American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the first quarter ended March 31, 2011. ARL announced today that

the Company reported net loss applicable to common shares of $9.8

million or $0.86 per diluted earnings per share, as compared to a

net loss applicable to common shares of $12.5 million or $1.09 per

diluted earnings per share for the same period ended 2010.

Rental and other property revenues were $38.7 million for the

three months ended March 31, 2011. This represents a decrease of

$1.5 million, as compared to the prior period revenues of $40.2

million. This change, by segment, is a decrease in the commercial

portfolio of $2.2 million, a decrease in the hotel portfolio of

$0.3 million, and a decrease in the land and other portfolios of

$0.1 million, offset by an increase in the apartment portfolio of

$1.1 million. Within the apartment portfolio, there was an increase

of $0.5 million due to the developed properties in the lease-up

phase and an increase of $0.6 million in the same property

portfolio. Within the commercial and hotel portfolios, the decrease

is attributable to increased vacancies due to the current state of

the economy. We have directed our efforts to apartment development

and put some additional land projects on hold until the economic

conditions turn around. We are continuing to market our properties

aggressively to attract new tenants and strive for continuous

improvement of our properties in order to maintain our existing

tenants.

Property operating expenses were $23.3 million for the three

months ended March 31, 2011. This represents a decrease of $1.3

million, as compared to the prior period operating expenses of

$24.6 million. This change, by segment, is a decrease in our

commercial properties of $0.3 million, a decrease in our apartment

portfolio of $0.6 million, a decrease in our hotels of $0.1 million

and a decrease in our in our land and other segments of $0.3

million. The Company has taken great strides to reduce costs and

increase efficiency for repairs and maintenance of the

properties.

Mortgage and loan interest expense was $17.9 million for the

three months ended March 31, 2011. This represents a decrease of

$1.4 million, as compared to the prior period interest expense of

$19.3 million. This change, by segment, is a decrease in our

commercial properties of $0.5 million, a decrease in our apartment

portfolio of $0.4 million, a decrease in our hotels of $0.1 million

and a decrease in our other portfolios of $0.7 million, offset by

an increase in our land portfolio of $0.3 million. The commercial

portfolio experienced a reduction in interest expense due to a

matured loan that is being negotiated at a lower interest rate. The

decrease in the apartment portfolio is primarily due to loans that

were refinanced in 2010 at a lower interest rate. The decrease in

the other portfolio is due to a decrease in interest expense on

loan amounts due to our advisor.

Provision for impairment was $6.1 million for the three months

ended March 31, 2011. Impairment was recorded as an additional loss

of $0.9 million in the commercial properties we currently hold and

$5.2 million in the apartments we currently hold.

Gain on land sales increased for the three months ended March

31, 2011 as compared to the prior period. In the current period, we

sold 230.45 acres of land in 12 separate transactions for an

aggregate sales price of $50.1 million and recorded a gain of $5.3

million. In the prior period, we sold 0.275 acres of land in one

transaction for an sales price of $8,984 and recorded a gain of

$6,470.

Included in discontinued operations are a total of two and 17

properties as of 2011 and 2010, respectively. The gain on sale of

the properties is also included in discontinued operations for

those years.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

hotels, shopping centers and developed and undeveloped land. The

Company invests in real estate through direct equity ownership and

partnerships nationwide. For more information, visit the Company’s

website at www.amrealtytrust.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited) For the Three

Months Ended March 31, 2011

2010 (dollars in thousands, except share

and per share amounts) Revenues: Rental and other

property revenues (including $372 and $714 for the three months

ended 2011 and 2010 respectively from affiliates and related

parties) $ 38,741 $ 40,242

Expenses: Property

operating expenses (including $534 and $700 for the three months

ended 2011 and 2010 respectively from affiliates and related

parties) 23,255 24,553 Depreciation and amortization 7,173 6,870

General and administrative (including $1,187 and $1,226 for the

three months ended 2011 and 2010 respectively from affiliates and

related parties) 3,547 2,587 Provision on impairment of notes

receivable and real estate assets 6,059 - Advisory fee to affiliate

3,522 4,053 Total operating expenses

43,556 38,063 Operating income (loss)

(4,815 ) 2,179

Other income (expense): Interest

income (including $466 and $1,186 for the three months ended 2011

and 2010 respectively from affiliates and related parties) 668

1,502 Other income 1,467 867 Mortgage and loan interest (including

$306 and $845 for the three months ended 2011 and 2010 respectively

from affiliates and related parties) (17,862 ) (19,254 ) Earnings

from unconsolidated subsidiaries and investees (95 ) (22 ) Gain on

foreign currency translation - (673 ) Litigation settlement

- - Total other expenses (15,822 )

(17,580 ) Loss before gain on land sales, non-controlling

interest, and taxes (20,637 ) (15,401 ) Gain on land sales

5,344 6 Loss from continuing operations before

tax (15,293 ) (15,395 ) Income tax benefit 1,372

1,080 Net loss from continuing operations (13,921 )

