Galantas Reports Results for Third Quarter 2011

November 28 2011 - 8:00AM

Marketwired Canada

Galantas Gold Corporation (TSX VENTURE:GAL)(AIM:GAL) (the 'Company') results for

the three and nine months ended September 30, 2011 have been published.

Net Income for the three months ended September 30, 2011 amounted to CAD$

445,646 compared to a Net Income of CAD$ 206,069 for the three months ended

September 30, 2010. When Net Income is adjusted for non-cash items on the Income

Statement (before changes in non-cash working capital), the cash generated from

operating activities amounted to CAD$ 792,682 for the third quarter of 2011

compared to CAD$ 358,514 for the third quarter of 2010.

Net Income for the nine months ended September 30, 2011 amounted to CAD$

1,165,045 compared to a Net Income of CAD$ 810,934 for the nine months ended

September 30, 2010. When Net Income is adjusted for non cash items on the Income

Statement (before changes in non-cash working capital), the cash generated from

operating activities amounted to CAD$ 2,001,466 for the first nine months of

2011 compared to CAD$ 1,538,537 for the first nine months of 2010.

The main reason for the improved results was the higher gold prices achieved

together with increased production at its Northern Ireland subsidiary during

2011. Gains were partially offset, however, by an increase in costs during the

two intervals.

Production at the Omagh mine during the three months ended September 30, 2011

was well above production levels achieved during both the first quarter of 2011

and the corresponding third quarter of 2010 but below the record quarterly

production achieved during the second quarter of 2011. The three and nine-month

figures to September 30, 2011 and their comparative 2010 figures are summarized

in the table below.

----------------------------------------------------------------------------

Three Months Three Months Nine Months Nine Months

to September to September to September to September

30 2011 30 2010 30 2011 30 2010

----------------------------------------------------------------------------

Tonnes Milled 13,707 8,375 36,539 29,729

----------------------------------------------------------------------------

Average Grade g/t

gold 4.34 4.75 4.73 4.73

----------------------------------------------------------------------------

Concentrate Dry

Tonnes 545 309 1,582 1,226

----------------------------------------------------------------------------

Gold Grade

(concentrate) 91.2 131 98.3 119.9

----------------------------------------------------------------------------

Gold Produced (oz) 1,597 1,303 5,007 4,729

----------------------------------------------------------------------------

Gold Produced (kg) 49.6 40.5 155.6 147.1

----------------------------------------------------------------------------

Silver Grade 236.5 296.1 239.4 337.6

----------------------------------------------------------------------------

Silver Produced (oz) 4,142 2,942 12,176 13,299

----------------------------------------------------------------------------

Silver Produced (kg) 128.8 91.5 378.7 413.6

----------------------------------------------------------------------------

Lead Produced tonnes 56.3 51 227 202.4

----------------------------------------------------------------------------

Gold Equivalent (oz) 1,766 1,426 5,658 5,283

----------------------------------------------------------------------------

The 2011 production figures and metal contents are provisional and subject to

averaging or umpiring provisions under the concentrate off - take agreement

detailed in a press release dated October 3, 2007.

Highlights of the 2011 third quarter and first nine months results, which are

expressed in Canadian Dollars (CAD$), are:

----------------------------------------------------------------------------

Third Quarter Ended Nine Months Ended

All figures denominated in September 30 September 30

Canadian Dollars (CAD$)

2011 2010 2011 2010

----------------------------------------------------------------------------

Revenue 2,510,985 1,759,978 6,979,698 5,244,089

----------------------------------------------------------------------------

Cost of Sales 1,247,229 1,118,807 3,621,382 3,125,974

----------------------------------------------------------------------------

Amortization 222,079 133,961 603,939 579,847

----------------------------------------------------------------------------

Income (loss) before the

undernoted 1,041,677 507,210 2,754,377 1,538,268

----------------------------------------------------------------------------

General administrative

expenses 655,568 250,566 1,647,918 698,390

----------------------------------------------------------------------------

Foreign exchange/(gain)

loss (59,537) 50,575 (58,586) 28,944

----------------------------------------------------------------------------

Net Income for the period 445,646 206,069 1,165,045 810,934

----------------------------------------------------------------------------

During the third quarter, Omagh Minerals Limited ('OML') received an

environmental compliance study conducted by the Northern Ireland Environment

Agency. The report confirmed that OML continued to be within terms of its

consent and met the relevant Environmental Quality Standards.

