- Record Q2 Revenue of $236 million

(22% increase over prior year)

- Record Non-GAAP Q2 Earnings Per

Share

- GAAP of $0.71

- Non-GAAP of $0.78

- Free Cash Flow of $35

million

OSI Systems, Inc. (NASDAQ: OSIS) today announced financial

results for the second fiscal quarter ended December 31, 2013.

“We are pleased to announce strong second quarter results. We

achieved record sales, as each of our three divisions reported

double digit sales growth over the prior year, resulting in overall

growth of 22%. In addition, we reported record year-over-year

non-GAAP earnings for the 18th straight quarter along with

significant free cash flow,” said Deepak Chopra, OSI Systems’

Chairman and CEO.

The Company reported revenues of $236 million for the second

quarter of fiscal 2014, an increase of 22% as compared to the same

period a year ago. Net income for the second quarter of fiscal 2014

was $14.6 million, or $0.71 per diluted share, compared to net

income of $12.4 million, or $0.60 per diluted share, for the second

quarter of fiscal 2013. Excluding the impact of impairment,

restructuring and other charges, net income for the second quarter

of fiscal 2014 would have been $16.1 million, or $0.78 per diluted

share, compared to net income of $14.4 million, or $0.70 per

diluted share for the comparable quarter of the prior year.

For the six months ended December 31, 2013, the Company reported

revenues of $443 million, an increase of 18% as compared to the

same period a year ago. Net income in this period was $21.0

million, or $1.02 per diluted share, compared to net income of

$18.8 million, or $0.91 per diluted share, in the same period a

year ago. Excluding the impact of impairment, restructuring and

other charges, net income for the six months ended December 31,

2013 would have been $25.5 million, or $1.24 per diluted share,

compared to net income of $20.7 million, or $1.01 per diluted

share, for the comparable period in the prior year.

As of December 31, 2013, the Company’s backlog was approximately

$0.9 billion. During the second fiscal quarter, the Company

generated cash flow from operations of $69 million and capital

expenditures totaled $34 million.

Mr. Chopra continued, “During the second quarter, our Security

Division generated both record sales and profits as sales grew by

16% over the prior year and operating income, excluding the impact

of impairment, restructuring and other charges, increased by 49%.

The excellent performance of our turnkey operations were a major

contributor to our top line growth and increased operating

margins.”

Mr. Chopra concluded, “We are also pleased with the performance

of our Healthcare Division as sales grew by 12% over the prior year

while operating income increased by 33% over the same period. This

double-digit sales growth was encouraging and we remain optimistic

about our new product offerings.”

Fiscal Year 2014 Outlook

The Company is raising its sales guidance for fiscal 2014 to

$890 million - $920 million, representing an 11% to 15% increase

over fiscal 2013. In addition, the Company is updating its fiscal

2014 earnings guidance and expects earnings per diluted share to

increase at a rate of 12% - 23% to between $3.10 to $3.39,

excluding the impact of impairment, restructuring and other

charges, and the impact of certain tax elections. However, actual

sales and non-GAAP diluted EPS could vary from this guidance due to

the risks and uncertainties applicable to our business and industry

including the timing of certain awards and the outcome of the

issues with the Transportation Security Administration.

Non-GAAP Figures

Discussion of adjustments to arrive at non-GAAP figures for the

three and six months ended December 31, 2013 and 2012 is provided

to allow for the comparison of underlying earnings, net of

impairment, restructuring and other non-recurring charges and their

related tax benefit, thus providing additional insight into the

on-going operations of the Company. Non-GAAP financial measures

should not be considered a substitute for, or superior to, measures

of financial performance prepared in accordance with GAAP. We

believe that these non-GAAP financial measures provide meaningful

supplemental information regarding the Company’s results primarily

because they exclude amounts that we do not view as reflective of

ongoing operating results when planning and forecasting and when

assessing the performance of the business. We believe that our

non-GAAP financial measures also facilitate the comparison of

results for current periods and guidance for future periods with

results for past periods. Please see the reconciliation of GAAP to

non-GAAP net income and earnings per share at the end of this

release.

