Regulatory News:

ORPEA SA (the "Company") (Paris:ORP) today announces

its consolidated revenue for the 1st half of 2023.

While occupancy rates of retirement homes in France remained

below expectations, the 2nd quarter of 2023 confirmed the trend

observed in the 1st quarter of 2023, with growth of +11.1% vs. the

same period last year. This is the result of an overall increase in

occupancy rates, with the exception of France, an increase in

installed capacity with the contribution of recently opened

facilities, and the effects of price increases, which were

particularly marked in Central Europe.

Overall, sales for the first half of 2023 totaled €2,539

million, corresponding to year-on-year growth of +10.7%, mostly

organic.

As a reminder, and as indicated in the press release

published on July 13th, the Company anticipates lower sales growth

and a substantial lag in EBITDAR generation for the full year 2023,

in the range of -15% to -20% compared with the EBITDAR forecast of

€881 million set out in the November 2022 Updated Business Plan

communicated to the market on May 12th, 2023 (i.e. EBITDAR 2023 of

between €705 million and €750 million).

With regard to the financial restructuring process, the

Company reminds that the Accelerated Safeguard Plan (“Plan de

Sauvegarde Accélérée”), as approved by the Nanterre Specialized

Commercial Court (link) on 24 July through a cross-class

cram down, provides for the implementation of three capital

increases, starting in the last quarter of 2023 and after the

lifting of the last condition precedent1, which will result in a

massive dilution for existing shareholders. After these operations,

and in the absence of reinvestment, they would hold around 0.04% of

the capital, with a theoretical share value of €0.02.

In €m

Quarterly figures

Half-year figures (30

June)

Q2 2022

Q2 2023

Change

o/w organic2

H1 2022

H1 2023

Change

o/w organic2

France Benelux UK Ireland

712

769

+8.0%

+4.6%

1,391

1,489

+7.0%

+5.2%

Central Europe

294

335

+14.0%

+13.3%

577

658

+13.9%

+12.9%

Eastern Europe

109

129

+18.7%

+18.9%

210

250

+19.2%

+19.3%

Iberian Peninsula and Latam

59

69

+18.4%

+17.7%

114

139

+21.4%

+19.7%

Other countries

0,9

1,8

ns

ns

1,9

3,6

ns

ns

Total revenue

1,175

1,305

11.1%

+8.8%

2,295

2,539

+10.7%

+9.1%

1. Q2 2023 revenue

Revenues reached €1,305 million in the 2nd quarter of 2023, a

year-on-year increase of +11.1%, including organic growth of

+8.8%.

Continuing from the 1st quarter of 2023, activity in the 2nd

quarter is up in all geographical areas, thanks to average

occupancy rates that are generally up and the contribution of

facilities opened in the last 12 months.

2. H1 2023 revenue

For the first half of 2023, revenue amounted to €2,539 million,

up +10.7% compared to the 1st half of 2022, of which +9.1%

organically.

The overall level of activity in clinics both in France and

internationally, as well as in retirement homes outside of France,

is increasing. This evolution is illustrated at the global level,

by an average occupancy rate up +136 bps compared to the 1st half

of 2022, at 82.7%.

In the France Benelux UK Ireland area, revenue amounted

to €1,489 million over the 1st semester, up +7.0% (including +5.2%

on an organic basis) compared to the first half of the previous

year.

In France, nursing home activity remains far from historical

levels, with an average occupancy rate of 83.4% over the period as

a whole, down on the same period last year (86.0%). Clinics

(Medical and Rehabilitation Care, Mental Health), on the other

hand, are experiencing an increase in activity levels, illustrating

the diversity of activities and specialties developed within the

facilities, in the various regions where the Group is active.

Elsewhere in the region, Belgium benefited from the inclusion of 19

new facilities in its scope of consolidation, and business grew

despite the closure of seven facilities in Brussels, while the

Netherlands posted sustained growth thanks to the ramp-up of new

facilities.

