TIDMUSG

RNS Number : 1989C

Ultimate Sports Group PLC

27 September 2018

Ultimate Sports Group PLC

("USG" or the "Company")

27 September 2017

Interim Results

Ultimate Sports Group Plc, the AIM listed investment vehicle, is

pleased to announce its interim results for six months ended 30

June 2018.

CHAIRMAN'S STATEMENT AND CHIEF EXECUTIVE'S REVIEW

For the six months ended 30 June 2018 we are reporting a total

comprehensive loss of GBP45,552 (30 June 2017: loss GBP53,375).

USG's cash balances as at 30 June 2018 were GBP479,722 (30 June

2017: GBP208,022). The directors are not recommending the payment

of a dividend.

FUNDRAISE

As reported comprehensively in the Circular to Shareholders

issued in February 2018, the Company raised GBP537,500 (before

legal and other professional expenses) by the issue of 10,750,000

new shares at 5p per share following approval obtained from

shareholders at the General Meeting in March 2018

SUBSTANTIAL SHAREHOLDERS

The Company welcomes the involvement of Mr. Richard Bernstein as

a strategic shareholder following on from fundraising concluded in

February 2018. In addition, the company entered into an agreement

with Mr. Bernstein pursuant to which Mr. Bernstein will seek to

introduce the Company to potential investment or acquisition

opportunities. To date he has carried out and continues to

undertake due diligence on potential introductions at his own

expense.

PANTHEON LEISURE PLC ("PANTHEON")

USG holds 85.87% of the issued share capital of Pantheon which

in turn owns 100% of the operating business of Pantheon's Sport and

Leisure division. Pantheon's sport and leisure division is the

owner of Sport in Schools Limited also known as The Elms Sport in

Schools ("ESS").

Pantheon as a group made a profit of GBP43,913 for the six

months ended 30 June 2018 (30 June 2017: GBP33,057 (excluding the

non - recurring net proceeds on the sale of the business of

Football Partners Ltd).

SPORT IN SCHOOLS LIMITED

On a turnover of GBP800,705 (30 June 2017 - GBP739,249), ESS has

contributed a divisional profit of GBP80,059 (30 June 2017:

GBP70,644).

CORPORATE GOVERNANCE CODE

In accordance with changes to AIM Rules regarding corporate

governance our website will be updated to reflect our compliance

with (and explains any departures from) the standard set by the

Quoted Companies Alliance.

PROSPECTS

As outlined in the Report and Accounts for the year ended 30

December 2017 issued in June 2018 we continue to pursue, from a

firm financial base, a strategy of developing Sport in Schools

Limited and to carefully appraise any and all acquisition

opportunities, including those proposed by Mr. Bernstein.

R.L. Owen

G.M. Simmonds 26 September 2018

Consolidated statement of comprehensive income for the six

months ended 30 June 2018

Unaudited Unaudited Audited

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2018 June 2017 2017

GBP GBP GBP

Continuing and discontinued

activities:

Revenues 800,836 839,599 1,369,193

Cost of revenues (385,274) (391,624) (793,310)

415,562 447,975 599,883

----------- ----------- -------------

Administrative expenses (461,285) (467,028) (833,533)

Exceptional item and non-recurring

costs - (65,707) (563,325)

(461,285) (532,735) (1,396,858)

Operating loss (45,723) (84,760) (796,975)

Finance income 171 - -

Finance costs - (1,986) (3,714)

Other gains 20,497

Loss before taxation (45,552) (86,746) (780,192)

Taxation - 20,144 17,572

-----------

Loss after taxation from continuing

activities (45,552) (66,602) (762,620)

Profit from discontinued activities - - 53,567

----------- ----------- -------------

(45,552) (66,602) (709,053)

----------- ----------- -------------

Attributable to:

----------- ----------- -------------

Owners of the company (51,755) (81,046) (709,470)

----------- ----------- -------------

Non- controlling interests 6,203 14,444 417

----------- ----------- -------------

(45,552) (66,602) (709,053)

----------- ----------- -------------

Other comprehensive (loss)/income

----------- ----------- -------------

Net gain/(loss) arising on

revaluation of available-for-sale

investments - 16,130 (1,838)

----------- ----------- -------------

Tax relating to components

of other comprehensive income - (2,903) 331

----------- ----------- -------------

- 13,227 (1,507)

----------- ----------- -------------

Total comprehensive loss attributable

to:

----------- ----------- -------------

Owners of the company (51,755) (67,819) (710,977)

----------- ----------- -------------

Non- controlling interests 6,203 14,444 417

----------- ----------- -------------

(45,552) (53,375) (710,560)

----------- ----------- -------------

Diluted and undiluted total

comprehensive

----------- ----------- -------------

loss per share (0.0018)p (0.0032)p (0.0320p)

