Current Report Filing (8-k)

March 01 2018 - 5:29PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) February 27, 2018

Premier

Products Group, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-51232

|

|

82-4608069

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

1325

Cavendish Drive, Suite 201, Silver Spring, MD 20905

(301)

202-7762

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

Effective

February 22, 2018, as discussed below, effective February 22, 2018, the issuer, having been renamed, then re-domiciled from Wyoming

to Delaware and engaged in a Holding Company Reorganization. See Exhibit 3.1.

|

ITEM 1.01.

|

ENTRY

INTO A MATERIAL DEFINITIVE AGREEMENT

|

Holding

Company Reorganization

On

February 22, 2018, the issuer (having been renamed, immediately prior to this Holding Company Reorganization, from “Premier

Products Group, Inc.” to “Valley High Mining Company”) completed a corporate reorganization (the “Holding

Company Reorganization”) pursuant to which Valley High Mining Company, as previously constituted (the “Predecessor”)

became a direct, wholly-owned subsidiary of a newly formed Delaware corporation, Premier Products Group, Inc. (the “Holding

Company”), which became the successor issuer. In other words, the Holding Company is now the public entity. The Holding

Company Reorganization was effected by a merger conducted pursuant to Section 251(g) of the Delaware General Corporation

Law (the “DGCL”), which provides for the formation of a holding company without a vote of the stockholders of the

constituent corporations.

In

accordance with Section 251(g) of the DGCL, Premier Services, Inc. (“Merger Sub”), another newly formed Delaware

corporation and, prior to the Holding Company Reorganization, was an indirect, wholly owned subsidiary of the Predecessor, merged

with and into the Predecessor, with the Predecessor surviving the merger as a direct, wholly owned subsidiary of the Holding Company

(the “Merger”). The Merger was completed pursuant to the terms of an Agreement and Plan of Merger among the Predecessor,

the Holding Company and Merger Sub, dated February 22, 2018 (the “Merger Agreement”).

As

of the effective time of the Merger and in connection with the Holding Company Reorganization, all outstanding shares of common

stock and preferred stock of the Predecessor were automatically converted into identical shares of common stock or preferred stock,

as applicable, of the Holding Company on a one-for-one basis, and the Predecessor’s existing stockholders and other holders

of equity instruments, became stockholders and holders of equity instruments, as applicable, of the Holding Company in the same

amounts and percentages as they were in the Predecessor prior to the Holding Company Reorganization.

The

executive officers and board of directors of the Holding Company are the same as those of the Predecessor in effect immediately

prior to the Holding Company Reorganization.

For

purposes of Rule 12g-3(a), the Holding Company is the successor issuer to the Predecessor, now as the sole shareholder of the

Predecessor. Accordingly, upon consummation of the Merger, the Holding Company’s common stock was deemed to be registered

under Section 12(b) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12g-3(a) promulgated thereunder.

The

foregoing description of the Merger Agreement set forth in this Item 1.01 is qualified in its entirety by reference to the

full text of the Merger Agreement, a copy of which is attached as Exhibit 2.1 hereto and incorporated by reference herein.

|

ITEM 5.03.

|

AMENDMENTS

TO ARTICLES OF INCORPORATION OR BYLAWS

|

On

February 22, 2018, the Predecessor changed its name and then re-domiciled from Wyoming to Delaware. Immediately following such

re-domiciliation, the Holding Company adopted a certificate of incorporation (the “Certificate”) and bylaws (the “Bylaws”)

that are, in all material respects, identical to the certificate of incorporation and bylaws of the Predecessor immediately prior

to the Holding Company Reorganization, with the possible exception of certain amendments that are permissible under Section 251(g)(4)

of the DGCL. The Holding Company has the same authorized capital stock and the designations, rights, powers and preferences of

such capital stock, and the qualifications, limitations and restrictions thereof are the same as that of the Predecessor’s

capital stock immediately prior to the Holding Company Reorganization.

The

Certificate of the Holding Company is attached hereto as Exhibits 3.1 and incorporated by reference into this Item 5.03.

The

common stock of the Holding Company trades on OTCMarkets under the symbol “PMPG” under which the common stock of the

Predecessor was previously listed and traded. As a result of the Holding Company Reorganization, the common stock of the Predecessor

will no longer be publicly traded.

|

ITEM 9.01.

|

FINANCIAL

STATEMENTS AND EXHIBITS

|

Exhibits

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

2.1

|

|

Agreement and Plan of Merger, dated February 22, 2018, by and among Premier Products Group, Inc., Valley High Mining Company and Premier Services, Inc.

|

|

|

|

|

|

3.1

|

|

Certificate of Incorporation of each constituent entity, including any exhibits thereto, as may be amended from time to time, of each of Valley High Mining Company, Premier Products Group, Inc. and Premier Services, Inc.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

Premier Products Group, Inc.

(Registrant)

|

|

|

|

|

|

Date: February

27, 2018

|

|

By:

|

/s/

Clifford Pope

|

|

|

|

|

Clifford

Pope

CEO and President

|

INDEX

TO EXHIBITS

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

2.1

|

|

Agreement and Plan of Merger, dated February 22, 2018, by and among Premier Products Group, Inc., Valley High Mining Company and Premier Services, Inc.

|

|

|

|

|

|

3.1

|

|

Certificate of Incorporation of each participating entity, as may be amended from time to time, of each of Valley High Mining Company, Premier Products Group, Inc. and Premier Services, Inc.

|

4

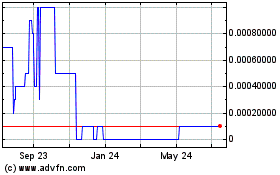

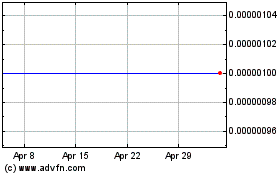

Premier Products (CE) (USOTC:PMPG)

Historical Stock Chart

From Apr 2024 to May 2024

Premier Products (CE) (USOTC:PMPG)

Historical Stock Chart

From May 2023 to May 2024