(14,315 ) Discontinued operations: Income (loss) from discontinued

operations (217 ) 1,274 Gain on sale of real estate from

discontinued operations 4,137 - Income tax expense from

discontinued operations (1,372 ) (446 ) Net income

from discontinued operations 2,548 828 Net loss (11,373 ) (13,487 )

Net loss attributable to non-controlling interests 2,170

1,577 Net loss attributable to American Realty

Investors, Inc. (9,203 ) (11,910 ) Preferred dividend requirement

(617 ) (622 ) Net loss applicable to common shares $

(9,820 ) $ (12,532 )

Earnings per share - basic Loss

from continuing operations $ (1.08 ) $ (1.16 ) Income from

discontinued operations 0.22 0.07 Net

loss applicable to common shares $ (0.85 ) $ (1.09 )

Earnings per share - diluted Loss from continuing operations

$ (1.08 ) $ (1.16 ) Income from discontinued operations 0.22

0.07 Net loss applicable to common shares $

(0.85 ) $ (1.09 ) Weighted average common share used in

computing earnings per share 11,493,115 11,514,038 Weighted average

common share used in computing diluted earnings per share

11,493,115 11,514,038

Amounts attributable to

American Realty Investors, Inc. Loss from continuing operations

$ (11,751 ) $ (12,738 ) Income from discontinued operations

2,548 828 Net loss $ (9,203 ) $ (11,910 )

The accompanying notes are an integral part of these

consolidated financial statements.

AMERICAN

REALTY INVESTORS, INC. CONSOLIDATED BALANCE SHEETS

(unaudited) March 31, December 31,

2011 2010 (dollars in

thousands, except share and par value amounts) Assets

Real estate, at cost $ 1,047,080 $ 1,170,214 Real estate subject to

sales contracts at cost, net of depreciation ($106,728 for 2011 and

$75,639 for 2010) 354,301 295,921 Less accumulated depreciation

(107,967 ) (133,550 ) Total real estate 1,293,414

1,332,585 Notes and interest receivable Performing (including

$82,692 in 2011 and $89,982 in 2010 from affiliates and related

parties) 91,178 99,839 Non-performing 3,132 3,123 Less allowance

for estimated losses (including $9,926 in 2011 and 2010 from

affiliates and related parties) (14,348 ) (14,348 )

Total notes and interest receivable 79,962 88,614 Cash and cash

equivalents 8,393 12,649 Investments in unconsolidated subsidiaries

and investees 12,152 12,491 Affiliate receivable 4,048 - Other

assets (including $160 in 2011 and $164 in 2010 from affiliates and

related parties) 97,664 110,936 Total

assets $ 1,495,633 $ 1,557,275

Liabilities

and Shareholders’ Equity Liabilities: Notes and interest

payable $ 815,567 $ 913,134 Notes related to subject to sales

contracts 382,566 315,547 Stock-secured notes payable and margin

debt 25,598 23,100 Affiliate payables - 12,219 Deferred revenue

(including $98,473 in 2011 and $100,212 in 2010 from sales to

related parties) 102,787 104,534 Accounts payable and other

liabilities (including $1,783 in 2011 and $1,539 in 2010 to

affiliates and related parties) 79,278 88,506

1,405,796 1,457,040 Shareholders’ equity: Preferred

stock, $2.00 par value, authorized 15,000,000 shares, issued and

outstanding Series A, 3,353,954 shares in 2011 and $3,389,546 in

2010 (liquidation preference $10 per share), including 900,000

shares in 2011 and 2010 held by subsidiaries 4,908 4,979 Common

stock, $.01 par value, authorized 100,000,000 shares; issued

11,941,174 and 11,874,138, and outstanding 11,525,389 and

11,466,853 shares in 2011 and in 2010 115 114 Treasury stock at

cost; 415,785 and 407,285 shares in 2011 and 2010 and 276,972

shares held by TCI (consolidated) as of 2011 and 2010 (6,395 )

(6,333 ) Paid-in capital 90,407 88,620 Retained earnings (57,596 )

(47,776 ) Accumulated other comprehensive income (loss) (786

) (786 ) Total American Realty Investors, Inc. shareholders'

equity 30,653 38,818 Non-controlling

interest 59,184 61,417 Total equity

89,837 100,235 Total liabilities and

equity $ 1,495,633 $ 1,557,275 The

accompanying notes are an integral part of these consolidated

financial statements.

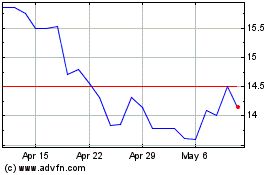

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2024 to May 2024

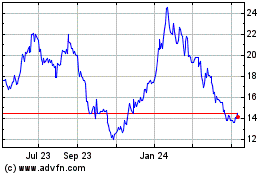

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From May 2023 to May 2024