Luna Innovations Incorporated (NASDAQ:LUNA), a company focusing

on sensing, instrumentation and nanotechnology, today announced its

financial results for the third quarter and nine months ended

September 30, 2010.

As compared to the same quarter last year, total revenue

decreased by 3%, from $8.9 million in the third quarter of 2009 to

$8.6 million in the third quarter of 2010. Revenue in the company’s

product and license segment improved by 49%, from $2.4 million in

the third quarter of 2009 to $3.6 million in the third quarter of

2010. Technology development revenues decreased by 23% to $5.0

million for the third quarter of 2010 from $6.5 million for the

third quarter of 2009.

Operating expenses improved by $1.7 million, or 31%, primarily

due to the non-recurring litigation and reorganization costs in

2009 and to the company’s ongoing expense savings initiatives. The

company reported a net loss attributable to common stockholders of

$0.5 million, or $0.04 per common share, for the third quarter of

2010, as compared to a net loss of $2.0 million, or $0.18 per

common share for the third quarter of 2009.

Adjusted EBITDA less litigation- and reorganization-related

items improved to $0.9 million for the third quarter of 2010, as

compared to $0.8 million for the third quarter of 2009. Adjusted

EBITDA reflects the company’s earnings before interest, taxes,

depreciation and amortization, non-cash stock-based compensation

expense, warrant expense, and non-cash charges for impairment of

intangible assets. In addition, the company achieved positive cash

flow for the quarter of $0.9 million.

Dale Messick, Interim President and Chief Operating Officer,

provided this overview of Luna’s results: “We are extremely pleased

to report positive cash flow for the quarter along with a nearly

50% growth in our product and license revenues. As we have

anticipated, with the elimination of last year’s litigation and

Chapter 11 reorganization expenses from our quarterly results, we

have realized significant improvement in our bottom line and in our

cash flow.”

Third Quarter Financial and Business

Highlights

-- Product and license revenues improved by 49%, from $2.4

million in the third quarter of 2009 to $3.6 million in the third

quarter of 2010. Technology development revenues decreased by 23%

to $5.0 million for the third quarter of 2010 from $6.5 million for

the third quarter of 2009.

-- Gross profit for the third quarter of 2010 decreased 2% from

$3.5 million in the third quarter 2009 to $3.4 million in 2010.

-- Selling, general and administrative expenses decreased by

$0.5 million to $3.4 million, or 39% of total revenues for the

third quarter of 2010, from $3.9 million, or 44% of total revenues,

for the third quarter of 2009, driven by a reduction in legal

expenses.

-- Total operating expenses decreased by 31%, from $5.4 million

in the third quarter of 2009 to $3.7 million in the third quarter

of 2010, primarily driven by a reduction in litigation and Chapter

11 reorganization expenses, as well as by the company’s ongoing

expense savings initiatives.

-- Adjusted EBITDA excluding litigation and

reorganization-related items increased to $0.9 million in the third

quarter of 2010 from $0.8 million in the third quarter of 2009.

-- Net loss attributable to common stockholders improved to $0.5

million for the third quarter of 2010, compared to a net loss

attributable to common stockholders of $2.0 million for the third

quarter of 2009.

-- Cash and cash equivalents totaled $7.2 million at September

30, 2010, as compared to $5.7 million at September 30, 2009 and

$5.2 million at December 31, 2009. At September 30, 2010, $2.5

million continued to be outstanding under the company’s $5.0

million revolving line of credit.

-- Launched the Optical Backscatter Reflectometer™(OBR) 4600

product in the third quarter offering high resolution, high

sensitivity measurements of optical fiber assemblies and networks

up to two kilometers in length with substantially increased speed

over predecessor versions of the OBR.

--Increased the backlog for future technology development to

$29.6 million at September 30, 2010 compared to $23.5 million at

September 30, 2009.

Outlook for 2010

Based on information as of November 9, 2010, the company

continues to expect a net loss for the year in the range of $3.0

million to $4.0 million. The company also expects revenue for the

year to be in the range of $33.0 million to $34.0 million, a

narrowing of the company’s previous revenue guidance of $33.0

million to $35.5 million.

Non-GAAP Measures

In evaluating the operating performance of its business, Luna’s

management excludes certain charges and credits that are required

by generally accepted accounting principles (“GAAP”). These

non-GAAP results provide useful information to both management and

investors by excluding items that the company believes may not be

indicative of its operating performance, because either they are

non-cash items or they are unusual items that the company does not

expect to recur in the ordinary course of its business or are

unrelated to the ongoing operation of the business in the ordinary

course. These non-GAAP measures should be considered in addition to

results and guidance prepared in accordance with GAAP, but should

not be considered a substitute for, or superior to, GAAP results.

The non-GAAP measures included in this press release have been

reconciled to the nearest GAAP measure in the table following the

financial statements attached to this press release.

