Paramount Gold and Pacific Gold Continue to Lag Stable Bullion Prices

November 21 2011 - 8:16AM

Marketwired

With the price of Gold near all-time highs, analysts and investors

are beginning to question the underperformance of Gold Mining

stocks. Key gold index stocks are down on average about 8 percent

year to date, while gold futures have added about 17 percent. Paul

Simon, chief investment officer of Tactical Allocation Group,

argues that "Investors in gold miners still have to account for

business risk and global uncertainty." Simon adds that "part of the

problem miners face is they're located in countries with

governments in bad fiscal positions or uncertain political

climates." The Paragon Report examines investing opportunities in

the Gold Industry and provides equity research on Paramount Gold

& Silver Corporation (NYSE Amex: PZG) (TSX: PZG) and Pacific

Gold Corporation (PINKSHEETS: PCFG). Access to the full company

reports can be found at:

www.paragonreport.com/PZG

www.paragonreport.com/PCFG

Earlier this month, the the World Gold Council said that gold

demand rose 6 percent in the third quarter from a year earlier as

Europe's debt crisis spurred investors to accumulate the metal as a

protection of wealth and push prices to a record. Despite the

uptick, jewellery demand fell 10 percent to 465.6 tons in the third

quarter, the council said. Usage in India fell 26 percent to 125.3

tons, and the country and China accounted for 57 percent of global

purchases, according to the report. Total gold demand fell 23

percent in India and rose 17 percent in China. A report from the

World Gold Council (WGC) titled 'India: Heart of Gold' argues that

Gold demand in India will continue to be robust in the next decade.

The report estimates that cumulative annual demand will be in

excess of 1,200 tonnes by 2020, registering a growth of 33

percent.

The Paragon Report provides investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on the gold industry register with us free at

www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Pacific Gold Corp, through its subsidiaries, engages in the

identification, acquisition, exploration, and mining of mineral

properties, primarily alluvial gold and base metals in western

North America. Shares of the company collapsed last week after it

released third quarter results. During the third quarter, the

Company mined approximately 11,000 cubic yards of new gravels

beginning in mid-September to the end of the quarter.

Paramount Gold and Silver Corp., an exploration stage mining

company, engages in the acquisition, exploration, and development

of gold, silver, and precious metal properties in Mexico and the

United States. Earlier this month the company announced additional

high-grade gold and silver at its Mexico-based San Miguel

project.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer.

Add to Digg Bookmark with del.icio.us Add to Newsvine

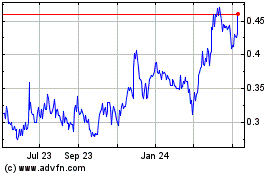

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Jul 2023 to Jul 2024