StarTek, Inc. (NYSE:SRT) today announced its financial results

for the first quarter ended March 31, 2012. The Company reported

first quarter 2012 revenue of $50.9 million and adjusted EBITDA of

$1.2 million. As of March 31, 2012, the Company had approximately

$10.5 million in cash and cash equivalents and no debt.

First Quarter 2012 Financial Results

First quarter 2012 revenue decreased 0.6% compared to the fourth

quarter of 2011. Revenue offshore increased 18% in the first

quarter of 2012, compared to the fourth quarter of 2011. The

increase was due to revenue growth of $2.3 million, or 13%, in Asia

Pacific (the Philippines) and $1.4 million, or 54%, in Latin

America. Domestic revenue decreased by approximately $3.8 million

due to the ramp-down of business in our Decatur and Jonesboro

locations and the site closure in Collinsville.

Gross margin increased to 10.5% in the first quarter of 2012

from 7.7% in the fourth quarter of 2011. The improvement was due to

continued growth in Asia Pacific and Latin America. Gross margin in

Asia Pacific increased from 22% to 25%. Gross profit in Latin

America increased by $0.8 million in the first quarter of 2012 from

the fourth quarter 2011, as new business continued ramping in the

Company’s Costa Rica and Honduras facilities. Domestic gross margin

fell slightly from 4% to 3% due to the ramp-down of business

discussed above.

SG&A expense for the quarter totaled $8.3 million, compared

to $9.3 million in the fourth quarter of 2011. The decrease was

driven primarily by lower IT related and support staff costs.

The Company reported first quarter 2012 adjusted EBITDA of $1.2

million and an operating loss before impairment and restructuring

charges of $3.0 million, compared to a fourth quarter 2011 adjusted

EBITDA of negative $1.2 million and an operating loss before

impairment and restructuring charges of $5.4 million. The Company

had a net loss of $6.1 million, or $0.40 per share, during the

first quarter of 2012. The first quarter 2012 net loss compares to

a net loss of $7.5 million, or $0.49 per share, in the fourth

quarter of 2011.

Liquidity and Capital Resources

As of March 31, 2012, the Company had approximately $10.5

million in cash and cash equivalents and no debt, compared to $9.7

million and no debt at December 31, 2011. The Company had

approximately $1.2 million and $1.5 million in capital expenditures

during the quarters ending March 31, 2012 and December 31, 2011,

respectively.

Recent 2012 Operational Highlights

- Excluding its two largest clients, the

Company experienced revenue growth of 52%, compared to the first

quarter of 2011 and 21% compared to the fourth quarter of

2011;

- Signed a new expanded $20 million

credit facility with Wells Fargo Bank;

- Continued its sales momentum, signing

three new agreements with an expected annual contract value of $8.5

million;

- Continued growth in the Philippines,

increasing the quarterly number of full-time equivalent agents by

7% from the fourth quarter of 2011;

- Continued growth in Latin America,

increasing the quarterly number of full-time equivalent agents by

39% from the fourth quarter of 2011;

- Added a new SVP, Sales and Marketing;

and

- Announced the relocation of its

corporate headquarters, which will result in significant

savings.

“I am very pleased with the progress made strengthening our

company foundation during the quarter,” said Chad Carlson,

President and Chief Executive Officer. “We grew our client revenues

(excluding our largest two clients), greatly improved DSO through

better process management and we are on track with our roadmap

initiatives, which will bring further G&A savings into second

half of this year. The continuation of successful new program

launches in the Philippines and Latin America resulted in

significant margin improvement in those regions,” said Chad

Carlson. “In addition, I am excited about the addition of Joe

Duryea as our SVP, Sales and Marketing, whom I believe has proven

experience at attracting and leading successful business

development teams and launching new verticals.”

Effective January 1, 2012, the Company realigned its segment

reporting into three distinct operating segments: Domestic (results

from U.S. and Canadian sites), Asia Pacific (results from

Philippine sites) and Latin America (results from Costa Rican and

Honduran sites). In addition, during the quarter the Company began

presenting certain human resource, recruiting and facility costs

within cost of services, rather than SG&A, to provide enhanced

clarity on the Company’s operations and cost structure and to drive

segment efficiencies and accountability. First quarter of 2011

financial information in this release has been adjusted to provide

comparability.

