The Best Gold Mining ETF for 2014 - ETF News And Commentary

February 21 2014 - 12:00PM

Zacks

Leaving many investors in

utter shock, gold mining ETFs bounced back from their 2013-lows at

the start of 2014 and kept on trending higher. Most market experts

and investors expected gold mining ETFs – which lost over 50% in

2013 – to succumb to steeper losses with the greenback gaining

strength on escalation of the Fed’s QE taper.

The fear of gradual cease in cheap-dollar inflow, emerging market

lull, softer economic data, sub-par corporate guidance as well as

overvalued stock markets initiated the ‘Great Un-rotation’ – stocks

to bonds – to start the year. Apart from bonds, gold has also

proved to be a big winner from this flight to safety.

Extreme low valuation also opened up buying opportunities for these

ETFs. SPDR Gold Shares (GLD)

added 5.86% while the biggest gold mining fund

Market Vectors Gold Miners ETF (GDX) surged about

17%. The latter enjoyed more gains as it often trades as leveraged

plays on gold (read: 3 ETFs Surging on Weak Jobs Data).

Many gold miners are breezing past the broader market in the

year-to-date time frame, with most stocks logging double-digit

performances. Investors should note that among all regular gold

mining funds, Market Vectors Junior Gold Miners ETF

(GDXJ)

stole the show by returning almost double (28.7%

year-to-date) than GDX. This prompts us look for at the reason

behind GDXJ’s recent success.

Inside GDXJ’s Recent Rally

Launched in November 2009, GDXJ – which looks to track the Market

Vectors Global Junior Gold Miners Index – provides exposure to

small and medium capitalization of companies involved in the gold

mining business. With an asset base of $1.6 billion, GDXJ is one of

the largest ETFs covering commodity producers’ equities.

Apparently, a smart stock selection technique enables GDXJ to

deliver big-time returns (read: Direxion Debuts Leveraged Junior

Gold Miner ETFs).

Lower capitalization stocks trend to be more volatile than their

large cap counterparts, and these see bigger moves when gold prices

are either soaring or slipping. This is one reason why GDXJ is a

good bet for investors looking for a higher payoff on a move in

gold.

More than three-fifth of the assets are invested in Canadian

companies with Australia coming a distant second at 20%. The U.S.

(less than 10%), Europe, Asia and Africa also get some

allocation.

GDXJ follows an almost equal-weighted methodology as opposed to GDX

which puts more than 13% of its 36-stock portfolio each in Barrick

Gold and Goldcorp while no stock accounts for than 4.32% of GDXJ’s

68-stock basket. This clearly offers a higher scope for

diversification and lesser amount of risks (read: Any Hope for Gold

ETFs in 2014?).

In line with many Junior Gold Miners, GDXJ declined about 80% from

its April 2011 peak before it bottomed out in December 2013 thus

opening up opportunities to make more profits at a fearful time

like this.

Final View

At present, GDXJ is witnessing an uptrend on the fundamental

strength of the underlying stocks. Added to this, excessive

bearish sentiment over the space and the resultant oversold

condition made it an intriguing pick. At the end, gold mining

stocks had to recuperate, though not in full swing, after such a

devastated year.

However, we might see the gap between the returns of GDX and GDXJ

tapering in the coming days. Notably, GDXJ is more than 50% opened

to Canadian dollar trailed by the U.S. (27%) and Aussie dollar

(16%). On the other hand, its larger counterpart GDX is exposed to

the U.S. dollar by as much as 89%, as per the data by xtf.com.

Thus, with the Canadian dollar losing strength to the greenback so

far this year, GDXJ might not return outstandingly ahead,

especially if the current pace of QE wrap-up remains intact. The

American currency has gained 3.21% (as of February 10) so far this

year against the Canadian currency. In short, if the Canadian

currency appreciates, GDXJ benefits and vice versa (read: Inside

the New Currency Hedged ETFs from iShares).

Also, GDXJ is currently

hovering a little higher than its 52-week low price. However, its

short-term moving average is still below the long-term average.

GDXJ is also trading below the parabolic SAR indicator. This

suggests continued bearishness for this ETF.

The relative strength index for GDX is presently 68.02, indicating

that the fund is peeping into the overbought territory.

Overall, the gold mining space will likely see a mixed 2014 and

will be busy paring down monumental losses incurred last year.

Investors interested to bet on gold should follow the space closely

as it is expected to be on a roller coaster ride this year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report

>>

MKT VEC-GOLD MI (GDX): ETF Research Reports

MKT VEC-JR GOLD (GDXJ): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

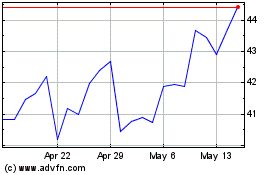

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Apr 2024 to May 2024

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From May 2023 to May 2024