Gold Mining ETF Slump Continues - ETF News And Commentary

April 02 2013 - 2:30PM

Zacks

Gold prices finished Tuesday lower once again, as futures for

June delivery dropped more than 1.5% on the session. This pushed

the precious metal below the $1,600/oz. mark once more, and led to

renewed worries over a further slump in the commodity’s price going

forward.

This is especially true given the robust level of dollar

strength in the market, and the continued bullishness in the equity

world, factors that are dulling safe haven appeal across the board.

In fact, this somewhat unusual combination has devastated gold

prices so far in 2013, pushing the commodity down by nearly $100/oz

since the start of the year (read 3 ETF Strategies for Long Term

Success).

The weakness has also transferred over into the ETF space as

well, with key products like GLD, IAU, and SGOL losing similar

amounts (percentage wise) this year. All three are now down

more than 5% on the year, pushing the trio down to negative double

digit territory in the trailing six month period.

While these performances have been bad, events have been even

worse in the gold mining ETF space. Products in this category

generally trade as a leveraged play on the underlying commodities,

so when gold prices are slumping, these mining ETFs are truly

hurting (read Have We Seen the Bottom in Gold ETFs?).

This has particularly been the case as of late, as the double

whammy of weak gold prices and a strong dollar has hurt operations

of these firms. This is even more true for gold miners that have

heavy international operations, as repatriation from foreign

currencies back to U.S. dollars adds to their woes even more.

Gold Miner ETFs in Focus

Thanks to this trend, gold mining ETFs were crushed after

today’s latest slump in gold bullion prices. Two of the most

popular products in the space, GDX and GDXJ, both finished the day

lower by more than 4%, while other choices in the space, PSAU,

RING, and GGG, also traded down significantly on the day.

These terrible performances continue the trend that investors

have seen so far in 2013 in this downtrodden space. All of the

above highlighted gold mining ETFs are now down more than 20% YTD,

far outpacing the -5% losses seen in the commodity market, and

showcasing just how leveraged these funds can be when compared to

underlying products (also see Gold ETFs Meet Covered Calls in Brand

New GLDI).

Outlook for Gold Miner ETFs

Given how deep these trends are, and the apparent durability of

the bull market in many other equity segments, it may be a good

idea to avoid gold mining ETFs for the time being. There are plenty

of other choices in the market that are less sensitive to

commodities which likely to be better picks going forward (see Time

to Buy This Top Ranked Dividend ETF?).

If you are still bullish on gold, it may instead be time to look

at the underlying commodity as opposed to the miners, at least in

the near term. That is because the volatility—and

underperformance—in the gold mining space has been significant, and

bullion appears to be a lower risk play at this time.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT VEC-GOLD MI (GDX): ETF Research Reports

MKT VEC-JR GOLD (GDXJ): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-GOLD TR (IAU): ETF Research Reports

ETFS-GOLD TRUST (SGOL): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

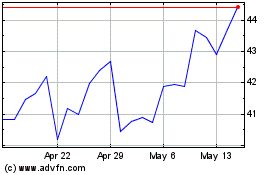

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Apr 2024 to May 2024

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From May 2023 to May 2024