US Gold Corp and Paramount Gold & Silver -- Undervalued and on the Rise

December 05 2011 - 8:16AM

Marketwired

Gold stocks are coming off a strong week after the US dollar fell

on news that 6 central banks, including the Federal Reserve, would

lend more dollars at cheaper prices. One of the most well-known

relationships in currency markets is the inverse relationship

between the US dollar and the value of gold. This relation occurs

because gold is typically used as a hedge against inflation through

its intrinsic metal value. The Bedford Report examines investing

opportunities in the Gold Industry and provides equity research on

US Gold Corporation (NYSE: UXG) (TSX: UXG) and Paramount Gold &

Silver Corporation (NYSE Amex: PZG) (TSX: PZG). Access to the full

company reports can be found at:

www.bedfordreport.com/UXG

www.bedfordreport.com/PZG

Last week Reuters reported that Zhang Bingnan, vice chairman of

the China Gold Association, said the unsustainable debt burdens of

both Europe and the United States would encourage them to print

more money, making gold more attractive. "Whether or not Europe and

the United States find a way out of their debt mess, there is one

thing for certain -- investors would now be more convinced than

ever that they need to have a larger portfolio in gold," Zhang

said.

Gold has climbed more than 20 percent year-to-date as investors

and central banks bought the metal as an alternative to stocks,

bonds and currencies.

The Bedford Report releases stock reports on the Gold Industry

so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.bedfordreport.com and get exclusive

access to our numerous analyst reports and industry

newsletters.

Even gold mining stocks are showing signs of strength in recent

weeks. Gold mining stocks have performed relatively poorly this

year in relation to the price of gold. Bloomberg reports that

valuations on gold mining stocks have fallen to their cheapest

level in nine years even though sector profits are projected to

nearly double this year and gold remains within striking distance

of its record highs.

Paramount Gold and Silver Corporation is a US-based exploration

and development company with multi-million ounce advanced stage

precious metals projects in Nevada (Sleeper) and northern Mexico

(San Miguel). Last week the company reported more high-grade gold

and silver results from 10 holes recently completed at its

100%-owned San Miguel Project.

US Gold Corporation explores for gold and silver in the Americas

and is advancing its El Gallo Project in Mexico and its Gold Bar

Project in Nevada towards production. Shares of the company

exploded last week after the company said it completed a

preliminary feasibility study (PFS) on its Gold Bar mining project.

The study indicates that the mine could potentially produce 51,000

ounces of gold annually over an eight-year period at cash costs of

$665 an ounce.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

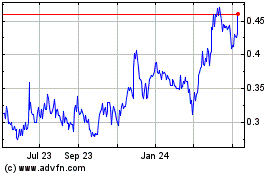

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Jul 2023 to Jul 2024