----------- ----------- -------------

Statement of financial position as at 30 June 2018

Unaudited Unaudited Audited

as at 30 as at 30 As at 31

June June December

2018 2017 2017

GBP GBP GBP

Non- current assets

Goodwill and patents 60,054 60,054 60,054

Plant and equipment 13,713 15,343 12,923

Social media website development costs - 491,432 -

------------ ------------

Total non-current assets 73,767 566,829 72,977

------------ ------------ ------------

Current assets

Available-for-sale investments - 42,128 -

Trade and other receivables 205,684 231,019 68,981

Cash and cash equivalents 479,722 208,022 129,611

------------ ------------ ------------

Total current assets 685,406 481,169 198,592

------------ ------------ ------------

Total assets 759,173 1,047,998 271,569

Current liabilities

Trade and other payables 218,397 253,196 173,661

Borrowings 1,000 38,500 2,000

------------ ------------ ------------

Total current liabilities 219,397 291,696 175,661

------------ ------------ ------------

Total liabilities 219,397 291,696 175,661

Net assets 539,776 756,302 95,908

============ ============

Equity

Share capital 2,388,664 2,281,164 2,281,164

Share premium 775,374 385,641 393,454

Merger reserve 325,584 325,584 325,584

Fair value reserve - 11,720 -

Retained earnings (2,892,550) (2,198,335) (2,840,795)

Equity attributable to owners of the

company 597,072 805,774 159,407

Non-controlling interest (57,296) (49,472) (63,499)

Total Equity 539,776 756,302 95,908

============ ============ ============

Consolidated statement of changes in equity

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2018 2017 2017

GBP GBP GBP

Total equity at the beginning

of period/year 95,908 578,767 578,767

Issue of shares 489,420 224,686 224,687

Revaluation gains/(losses)

on available-for sale investments - 16,130 1,838

Taxation on items taken

directly to equity - (2,903) (331)

Share based payments - 6,224 -

Loss for the period/year (45,552) (66,602) (709,053)

At end of period/year 539,776 756,302 95,908

=========== =========== =============

Consolidated statement of cash flows for the six months ended 30

June 2018

Six months Six months Year ended

ended ended 31 December

30 June 2018 30 June 2017 2017

GBP GBP GBP

Cash flow from all activities:

Loss before taxation from continuing

activities (45,552) (86,746) (780,192)

Profit before taxation from discontinued

activities - - 53,567

(45,552) (86,746) (726,625)

Adjustments for:

Depreciation and amortisation 3,557 47,709 546,937

Finance income (171) - -

Finance costs - 1,986 3,714

Share based payments - 6,224 -

Profit on sale of tangible assets - (30,865)

Other gains and losses - (103,097)

Operating cash flow before working

capital movements (42,166) (30,827) (309,936)

(Increase)/decrease in receivables (136,703) (133,317) 28,720

(Increase)/decrease in payables 44,736 30,649 (48,886)

Net cash absorbed by operations (134,133) (133,495) (330,102)

--------------

Taxation - 17,241 17,241

-------------- -------------- -------------

Cash flow from Investing activities

Property, plant and equipment acquired (4,347) (2,122) (9,820)

Intangible asset development costs - (16,300) (16,300)

Proceeds on sale of property, plant

and equipment - - 33,187

Proceeds on disposal of available

for sale investments - 48,334

Net proceeds on sale of business - 82,600

-------------- -------------- -------------

Net cash from/(used) in investing

activities (4,347) (18,422) 138,001

-------------- -------------- -------------

Financing activities

Proceeds from share issues 489,420 224,686 224,687

Finance income 171

Finance costs - (1,986) (3,714)

Repayment of borrowings (1,000) (9,439) (45,939)

Net cash from/(used) in financing

activities 488,591 213,261 175,034

-------------- -------------- -------------

Net increase/(decrease) in cash and

cash equivalents 350,111 78,585 174

Cash and cash equivalents and bank

overdraft at the beginning of the

period/year 129,611 129,437 129,437

Cash and cash equivalents at the

end of the period/year 479,722 208,022 129,611

============== ============== =============

Notes to the financial statements for the six months ended 30

June 2018

1. General information

Ultimate Sports Group plc (the "company") is a company domiciled

in England and its registered office address is 30 City Road,

London EC1Y 2AB. The condensed consolidated interim financial

statements of the company for the six months ended 30 June 2018

comprise the company and its subsidiaries (together referred to as

"the group").

The condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006.

The financial information for the year ended 31 December 2017

has been extracted from the statutory accounts. The auditors'

report on those statutory accounts was unqualified and did not

contain a statement under Section 434 of the Companies Act 2006. A

copy of those accounts has been filed with the Registrar of

Companies.