Conference Call

Information

As previously announced, Luna Innovations will conduct an

investor conference call at 5:00 p.m. (EST) today to discuss its

financial results and business developments for the third quarter

of 2010. The investor conference call will be available via live

webcast on the Luna Innovations website at

http://www.lunainnovations.com under the tab "Investor Relations."

To participate by telephone, the domestic dial-in number is

866.770.7146 and the international dial-in number is 617.213.8068.

The participant access code is 55009308. Investors are advised to

dial in at least five minutes prior to the call to register. The

webcast will be archived on the company's website under "Webcasts

and Presentations" for 30 days following the conference call.

About Luna Innovations:

Luna Innovations Incorporated (www.lunainnovations.com) is focused on sensing and

instrumentation, and pharmaceutical nanomedicines. Luna develops

and manufactures new-generation products for the healthcare,

telecommunications, energy and defense markets. The company’s

products are used to measure, monitor, protect and improve critical

processes in the markets we serve. Through its disciplined

commercialization business model, Luna has become a recognized

leader in transitioning science to solutions. Luna is headquartered

in Roanoke, Virginia.

Forward Looking Statements:

The statements in this release that are not historical facts

constitute “forward-looking statements” made pursuant to the safe

harbor provision of the Private Securities Litigation Reform Act of

1995 that involve risks and uncertainties. These statements include

our expectations regarding financial results for the full year 2010

and capabilities of the Company’s OBR 4600 product. Management

cautions the reader that these forward-looking statements are only

predictions and are subject to a number of both known and unknown

risks and uncertainties, and actual results, performance, and/or

achievements of the Company may differ materially from the future

results, performance, and/or achievements expressed or implied by

these forward-looking statements as a result of a number of

factors. These factors include, without limitation the fact that

the outlook for full year 2010 could change, and also include,

without limitations, those risks and uncertainties set forth in the

Company’s periodic reports and other filings with the Securities

and Exchange Commission. Such filings are available at the SEC’s

website at http://www.sec.gov, and at the company’s website at

http://www.lunainnovations.com. The statements made in this release

are based on information available to the company as of the date of

this release and Luna Innovations undertakes no obligation to

update any of the forward-looking statements after the date of this

release.

Luna Innovations Consolidated Statements of

Operations Three Months Ended Nine Months

Ended September 30, September 30, 2010

2009 2010 2009 (unaudited)

(unaudited) Revenues: Technology development revenues $

5,027,024 $ 6,493,741 $ 16,929,621 $ 19,795,638 Product and license

revenues 3,558,118 2,381,184

8,539,953 6,234,621 Total revenues

8,585,142 8,874,925 25,469,574 26,030,259 Cost of revenues:

Technology development costs 3,534,089 4,136,935 11,559,351

13,189,007 Product and license costs 1,613,499

1,231,289 4,332,600 3,275,076

Total cost of revenues 5,147,588

5,368,224 15,891,951 16,464,083

Gross Profit 3,437,554 3,506,701 9,577,623 9,566,176

Operating expense: Selling, general and administrative

3,383,121 3,892,238

10,044,549

13,033,818 Research, development, and engineering 307,777 660,836

1,249,385 2,343,176 Litigation reserve — — — 36,303,643 Impairment

of intangible assets — — — 1,310,598 Reorganization expense

53,597 872,644 161,801

872,644 Total operating expense 3,744,495

5,425,718 11,455,735

53,863,879 Operating loss (306,941 )

(1,919,017 ) (1,878,112 ) (44,297,703 ) Other income

(expense): Other income (expense) 10,000 — (5,477 ) (18,167 )

Interest expense (124,756 ) (124,208 )

(352,282 ) (422,702 ) Total other (expense)

(114,756 ) (124,208 ) (357,759 )

(440,869 ) Loss before income taxes (421,697 )

(2,043,225 ) (2,235,871 ) (44,738,572 ) Income tax expense

1,817 — 1,817 600,000

Net loss (423,514 ) (2,043,225 ) (2,237,688 )

(45,338,572 ) Preferred stock dividend 93,000

— 267,633 —

Net loss attributable to common

stockholders

$ (516,514 ) $ (2,043,225 ) $ (2,505,321 ) $ (45,338,572 )

Net loss per share: Basic and Diluted $ (0.04 ) $ (0.18 ) $ (0.19 )

$ (4.05 ) Weighted average shares: Basic and Diluted

13,188,913 11,247,749 12,890,752 11,205,575

Luna Innovations Consolidated Balance Sheets September

30, December 31, 2010 2009

(unaudited) Assets Current assets Cash and cash equivalents

$ 7,152,228 $ 5,228,802 Accounts receivable, net 6,578,187

7,203,203 Inventory, net 2,984,848 2,890,364 Prepaid expenses

508,138 560,964 Other current assets 45,524

729,532 Total current assets 17,268,925 16,612,865

Property and equipment, net 3,428,076 4,129,015 Intangible assets,

net 571,444 580,785 Other assets 322,002

435,259 Total assets $ 21,590,447 $ 21,757,924

Liabilities and stockholders’ equity (deficit)