Conference Call Information

OSI Systems, Inc. will host a conference call and simultaneous

webcast over the Internet beginning at 9:00am PT (12:00pm ET),

today to discuss its results for the second quarter of fiscal 2014.

To listen, please log on to the Company’s website at

www.osi-systems.com and follow the link in the Investor Relations

section. A replay of the webcast will be available shortly after

the conclusion of the conference call until February 11, 2014. The

replay can either be accessed through the Company’s website,

www.osi-systems.com, or via telephonic replay by calling

888-286-8010 and entering the conference call identification number

‘56517283’ when prompted for the replay code.

About OSI Systems, Inc.

OSI Systems, Inc. is a vertically integrated designer and

manufacturer of specialized electronic systems and components for

critical applications, and provider of security screening services.

The Company sells its products in diversified markets, including

homeland security, healthcare, defense and aerospace. The Company

has more than 35 years of experience in electronics engineering and

manufacturing and maintains offices and production facilities in

more than a dozen countries. It implements a strategy of expansion

by leveraging its electronics and contract manufacturing

capabilities into selective end product markets through organic

growth and acquisitions. For more information on OSI Systems, Inc.

or any of its subsidiary companies, visit www.osi-systems.com. News

Filter: OSIS-E

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to the Company’s current

expectations, beliefs, projections and similar expressions

concerning matters that are not historical facts and are not

guarantees of future performance. Forward-looking statements

involve uncertainties, risks, assumptions and contingencies, many

of which are outside the Company’s control and which may cause

actual results to differ materially from those described in or

implied by any forward-looking statement. Such statements include,

but are not limited to, information provided regarding expected

revenues and earnings in fiscal 2014. For example, the Company

could be exposed to a variety of negative consequences as a result

of one or more enforcement actions in respect of the matters that

are the subject of some or all of the Company’s ongoing

investigations and compliance review, including contract and

regulatory compliance matters with the U.S. Government, and such

actions, if brought, may result in judgments, settlements, fines,

injunctions, debarment and/or penalties, which could have a

material and adverse impact on the Company's business, financial

condition and results of operation. For a further discussion of

these and other factors that could cause the Company’s future

results to differ materially from any forward-looking statements,

see the section entitled “Risk Factors” in the Company’s Annual

Report on Form 10-K for the fiscal year ended June 30, 2013 and

other risks described in documents subsequently filed by the

Company from time to time with the Securities and Exchange

Commission. All forward-looking statements are based on currently

available information and speak only as of the date on which they

are made. The Company assumes no obligation to update any

forward-looking statement made in this press release that becomes

untrue because of subsequent events, new information or otherwise,

except to the extent it is required to do so in connection with its

ongoing requirements under federal securities laws.

OSI SYSTEMS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

data)

(Unaudited)

For the Three Months Ended

December 31,

For the Six Months Ended

December 31,

2012 2013

2012 2013

Revenues $ 194,049 $ 236,408 $ 375,743 $ 442,682 Cost of goods sold

123,961 155,469 244,300 293,797 Gross

profit 70,088 80,939 131,443 148,885 Operating expenses: Selling,

general and administrative 36,829 45,556 76,754 87,770 Research and

development 11,858 11,175 23,174 22,195 Impairment, restructuring

and other charges 2,723 2,179 2,723

6,418 Total operating expenses 51,410 58,910

102,651 116,383 Income from operations 18,678 22,029 28,792

32,502 Interest expense and other, net 1,385 1,503

2,482 2,973 Income before income taxes 17,293 20,526

26,310 29,529 Provision for income taxes 4,872 5,953

7,550 8,562 Net income $ 12,421 $ 14,573 $ 18,760 $

20,967 Diluted earnings per share $ 0.60 $ 0.71 $ 0.91 $

1.02 Weighted average shares outstanding - diluted 20,609

20,589 20,589 20,604

CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

June 30, 2013 December 31, 2013 Assets Cash

and cash equivalents $ 34,697 $ 39,899 Accounts receivable, net

206,817 164,006 Inventories 206,213 219,998 Other current assets

78,972 82,246 Total current assets 526,699 506,149

Non-current assets 393,097 429,121 Total Assets $

919,796 $ 935,270

Liabilities and Stockholders'

