelve Months Ended 12/31/2005

12/31/2004 %change 12/31/2005 12/31/2004 %change 2005 YTD Cockpit

Lighting $6,821 $5,026 35.71% $28,417 $20,384 39.41% 37.71% Cabin

Power & Data 4,068 - NA 16,624 - NA 22.06% Airframe Power 3,782

- NA 11,972 - NA 15.89% External Lighting 3,257 1,394 133.64% 9,890

6,631 49.15% 13.13% Cabin Lighting 2,306 1,569 46.97% 7,279 6,242

16.61% 9.66% Other 202 349 -42.12% 1,170 1,439 -18.69% 1.55% Total

$20,436 $8,338 145.09% $75,352 $34,696 117.18% 100.00% ORDER AND

BACKLOG TREND ($, in thousands) Twelve Q1 2004 Q2 2004 Q3 2004 Q4

2004 Months 4/3/04 7/3/04 10/2/04 12/31/04 12/31/04 Bookings

$13,270 $8,300 $11,700 $9,862 $43,132 Backlog $23,030 $22,300

$25,600 $27,170 $27,170 Book: Bill 1.48 0.93 1.38 1.18 1.24 Twelve

Q1 2005 Q2 2005 Q3 2005 Q4 2005 Months 4/2/05 7/2/05 10/1/05

12/31/05 12/31/05 Bookings $14,868 $23,564 $20,176 $37,946 $96,554

Backlog $72,292 $77,856 $77,611 $95,121 $95,121 Book: Bill 0.95

1.25 0.99 1.86 1.28 DATASOURCE: Astronics Corporation CONTACT:

David C. Burney, Chief Financial Officer of Astronics Corporation,

+1-716-805-1599, ext. 159, Fax +1-716-805-1286, Web site:

http://www.astronics.com/

Copyright

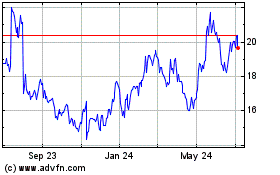

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From May 2024 to Jun 2024

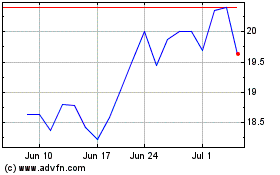

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Jun 2023 to Jun 2024