Liabilities not subject to compromise: Current Liabilities:

Revolving line of credit $ 2,500,000 $ — Current portion of long

term-debt obligation 1,164,005 — Accounts payable 1,279,763

1,142,267 Accrued liabilities 3,234,115 3,386,849 Deferred credits

1,343,348 1,027,016 Total

current liabilities 9,521,231 5,556,132 Long-term debt obligation

2,993,296 — Liabilities subject to compromise —

19,062,000 Total liabilities 12,514,527

24,618,132 Commitments and contingencies Stockholders’

equity (deficit): Preferred stock, par value $0.001, 1,321,514

shares authorized, issued and outstanding at September 30, 2010

1,322 —

Common stock, par value $0.001,

100,000,000 shares authorized, 13,280,696 and 11,351,967 shares

issuedand outstanding at September 30, 2010 and December 31, 2009,

respectively

13,338 11,352 Additional paid-in capital 55,666,838 41,228,698

Accumulated deficit (46,605,578 ) (44,100,258 )

Total stockholders’ equity (deficit) 9,075,920

(2,860,208 ) Total liabilities and stockholders’

equity (deficit) $ 21,590,447 $ 21,757,924

Luna Innovations Consolidated Statements of Cash

Flows Nine months ended September 30, 2010

2009 (unaudited) Cash flows used in operating

activities Net loss $ (2,237,688 ) $ (45,338,572 ) Adjustments

to reconcile net loss to net cash used in operating activities

Depreciation and amortization 953,630 1,504,211 Impairment of

intangible assets — 1,310,598 Share-based compensation 2,616,024

2,378,968 Deferred tax expense

—

600,000 Reorganization expense in excess of cash payments

—

88,210 Reorganization accrual

—

146,964 Change in assets and liabilities: Accounts receivable

625,016 (263,620 ) Inventory (140,220 ) (1,181,901 ) Other current

assets 736,834 — Other assets 71,029 (34,581 ) Accounts payable and

accrued expenses (3,267,285 ) (102,956 ) Litigation reserve —

36,303,643 Deferred credits 316,332 (102,391 )

Net cash used in operating activities (326,328

) (4,691,427 )

Cash flows used in investing

activities Acquisition of property and equipment (50,540 )

(49,295 ) Intangible property costs (152,404 )

(152,011 ) Net cash used in investing activities

(202,944 ) (201,306 )

Cash flows provided

by (used in) financing activities Payments on capital lease

obligations (4,000 ) (7,927 ) Proceeds from debt obligations

2,500,000 — Payment of debt obligations (842,699 ) (5,000,000 )

Proceeds from the exercise of options and warrants 799,397

35,556 Net cash provided by (used in)

financing activities 2,452,698 (4,972,371 )

Net change in cash 1,923,426 (9,865,104 ) Cash and

cash equivalents—beginning of period 5,228,802

15,518,960 Cash and cash equivalents—end of period $

7,152,228 $ 5,653,856

Luna Innovations Incorporated

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA

Three Months Ended Nine Months Ended

September 30,

September 30, 2010 2009 2010

2009 (unaudited) (unaudited)

Net loss $ (423,514 ) $ (2,043,225 ) $ (2,237,688 ) $

(45,338,572 ) Interest 124,756 124,208 352,282 422,702 Taxes

1,817

—

1,817 600,000 Depreciation and amortization 311,652 361,365 953,630

1,504,211 Impairment of intangible assets

—

—

—

1,310,598 EBITDA 14,711 (1,557,652 ) (929,959

) (41,501,061 ) Stock-based compensation 853,009 809,925

2,616,024 2,378,968 Warrant expense 27,667

—

149,850

—

Adjusted EBITDA 895,387 (747,727 ) 1,835,915

(39,122,093 ) Litigation reserve

—

—

—

36,303,643

Fees associated with litigation and

reorganization

53,597 1,556,952 284,193

4,155,008 Adjusted EBITDA less litigation and

reorganization-related items $ 948,984 $ 809,225 $

2,120,108 $ 1,336,558

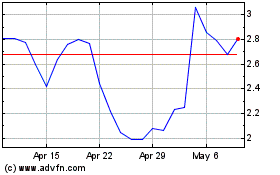

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Apr 2024 to May 2024

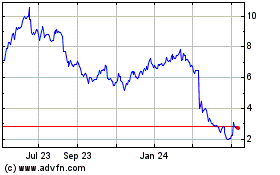

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From May 2023 to May 2024