As

filed with the Securities and Exchange Commission on May 13, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

AKANDA

CORP.

(Exact

name of registrant as specified in its charter)

| Ontario,

Canada |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| Akanda

Corp. |

|

|

| 1a,

1b Learoyd Road |

|

|

| New

Romney TN28 8XU, United Kingdom |

|

Not

Applicable |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

AKANDA

CORP. 2024 EQUITY INCENTIVE PLAN

(Full

title of the plan)

C

T Corporation System

1015 15th Street N.W., Suite 1000

Washington,

DC 20005

(Name

and address of agent for service)

1

(866) 925-9916

(Telephone

number, including area code, of agent for service)

with

a copy to:

Mark

C. Lee

Rimon,

P.C.

423

Washington Street, Suite 600

San

Francisco, CA 94111

(916)

603-3444

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The

following documents filed by Akanda Corp., a corporation organized under the laws of the Province of Ontario, Canada (the “Registrant”)

with the Securities and Exchange Commission (the “Commission”) are incorporated by reference herein:

| (a) | The

Registrant’s annual report on Form 20-F filed with the Commission on May 1, 2024; and |

| (b) | The

description of the Registrant’s common shares contained in Exhibit 2.1 to its annual report on Form 20-F filed with the Commission

on May 1, 2024, including any amendments or reports filed for the purpose of updating such description. |

All

documents filed and to be filed by the Registrant with the Commission pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), subsequent to the effectiveness of this Registration Statement on

Form S-8 (this “Registration Statement”) and, prior to the filing of a post-effective amendment which indicates that all

securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference

into this Registration Statement and to be a part hereof from the respective date of filing of such documents. The Registrant’s

Exchange Act file number with the Commission is 001-41324. In addition, any Report on Form 6-K of the Registrant hereafter furnishes

to the Commission pursuant to the Exchange Act shall be incorporated by reference into this Registration Statement if and to the extent

provided in such document.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which

also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

In

accordance with the Business Corporations Act (Ontario) and pursuant to the bylaws of the Registrant (the “Bylaws”),

subject to certain conditions, the Registrant shall, to the maximum extent permitted by law, indemnify a director or officer, a former

director or officer, or another individual who acts or acted at the Registrant’s request as a director or officer, or an individual

acting in a similar capacity, of another entity, against all costs, charges and expenses, including any amount paid to settle an action

or satisfy a judgment, reasonably incurred by the individual in respect of any civil, criminal, administrative, investigative or other

proceeding in which the individual is involved because of that association with the Registrant or other entity. The Registrant shall

advance monies to a director, officer or other individual for costs, charges and expenses reasonably incurred in connection with such

a proceeding; provided that such individual shall repay the moneys if the individual does not fulfill the conditions described below

or is not successful on the merits in their defense of the action or proceeding. Indemnification is prohibited unless the individual:

| ● | acted

honestly and in good faith with a view to the Registrant’s best interests; |

| ● | in

the case of a criminal or administration action or proceeding enforced by a monetary penalty, had reasonable grounds to believe the conduct

was lawful; and |

| ● | was

not judged by a court or other competent authority to have committed any fault or omitted to do anything that the individual ought to

have done |

The

Registrant also has entered into indemnification agreements with each of the Registrant’s executive officers and directors. The

indemnification agreements provide the indemnitees with contractual rights to indemnification, and expense advancement and reimbursement,

to the fullest extent permitted under Ontario law.

Item

7. Exemption From Registration Claimed.

Not

applicable.

Item

8. Exhibits.

The

following exhibits are filed as part of this Registration Statement and are numbered in accordance with Item 601 of Regulation S-K:

Item

9. Undertakings

(a)

The undersigned Registrant hereby undertakes:

(1)

to file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

| (i) | to

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | to

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement; and |

| (iii) | to

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement; |

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section

15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2)

that, for the purpose of determining any liability under the Securities Act of 1933, as amended (the “Securities Act”), each

such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b)

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act ) that is incorporated by

reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of

the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In

the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be

governed by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the city of Fort Lauderdale, the United States, on May 13, 2024.

