Bitcoin Bull Run In Jeopardy? Analyst Finds Market Top Signals With BTC At $40,000

December 18 2023 - 2:30PM

NEWSBTC

Bitcoin is walking back on some of its gains over the past few

days. The number one cryptocurrency by market cap might be on the

verge of a more significant retracement, which could push it back

to the $30,000 zone. Related Reading: Internet Computer Loses Grip

On $10, But Still Inks 82% Rally – Details As of this writing,

Bitcoin (BTC) trades at $40,950 with a 2% loss in the past 24

hours. On the weekly chart, the cryptocurrency records a 3% loss,

with all tokens in the top 10 by market recording a similar

performance, except for Avalanche (AVAX). Bitcoin Hits Local Top?

Bull Run Slows Down Over the weekend, Bitcoin was rejected from the

critical resistance level at $43,500. According to a pseudonym

analyst, as the BTC price dropped to its current levels, a

significant player placed a “substantial resistance block.” The

chart below shows that the selling order is 1,562 BTC, or around $7

million. It also shows thick support for BTC as the bullish

momentum fades. In other words, Bitcoin might slow down, but the

area around $40,000 could provide critical support for a potential

bounce. The analyst stated on the increasing selling orders

appearing on the books: Massive resistance added on BTC Binance

Spot. This is what a top looks like. A substantial resistance block

of 1562 BTC has just arrived in the order books. BTC Whales On The

Move While many believe that the market can absorb the spike in

selling pressure, crypto analytics firm Material Indicators showed

that Bitcoin is losing the support of major players. Over the

weekend, players selling orders above $1 million “dumped” their

positions. The firm has been warning traders about this possibility

by arguing that the recent bullish price action was a strategy to

suck in liquidity from retail investors. Once this smaller player

jumped in, whales began to “distribute” or sell their coins into

the rally. Related Reading: Solana Threatens To Unseat Ethereum In

Trade Volume With $1 Billion In Single Day In that sense, the firm

set a potential local top for BTC at $45,000. Keith Alan, one of

Material Indicators senior analysts, stated the following on the

current price action: The good news is, at some point the market

does flip to accumulation, and prices moving lower will get us to

that point. As bad as it looks for bulls right now, I’m not

expecting a straight line down. Time to exercise some patience and

see how things develop from here. Cover image from Unsplash, chart

from Tradingview

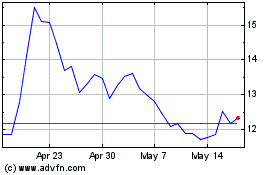

Internet Computer (COIN:ICPUSD)

Historical Stock Chart

From May 2024 to Jun 2024

Internet Computer (COIN:ICPUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024