For additional information on revenue, margin and operating

metrics, please refer to the Financial Scorecard posted on the

Investor Relations section of the Company’s website

(investor.startek.com). Further details regarding the earnings call

are described below.

Conference Call and Webcast Details

The Company will host a conference call today, May 10, 2012, at

9:00 a.m. MDT (11:00 a.m. EDT) to discuss its first quarter 2012

financial results. To participate in the teleconference, please

call toll-free 800-322-5044 (or 617-614-4927 for international

callers) and enter “70960167”. You may also listen to the

teleconference live via the Company’s website at www.startek.com.

For those that cannot access the live broadcast, a replay will be

available on the Company’s website at www.startek.com.

About StarTek

StarTek, Inc. is a global provider of business process

outsourcing services with over 9,000 employees, whom we refer to as

Brand Warriors, that have been committed to making a positive

impact on our clients’ business results for over 25 years. Our

company mission is to enable and empower our employees to advance

our clients’ brands every day to bring value to our stakeholders.

We accomplish this by aligning with our clients’ business

objectives resulting in a trusted partnership. The StarTek

Advantage System provides the expertise, best practices and thought

leadership to move our clients’ programs toward specific,

measurable goals and improve year over year performance. The

foundation for this is the StarTek Operating Platform, which

includes execution and innovation in every area of the core

operating process. Examples of this process would include:

onboarding our employees, enabling our employees, executing against

goals, evaluating performance, improving performance and enhancing

our client’s business. StarTek has proven results for the multiple

services we provide including sales, order management and

provisioning, customer care, technical support, receivables

management, and retention programs. We manage programs using a

variety of multi-channel customer interaction capabilities

including voice, chat, email, IVR and back-office support. StarTek

has delivery centers in the U.S., Philippines, Canada, Costa Rica,

Honduras and through its StarTek@Home workforce. For more

information, visit www.StarTek.com or call +1303.262.4500.

Forward-Looking Statements

The matters regarding the future discussed in this news release

include forward-looking statements as defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are intended to be identified in this document by the

words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “objective,” “outlook,” “plan,” “project,” “possible,”

“potential,” “should” and similar expressions. As described below,

such statements are subject to a number of risks and uncertainties

that could cause StarTek's actual results to differ materially from

those expressed or implied by any such forward-looking statements.

These factors include, but are not limited to, risks relating to

our reliance on two significant customers, consolidation by our

clients, the concentration of our business in the

telecommunications industry, pricing pressure, maximization of

capacity utilization, lack of success of our clients’ products and

services, consolidation of vendors by our clients, interruptions to

the Company’s business due to geopolitical conditions and/or

natural disasters, foreign currency exchange risk, lack of minimum

purchase requirements in our contracts, ability to hire and retain

qualified employees, the timely development of new products or

services, failure to implement new technological advancements,

increases in labor costs, lack of wide geographic diversity,

continuing unfavorable economic conditions, our ability to

effectively manage growth, increases in the cost of telephone and

data services, unauthorized disclosure of confidential client or

client customer information, risks inherent in the operation of

business outside of North America, ability of our largest

stockholder to affect decisions, stock price volatility, variation

in quarterly operating results and inability to renew or replace

sources of capital funding. Readers are encouraged to review Item

1A. - Risk Factors and all other disclosures appearing in the

Company's Form 10-K for the year ended December 31, 2011 filed with

the Securities and Exchange Commission, for further information on

risks and uncertainties that could affect StarTek’s business,

financial condition and results of operation.