| |

AKANDA CORP. |

| |

|

|

| |

By: |

/s/ Katie Field Katie Field |

| |

|

Interim Chief Executive Director and Director |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Katie Field as his

or her true and lawful attorney-in-fact and agent with full power of substitution, for him or her in any and all capacities, to sign

any and all amendments to this Registration Statement (including post-effective amendments), and to file the same, with all exhibits

thereto and other documents in connection therewith, with the Commission, granting unto said attorney-in-fact, proxy, and agent full

power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully

for all intents and purposes as he or her might or could do in person, hereby ratifying and confirming all that said attorney-in-fact,

proxy and agent, or his or her substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities held

on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Katie Field |

|

Interim Chief Executive Officer and Director |

|

May 13, 2024 |

| Katie Field |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Gurcharn Deol |

|

Chief Financial Officer |

|

May 13, 2024 |

| Gurcharn Deol |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Christopher Cooper |

|

Director |

|

May 13, 2024 |

| Christopher Cooper |

|

|

|

|

| |

|

|

|

|

| /s/ Jatinder Dhaliwal |

|

Director |

|

May 13, 2024 |

| Jatinder Dhaliwal |

|

|

|

|

| |

|

|

|

|

| /s/ David Jenkins |

|

Director |

|

May 13, 2024 |

| David Jenkins |

|

|

|

|

Exhibit

5.1

May

13, 2024

Akanda

Corp.

1a, 1b Learoyd Road

New

Romney, TN28 8XU

United

Kingdom

Dear

Sirs/Mesdames:

We have acted as Canadian counsel to Akanda Corp.,

a corporation existing under the laws of the Province of Ontario, Canada (the "Corporation"), in connection with the

filing of a Registration Statement on Form S-8 (the "Registration Statement"), with the Securities and Exchange Commission

(the "Commission") under the Securities Act of 1933. The Registration Statement relates to the registration of an aggregate

of 18,540,745 common shares in the capital of the Corporation (the "Incentive Shares") issuable pursuant to the exercise

or settlement of the stock options, restricted share units (each an “RSU”) and other awards (collectively, the “Awards”)

that may be awarded under the Corporation’s 2024 Equity Incentive Plan (the “Incentive Plan”), representing

30% of the Corporation’s total issued and outstanding common shares as at the date hereof less any other common shares issuable

pursuant to any other option-based and share-based incentive compensation awards granted by the Corporation under previous equity incentive

plans.

EXAMINATION

OF DOCUMENTS

In

giving the opinion expressed below, as Canadian counsel for the Corporation, we have examined executed or electronically delivered copies,

which have been certified or otherwise identified to our satisfaction, of the following documents:

| a) | the

Registration Statement; and |

| b) | the

Incentive Plan (collectively, the "Documents"). |

This

opinion is being provided at the request of the Corporation.

For

the purposes of the opinion expressed below, we have considered questions of law, made the investigations, and examined originals or

copies, certified or otherwise identified to our satisfaction, of the certificates of public officials and other certificates, documents

and records, that we considered necessary or relevant, including:

| a) | a

certificate of status in respect of the Corporation issued by the Ontario Ministry of Public

and Business Service Delivery (formerly the Ministry of Government and Consumer Services)

(Ontario) on May 13, 2024 (the "Certificate of Status"); |

| b) | resolutions

of the director of the Corporation authorizing and approving the Registration Statement,

the Incentive Plan and the reservation of the Incentive Shares for issuance pursuant to the

Incentive Plan (the "Board Resolutions"); |

| c) | minutes

of the annual and special meeting of the shareholders of the Corporation held on March 22,

2024, whereby the shareholders approved, inter alia, the Incentive Plan (the “Shareholder

Resolutions” and, together with the Board resolutions, the “Authorizing

Resolutions”); |

| d) | as

to certain matters of fact relevant to the opinions expressed below, a certificate of an

officer of the Corporation dated the date of this opinion addressed to Gowling WLG (Canada)

LLP, including a certified copy of: |

| (i) | the

articles and by-laws of the Corporation; and |

| (ii) | the

Authorizing Resolutions. |

We

have not reviewed the minute books or, except as described above, any other corporate records of the Corporation.

ASSUMPTIONS

AND RELIANCES

We

have relied exclusively upon the documents and records we examined with respect to the accuracy of the factual matters contained in them

and we have not performed any independent investigation or verification of those factual matters. We have assumed those factual matters

were accurate on the date given and continue to be accurate as of the date of this opinion.