The Company notes that a further delay has been introduced into the planning

process regarding road transport of surplus rock. The application is recommended

for approval by the Planning Service, Department of Environment, Northern

Ireland but has not yet been determined. OML does not have clarity as to a

timetable for removal of surplus rock, for which storage at the mine site is

limited. Consequently an employment review is continuing which is likely to lead

to a reduction in the number of employees, via redundancy procedures (after

statutory consultation is complete), due to a switch to the processing of lower

grade material.

An active program of drilling is taking place to assess the gold and silver

mineralisation at depth on the Omagh property in order to examine potential for

underground mining. During 2011 (to the end of the third quarter), a total of

2558.6 metres has been drilled and a total of 33 drill holes completed. Detailed

financial studies have been carried out to estimate the cost of underground

development and these studies will be released in conjunction with a revised

resource report for the property. The report will comment upon the financial

studies and be to a standard suitable for publication in Canada (National

Instrument 43-101). An interim report is scheduled for late spring 2012.

Plans to develop an underground mine are at an advanced stage and are expected

to be submitted for permitting around the end of 2011. The plans include a cut

and cover adit within the backfilled open pit (being currently worked), with a

spiral decline to the base of a proposed Phase 1 Underground Mine, and a

raise-bored shaft to provide emergency egress and ventilation. The principal

mining method proposed is shrinkage-stoping and long term stability will be

assured by backfilling with waste rock and clean tailing sands. Potentially the

mine may progress to deeper levels than that planned for Phase 1 but this will

be subject to the identification of further resources by drilling. The current

drilling program is designed to identify resources to approximately 350 metres

below surface, for a potential Phase 1 mine. Permitting procedures have been

commenced in conjunction with continued drilling to enable an earlier

determination of planning permits.

An Environmental Impact Assessment (EIA), based upon new data and that from 14

years of environmental monitoring, is being drawn up to be submitted to Planning

Service, Northern Ireland. The EIA considers the processes involved, including

impact on water, air and noise, amongst other environmental factors.

The detailed results and Management Discussion and Analysis (MD&A) are available

on www.sedar.com and www.galantas.com and the highlights in this release should

be read in conjunction with the detailed results and MD&A. The MD&A provides an

analysis of comparisons with previous periods, trends affecting the business and

risk factors.

This disclosure has been reviewed by Leo O' Shaughnessy (Chief Financial

Officer) and Roland Phelps (President and CEO), who are qualified under the

meaning of N.I 43-101 and who have also reviewed this release for the purposes

of AIM requirements. The information is based upon financial and operating data

prepared under their supervision.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press release contains

forward-looking statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian securities

laws, including revenues and cost estimates, for the Omagh Gold project.

Forward-looking statements are based on estimates and assumptions made by

Galantas in light of its experience and perception of historical trends, current

conditions and expected future developments, as well as other factors that

Galantas believes are appropriate in the circumstances. Many factors could cause

Galantas' actual results, the performance or achievements to differ materially

from those expressed or implied by the forward looking statements or strategy,

including: gold price volatility; discrepancies between actual and estimated

production, the commercial viability of processing lower grade material, actual

and estimated metallurgical recoveries; mining operational risk; regulatory

restrictions, including environmental regulatory restrictions and liability;

risks of sovereign involvement; speculative nature of gold exploration;

dilution; competition; loss of key employees; additional funding requirements;

planning and other permitting issues; and defective title to mineral claims or

property. These factors and others that could affect Galantas's forward-looking

statements are discussed in greater detail in the section entitled "Risk

Factors" in Galantas' Management Discussion & Analysis of the financial

statements of Galantas and elsewhere in documents filed from time to time with

the Canadian provincial securities regulators and other regulatory authorities.

These factors should be considered carefully, and persons reviewing this press

release should not place undue reliance on forward-looking statements. Galantas

has no intention and undertakes no obligation to update or revise any

forward-looking statements in this press release, except as required by law.

Galantas Gold Corporation Issued and Outstanding Shares total 235,650,055.

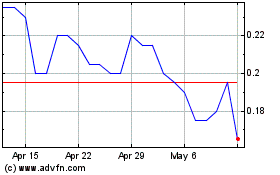

Galantas Gold (TSXV:GAL)

Historical Stock Chart

From Apr 2024 to May 2024

Galantas Gold (TSXV:GAL)

Historical Stock Chart

From May 2023 to May 2024