STARTEK, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in thousands, except per share

data)

(Unaudited)

Three Months Ended March 31, 2012

2011 Revenue $ 50,859 $ 59,510 Cost of services

45,522 53,804 Gross profit 5,337 5,706

Selling, general and administrative expenses 8,325 7,999 Impairment

losses and restructuring charges 3,086 -

Operating loss (6,074 ) (2,293 ) Net interest and other

income 103 18 Loss before income taxes

(5,971 ) (2,275 ) Income tax expense (161 ) (279 )

Net loss $ (6,132 ) $ (2,554 ) Net loss per share

Basic $ (0.40 ) $ (0.17 ) Diluted $ (0.40 ) $ (0.17 )

Weighted average shares outstanding (in thousands) Basic 15,189

15,014 Diluted 15,189 15,014

STARTEK, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

& STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

As of March 31, 2012

December 31, 2011

ASSETS Current assets: Cash, cash equivalents and

investments $ 10,471 $ 9,719 Trade accounts receivable 36,692

37,736 Other current assets 8,974 8,872 Total current

assets 56,137 56,327 Property, plant and equipment, net

33,512 38,475 Other assets 6,426 6,631 Total assets $

96,075 $ 101,433

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities $ 23,927 $ 23,485 Other liabilities

3,146 3,586 Total liabilities 27,073 27,071

Stockholders' equity 69,002 74,362 Total liabilities

and stockholders' equity $ 96,075 $ 101,433

Three Months Ended March 31,

2012 2011 Operating Activities Net loss

$ (6,132 ) $ (2,554 ) Adjustments to reconcile net loss to net cash

provided by operating activities: Depreciation 3,810 3,986

Impairment losses 3,086 - Non-cash compensation cost 334 449

Changes in operating assets & liabilities and other, net

691 1,498 Net cash provided by operating

activities 1,789 3,379

Investing

Activities Purchases of property, plant and equipment (1,162 )

(1,928 ) Proceeds from note receivable 165 165

Net cash used in investing activities (997 )

(1,763 )

Financing Activities Other financing, net 4

139 Net cash provided by financing activities

4 139 Effect of exchange rate changes on cash (44 )

(115 ) Net increase in cash and cash equivalents 752 1,640 Cash and

cash equivalents at beginning of period 9,719

18,740 Cash and cash equivalents at end of period $ 10,471

$ 20,380

STARTEK, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (Dollars in

thousands)(Unaudited)

The information presented in this press release reports 1)

adjusted EBITDA, which the Company defines as net income (loss)

plus income tax expense, interest income (expense), impairment and

restructuring charges, depreciation expense and stock compensation

expense and 2) operating loss before impairment and restructuring

charges. The following tables provide reconciliation of 1) adjusted

EBIDTA to net loss calculated in accordance with GAAP and 2)

operating loss before impairment and restructuring charges to

operating loss calculated in accordance with GAAP. This non-GAAP

information should not be construed as an alternative to the

reported results determined in accordance with generally accepted

accounting principles in the United States (GAAP). It is provided

solely to assist in an investor’s understanding of these items on

the comparability of the Company’s operations. A reconciliation of

the GAAP amounts to the non-GAAP amounts is shown below.

Adjusted EBITDA:

Three Months Ended March 31, 2012

December 31, 2011 Net loss $ (6,132 ) $ (7,461

) Income tax expense 161 137 Interest income (17 ) (25 ) Impairment

losses & restructuring charges 3,086 1,933 Depreciation expense

3,810 3,802 Stock compensation expense 334 408

Adjusted EBITDA $ 1,242 $ (1,206 )

Operating Loss Before Impairment and

Restructuring Charges:

Three Months Ended March 31, 2012

December 31, 2011 Operating loss $ (6,074 ) $

(7,346 ) Impairment & restructuring charges 3,086

1,933 Operating loss before impairment and

restructuring charges $ (2,988 ) $ (5,413 )

StarTek (NYSE:SRT)

Historical Stock Chart

From May 2024 to Jun 2024

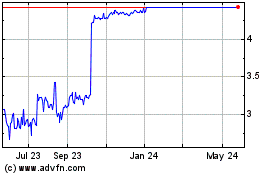

StarTek (NYSE:SRT)

Historical Stock Chart

From Jun 2023 to Jun 2024