For

the purposes of the opinion expressed below, we have assumed, without independent investigation or inquiry, that:

| 1. | with

respect to all documents examined by us, the signatures are genuine, the individuals signing

those documents had legal capacity at the time of signing, all documents submitted to us

as originals are authentic, and all documents submitted to us as copies conform to the authentic

original documents; |

| 2. | the

indices and records in all filing systems maintained in all public offices where we have

searched or inquired or have caused searches or inquiries to be conducted are accurate and

current, and all certificates and information issued or provided under those searches or

inquiries are and remain accurate and complete; |

| 3. | none

of the Documents have been modified in any manner, whether by written or oral agreement or

by conduct of the parties to them or otherwise; |

| 4. | all

information contained in all documents reviewed by us is true and correct; and |

| 5. | there

is no foreign law that would affect the opinion expressed herein. |

We

have also assumed that at all relevant times:

| 1. | the

Corporation has the corporate power and capacity to authorize the issuance of the Incentive

Shares underlying the Awards granted pursuant to the Incentive Plan; |

| 2. | the

Corporation has the corporate power and capacity to perform its obligations under the terms

and conditions of the Documents; |

| 3. | the

Corporation has taken all necessary corporate action to authorize the execution and delivery

by the Corporation of the Documents and the performance of its obligations under the terms

and conditions thereof; |

| 4. | each

of the Documents has been duly authorized, executed (as applicable) and delivered by all

parties thereto and such parties have the capacity to do so; |

| 5. | to

the extent any future changes are made to the terms and conditions of the Incentive Plan,

they will have been duly authorized by the Corporation and, if applicable, approved by the

Corporation’s shareholders and any applicable stock exchange and other applicable regulatory

authorities, and will comply with applicable law; |

| 6. | the

execution (as applicable) and delivery of the Documents and the performance by the Corporation

of its obligations under the terms and conditions thereunder do not and will not conflict

with and do not and will not result in a breach of or default under, and do not and will

not create a state of facts which, after notice or lapse of time or both, will conflict with

or result in a breach of or default under any of the terms or conditions of any resolutions

of the board of directors or shareholders of the Corporation, any agreement or obligation

of the Corporation, or applicable law; |

| 7. | the

Corporation has the corporate power and capacity to authorize, create, authenticate, issue,

and deliver the Awards and the Incentive Shares underlying such Awards and to perform its

obligations under the terms and conditions of such Awards; |

| 8. | the

authentication and delivery of the Incentive Shares and the performance by the Corporation

of its obligations under the terms and conditions of the Awards do not and will not conflict

with and do not and will not result in a breach of or default under, and do not and will

not create a state of facts which, after notice or lapse of time or both, will conflict with

or result in a breach of or default under any of the terms or conditions of any resolutions

of the board of directors or shareholders of the Corporation, any agreement or obligation

of the Corporation, or applicable law; |

| 9. | the

effectiveness of the Registration Statement, and any amendments thereto (including post-effective

amendments), will not have been terminated or rescinded; |

| 10. | the

Incentive Shares are being offered and sold in compliance with the Incentive Plan and all

applicable United States federal and state securities laws and in the manner stated in the

Registration Statement; and |

| 11. | no

order, ruling or decision of any court or regulatory or administrative body is in effect

at any relevant time that restricts the issuance of the Incentive Shares. |

We

also have assumed the due authorization, execution and delivery of all documents where authorization, execution and delivery are prerequisites

to the effectiveness of such documents.

Where

our opinion expressed herein refers to any of the Incentive Shares having been issued as "fully paid and non-assessable", such

opinion assumes that all required consideration (in whatever form) has been paid for such Incentive Shares. No opinion is expressed as

to the adequacy of any consideration received.

In

expressing the opinion in paragraph 1, we have relied exclusively upon the Certificate of Status.

LAWS

ADDRESSED

We

are solicitors qualified to express opinions only with respect to the laws of the Province of Ontario and the opinion expressed herein

relates only to the laws of the Province of Ontario and the federal laws of Canada applicable therein as in effect on the date hereof.

OPINION

Based

upon the foregoing, and subject to the qualifications, assumptions and limitations stated herein, we are of the opinion that:

| 1. | The

Corporation is incorporated and existing under the Business Corporations Act (Ontario). |

| 2. | The

Corporation has reserved for issuance the Incentive Shares and such Incentive Shares will,

when issued in accordance with the terms and conditions of the Incentive Plan and the applicable

Award agreement, be validly issued as fully paid and non-assessable common shares in the

capital of the Corporation. |

QUALIFICATIONS

AND LIMITATIONS

| 1. | The

legality, validity, binding effect and enforceability of the Documents are subject to, and

may be limited by, applicable bankruptcy, insolvency, reorganization, arrangement, winding-up,

liquidation, moratorium, preference and other similar laws of general application affecting

the enforcement of creditors’ rights generally. |

| 2. | The

enforceability of the obligations of the Corporation under the Documents is subject to, and

may be limited by, general equitable and legal principles, including those relating to the

conduct of parties such as reasonableness and good faith in the performance of contracts,

and to the principle that equitable remedies such as injunctive relief and specific performance

are only available in the discretion of the court. |

RELIANCE

This

opinion is solely for the benefit of its addressee in connection with the filing of the Registration Statement with the Commission and

is not to be transmitted to any other person, nor is it to be relied upon in any manner by any other person. This opinion is limited

to the matters stated herein, and no opinion is implied or may be inferred beyond the matters expressly stated herein.