The group has presented its results in accordance with the

measurement principles set out in International Financial Reporting

Standards as adopted by the EU using the same accounting policies

and methods of computation as were used in the annual financial

statements for the year ended 31 December 2017. As permitted, the

interim report has been prepared in accordance with the AIM rules

for companies and is not compliant in all respects with IAS34

'Interim Financial Statements'.

The condensed consolidated interim financial statements do not

include all the information required for full annual financial

statements and therefore cannot be construed to be in full

compliance with IFRS.

The condensed consolidated interim financial statements were

approved by the board and authorised for issue on 26 September

2018.

2. Business segment analysis

Six months ended 30 June

2018

Discontinued Continuing

Sports and Sports and Social

Continuing activities leisure leisure media website Consolidated

Results from operations GBP GBP GBP GBP

Revenue - 800,705 131 800,836

=============== =========== =============== =============

Segment operating profit/(loss) 80,059 (20,079) 59,980

=========== ===============

Group operating expenses (105,703)

-------------

Operating loss (45,723)

Finance income 171

-------------

Loss before tax from continuing

activities (45,552)

Net revenue from discontinued - -

Activities

============== -------------

Loss before tax (45,552)

Taxation -

-------------

Operating profit/(loss)

after tax (45,552)

=============

Six months ended 30 June

2017 Discontinued Continuing

Sports and Sports and Social

leisure leisure media website Consolidated

Results from operations GBP GBP GBP GBP

Revenue 100,000 739,249 350 839,599

============= =========== =============== =============

Segment operating profit/(loss) 70,644 (78,020) (7,376)

=========== ===============

Group operating expenses (146,582)

-------------

Operating loss (153,958)

Finance costs net (1,986)

-------------

Loss before tax from continuing

activities (155,944)

Net Revenue from discontinued

Activities 69,198 69,198

============= -------------

(86,746)

Taxation 20,144

-------------

Loss after taxation from

all activities (66,602)

=============

Year Ended 31 December

2017 Discontinued Continuing

Sports and Sports and Social

leisure leisure media website Consolidated

Results from operations GBP GBP GBP GBP

Revenue - 1,366,710 483 1,369,193

============= =========== =============== =============

Segment operating (loss)/profit 28,255 (587,536) (559,281)

=========== ===============

Group operating expenses (237,694)

Operating loss (796,975)

Other gains and losses 20,497

Finance costs (3,714)

Loss before tax from continuing

activities (780,192)

Discontinued activities 53,567 53,567

============= -------------

(726,625)

Taxation 17,572

-------------

Loss after taxation from

all activities (709,053)

=============

3. Taxation

The tax charge in the accounts represents adjustments for

deferred tax arising from origination and reversal of timing

differences.

4. Basic and diluted loss per share

Comprehensive loss per share for the six month period ended 30

June 2018 has been calculated on the comprehensive loss

attributable to owners of the company of GBP51,755 and on the

weighted average number of shares in issue during the period of

29,344,788.

Comprehensive loss per share for the six month period ended 30

June 2017 has been calculated on the comprehensive loss

attributable to owners of the company of GBP67,819 and on the

weighted average number of shares in issue during the period of

21,029,720.

Comprehensive loss per share for the year ended 31 December 2017

has been calculated on the comprehensive loss attributable to

owners of the company of GBP710,977 and on the weighted average

number of shares in issue during the year of 22,211,434.

For the six month period ended 30 June 2018, six month period

ended 30 June 2017 and for the year ended 31 December 2017, share

options and warrants to subscribe for shares in the company are

anti-dilutive and therefore diluted earnings per share information

is the same as the basic loss per share.

* * ENDS * *

For further information, please visit www.ultimatesportsgroup.me

or contact:

Ultimate Sports Group PLC

Geoffrey Simmonds, Managing Director +44 (0)20 7935 0823

St Brides (Financial PR)

Charlotte Page/Isabel de Salis +44 (0)20 7236 1177

Cantor Fitzgerald Europe (Nomad and Joint

Broker)

Marc Milmo / Catherine Leftley +44 (0)20 7894 7000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LDLFLVKFLBBX

(END) Dow Jones Newswires

September 27, 2018 08:26 ET (12:26 GMT)

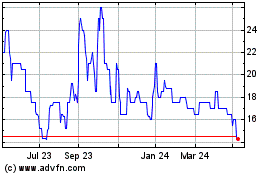

Insig Ai (LSE:INSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

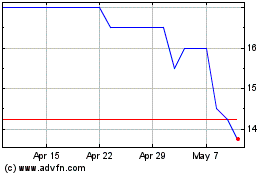

Insig Ai (LSE:INSG)

Historical Stock Chart

From Apr 2023 to Apr 2024