In Central Europe, sales rose by 13.9% (+12.9% organic)

to €657 million over the half-year. Germany and Switzerland

reported good activity momentum over the half-year, with occupancy

rates up in both the retirement homes and clinics. In Germany, the

good momentum also reflects the premium positioning on this

market.

In Eastern Europe, sales rose by 19.2% to €250 million

over the half-year, benefiting from a marked increase in the

occupancy rate of facilities opened over the past 12 months.

In the Iberian Peninsula and Latin America region, sales

came to €139 million for the first half, up 21.4%, mainly on an

organic basis, reflecting a marked increase in occupancy rates in

Spain, the region's main contributor.

Average occupancy rate

by geographical areas

Average occupancy rate

Quarterly figures

Half-year figures

Q2 2022

Q2 2023

Change

H1 2022

H1 2023

Change

France Benelux UK Ireland

83.4%

82.5%

(91)bps

84.2%

83.1%

(105)bps

Central Europe

79.4%

82.0%

+268bps

78.7%

81.8%

+304bps

Eastern Europe

81.9%

85.8%

+387bps

81.4%

84.6%

+323bps

Iberian Peninsula and Latam

75.3%

81.8%

+647bps

74.8%

82.5%

+766bps

Other countries

ns

ns

ns

ns

ns

ns

Total group

81.2%

82.4%

+118bps

81.3%

82.7%

+136bps

3. Update on the ash and debt position

at June 30th, 2023

The Group's cash position at June 30, 2023 is estimated at €527

million (unaudited figure), in line with expectations, for a net

financial debt of €9,328 million (including accrued interest of

€184 million; unaudited figure and excluding other IFRS

adjustments).

Over the 2nd half of 2023, liquidity requirements until the

completion of the Accelerated Safeguard Plan will be covered by

additional financing arranged by the Group's main banking partners.

In particular, tranche D1B of €200 million should be drawn down by

early August 2023, all conditions precedent having been met.

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 21 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https://www.orpea-group.com/en

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, MSCI Small Cap Europe and CAC Mid 60

indices.

Disclaimer - forward-looking information

This press release contains forward-looking statements that

involve risks and uncertainties, including those included or

incorporated by reference, regarding the Group's future growth and

profitability that could cause actual results to differ materially

from those indicated in the forward-looking statements. These risks

and uncertainties relate to factors that the Company cannot control

or accurately estimate, such as future market conditions. The

forward-looking statements in this press release constitute

expectations of future events and should be treated as such. Actual

events or results may differ from those described in this document

due to a number of risks or uncertainties described in the

Company's 2022 Universal Registration Document, which is available

on the Company's website and on the AMF website

(www.amf-france.org).

---

1 The final condition precedent is the purging of appeals lodged

against the waiver of the Caisse des Dépôts-led consortium's

obligation to launch a takeover bid for ORPEA shares, granted on

May 26, 2023.The decision by the Paris Court of Appeal is expected

in the 4 quarter of 2023.

2 Organic growth of Group revenue reflects the following

factors: 1. The year-on-year change in the revenue of existing

facilities as a result of changes in their occupancy rates and per

diem rates; 2. The year-on-year change in the revenue of

redeveloped facilities or those where capacity has been increased

in the current or year-earlier period; 3. Revenue generated in the

current period by facilities created during the year or

year-earlier period, and 4. the change in revenue of recently

acquired facilities by comparison with the previous equivalent

period

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726101372/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Toll-free number for shareholders : 0 805 480 480

Investor Relations NewCap Dusan Oresansky Tel: 01

44 71 94 94 ORPEA@newcap.eu

Press Relations ORPEA Isabelle Herrier-Naufle

Press Relations Director Tel: 07 70 29 53 74

i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78

37 27 60 - 06 89 87 61 37 clebarbier@image7.fr

lheilbronn@image7.fr

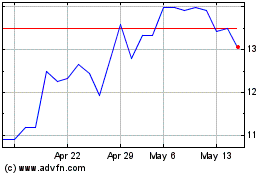

Orpea (EU:ORP)

Historical Stock Chart

From Apr 2024 to May 2024

Orpea (EU:ORP)

Historical Stock Chart

From May 2023 to May 2024