In

rendering the foregoing opinion, we are not passing upon, and assume no responsibility for, any disclosure in the Registration Statement

or any related prospectus or other offering material regarding the Corporation or its securities or their offering and sale.

We

hereby consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement and to the use of our name in Item 8 of the

Registration Statement. By the giving of such consent, we do not admit that we are experts with respect to any part of the Registration

Statement, or otherwise, within the meaning of the rules and regulations of the Commission.

Our

opinion is given as of the date of this opinion letter. Among other things, our opinion does not take into account any circumstance (including

changes in law or facts or the conduct of any of the relevant parties) that may occur after that date. We assume no obligation to update

or supplement the opinion set forth herein to reflect any changes of law or fact that may occur.

Yours

truly,

(Signed) “Gowling WLG (Canada) LLP”

4

Exhibit

23.1

To the Board of Directors of Akanda Corp.

We hereby consent to the incorporation

by reference in each of the Akanda Corp.’s Registration Statements on Form S-8 (No. 264450, No. 267976 and No. 273245) of our report

dated April 30, 2024, relating to the consolidated financial statements of Akanda Corp., which appears in this Form 20-F.

May 13, 2024

We have served as the Company’s auditor since 2022

Los Angeles, California

PCAOB ID Number 6580

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-8

(Form Type)

Akanda

Corp.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| | |

| |

| |

| | |

Proposed Maximum | | |

Maximum | | |

| | |

| |

| | |

Security | |

Fee Calculation | |

Amount | | |

Offering Price Per | | |

Aggregate Offering | | |

| | |

Amount of Registration | |

| Security Type | |

Class Title | |

Rule | |

Registered(1) | | |

Unit(3) | | |

Price(3) | | |

Fee Rate | | |

Fee | |

| Equity | |

Common Shares(2) | |

457(c) and 457(h) | |

| 18,540,745 | | |

$ | 0.0905 | | |

$ | 1,677,937.42 | | |

| 0.00014760 | | |

$ | 247.67 | |

| Total Offering Amounts | |

| |

| |

| | | |

| | | |

$ | 1,677,937.42 | | |

| | | |

$ | 247.67 | |

| Total Fee Offsets (4) | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| — | |

| Net Fee Due | |

| |

| |

| | | |

| | | |

| | | |

| | | |

$ | 247.67 | |

| (1) | Pursuant

to Rule 416 of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also

cover any additional common shares (“Common Shares”) of Akanda Corp. (the “Company”) that become

issuable by reason of any future stock dividend, stock split, recapitalization or other similar transaction or to cover such additional

shares as may hereinafter be offered or issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or

certain other capital adjustments, effected without the receipt of consideration by the Company, which results in an increase in the

number of the outstanding Common Shares. |

| (2) | Represents

Common Shares authorized for issuance under the Akanda Corp. 2024 Equity Incentive Plan (the “Plan”). Pursuant to

the Plan the aggregate number of Common Shares reserved for issuance pursuant to awards granted under the Plan shall not exceed 30% of

the Company’s total issued and outstanding Common Shares from time to time. The Plan is considered an “evergreen” plan,

since the Common Shares covered by awards which have been exercised or terminated shall be available for subsequent grants under the

Plan and the number of awards available to grant increases as the number of issued and outstanding Common Shares increases. |

| (3) | Estimated

in accordance with Rule 457(c) and Rule 457(h) of the Securities Act. The price shown is based upon the average of the high and low prices

reported for the Common Shares on The Nasdaq Capital Market on May 8, 2024, which date is within five business days prior to the initial

filing date of this registration statement.. |

| (4) | The

Registrant does not have any fee offsets. |

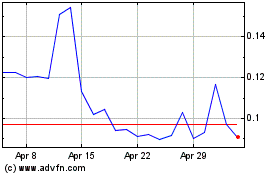

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From Apr 2024 to May 2024

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From May 2023 to May 2024