Equity Bank lines of credit $ 59,000 $ 60,000 Current portion

of long-term debt 1,797 2,971 Accounts payable and accrued expenses

123,660 95,926 Deferred revenues 18,131 46,539 Other current

liabilities 78,825 80,847 Total current liabilities

281,413 286,283 Long-term debt 10,673 11,724 Advances from

customers 75,000 62,500 Other long-term liabilities 74,259

81,507 Total liabilities 441,345 442,014 Total stockholders’

equity 478,451 493,256 Total Liabilities and Equity $

919,796 $ 935,270

SEGMENT INFORMATION

(in thousands)

(unaudited)

Three Months EndedDecember

31,

Six Months EndedDecember

31,

2012

2013 2012

2013 Revenues – by Segment

Group: Security Group $ 91,863 $ 106,588 $ 174,779 $ 203,741

Healthcare Group 56,114 63,106 107,695 108,893 Optoelectronics and

Manufacturing Group including intersegment revenues 57,277 76,358

114,424 147,669 Intersegment revenues elimination (11,205 )

(9,644 ) (21,155 ) (17,621 ) Total $ 194,049

$ 236,408 $ 375,743 $ 442,682

Operating income (loss) – by Segment Group: Security Group

(1) $ 8,607 $ 15,149 $ 13,072 $ 26,771 Healthcare Group (2) 6,915

9,226 10,796 7,228 Optoelectronics and Manufacturing Group (3)

5,457 2,121 10,290 6,886 Corporate (2,438 ) (4,355 ) (5,687 )

(8,400 ) Eliminations 137 (112 ) 321

17 Total $ 18,678 $ 22,029 $

28,792 $ 32,502 (1) Includes

impairment, restructuring and other charges of $1.7 million and

$3.3 million for the three and six months ended December 31, 2013,

respectively, and $2.7 million for the three and six months ended

December 31, 2012. (2) Includes impairment, restructuring

and other charges of $2.0 million for the six months ended December

31, 2013. (3) Includes impairment, restructuring and other

charges of $0.5 million and $1.1 million for the three and six

months ended December 31, 2013, respectively.

Reconciliation of GAAP to

Non-GAAP

(in thousands, except earnings per

share data)

(Unaudited)

For the Three Months

Ended December 31, For the Six Months Ended December 31,

2012 2013 2012

2013 Net income

EPS Net income EPS Net

income EPS Net income

EPS GAAP basis $ 12,421 $ 0.60 $ 14,573

$ 0.71 $ 18,760 $ 0.91 $ 20,967 $ 1.02 Impairment,

restructuring and other charges, net of tax 1,956 0.10 1,547 0.07

1,956 0.10 4,557 0.22

Non-GAAP basis $ 14,377 $ 0.70 $ 16,120 $ 0.78 $

20,716 $ 1.01 $ 25,524 $ 1.24

OSI Systems, Inc.Ajay VashishatVice President, Business

Development310-349-2237avashishat@osi-systems.com

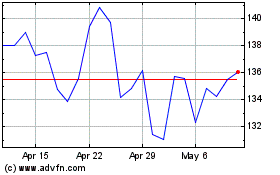

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From May 2024 to Jun 2024

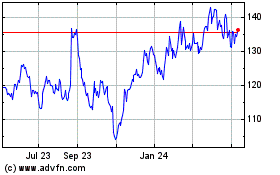

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2023 to Jun 2024